🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Adhesion Promoter Market

Adhesion Promoter Market Global Industry Analysis and Forecast (2024-2032) By Form (Liquid, Spray),By Type (Silanes, Maleic Anhydride, Chlorinated Polyolefins, Titanate & Zirconate, Others),By Application (Plastics & Composite, Paints & Coatings, Ink, Rubber, Metals, Glass, Others),By End-Use Industry(Building & Construction, Automotive & Transportation, Packaging, Electronics, Others) and Region

Feb 2025

Chemicals and Materials

Pages: 138

ID: IMR1781

Adhesion Promoter Market Synopsis

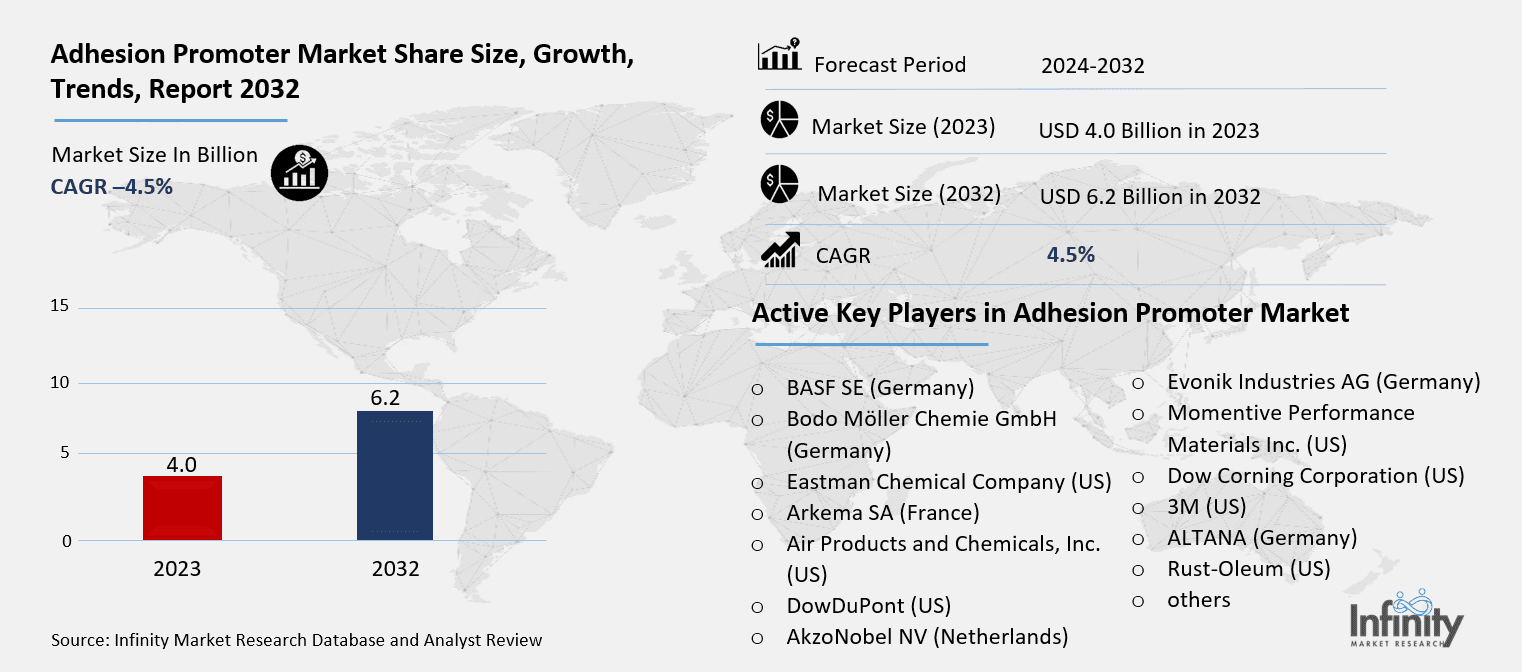

Adhesion Promoter Market Size Was Valued at USD 4.0 Billion in 2023, and is Projected to Reach USD 6.2 Billion by 2032, Growing at a CAGR of 4.5% From 2024-2032.

The global adhesion promoter market is an important part of the chemical industry because of the growing need for high-performance adhesives in many end-use areas, such as healthcare, electronics, construction, and the automotive industry. Chemicals known as adhesion promoters help to improve the bonding between adhesives and substrates, therefore guaranteeing better, more robust connections. In sectors where materials with varying surface properties, such as metals, plastics, and glass, must be properly bonded together, these promoters are absolutely vital. The development of end-use sectors and the ongoing need for sophisticated, long-lasting adhesives significantly influence the market's rise.

Several adhesion boosters, including silanes, titanates, zircons, and others, divide the market accordingly. Silane-based adhesion promoters are the most common type on the market because they can stick to a wide range of substrates. This is especially true in the construction and automotive industries. Though not as often employed as silanes, titanates and zircons are becoming more and more popular in specialist uses, especially in sectors like electronics and coatings, where exact bonding and outstanding performance are absolutely vital. New adhesion promoters that are safe for the environment are also a big trend in the industry. This is because regulations are getting stricter and customers want long-lasting solutions.

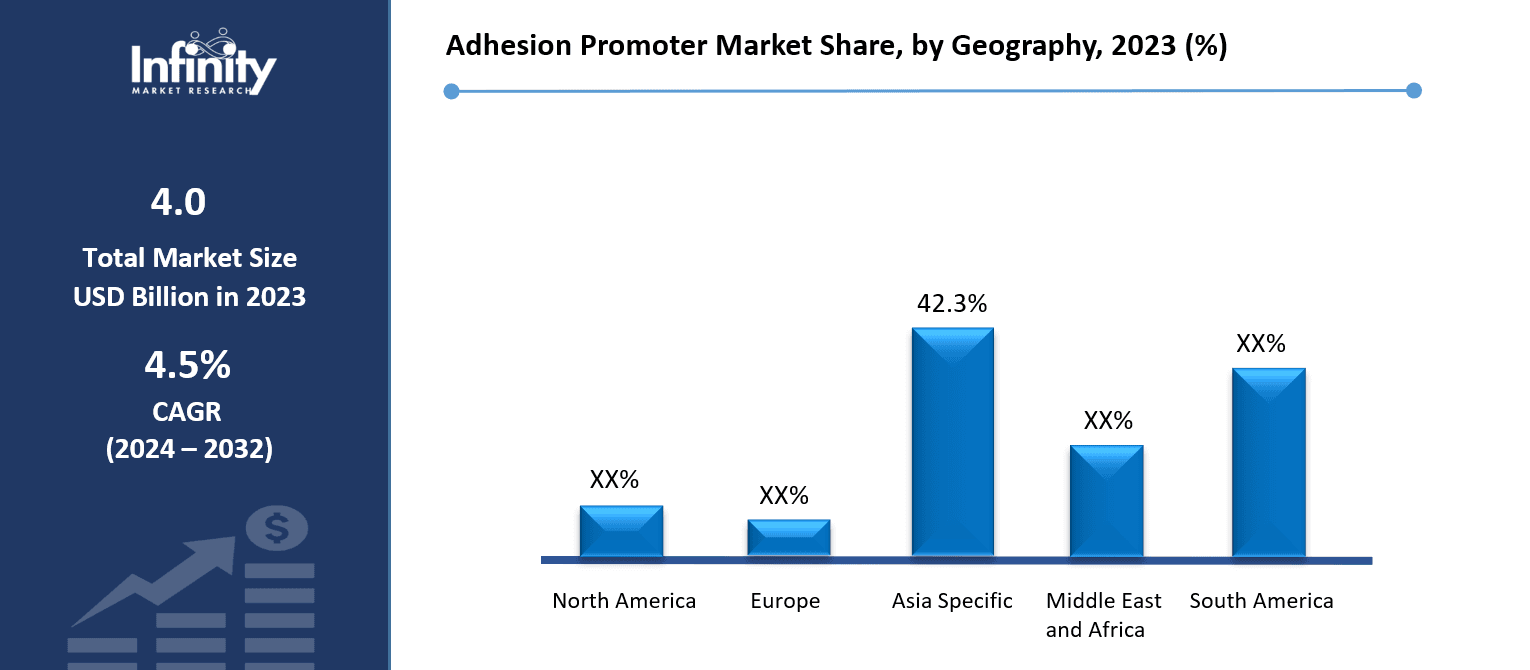

Because of their established industrial infrastructure, strict standards for product quality, and great demand for innovative adhesive solutions, North America and Europe have large portions of the worldwide adhesion promoter market. Since both the construction and automotive sectors in these areas are using new technologies and materials requiring sophisticated adhesion methods, they are the main drivers of market growth. Driven by rapid modernization, rising automobile output, and expanding manufacturing sectors in nations including China, India, and Japan, the Asia-Pacific region is expected to see the fastest increase as well. The increasing need for consumer products and electronic goods in these areas drives the adhesion promoter market even more.

Adhesion Promoter Market Outlook, 2023 and 2032: Future Outlook

Adhesion Promoter Market Trend Analysis

Trend: Increasing Demand for Eco-friendly and Sustainable Adhesion Promoters

The market for adhesion promoters is seeing notable movement toward environmentally friendly, sustainable solutions. Companies are under pressure to provide goods that are both efficient and ecologically friendly given growing environmental issues and customer desire for greener solutions. Usually biodegradable and with fewer volatile organic compounds (VOCs), environmentally friendly adhesion agents help minimize their impact. In sectors including automotive, packaging, and construction where sustainability is becoming a major factor in product choice, these goods are becoming more and more sought after. The move toward more sustainable materials corresponds with worldwide legislative measures meant to lower negative chemical emissions, therefore guiding the market toward better substitutes.

Drivers: Growth in Automotive and Construction Industries

The expansion in the construction and automotive sectors primarily drives the adhesion promoter market. Manufacturers in the automotive industry are using cutting-edge materials, including composites, lightweight metals, and plastics, more and more to increase fuel economy and safety, which calls for specific adhesion solutions to guarantee consistent bonding. Adhesion boosters help different materials stick together better, which leads to stronger, longer-lasting connections in vehicle assembly. This includes body panels, interior parts, and exterior trims. We predict an increase in demand for high-performance adhesion promoters as the automotive sector continues to embrace innovation, including electric vehicles (EVs), thereby driving market expansion.

Restraints: High Costs of Advanced Adhesion Promoter Products

The substantial expenses connected with enhanced adhesion promoter goods are one of the main limitations in the market for adhesives. Particularly those intended for specialist uses like electronics or aerospace, these high-performance compounds can call for costly raw materials and sophisticated manufacturing techniques. The outcome can be a finished product far more costly than conventional adhesives. Small and medium-sized producers may find this cost barrier difficult, especially in areas where cost-effective substitutes could be preferred, and it underlines price sensitivity. Furthermore, the high cost of these cutting-edge technologies may limit their widespread acceptance in sectors where financial constraints significantly influence material choice.

Opportunities: Expansion in Emerging Markets, particularly in Asia-Pacific

For industry participants, the spread of the adhesion promoter market in developing countries—especially in the Asia-Pacific area—offers major potential prospects. Demand for sophisticated adhesive solutions in areas including automotive, building, and electronics is rising as nations including China, India, and Japan undergo rapid industrialization and urbanization. Adhesion promoters are becoming more popular in these areas because more people are using new materials and machines need to be able to stick things together well. The automotive industry is growing quickly, with a focus on making lightweight materials and electric vehicles. This is increasing the need for high-performance adhesion promoters that ensure long-lasting bonding of different substrates.

Adhesion Promoter Market Segment Analysis

Adhesion Promoter Market Segmented on the basis of By Form, By Type, By Application and By End-Use Industry.

By Type

o Silanes

o Maleic Anhydride

o Chlorinated Polyolefins

o Titanate & Zirconate

o Others

By Form

o Liquid

o Spray

By Application

o Plastics & Composite

o Paints & Coatings

o Ink

o Rubber

o Metals

o Glass

o Others

By End Use Industry

o Building & Construction

o Automotive & Transportation

o Packaging

o Electronics

o Others

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Form, Silanes segment is expected to dominate the market during the forecast period

The adhesion promoter market is segmented by form, with the two main categories being liquid and spray forms. Liquid adhesion promoters are widely used due to their versatility and ease of application, especially in industrial settings where precise control over the amount of adhesive is necessary. These liquid formulations are typically applied directly to substrates before the adhesive is applied, providing a strong bond between the material and the adhesive. Liquid forms are particularly favored in applications such as automotive manufacturing, construction, and electronics, where bonding strength and durability are essential. They can be easily incorporated into production processes, making them a popular choice for large-scale industrial use.

Spray adhesion promoters, on the other hand, offer the advantage of quick and even application over large surface areas. They are commonly used in industries where speed and efficiency are critical, such as in packaging or assembly lines. Spray forms of adhesion promoters are ideal for applications requiring a thin, consistent coating across irregularly shaped surfaces. This form also provides ease of use, especially in smaller-scale applications or environments where precise dispensing might be more challenging. As demand for automation and faster production times increases, the spray form is gaining popularity, offering opportunities for growth in industries where time and cost efficiency are prioritized.

By End-Use Industry, Building & Construction segment expected to held the largest share

The adhesion promoter market is driven by the different needs of end-use sectors. This is because each sector needs unique bonding solutions to make sure that adhesives work well. Particularly in high-performance coatings and sealants, adhesion boosters are vital for guaranteeing strong bindings between materials such as concrete, glass, and metal in the building and construction sector. Manufacturers depend on adhesion promoters to bond lightweight materials, such as plastics and metals, for components including body panels, bumpers, and interiors; therefore, the automobile and transportation sectors also play a vital role. Adhesion promoters enhance the lifetime and durability of automotive adhesives, thereby contributing to fuel economy and safety in the sector.

Adhesion promoters are becoming more and more important in the packaging sector as flexible packaging, labels, and containers are produced; robust, long-lasting bindings are needed to guarantee product integrity. Another important end-user is the electronics sector, especially in the manufacturing of semiconductors, displays, and circuit boards, where exact bonding and environmental factor protection are very vital. As the demand for high-performance specialized adhesives keeps increasing, other industries, including healthcare, aerospace, and consumer products, also help drive market expansion. There are more new materials being used and more industries needing reliable, strong bonding solutions, which is making the adhesion promoter market grow.

Adhesion Promoter Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The Asia-Pacific region is expected to have the largest adhesion promoter market over the next few years. This is because of its fast industrialization and growing need for advanced adhesive solutions in key industries such as construction, electronics, and automotive. Manufacturing and production of nations such as China, India, and Japan are rising significantly, which creates more need for high-performance adhesives needing effective adhesion boosters. Particularly, the automobile sector is growing quickly in this area and is moving toward lightweight materials and complex composites that need specific adhesion promoter technologies. The demand for adhesion promoters to improve bonding performance in intricate applications will also increase as these sectors continue to develop.

Adhesion Promoter Market Share, by Geography, 2023 (%)

Active Key Players in the Adhesion Promoter Market

o BASF SE (Germany)

o Bodo Möller Chemie GmbH (Germany)

o Eastman Chemical Company (US)

o Arkema SA (France)

o Air Products and Chemicals, Inc. (US)

o DowDuPont (US)

o AkzoNobel NV (Netherlands)

o Evonik Industries AG (Germany)

o Momentive Performance Materials Inc. (US)

o Dow Corning Corporation (US)

o 3M (US)

o ALTANA (Germany)

o Rust-Oleum (US)

o others

Global Adhesion Promoter Market Scope

|

Global Adhesion Promoter Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.0 Billion |

|

Forecast Period 2024-32 CAGR: |

4.5% |

Market Size in 2032: |

USD 6.2 Billion |

|

Segments Covered: |

By Form |

· Liquid · Spray

| |

|

By Type |

· Silanes · Maleic Anhydride · Chlorinated Polyolefins · Titanate & Zirconate · Others | ||

|

By Application |

· Plastics & Composite · Paints & Coatings · Ink · Rubber · Metals · Glass · Others | ||

|

By End-Use Industry |

· Building & Construction · Automotive & Transportation · Packaging · Electronics · Others | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Growth in Automotive and Construction Industries | ||

|

Key Market Restraints: |

· High Costs of Advanced Adhesion Promoter Products | ||

|

Key Opportunities: |

· Expansion in Emerging Markets, particularly in Asia-Pacific | ||

|

Companies Covered in the report: |

· BASF SE (Germany), Bodo Möller Chemie GmbH (Germany), Eastman Chemical Company (US), Arkema SA (France), Air Products and Chemicals, Inc. (US), DowDuPont (US), AkzoNobel NV (Netherlands), Evonik Industries AG (Germany), Momentive Performance Materials Inc. (US), Dow Corning Corporation (US), 3M (US), ALTANA (Germany), Rust-Oleum (US), others.

| ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Adhesion Promoter Market research report?

Answer: The forecast period in the Adhesion Promoter Market research report is 2024-2032.

2. Who are the key players in the Adhesion Promoter Market?

Answer: BASF SE (Germany), Bodo Möller Chemie GmbH (Germany), Eastman Chemical Company (US), Arkema SA (France), Air Products and Chemicals, Inc. (US), DowDuPont (US), AkzoNobel NV (Netherlands), Evonik Industries AG (Germany), Momentive Performance Materials Inc. (US), Dow Corning Corporation (US), 3M (US), ALTANA (Germany), Rust-Oleum (US), others.

3. What are the segments of the Adhesion Promoter Market?

Answer: The Adhesion Promoter Market is segmented into By Form, By Type, By Application, By End-Use Industry and region. By Form (Liquid, Spray),By Type (Silanes, Maleic Anhydride, Chlorinated Polyolefins, Titanate & Zirconate, Others),By Application (Plastics & Composite, Paints & Coatings, Ink, Rubber, Metals, Glass, Others),By End-Use Industry(Building & Construction, Automotive & Transportation, Packaging, Electronics, Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Adhesion Promoter Market?

Answer: An adhesion promoter is a chemical substance used to improve the bond between different substrates and adhesives, enhancing the adhesive’s performance and durability. It works by modifying the surface energy of a material to promote better interaction between the adhesive and the substrate, particularly when the materials have low or incompatible surface energies. Commonly used in industries like automotive, construction, electronics, and packaging, adhesion promoters are available in various forms, including silanes, titanates, and zircons, each tailored for specific applications to achieve strong, lasting adhesion in diverse environments.

5. How big is the Adhesion Promoter Market?

Answer: Adhesion Promoter Market Size Was Valued at USD 4.0 Billion in 2023, and is Projected to Reach USD 6.2 Billion by 2032, Growing at a CAGR of 4.5% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.