🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

3D Printing Metals Market

3D Printing Metals Market (By Form (Filament, Powder), By Metal Type (Titanium, Stainless Steel, Nickel, Aluminum, Others), By Application (Aerospace & Defense, Automotive, Medical & Dental, Others), By Region and Companies)

Jul 2024

Chemicals and Materials

Pages: 275

ID: IMR1139

3D Printing Metals Market Overview

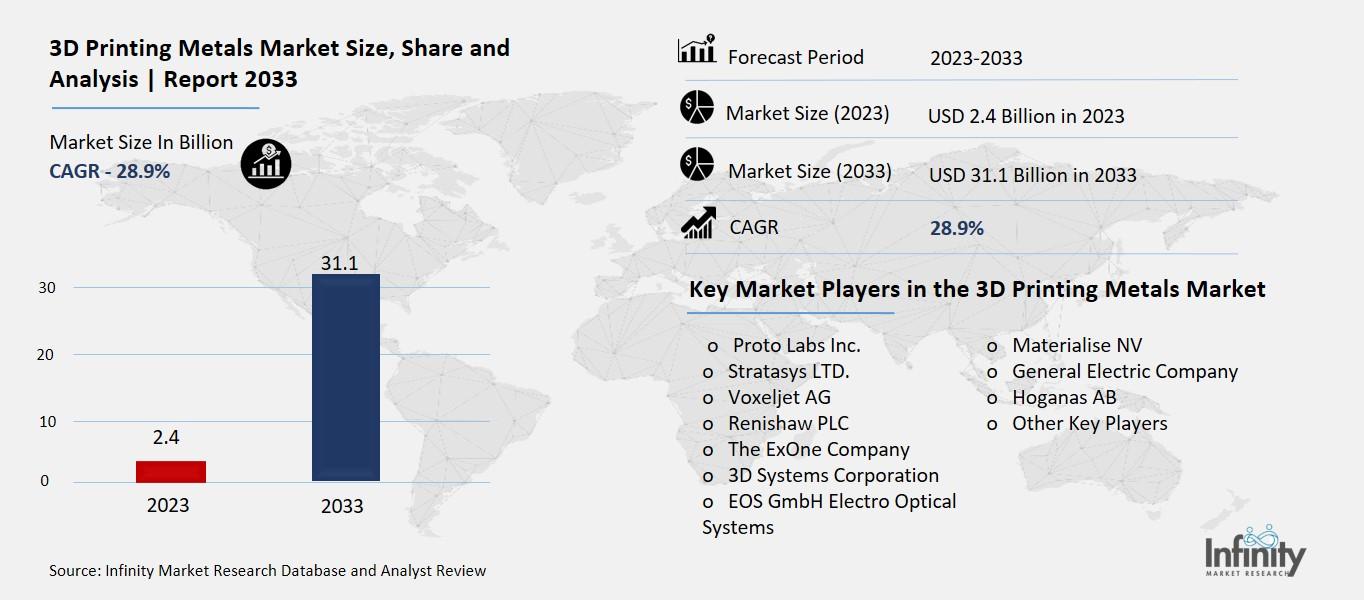

Global 3D Printing Metals Market size is expected to be worth around USD 31.1 Billion by 2033 from USD 2.4 Billion in 2023, growing at a CAGR of 28.9% during the forecast period from 2023 to 2033.

The 3D Printing Metals Market is all about using 3D printing technology to create objects made from metal. In simple terms, instead of using plastic or other materials, these printers use metal powders that get melted and shaped into solid objects. This technology is used in many industries, like aerospace, healthcare, and automotive because it allows for making complex and custom parts that are strong and durable.

This market is growing because 3D printing with metals can save time and reduce waste compared to traditional methods. Companies are investing in this technology to improve their products and production processes. For example, in healthcare, 3D printing metals can be used to create custom implants that perfectly fit a patient’s body. This kind of innovation is why the 3D Printing Metals Market is becoming more important and popular.

Drivers for the 3D Printing Metals Market

Rising Demand from Key Industries

The 3D printing metals market is driven significantly by the growing demand from the aerospace and defense, automotive, and healthcare sectors. In aerospace and defense, the technology is prized for its ability to create complex and lightweight components, which are essential for improving fuel efficiency and performance. The automotive industry benefits from the customization capabilities of 3D printing, enabling the production of intricate parts that are both strong and lightweight. Healthcare applications include the creation of customized implants and prosthetics, which offer better patient outcomes due to their tailored fit and design.

Advancements in Technology

Technological advancements are another key driver of the 3D printing metals market. Innovations in printer capabilities, such as higher precision and faster printing speeds, are making 3D printing more viable for large-scale production. Additionally, the development of new metal powders and alloys specifically designed for 3D printing is expanding the range of applications. These advancements are not only improving the quality and durability of printed products but also reducing production costs and waste.

Reduction in Manufacturing Costs

3D printing metals offer a significant reduction in manufacturing costs compared to traditional methods. This is particularly important for industries that require high precision and customization. The ability to produce parts on demand reduces the need for large inventories, which lowers storage costs. Furthermore, 3D printing minimizes material waste since the process uses only the necessary amount of material, unlike subtractive manufacturing methods where excess material is cut away.

Decrease in Lead Times

One of the major advantages of 3D printing metals is the significant reduction in lead times. Traditional manufacturing processes often involve multiple steps and require specialized tooling, which can be time-consuming. In contrast, 3D printing allows for the direct creation of parts from digital models, speeding up the production process. This is particularly beneficial for industries that require rapid prototyping and quick turnaround times, such as the aerospace and automotive sectors .

Environmental Benefits

The environmental benefits of 3D printing metals are also driving market growth. The technology is more sustainable than traditional manufacturing because it produces less waste and uses less energy. Additionally, 3D printing enables the recycling of metal powders, further reducing the environmental impact. As companies and governments around the world increasingly focus on sustainability, the eco-friendly nature of 3D printing metals makes it an attractive option for various industries.

Supportive Government Initiatives

Government initiatives and funding for research and development in 3D printing technologies are providing a boost to the market. Many countries are recognizing the potential of 3D printing to revolutionize manufacturing and are investing in the development of new materials and technologies. These initiatives are helping to lower the barriers to entry for new companies and are promoting the adoption of 3D printing across various sectors.

Restraints for the 3D Printing Metals Market

High Costs and Technology Limitations

One of the significant restraints for the 3D printing metals market is the high cost associated with the technology. The initial investment for setting up 3D printing systems is substantial, which can be a barrier for many companies, especially small and medium-sized enterprises. The cost of raw materials, such as metal powders, is also higher compared to traditional manufacturing materials. Moreover, the maintenance and operation costs, including the need for specialized training for operators, add to the overall expense. These high costs limit the widespread adoption of 3D printing metals, making them feasible primarily for high-value and low-volume applications.

Production Speed and Scalability Issues

Another challenge is the production speed of 3D printing metals. While the technology excels at producing complex and customized parts, it is generally slower than conventional manufacturing methods like casting or machining for mass production. This slow speed can be a significant drawback when large quantities of parts are needed quickly. Additionally, scalability remains an issue as 3D printing is not yet efficient for high-volume manufacturing. The layer-by-layer construction process, which is advantageous for precision, becomes a hindrance when speed and volume are critical factors.

Technical Challenges and Quality Control

Technical challenges and quality control issues also restrain the growth of the 3D printing metals market. The process of metal additive manufacturing involves complex thermal cycles that can lead to residual stresses and warping of parts. Ensuring consistent quality across different batches of printed parts can be difficult due to variations in machine performance and material properties. Furthermore, the mechanical properties of 3D-printed metal parts, such as strength and fatigue resistance, can sometimes be inferior to those produced by traditional methods, necessitating additional post-processing steps.

Limited Material Options

The range of metals that can be used in 3D printing is still limited compared to traditional manufacturing methods. While materials like titanium, aluminum, and stainless steel are commonly used, many other metals and alloys are not yet viable for 3D printing. This limitation restricts the applications of 3D printing in industries that require specific materials with unique properties. Research and development efforts are ongoing to expand the range of printable metals, but progress is slow and requires significant investment.

Regulatory and Certification Hurdles

Finally, regulatory and certification hurdles can impede the adoption of 3D printing metals, particularly in highly regulated industries like aerospace and medical. Parts produced by 3D printing must meet stringent quality and safety standards, which can be challenging given the novel nature of the technology. Obtaining certifications and approvals from regulatory bodies involves rigorous testing and validation processes, which can be time-consuming and costly. These hurdles can delay the introduction of 3D-printed metal parts into the market and increase the overall cost of production

Opportunity in the 3D Printing Metals Market

Expanding Aerospace and Automotive Sectors

The aerospace and automotive industries present significant opportunities for the 3D printing metals market. The rise in manufacturing aircraft due to increasing global air travel demands more lightweight and complex components, which 3D printing excels at producing. This trend is expected to drive the market, as the technology allows for the creation of parts that are both strong and lightweight, essential for fuel efficiency and performance in aircraft. Similarly, the automotive industry is increasingly adopting 3D printing to produce lightweight components, reducing fuel consumption and emissions.

Advancements in Medical Applications

The medical field is another promising area for the 3D printing metals market. The ability to create customized prosthetics, implants, and surgical instruments tailored to individual patient needs is revolutionizing healthcare. For instance, companies are developing 3D-printed orthopedic implants and low-cost robotic prosthetics, making advanced medical care more accessible. This trend is expected to accelerate as the technology becomes more refined and widespread, offering personalized medical solutions that were previously unattainable.

Increased Industrial Adoption

Industries beyond aerospace and healthcare are also exploring 3D printing with metals, driven by the need for rapid prototyping and complex part manufacturing. The technology's ability to reduce material waste and production time is highly attractive to manufacturers looking to optimize operations and reduce costs. This adoption is particularly notable in regions like Europe and Asia-Pacific, where industrialization and technological advancements are progressing rapidly.

Government and Corporate Investments

Government initiatives and corporate investments are further boosting the 3D printing metals market. For instance, national strategies for additive manufacturing in countries like Germany and the UK are fostering an environment conducive to technological adoption. Additionally, significant investments from aerospace companies in India highlight the growing global interest in leveraging 3D printing for industrial applications. These investments are critical in driving innovation and expanding the market's reach.

Technological Innovations

Ongoing innovations in 3D printing technology itself are creating new opportunities. Developments such as multi-laser systems and affordable 3D printers are democratizing access to metal 3D printing, making it feasible for smaller companies to adopt. These advancements not only improve production efficiency but also open up new possibilities for complex designs and applications that were not previously possible with traditional manufacturing methods.

Future Outlook

Looking ahead, the 3D printing metals market is poised for substantial growth. The continued expansion in key sectors like aerospace, automotive, and healthcare, combined with technological advancements and supportive government policies, will drive market demand. As the technology becomes more accessible and its applications more diverse, the potential for market growth remains significant, promising a transformative impact on manufacturing and production processes worldwide.

Trends for the 3D Printing Metals Market

Growth in Adoption Across Various Industries

One of the major trends in the 3D printing metals market is the increasing adoption across various industries. Sectors such as aerospace, automotive, healthcare, and defense are leading the way in integrating 3D printing technologies into their manufacturing processes. The ability of 3D printing to produce complex, lightweight, and strong components is particularly valuable in the aerospace and automotive industries, where reducing weight and maintaining strength is crucial. Healthcare is also benefiting from 3D printing with the production of customized implants and prosthetics, which improve patient outcomes significantly.

Technological Advancements and Innovations

Technological advancements are driving the 3D printing metals market forward. The development of multi-laser systems and other innovative solutions by companies like Velo3D, Seurat, and VulcanForms is reshaping the market landscape. These advancements are making metal 3D printing more efficient and cost-effective, thereby expanding its applications. Innovations in material science are also leading to the development of new metal powders that enhance the properties of printed components, making them suitable for more demanding applications.

Increased Investment and Funding

The market is also seeing a significant increase in investment and funding. Major companies are investing heavily in 3D printing technologies to gain a competitive edge. This influx of capital is not only helping in the development of new technologies but also in scaling up production capabilities. Additionally, startups are receiving funding to develop niche applications and technologies, which is contributing to the overall growth of the market. This trend is expected to continue, with more investments flowing into the sector in the coming years.

Expansion of Market Reach

The global reach of the 3D printing metals market is expanding, with significant growth in regions such as Asia-Pacific, North America, and Europe. Countries like China, Japan, and South Korea are becoming key players due to their strong manufacturing bases and advanced technology investments. In North America and Europe, the focus is on high-value applications in aerospace, defense, and healthcare. This geographic expansion is creating new opportunities and driving the market growth further.

Shift Towards Sustainable Manufacturing

Sustainability is becoming a key trend in the 3D printing metals market. The ability to reduce waste and produce components with minimal environmental impact drives the adoption of 3D printing technologies. Companies are increasingly focusing on sustainable manufacturing practices, which include using recycled materials and optimizing production processes to reduce energy consumption. This shift towards sustainability is not only beneficial for the environment but also helps companies reduce costs and improve their market reputation.

Customization and On-Demand Production

Customization and on-demand production are gaining traction as significant trends in the market. The ability to produce customized parts tailored to specific requirements is a major advantage of 3D printing. This trend is particularly important in industries like healthcare and aerospace, where custom solutions can provide significant benefits. On-demand production also reduces the need for large inventories, leading to cost savings and more efficient supply chains .

Segments Covered in the Report

By Form

o Filament

o Powder

By Metal Type

o Titanium

o Stainless Steel

o Nickel

o Aluminum

o Others

By Application

o Aerospace & Defense

o Automotive

o Medical & Dental

o Others

Segment Analysis

By Form Analysis

With a revenue share of around 90.2%, the powder form has the highest sector breadth in this market size. Numerous factors influence the characteristics of metal powder particles. These settings have an impact on the final component's qualities in addition to the additive construction process.

This includes the raw materials' physical and chemical properties, which need to be precisely identified and described. The need for metal dust will probably rise as a result in the future. The final product launches require the 3D-printed metal particles to have a fine print, often falling between 15 and 75 μm (microns).

For the best outcomes, the particle distribution shouldn't be excessively unequal. Typically, fillers are a combination of polymers and metals. In this instance, a layer of PLA or ABS covers the metal. Producers are putting a lot of effort into creating filament printing techniques that are less expensive than selective laser melting. This is anticipated to raise filament consumption throughout the projection period.

By Metal Type Analysis

In 2023, the titanium products segment accounted for 41.9% of total revenue. Throughout the forecast period, this segment is anticipated to increase at the quickest CAGR. The market for product categories based on titanium will grow because of its non-corrosive qualities and ability to withstand hard settings.

The ability of conventional polymer 3D printers to produce semi-metallic objects when combined with polymers or filaments will probably be the main driver of market expansion.

As the aerospace and defense sector can bear large upfront expenses and change with the times, it is anticipated that titanium powder will soon be created for 3D printing applications. Complex geometric structures will facilitate a new aerospace strategy that will propel 3D printing technology and consequently raise titanium powder demand.

Over the next few years, stainless steel 3D printing is expected to see a lot of interest due to its broad demand across industries. Stainless steel printed parts are robust but lightweight. Moreover, stainless steel can aid in the production of huge items with excellent surface printing.

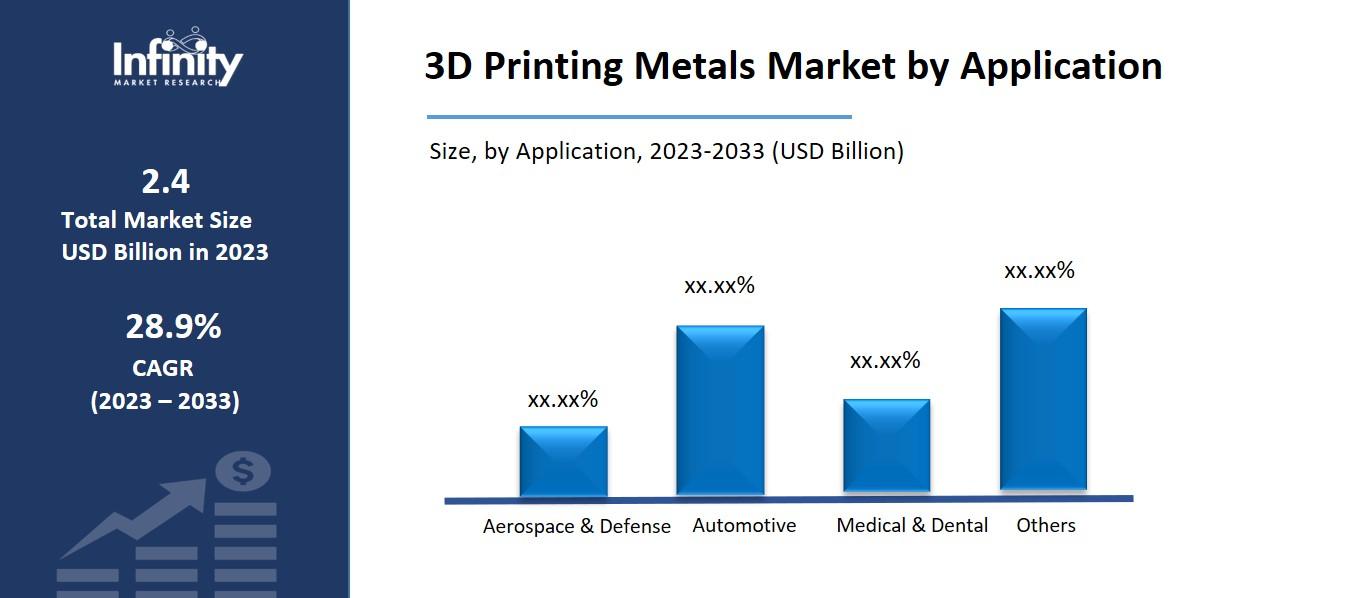

By Application Analysis

In 2023, aerospace and defense constituted the greatest portion of volume, accounting for almost 39.8%. The aerospace and defense industry is being forced to invest in 3D printing due to the potential to build complicated components in less time. For example, the U.S. Department of Defense awarded a fresh round of financing to Senvol, a 3D printing data specialist, in 2021 so that they could optimize defense and aerospace components.

Throughout the forecast period, the medical and dental application category is anticipated to increase at the quickest rate, with revenue estimated to rise by 21.9%. In the medical field, 3D printing is utilized to create hemostats, implants, forceps, and prosthetic limbs. 3D printing technologies are being adopted by numerous medical businesses for a range of medical purposes. For example, Monogram is using 3D printing to produce orthopedic implants. In a similar vein, Open Bionics has used 3D printing to create inexpensive robotic prosthetics.

Another important business category for 3D printing metal is automotive. The automobile sector is anticipated to reap numerous benefits from the implementation of 3D printing metal technology, including the ability to create hollow components, thinner walls, and the ability to blend different raw materials during the component-making process. Over the ensuing years, this is anticipated to have a favorable effect on the market's development and expansion.

Regional Analysis

In 2023, the Asia Pacific region held the greatest market share of 31.9% in the worldwide 3D printing metal market. The fastest regional CAGR of more than 26.5% is expected to occur in Europe between 2023 and 2033. Germany, the Netherlands, France, Spain, and Italy are the top five nations in this region for 3D printing parts for end-use industries.

These include the aerospace and healthcare sectors. As part of their advanced manufacturing or Industry 4.0 initiatives, several nations have created national additive manufacturing strategies.

Leading 3D printers in the UK are Attenborough Dental and Renishaw for crowns and bridges, Bowman International for bearing boxes, and GKN for automotive and aerospace parts. The majority of people in the UK haven't yet embraced metal additive manufacturing technology, though. This suggests that there is a great deal of room for other market growth factors.

The Asia Pacific market will continue to be significantly influenced by 3D printing. The biggest aircraft manufacturer in India, Hindustan Aeronautics Ltd., uses metal additive manufacturing (AM) technology to create a variety of parts for their engineering program. HAL used Direct Metal Laser Sintering (DMLS) for the Hindustan Turbofan Engine-25's parts.

Competitive Analysis

The global market, which is presently in its growth stage, has enormous potential because of its increasing use and penetration across many industries. Additionally, the market is seeing an increase in small business investments. Throughout the projected period, merger and acquisition activity in the market is expected to rise due to the intensifying competition. For example, in 2019, the provider of additive manufacturing solutions 3D Materials Technology, Inc. (3DMT) was bought by Aerojet Rocketdyne Holdings, Inc. It is anticipated that the acquisition of 3DMT will help the business grow the range of goods and services it provides to the aerospace and defense sector.

Recent Developments

May 2022: The firm, a global leader in 3D printing solutions, revealed the most recent version of Materialise's industry-leading data and build preparation software, Magics 26, at the RAPID+TCT Conference. Magic 26 integrates native support for CAD workflow with its mesh capabilities. By choosing the optimum method for each 3D printing project, users can maximize productivity without sacrificing quality. This gives them the best of both worlds.

May 2022: An open software platform called CO-AM was released by Materialise, a leader in 3D printing solutions globally, to effectively manage the additive manufacturing (AM) production process. Through CO-AM, manufacturers will have cloud-based access to a comprehensive suite of software tools that facilitate the planning, management, and optimization of each phase of their AM operations. Materialise tackles the unexplored potential of AM for mass customization and serial manufacturing with CO-AM.

Key Market Players in the 3D Printing Metals Market

o Proto Labs Inc.

o Stratasys LTD.

o Voxeljet AG

o Renishaw PLC

o The ExOne Company

o 3D Systems Corporation

o EOS GmbH Electro Optical Systems

o Materialise NV

o General Electric Company

o Hoganas AB

o Other Key Players

Report Scope:

|

Report Features |

Description |

|

Market Size 2023 |

USD 2.4 Billion |

|

Market Size 2033 |

USD 31.1 Billion |

|

Compound Annual Growth Rate (CAGR) |

28.9% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Form, Metal Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Proto Labs Inc., Stratasys LTD., Voxeljet AG, Renishaw PLC, The ExOne Company, 3D Systems Corporation, EOS GmbH Electro Optical Systems, Materialise NV, General Electric Company, Hoganas AB, Other Key Players |

|

Key Market Opportunities |

Expanding Aerospace and Automotive Sectors |

|

Key Market Dynamics |

Rising Demand from Key Industries |

📘 Frequently Asked Questions

1. Who are the key players in the 3D Printing Metals Market?

Answer: Proto Labs Inc., Stratasys LTD., Voxeljet AG, Renishaw PLC, The ExOne Company, 3D Systems Corporation, EOS GmbH Electro Optical Systems, Materialise NV, General Electric Company, Hoganas AB, Other Key Players

2. How much is the 3D Printing Metals Market in 2023?

Answer: The 3D Printing Metals Market size was valued at USD 2.4 Billion in 2023.

3. What would be the forecast period in the 3D Printing Metals Market?

Answer: The forecast period in the 3D Printing Metals Market report is 2023-2033.

4. What is the growth rate of the 3D Printing Metals Market?

Answer: 3D Printing Metals Market is growing at a CAGR of 28.9% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.