🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Actuator Market

Global Actuator Market (By Motion, Linear and Rotary; By Type, Hydraulic, Electric, Pneumatic, and Other Types; By End-Use Industry, Aerospace & Defense, Construction, Automotive, Chemicals, Healthcare & Pharmaceuticals, Food & Beverages, Oil & Gas, Marine, Mining, and Other End-Use Industries, By Region and Companies), 2024-2033

Oct 2024

Industrial Automation and Equipment

Pages: 138

ID: IMR1247

Actuator Market Overview

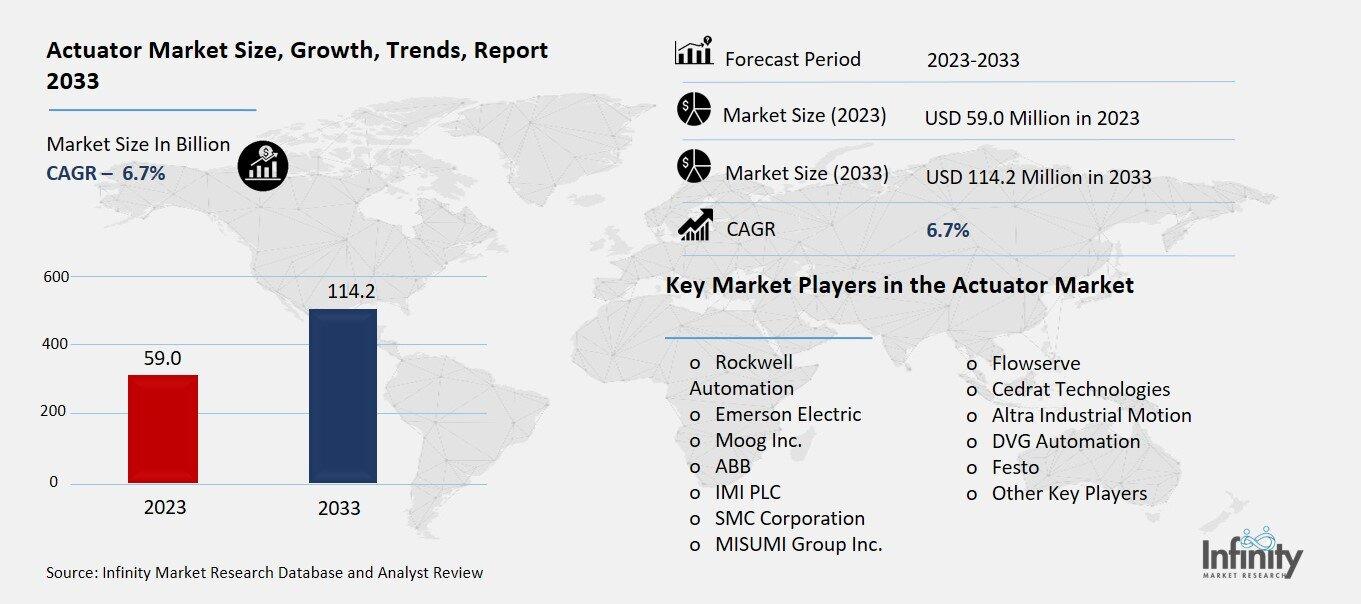

Global Actuator Market acquired the significant revenue of 59.0 Billion in 2023 and expected to be worth around USD 114.2 Billion by 2033 with the CAGR of 6.7% during the forecast period of 2024 to 2033. The actuator market is a rapidly growing segment of the automation industry. Moreover, the market driven by rise in demand across sectors like automotive, aerospace, manufacturing, and healthcare. Actuators are essential components in systems that requires controlled movement as they convert energy into mechanical motion.

To Get An Overview , Request For Sample

The market is expanding due to technological advancements in robotics, industrial automation, and electric vehicles. Electric actuators are gaining popularity over hydraulic and pneumatic types due to their higher efficiency and lower maintenance. Factors such as rising adoption of smart technologies, increased energy efficiency requirements, and a growing focus on automation in manufacturing are further fueling market growth.

Drivers for the Actuator Market

Growing Demand for Automation in Manufacturing and Process Industries

The growing demand for automation in manufacturing and process industries is significantly boosts the need for actuators, as companies strive to enhance productivity, efficiency, and quality. Automation helps in reducing labor costs, minimizing human error, and achieving faster production cycles, which is crucial in industries such as automotive, pharmaceuticals, food and beverages, and chemicals. Actuators play a pivotal role in the automation ecosystem by enabling precise control of machinery and equipment, thereby facilitating accurate movements, positioning, and flow control.

As industrial processes become more complex and require more sophisticated control systems, the reliance on advanced actuators, including electric and smart actuators, has increased. The trend of Industry 4.0, with a focus on connectivity, smart factories, and data-driven decision-making, further emphasizes the need for actuators capable of seamless integration with sensors and control systems.

Restraints for the Actuator Market

Limited Availability of Skilled Workforce

A shortage of skilled technicians for the installation, maintenance, and troubleshooting of actuators can act as a significant restraint for the market. Advanced actuators, especially those integrated with electronic control systems, require specialized skills to ensure proper setup, calibration, and ongoing maintenance. The lack of adequately trained personnel can lead to improper installation, resulting in reduced performance, increased downtime, and higher maintenance costs. Troubleshooting actuator issues also demands a good understanding of both mechanical and electronic components, which many technicians may not possess without specialized training.

Opportunity in the Actuator Market

Growing Focus on IIoT and Industry 4.0

The adoption of the Industrial Internet of Things (IIoT) is creating significant opportunities for smart actuators that provide real-time data and enhanced operational efficiency. IIoT enables the interconnection of industrial devices and systems, facilitating seamless data exchange and advanced analytics. Smart actuators, when integrated with IIoT, can provide real-time information on parameters such as position, force, temperature, and operating conditions, allowing for predictive maintenance and reducing unplanned downtime. These actuators also enable remote monitoring and control, enhancing the flexibility and responsiveness of manufacturing processes. The ability to gather and analyze real-time data helps in optimizing production, improving safety, and reducing energy consumption, which is critical for achieving operational efficiency.

Trends for the Actuator Market

Shift to Electric Actuators

There is a noticeable shift from hydraulic and pneumatic actuators to electric actuators, primarily driven by the superior energy efficiency, control precision, and lower maintenance requirements of electric systems. Hydraulic and pneumatic actuators have traditionally been used for their high force output, especially in heavy industrial applications. However, these systems often suffer from energy losses due to fluid leaks, pressure drops, and the need for constant pressurization, which reduces their efficiency. In contrast, electric actuators offer precise control over speed, position, and force, making them highly suitable for applications requiring accuracy and repeatability.

Additionally, electric actuators have fewer components, which leads to reduced maintenance needs compared to their hydraulic and pneumatic counterparts that require constant upkeep to prevent leaks and maintain pressure systems. With growing concerns over environmental sustainability and energy conservation, electric actuators have gained favor as they consume less power and eliminate the need for oil-based fluids.

Segments Covered in the Report

By Motion

o Linear

o Rotary

By Type

o Hydraulic

o Electric

o Pneumatic

o Other Types

By End-Use Industry

o Aerospace & Defense

o Construction

o Automotive

o Chemicals

o Healthcare & Pharmaceuticals

o Food & Beverages

o Oil & Gas

o Marine

o Mining

o Other End-Use Industries

Segment Analysis

By Motion Analysis

On the basis of motion, the market is divided into linear and rotary. Among these, linear segment acquired the significant share around 54.1% in the market owing to the widespread use of linear actuators in various industrial applications that require precise and controlled linear motion. Linear actuators are essential in sectors such as automotive, manufacturing, and construction, where tasks like lifting, positioning, and moving objects along a straight path are crucial. Their versatility in applications like assembly lines, material handling, and robotic systems, along with their ease of installation and maintenance, makes them highly preferred. Furthermore, the growing adoption of automation and the need for enhanced operational efficiency have driven the demand for linear actuators, particularly in industrial settings that prioritize accuracy and reliability in motion control.

By Type Analysis

On the basis of type, the market is divided into hydraulic, electric, pneumatic, and other types. Among these, electric held the prominent share of the market due to the growing preference for energy-efficient and low-maintenance solutions. Electric actuators offer superior control, precision, and reliability compared to hydraulic and pneumatic types, making them ideal for applications requiring accurate positioning and consistent performance. Additionally, they eliminate the need for fluid systems, reducing maintenance costs and the risk of leaks. The increasing adoption of electric vehicles, advancements in robotics, and a focus on reducing environmental impact have further boosted the demand for electric actuators.

To Learn More About This Report , Request For Sample

By End-Use Industry Analysis

On the basis of end-use industry, the market is divided into aerospace & defense, construction, automotive, chemicals, healthcare & pharmaceuticals, food & beverages, oil & gas, marine, mining, and other end-use industries. Among these, automotive held most of the share of the market due to the increasing demand for automation and advanced control systems in vehicle manufacturing and operation. Actuators are crucial components in modern automobiles, facilitating functions such as throttle control, braking systems, and electronic stability control. The shift towards electric and hybrid vehicles has further driven the adoption of electric actuators, which provide higher efficiency and precision compared to traditional hydraulic systems.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 32.5% the market. This dominance can be attributed to several factors, including the region's advanced manufacturing capabilities, robust industrial infrastructure, and a strong emphasis on automation across various sectors. The presence of key players in the actuator industry, coupled with substantial investments in research and development, has fostered innovation and the adoption of cutting-edge technologies. Additionally, industries such as automotive, aerospace, and healthcare are rapidly integrating automation solutions to enhance efficiency and productivity, further driving the demand for actuators. The region's commitment to sustainability and energy efficiency also supports the transition from traditional hydraulic and pneumatic actuators to more advanced electric actuators.

Competitive Analysis

The actuator market is characterized by a highly competitive landscape, with several key players vying for market share through innovation, strategic partnerships, and the expansion of product offerings. Major companies, including Siemens AG, Parker Hannifin Corporation, SMC Corporation, and Bosch Rexroth, are investing heavily in research and development to enhance actuator technologies and improve efficiency, performance, and reliability. The competition is intensified by the growing demand for automation across various industries, which encourages companies to differentiate themselves through the development of smart actuators integrated with IoT capabilities for real-time monitoring and control.

Recent Developments

In July 2023, Emerson Electric formed a partnership with Cavendish Renewable Technology (CRT), an Australia-based startup specializing in proprietary hydrogen technologies, to expedite the implementation of CRT's hydrogen production solutions.

In February 2023, Flowserve Corporation did strategic partnership with Clariter, a global leader in cleantech, to enhance the production of Clariter's high-quality, eco-friendly petrochemicals derived from plastic waste.

Key Market Players in the Actuator Market

o Rockwell Automation

o Emerson Electric

o Moog Inc.

o ABB

o IMI PLC

o SMC Corporation

o MISUMI Group Inc.

o Flowserve

o Cedrat Technologies

o Altra Industrial Motion

o DVG Automation

o Festo

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 59.0 Billion |

|

Market Size 2033 |

USD 114.2 Billion |

|

Compound Annual Growth Rate (CAGR) |

6.7% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Motion, Type, End-Use Industry, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Rockwell Automation, Emerson Electric, Moog Inc., ABB, IMI PLC, SMC Corporation, MISUMI Group Inc., Flowserve, Cedrat Technologies, Altra Industrial Motion, DVG Automation, Festo, and Other Key Players. |

|

Key Market Opportunities |

Growing Focus on IIoT and Industry 4.0 |

|

Key Market Dynamics |

Growing Demand for Automation in Manufacturing and Process Industries |

📘 Frequently Asked Questions

1. How much is the Actuator Market in 2023?

Answer: The Actuator Market size was valued at USD 59.0 Billion in 2023.

2. What would be the forecast period in the Actuator Market?

Answer: The forecast period in the Actuator Market report is 2024-2033.

3. Who are the key players in the Actuator Market?

Answer: Rockwell Automation, Emerson Electric, Moog Inc., ABB, IMI PLC, SMC Corporation, MISUMI Group Inc., Flowserve, Cedrat Technologies, Altra Industrial Motion, DVG Automation, Festo, and Other Key Players.

4. What is the growth rate of the Actuator Market?

Answer: Actuator Market is growing at a CAGR of 6.7% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.