🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

ADAS Market

Global ADAS Market (By System Type, Park Assist, E-Call System, Adaptive Cruise Control, Autonomous Emergency Braking, Lane Departure Warning System, Forward Collision Warning, and Other System Types; By Component Type, Sensor, LiDAR, Radar, and Camera; By Vehicle Type, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), and Passenger Cars, By Region and Companies), 2024-2033

Jan 2025

Automotive Technology

Pages: 138

ID: IMR1463

ADAS Market Overview

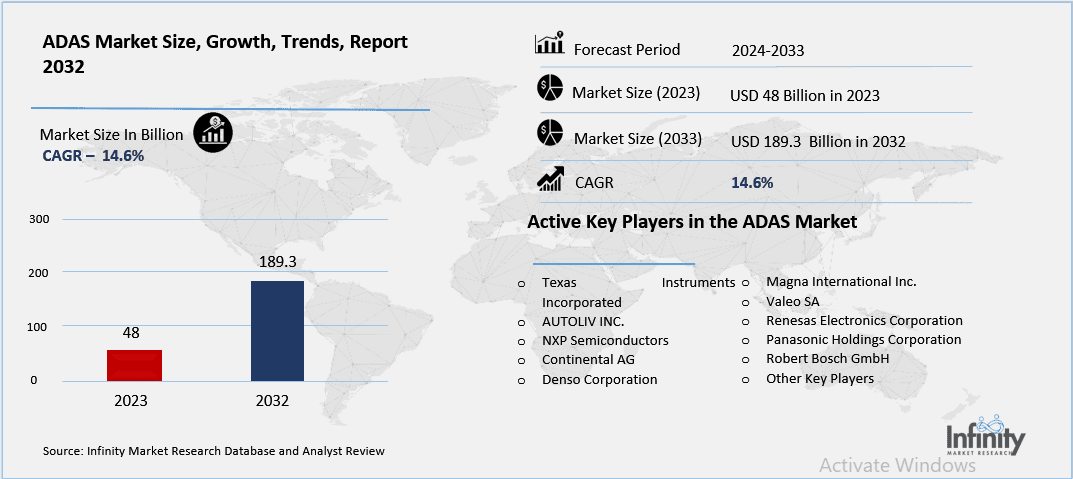

Global ADAS Market acquired the significant revenue of 48.0 Billion in 2023 and expected to be worth around USD 189.3 Billion by 2033 with the CAGR of 14.6% during the forecast period of 2024 to 2033.

The global ADAS market is growing because car buyers demand safety features in vehicles, and car manufacturers are making a shift towards autonomous vehicles. ADAS refers to many technologies aimed at increasing the safety of automobiles and helping drivers to manage and navigate their cars such as lane change warnings, speed control systems, emergency braking systems, and parking aids.

The key driving forces behind the market include human factors leading to error, government-driven standards for safety measures, technological improvements in sensing systems (radar, lidar, camera), and the overall move towards electrical and self-driving automobiles. In the same manner, there is scientifically improving concern towards road safety and the interest towards improved driving experiences also catalyze the market growth.

Drivers for the ADAS Market

Rising Demand for Vehicle Safety

Consumer demand for enhanced safety systems has become higher, and this has made ADAS to become popular throughout the automotive sector. With governments also putting emphasis towards road safety consumers are looking specifically for car models that make use of technology in the event of an accident. Continued incidents of injury or death occurring in road accidents, particularly for users of bicycles and pedestrians, make the consumers opt for cars that contain items like automatic emergency brakes, lane departure warnings, and collision warnings. These technologies reduce the incidences of human factors which are a major cause of traffic incidents. Furthermore, what gave a boost to the demand for car safety and better driving, was consumers’ awareness of a trend that aims at more individual safety and a more comfortable drive.

Restraints for the ADAS Market

High Implementation Costs

The complex technology and components involved in Advanced Driver Assistance Systems (ADAS) contribute significantly to the overall cost of vehicles, which may limit their adoption, particularly in budget and mid-range segments. ADAS technologies rely on a combination of sensors, cameras, radar, lidar, and processing units, all of which require significant investment in research, development, and manufacturing. These systems are sophisticated and require high-quality materials to ensure reliability and safety, further driving up the cost. As a result, manufacturers may struggle to incorporate such advanced features into lower-priced vehicles without impacting profit margins. For budget-conscious consumers, the added cost of ADAS features may be perceived as unaffordable or unnecessary, especially in markets where price sensitivity is high. This creates a barrier to widespread adoption, as only premium and high-end vehicles tend to offer a full suite of ADAS features, leaving the lower-priced segments underrepresented.

Opportunity in the ADAS Market

Integration with Electric Vehicles (EVs)

The rise of electric vehicles (EVs) presents a unique opportunity for the integration of Advanced Driver Assistance Systems (ADAS), creating a growth potential for both sectors. As the demand for EVs continues to surge due to environmental concerns, regulatory pressure, and technological advancements, the need for safety and efficiency becomes even more critical. ADAS systems, which enhance vehicle safety and automate driving functions, complement the design and performance goals of EVs. Electric vehicles typically have more flexible and spacious interior layouts, offering an ideal platform for the integration of sensors and hardware required for ADAS technologies.

Moreover, EV manufacturers are particularly keen to integrate cutting-edge technologies to differentiate their vehicles in a competitive market. ADAS not only improves safety but also enhances the overall driving experience, an essential consideration for consumers who are making the switch to electric vehicles.

Trends for the ADAS Market

Focus on Driver Assistance and Comfort

Features that go beyond basic safety, such as adaptive cruise control and automatic parking, are becoming key elements in enhancing the overall driving experience, especially in the context of Advanced Driver Assistance Systems (ADAS). While safety remains the primary focus, consumers are increasingly seeking technologies that improve convenience, comfort, and ease of driving. Adaptive cruise control, for instance, not only maintains a safe distance from other vehicles by adjusting the car's speed but also reduces the driver’s workload, especially during long drives or in heavy traffic. This feature contributes to a smoother and more relaxed driving experience by automating the speed and distance management.

Segments Covered in the Report

By System Type

o Park Assist

o E-Call System

o Adaptive Cruise Control

o Autonomous Emergency Braking

o Lane Departure Warning System

o Forward Collision Warning

o Other System Types

By Component Type

o Sensor

o LiDAR

o Radar

o Camera

By Vehicle Type

o Light Commercial Vehicles (LCV)

o Heavy Commercial Vehicles (HCV)

o Passenger Cars

Segment Analysis

By System Type Analysis

On the basis of system type, the market is divided into park assist, e-call system, adaptive cruise control, autonomous emergency braking, lane departure warning system, forward collision warning, and other system types. Among these, autonomous emergency braking segment acquired the significant share in the market owing to its critical role in preventing accidents and mitigating the severity of collisions. AEB systems are designed to automatically apply the vehicle’s brakes when an imminent collision is detected, helping to reduce the risk of accidents caused by human error or delayed reactions. With road safety being a top priority for both consumers and regulatory authorities, AEB has gained traction as a must-have feature in modern vehicles. Governments and safety organizations have increasingly pushed for the inclusion of AEB in vehicles, often mandating it as part of standard safety features, further driving its adoption.

By Component Type Analysis

On the basis of component type, the market is divided into sensor, LiDAR, radar, and camera. Among these, sensor segment held the prominent share of the market. Sensors, including ultrasonic sensors, infrared sensors, and proximity sensors, are essential for detecting and interpreting the vehicle's surroundings, providing the data needed for systems like adaptive cruise control, lane-keeping assist, and autonomous emergency braking. The widespread adoption of sensors can be attributed to their versatility, cost-effectiveness, and capability to work in diverse environmental conditions, such as low visibility or challenging weather. Sensors are often integrated into multiple ADAS functions, allowing them to perform a variety of tasks such as obstacle detection, distance measurement, and proximity sensing.

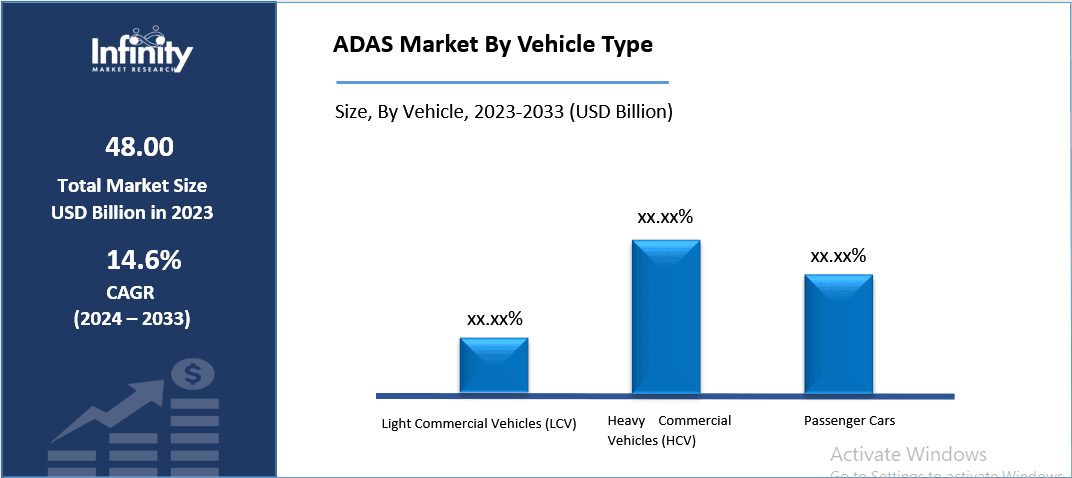

By Vehicle Type Analysis

On the basis of vehicle type, the market is divided into light commercial vehicles (LCV), heavy commercial vehicles (HCV), and passenger cars. Among these, passenger cars segment held the prominent share of the market due to the increasing consumer demand for safety, comfort, and convenience features. Passenger cars are the largest segment in the automotive market and account for the majority of ADAS adoption. The growing focus on road safety, as well as the shift toward more automated and connected driving experiences, has made ADAS technologies, such as lane-keeping assist, adaptive cruise control, and automatic emergency braking, highly desirable in passenger vehicles. As consumers seek higher levels of protection and convenience, automakers are integrating these systems as standard features, particularly in mid-range and premium models.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 32.4% of the market. The region is home to some of the world’s largest automobile manufacturers, including Toyota, Honda, Hyundai, and Nissan, which have been at the forefront of integrating ADAS technologies into their vehicles. The strong presence of these manufacturers, combined with substantial investments in automotive innovation, has contributed to the widespread adoption of ADAS systems. Furthermore, rising disposable incomes, urbanization, and increasing consumer awareness of vehicle safety are driving the demand for advanced safety features across various vehicle segments.

In China, the world's largest car market, there is a growing focus on vehicle safety and a push toward adopting autonomous driving technologies, which has significantly boosted the demand for ADAS. Government initiatives and regulations aimed at improving road safety and reducing accidents further support the integration of ADAS in the region.

Competitive Analysis

The competitive landscape of the Advanced Driver Assistance Systems (ADAS) market is marked by intense innovation and collaboration among key players, as companies strive to gain a technological edge in an increasingly safety-conscious and autonomous vehicle-focused market. Leading automotive manufacturers, such as Bosch, Continental, and Denso, along with technology giants like NVIDIA and Qualcomm, are at the forefront of developing and integrating ADAS technologies into vehicles. These companies are leveraging advancements in sensor technologies (radar, lidar, cameras), artificial intelligence, machine learning, and machine vision to enhance the effectiveness of ADAS systems. Strategic partnerships and collaborations between automakers and tech firms have become a key trend, as automakers seek to integrate cutting-edge technology into their vehicles while reducing R&D costs and speeding up the time to market.

Recent Developments

In April 2021, DENSO CORPORATION developed Advanced Drive, an ADAS technology designed to enhance vehicle sensing and safety. This technology is featured in the latest models of the Lexus LS and Toyota Mirai.

In July 2021, Magna International Inc. reached a definitive merger agreement to acquire Veoneer Inc., a prominent player in automotive safety technology. Through this acquisition, Magna intends to enhance and expand its ADAS portfolio, thereby solidifying its position in the industry.

Key Market Players in the ADAS Market

o Texas Instruments Incorporated

o AUTOLIV INC.

o NXP Semiconductors

o Continental AG

o Denso Corporation

o Magna International Inc.

o Valeo SA

o Renesas Electronics Corporation

o Panasonic Holdings Corporation

o Robert Bosch GmbH

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 48.0 Billion |

|

Market Size 2033 |

USD 189.3 Billion |

|

Compound Annual Growth Rate (CAGR) |

14.6% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By System Type, Component Type, Vehicle Type, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Texas Instruments Incorporated, AUTOLIV INC., NXP Semiconductors, Continental AG, Denso Corporation, Magna International Inc., Valeo SA, Renesas Electronics Corporation, Panasonic Holdings Corporation, Robert Bosch GmbH, and Other Key Players. |

|

Key Market Opportunities |

Integration with Electric Vehicles (EVs) |

|

Key Market Dynamics |

Rising Demand for Vehicle Safety |

📘 Frequently Asked Questions

1. Who are the key players in the ADAS Market?

Answer: Texas Instruments Incorporated, AUTOLIV INC., NXP Semiconductors, Continental AG, Denso Corporation, Magna International Inc., Valeo SA, Renesas Electronics Corporation, Panasonic Holdings Corporation, Robert Bosch GmbH, and Other Key Players.

2. How much is the ADAS Market in 2023?

Answer: The ADAS Market size was valued at USD 48 Billion in 2023.

3. What would be the forecast period in the ADAS Market?

Answer: The forecast period in the ADAS Market report is 2024-2033.

4. What is the growth rate of the ADAS Market?

Answer: ADAS Market is growing at a CAGR of 14.6% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.