🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

1, 4 Butanediol Market

1, 4 Butanediol Market Global Industry Analysis and Forecast (2024-2032) By Technology (Reppe Process, Davy Process, Propylene Oxide Process, Others), By Application (Gamma-Butyrolactone (GBL), Polybutylene Terephthalate (PBT), Polyurethanes (PU), Tetrahydrofuran (THF)) and Region

Feb 2025

Chemicals and Materials

Pages: 138

ID: IMR1780

1, 4 Butanediol Market Synopsis

1, 4 Butanediol Market Size Was Valued at USD 9.1 Billion in 2023, and is Projected to Reach USD 18.25 Billion by 2032, Growing at a CAGR of 8.2% From 2024-2032.

A major component used in creating plastics, elastic fibers, and other chemical intermediates, the 1,4-butanediol (BDO) market is vital for the worldwide chemical sector. Applied extensively in sectors including automotive, textiles, electronics, and pharmaceuticals, BDO is a white, viscous liquid. Its adaptability and demand have spurred significant market expansion throughout the years.

The synthesis of spandex fibers, polybutylene terephthalate (PBT), and thermoplastic polyurethanes (TPU) primarily drives the 1,4-butanediol market. Adoption of BDO-derived materials has increased due to the growing need for robust and lightweight automotive parts. Its importance in the pharmaceutical sector and solvent generation also helps to explain market expansion.

Growing environmental sustainability issues are driving a change in the industry toward bio-based production techniques. Bio-based substitutes using renewable resources are challenging conventional manufacturing techniques of 1,4-butanediol, which depend on petroleum-based fuels. In the next years, bio-based BDO production seems to present a major prospect for market participants.

1, 4 Butanediol Market Outlook, 2023 and 2032: Future Outlook

1, 4 Butanediol Market Trend Analysis

Trend: Emergence of bio-based production methods and increasing demand for sustainable chemical solutions.

The market for 1,4-butanediol (BDO) is clearly moving toward bio-based production technologies. This is because of growing concerns about the environment and legal requirements that support sustainability. Conventional BDO generation mostly depends on feedstocks derived from petroleum, which aggravate environmental damage and carbon emissions. Bio-based BDO made from renewable resources, including sugars and biomass, is becoming more and more popular as sectors give environmental practices top priority. This method not only lessens reliance on fossil fuels but also aids worldwide projects aiming at low carbon footprints.The growing need for sustainable chemical solutions in sectors such as automotive, textiles, and electronics further drives the adoption of bio-based BDO. Applications using high-strength, lightweight materials like thermoplastic polyurethanes (TPUs) and spandex fibers would find bio-based alternatives perfect since they are more environmentally friendly and offer similar performance. Long-term sustainable growth will help the market as technical developments improve the efficiency and scalability of bio-based production methods.

Drivers: Growing demand for thermoplastic polyurethanes, automotive components, and spandex fibers.

The rising demand for thermoplastic polyurethanes (TPUs) significantly drives the 1,4-butanediol market. Because of their lightweight, flexible, and resilient qualities—which help to improve vehicle performance and fuel economy—TPUs find excellent usage in automotive applications. As automakers use TPU-based components more and more in response to growing attention to lowering carbon emissions, BDO becomes even more important as a basic raw material. TPUs also find use in adhesives, building materials, and footwear; hence, they are increasing market demand. The growing use of BDO in the manufacturing of spandex fibers—known for their flexibility and strength—is another main influence. The expansion of the athleisure and sportswear sectors has significantly stimulated the demand for spandex. Widely used in electronics and industrial components, BDO-derived polybutylene terephthalate (PBT) also helps expand the market. This wide spectrum of uses in several industries guarantees 1,4-butanediol's continuous and expanding demand worldwide.

Restraints: Fluctuating raw material prices and stringent environmental regulations.

Changing raw material prices provide major difficulties for the 1,4-butanediol (BDO) business. BDO is usually made from petrochemical feedstocks like acetylene, butane, and propylene, and its price can change a lot due to geopolitical events, changes in crude oil prices, and imbalances in supply and demand. Manufacturers find it challenging to keep competitive pricing policies since these price fluctuations affect the profitability of market players and influence the production expenses.Apart from pricing instability, strict environmental rules also limit the expansion of the sector. Regulatory authorities worldwide are gradually imposing limits on chemical production methods due to their environmental impact, which includes greenhouse gas emissions and the generation of hazardous waste. To comply with these rules, businesses must heavily fund sustainable production techniques and pollution control technologies. Although such initiatives help long-term sustainability, they provide financial and operational difficulties for market players.

Opportunities: Advancements in bio-based BDO production and rising investments in green chemistry.

The market has great potential prospects because of the increasing developments in bio-based 1,4-butanediol (BDO) manufacture. Manufacturers are turning to sustainable and renewable production techniques as worries about the negative effects of traditional chemical processes continue to develop. Derived from plant-based feedstocks, bio-based BDO has a smaller carbon footprint and fits the worldwide need for more environmentally friendly industry methods. Aiming to satisfy the growing demand for environmentally friendly substitutes, several firms are funding research and development to improve the efficiency and scalability of bio-based BDO manufacture. Increasing investments in green chemistry helps to maximize the market even further. By providing financial incentives and regulatory support for sustainable chemical manufacture, governments and commercial players are pushing cleaner production processes. This change promotes strategic alliances and industry participant cooperation to create creative BDO synthesis processes. Adoption of green chemistry solutions not only helps sectors fulfill sustainability goals but also generates a competitive edge by drawing consumers who are ecologically sensitive.

1, 4 Butanediol Market Segment Analysis:

1, 4 Butanediol Market Segmented on the basis of By Technology and By Application

By Technology

o Reppe Process

o Davy Process

o Propylene Oxide Process

o Others

By Application

o Gamma-Butyrolactone (GBL)

o Polybutylene Terephthalate (PBT)

o Polyurethanes (PU)

o Tetrahydrofuran (THF)

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Technology, Reppe Process segment is expected to dominate the market during the forecast period

Different production processes define the 1,4-butanediol (BDO) industry and provide unique benefits and efficiencies. One of the most often utilized techniques, the Reppe procedure, generates BDO by using acetylene and formaldehyde. Many manufacturers use this approach as it's quite a simple process and has great yield appeal. The Davy process, on the other hand, turns maleic anhydride into hydrogen, which is an alternative route that is especially useful when the supply of feedstock matches the needs of the market.The propylene oxide process is becoming an increasingly interesting and cleaner way to make BDO because it has less of an impact on the environment and is linked to propylene oxide derivatives. Apart from these well-known approaches, several private and developing technologies are in development to handle cost-effectiveness and environmental issues. These developments are especially important since businesses, under growing regulatory pressure, look for greener and more energy-efficient solutions.

By Application, Gamma-Butyrolactone (GBL) segment expected to held the largest share

For the 1,4 Butanediol (BDO) market, it is very useful to make Gamma-Butyrolactone (GBL), Polybutylene Terephthalate (PBT), Polyurethanes (PU), and Tetrahydrofuran (THF). GBL, a vital derivative of BDO, is widely employed as an intermediary for the manufacturing of agrochemicals, medications, and specialty polymers. Its adaptable solvent qualities make it a necessary component in coatings and industrial cleaning products.In the automotive and electronics sectors, PBT and PU generated from BDO are important for making durable and lightweight parts, including connectors and insulators. Manufacturing spandex fibers and elastomers widely utilizes the major market segment, Tetrahydrofuran (THF). The growing need for spandex in the fashion and athletic sectors drives demand for THF even more, therefore affecting BDO. These several uses help the 1,4 Butanediol market to expand in several industrial sectors.

1, 4 Butanediol Market Regional Insights:

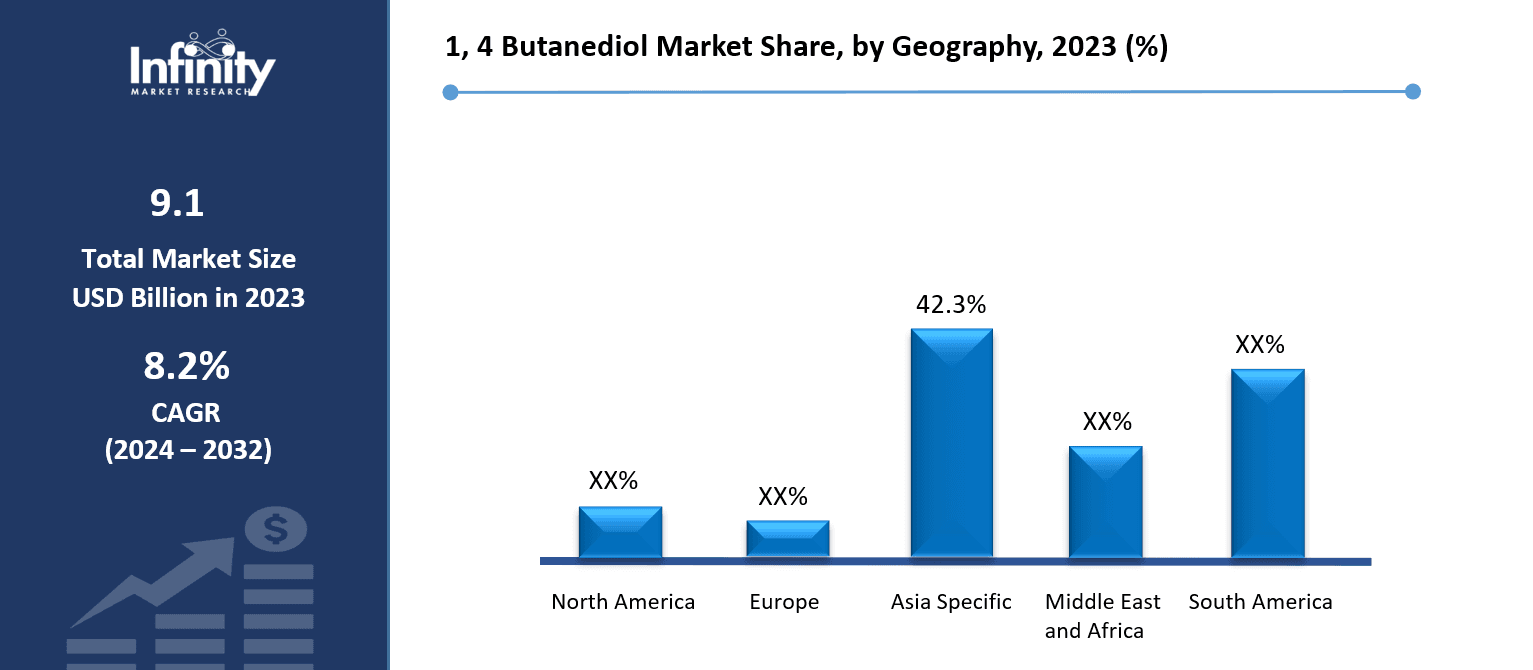

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Over the projected period, the Asia-Pacific region is expected to have the highest percentage of the 1,4-butanediol (BDO) market. Rapid industrialization as well as the growing automotive, textile, and electronics sectors in nations including China, India, Japan, and South Korea fuel this supremacy. The great demand for spandex fibers, thermoplastic polyurethanes (TPUs), and other BDO-based products drives the market expansion in these countries. Moreover, the area is a hub for chemical manufacture and exports since it benefits from affordable manufacturing capacity and a sizable client base.China especially is crucial in promoting market growth because of its large industrial infrastructure and growing demand for BDO derivatives in uses like solvents, resins, and automotive components. Government programs supporting green technologies and bio-based chemicals also encourage investments in environmentally friendly BDO manufacture. The excellent economic situation and changing manufacturing environment of the Asian- Pacific market make it a main center of growth for the worldwide 1,4-butanediol industry.

1, 4 Butanediol Market Share, by Geography, 2023 (%)

Active Key Players in the 1, 4 Butanediol Market

o BASF SE (Germany)

o Mitsubishi Chemical Corporation (Japan)

o Ashland Inc (USA)

o BioAmber Inc (Canada)

o Sipchem (Saudi Arabia)

o LyondellBasell Industries N.V (Netherlands)

o ExxonMobil Chemicals (USA)

o Others

Global 1, 4 Butanediol Market Scope

|

Global 1, 4 Butanediol Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.1 Billion |

|

Forecast Period 2024-32 CAGR: |

8.2% |

Market Size in 2032: |

USD 18.25 Billion |

|

Segments Covered: |

By Technology |

· Reppe Process · Davy Process · Propylene Oxide Process · Others | |

|

By Application |

· Gamma-Butyrolactone (GBL) · Polybutylene Terephthalate (PBT) · Polyurethanes (PU) · Tetrahydrofuran (THF) | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Growing demand for thermoplastic polyurethanes, automotive components, and spandex fibers. | ||

|

Key Market Restraints: |

· Fluctuating raw material prices and stringent environmental regulations. | ||

|

Key Opportunities: |

· Advancements in bio-based BDO production and rising investments in green chemistry. | ||

|

Companies Covered in the report: |

· BASF SE (Germany), Mitsubishi Chemical Corporation (Japan), Ashland Inc (USA), BioAmber Inc (Canada), Sipchem (Saudi Arabia), LyondellBasell Industries N.V (Netherlands), ExxonMobil Chemicals (USA), Others. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the 1, 4 Butanediol Market research report?

Answer: The forecast period in the 1, 4 Butanediol Market research report is 2024-2032.

2. Who are the key players in the 1, 4 Butanediol Market?

Answer: BASF SE (Germany), Mitsubishi Chemical Corporation (Japan), Ashland Inc (USA), BioAmber Inc (Canada), Sipchem (Saudi Arabia), LyondellBasell Industries N.V (Netherlands), ExxonMobil Chemicals (USA), Others.

3. What are the segments of the 1, 4 Butanediol Market?

Answer: The 1, 4 Butanediol Market is segmented into By Technology, By Application and region. By Technology (Reppe Process, Davy Process, Propylene Oxide Process, Others),By Application(Gamma-Butyrolactone (GBL),Polybutylene Terephthalate (PBT),Polyurethanes (PU),Tetrahydrofuran (THF)). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the 1, 4 Butanediol Market?

Answer: 1,4 Butanediol (BDO) is a colorless, viscous organic chemical compound with the formula C₄H₁₀O₂. It belongs to the diol family, containing two hydroxyl (-OH) groups positioned at the first and fourth carbon atoms of its molecular structure. BDO is primarily used as a versatile industrial solvent and an essential intermediate in the production of plastics, elastic fibers, polyurethanes, and resins. It is also a key precursor for chemicals like gamma-butyrolactone (GBL) and tetrahydrofuran (THF), which are widely used in various industrial applications, including pharmaceuticals, electronics, and coatings.

5. How big is the 1, 4 Butanediol Market?

Answer: 1, 4 Butanediol Market Size Was Valued at USD 9.1 Billion in 2023, and is Projected to Reach USD 18.25 Billion by 2032, Growing at a CAGR of 8.2% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.