🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Adhesive Tapes Market

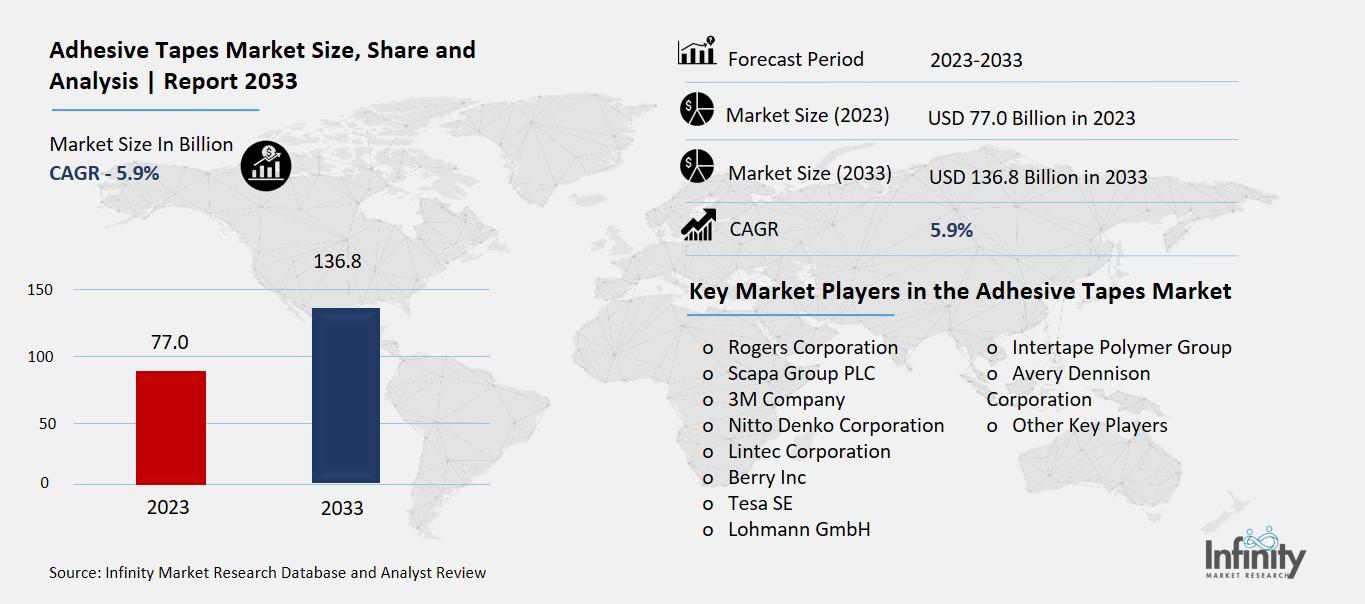

Adhesive Tapes Market (By Material (Polypropylene (PP), Paper, Polyvinyl Chloride (PVC), Others), By Resin (Acrylic, Rubber, Silicone, Others), By Technology (Solvent-based, Hot-Melt based, Water-based), By Application (Automotive, Healthcare, Packaging, Electrical & Electronics, Building & Construction, Retail, Others), By Region and Companies)

Jul 2024

Chemicals and Materials

Pages: 160

ID: IMR1126

Adhesive Tapes Market Overview

Global Adhesive Tapes Market size is expected to be worth around USD 136.8 Billion by 2033 from USD 77.0 Billion in 2023, growing at a CAGR of 5.9% during the forecast period from 2023 to 2033.

The Adhesive Tapes Market is all about the different kinds of sticky tapes that people and businesses use every day. These tapes can be used for lots of things, like sticking things together, sealing packages, or even in medical settings for bandages and wound care. They come in various types, such as duct tape, masking tape, and double-sided tape, each designed for specific purposes.

This market includes the companies that make these tapes, the raw materials they use, and the people who buy them. The demand for adhesive tapes is growing because they are so useful in many industries, including construction, healthcare, and packaging. As technology improves, we also see new types of tapes being developed that are stronger, more durable, and can stick to different surfaces better.

Drivers for the Adhesive Tapes Market

Rising Demand in the Packaging Industry

One of the primary drivers for the adhesive tapes market is the increasing demand in the packaging industry. Adhesive tapes are extensively used for sealing, labeling, and bundling products in various packaging applications. With the growth of e-commerce and the need for secure packaging solutions, the demand for adhesive tapes is on the rise. Additionally, these tapes offer advantages such as ease of use, cost-effectiveness, and the ability to provide tamper-evident seals, making them indispensable in the packaging sector.

Growth in the Automotive Industry

The automotive industry is another significant driver for the adhesive tapes market. Adhesive tapes are used in a variety of applications within vehicles, including bonding trim, attaching badges, and even structural components. They help reduce the weight of vehicles, which is crucial for improving fuel efficiency. The shift towards electric vehicles (EVs) further boosts the demand for adhesive tapes, as they are used in battery assembly and insulation to ensure safety and performance.

Increasing Applications in the Healthcare Sector

The healthcare sector's expansion also significantly contributes to the adhesive tapes market's growth. These tapes are used in medical devices, wound care products, and surgical procedures. The rise in global healthcare spending, the aging population, and the increasing prevalence of chronic diseases drive the demand for medical adhesive tapes. These tapes offer benefits like strong adhesion, hypoallergenic properties, and breathability, making them essential in medical applications.

Advancements in Tape Technology

Technological advancements in adhesive tape formulations and manufacturing processes are driving market growth. Innovations such as double-sided tapes, high-performance acrylic adhesives, and environmentally friendly tapes have expanded the applications and efficiency of adhesive tapes. These advancements cater to the specific needs of industries like electronics, construction, and aerospace, which require tapes with high strength, temperature resistance, and durability.

Expanding Construction Industry

The construction industry's growth, particularly in emerging economies, is a significant driver for the adhesive tapes market. These tapes are used for bonding, sealing, and insulation purposes in various construction applications. The increasing focus on sustainable building practices and the use of advanced materials in construction projects further boost the demand for adhesive tapes. Their ability to provide strong bonds and quick application makes them a preferred choice in the construction sector.

Restraints for the Adhesive Tapes Market

Environmental Regulations

One major challenge for the adhesive tapes market is the strict environmental regulations imposed by various governments. These rules often mandate the reduction or elimination of harmful chemicals in manufacturing processes. For example, the use of volatile organic compounds (VOCs) in adhesive production is heavily regulated due to their negative impact on air quality and human health. Complying with these regulations requires significant investment in research and development to create eco-friendly alternatives, which can be costly and time-consuming.

Volatile Raw Material Prices

The prices of raw materials used in adhesive tapes, such as petroleum-based products and natural rubber, can be highly volatile. This volatility is influenced by factors like geopolitical tensions, changes in supply and demand, and fluctuations in the global economy. Sudden price hikes can lead to increased production costs, which may not always be passed on to consumers, thus squeezing profit margins for manufacturers.

Availability of Alternatives

Another significant restraint is the availability of alternative bonding and fastening solutions. Products like mechanical fasteners, welding, and newer technologies such as UV-cured adhesives can often serve the same purpose as adhesive tapes. These alternatives may offer advantages in terms of strength, durability, or specific application requirements, leading customers to opt for them over traditional adhesive tapes.

Economic Downturns

Economic downturns can also negatively impact the adhesive tapes market. During periods of economic uncertainty or recession, industries like construction, automotive, and electronics—which are major consumers of adhesive tapes—tend to slow down. This decrease in industrial activity leads to reduced demand for adhesive tapes, affecting the overall market growth.

Competition and Market Saturation

The adhesive tapes market is highly competitive, with numerous players vying for market share. This intense competition can lead to price wars, reducing profitability for companies. Additionally, in some regions, the market is becoming saturated, making it difficult for new entrants to establish themselves and for existing companies to expand their market share without significant marketing and innovation efforts.

Opportunity in the Adhesive Tapes Market

Increasing Demand from the Automotive Sector

The automotive industry presents a significant opportunity for the adhesive tapes market. With advancements in vehicle design and engineering, the demand for specialized tapes is rising. Adhesive tapes are extensively used in vehicle assembly for tasks like bonding metal and composite parts, protective masking, and labeling. They offer advantages over mechanical fasteners by reducing assembly time and labor costs. As the automotive sector grows, particularly with the advent of electric and autonomous vehicles, the applications for adhesive tapes are expected to expand further, driving market growth.

Growing E-Commerce and Packaging Needs

The surge in e-commerce has significantly increased the demand for packaging solutions, including adhesive tapes. These tapes are essential for sealing packages, ensuring product safety during transit, and providing tamper-evident seals. The rise in online shopping, especially during and post-pandemic, has led to a boom in the packaging industry. As e-commerce continues to grow globally, the need for reliable and efficient adhesive tape solutions will create substantial market opportunities.

Technological Advancements and Product Innovation

Technological advancements and continuous product innovation are pivotal in driving the adhesive tapes market. Companies are investing in developing new types of tapes with enhanced properties such as heat resistance, moisture resistance, and chemical resistance. Innovations like UV-curable hot-melt adhesives and environmentally friendly tapes are gaining traction. These advancements not only meet the evolving needs of various industries but also open new application areas, thus expanding the market scope.

Expanding Applications in Healthcare

The healthcare sector is another significant growth area for adhesive tapes. These tapes are used in medical devices, wound care, and surgical procedures. With the growing emphasis on healthcare and the increasing demand for advanced medical solutions, the need for high-performance adhesive tapes is rising. This trend is further bolstered by the aging population and the increasing prevalence of chronic diseases, which drive the demand for medical tapes and adhesives.

Sustainability and Environmental Regulations

Sustainability is becoming a key focus for many industries, including the adhesive tapes market. The push for environmentally friendly products is leading to the development of sustainable tapes made from bio-based materials. Additionally, regulatory pressures to reduce carbon footprints and enhance recyclability are prompting manufacturers to innovate and offer greener solutions. Companies that can successfully navigate these regulations and provide sustainable products are likely to see significant market opportunities.

Regional Growth in Emerging Markets

Emerging markets, particularly in the Asia-Pacific region, are witnessing rapid industrialization and urbanization, creating robust demand for adhesive tapes. Countries like China, India, and Southeast Asian nations are seeing significant growth in industries such as automotive, electronics, and construction. This regional growth offers vast opportunities for adhesive tape manufacturers to expand their market presence and cater to the increasing demand from these burgeoning economies

Trends for the Adhesive Tapes Market

Rise of Eco-friendly Adhesives

One significant trend in the adhesive tapes market is the shift towards eco-friendly adhesives. Water-based adhesive tapes are gaining popularity due to their lower environmental impact. These tapes are made from natural polymers or vegetable sources, which reduces volatile organic compound (VOC) emissions, improves air quality, and decreases the risk of flammability. This trend is particularly strong in regions like China, India, and Malaysia, where infrastructure projects are driving demand for environmentally friendly materials.

Increasing Demand in Healthcare

The healthcare sector is seeing rapid growth in the use of adhesive tapes. This is driven by the rising number of hospitals, increasing health consciousness, and the launch of new medical products such as hydrophilic films, oral dissolvable films, and transdermal drug delivery patches. Adhesive tapes are crucial in medical applications for secure and non-invasive attachment of medical devices to the skin, wound care, and other healthcare uses. The healthcare category is expected to advance significantly, with a notable compound annual growth rate (CAGR) in the coming years.

Expansion in the Automotive Sector

The automotive industry continues to be a major driver for adhesive tapes. Tapes are used extensively in vehicle manufacturing for tasks like component assembly, bonding metals and composites, protective masking, and labeling. The shift towards lighter, more sustainable, and autonomous vehicles further increases the demand for specialized adhesive tapes that can withstand harsh environments within vehicle engines and exterior panels. As vehicle production and advancements in automotive design grow, the demand for adhesive tapes in this sector is expected to expand.

Growth in the Packaging Industry

The packaging industry remains a dominant consumer of adhesive tapes. With the increase in e-commerce and online shopping, the need for secure and reliable packaging solutions has surged. Adhesive tapes are essential for carton sealing, bundling, and strapping products. Additionally, advancements in digital printing have made these tapes a valuable promotional tool for brand owners. The continued growth of the packaging industry will keep driving the demand for adhesive tapes.

Technological Advancements

Technological innovations in adhesive tapes are also a notable trend. The development of hot melt-based adhesive tapes, which dominate the market, continues to evolve. These tapes are preferred for their versatility and strong adhesion in various manufacturing processes, including bookbinding, woodworking, construction, and product assembly. Moreover, innovations in acrylic and silicone-based tapes are providing better performance and durability, catering to a wide range of applications across different industries.

Regional Growth Trends

Regionally, the Asia-Pacific market is witnessing the fastest growth. Countries like China and India are leading this surge due to their large manufacturing sectors and increasing infrastructure projects. The availability of raw materials and lower labor costs attract major manufacturers to set up bases in these regions. Meanwhile, North America remains a strong market due to high demand from the automotive, healthcare, and packaging sectors. The presence of leading manufacturers in the U.S. also contributes to the region's market dominance

Segments Covered in the Report

By Material

- Polypropylene (PP)

- Paper

- Polyvinyl Chloride (PVC)

- Others

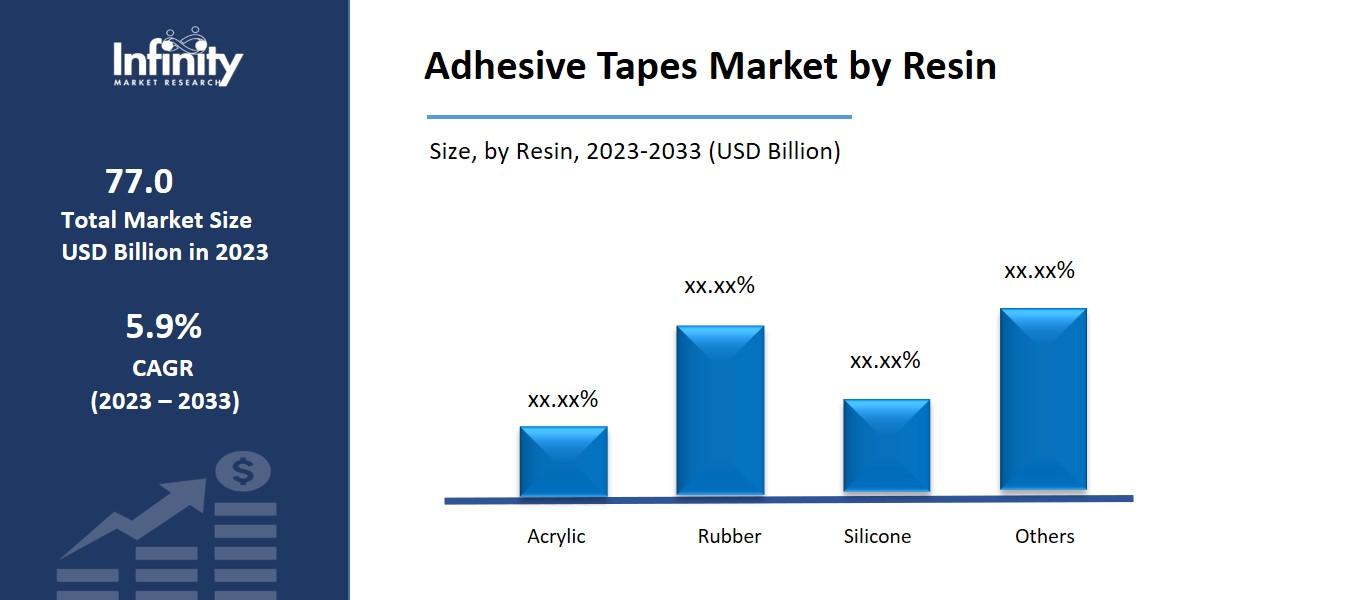

By Resin

- Acrylic

- Rubber

- Silicone

- Others

By Technology

- Solvent-based

- Hot-Melt based

- Water-based

By Application

- Automotive

- Healthcare

- Packaging

- Electrical & Electronics

- Building & Construction

- Retail

- Others

Segment Analysis

By Material Analysis

Based on backing material, the adhesive tapes market is segmented into segments for polypropylene (PP), paper, polyvinyl chloride (PVC), and other materials. In terms of revenue from adhesive tapes, the polypropylene (PP) adhesive tapes sector retained the lion's share in 2023, accounting for around 34.9% of the market.

Global demand for adhesive tapes is being driven by the increasing need for effective plastic packaging materials. In the packaging sector, polypropylene (PP) is the most often used plastic. The Plastic Trade Association states that in 2023, the industrial and packaging industries will employ a variety of plastic types.

By Resin Analysis

In addition to its superior adhesive qualities, acrylic is anticipated to account for 39.2% of the worldwide adhesive tape market in terms of resin by 2023. Strong adhesion to a variety of surfaces, such as paper, plastic, metal, and glass, is provided by acrylic tapes. They adhere strongly for an extended time and immediately form strong connections upon application. Acrylic tapes are more resilient to temperature variations, vibration, and moisture than tapes composed of other resins because of their strong adhesive power.

Acrylic tapes are a great option for applications in the construction, automotive, durable goods, and shipping/packaging industries where bonds need to survive rigors of use and environmental stressors because of their stability in performance throughout difficult situations. Acrylic tapes have additional uses in that they may be removed and repositioned to some extent without leaving any trace.

Additionally, because acrylic is transparent, tape colors and designs can show through, creating potential in the markets for visual identification. The appeal of acrylic as a tape resin is further enhanced by its favorable features for the environment and its ability to adhere to uneven surfaces. Thus, acrylic tapes have a competitive advantage due to their strong adhesive qualities and adaptability.

By Technology Analysis

Hot melt technology is anticipated to account for 39.1% of the worldwide adhesive tape market by 2023. This is because recent technology advancements have improved hot melt capabilities. Tapes can now offer strong initial tack, optimal adhesive strength, and resistance to harsh environments like heat, cold, and moisture as they age thanks to developments in hot melt resin formulations. The conventional usage of hot melt tapes in packaging has given way to increasingly complex industrial and engineering applications.

Equipment for precision coating reduces wastage from raw materials and maximizes the use of hot melt. Hot melt tapes can be used effectively in automated manufacturing lines thanks to online application systems. Furthermore, increasing the usefulness of hot melt tape are self-wounding designs with matrix release technology.

Furthermore, manufacturing costs are decreased by energy-efficient techniques for curing hot melt adhesives. Thus, technological advancements continue to enhance hot melt tapes' varied performance characteristics. This explains their growing inclination over alternatives based on solvents and water in a variety of industries.

By Application Analysis

Since the industry's strong expansion, the automotive end-user segment accounts for 37.2% of the worldwide adhesive tapes market in 2023. Global auto manufacturing is increasing, and advances in automotive engineering and design are important demand drivers. Because they improve process efficiency, adhesive tapes are essential to the automotive manufacturing industry. They are employed in processes such as identity labeling, protective masking, bonding of metals and composites, and assembly and manufacture of vehicle components.

Inside car engines and exterior panels, specialized heat-, moisture-, and chemical-resistant automotive-grade adhesive tapes provide strong and dependable bindings under challenging operating conditions. Automakers can save labor expenses and assembly time by using adhesive tapes.

It is easier to disassemble them for part replacements because they are more disposable than mechanical fasteners. The automobile industry will see a further expansion of adhesive tape uses in the future as new technology enables cars to be lighter, more environmentally friendly, and autonomous. As a result, throughout its extensive value chain, the thriving automobile industry serves as a major driver of adhesive tape demand.

Regional Analysis

With 39.1% of the market share in 2023, North America has long dominated the worldwide adhesive tapes market due to the strong presence of important industry players and strong demand from end-use industries. Because of its significant automotive, healthcare, and packaging industries, the United States holds the lion's share of the regional market share. With their headquarters located in the United States, industry leaders such as 3M, Tesla Tapes, and Berry Global possess an early-mover advantage that enables them to meet both domestic and international demand.

A robust manufacturing base is not the only element driving growth; the high rate of infrastructure projects, building retrofitting, and strong consumer demand for do-it-yourself projects and home improvement are all contributing factors. Logistics organizations' need for carton sealing and other packaging tapes has increased due to the growth of e-commerce. To keep their hold on the market, regional firms are introducing new product lines aimed at specialized markets including electronics, graphics, and automobile OEMs.

Competitive Analysis

The high pace of infrastructure projects, building retrofitting, and strong consumer demand for do-it-yourself projects and home improvement are all contributing elements to the growth being driven by a robust manufacturing base.

The rise of e-commerce has raised the requirement for carton sealing and other packaging tapes by logistics businesses. Regional businesses are launching new product lines targeted at niche industries including electronics, graphics, and auto OEMs to maintain their market share.

Recent Developments

In January 2022: Beiersdorf Group invests EUR 55 million in Vietnamese port city Haiphong, aiming to produce 40 million square meters of adhesive tape annually by 2023.

February 2024: Avery Dennison Performance Tapes introduces a new portfolio of Pressure-Sensitive-Adhesive (PSA) tape solutions for the appliance industry, offering nearly forty products for various applications.

Key Market Players in the Adhesive Tapes Market

-

Rogers Corporation

-

Scapa Group PLC

-

3M Company

-

Nitto Denko Corporation

-

Lintec Corporation

-

Berry Inc

-

Tesa SE

-

Lohmann GmbH

-

Intertape Polymer Group

-

Avery Dennison Corporation

-

Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 77.0 Billion |

|

Market Size 2033 |

USD 136.8 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.9% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Material, Resin, Technology, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Rogers Corporation, Scapa Group PLC, 3M Company, Nitto Denko Corporation, Lintec Corporation, Berry Inc, Tesa SE, Lohmann GmbH, Intertape Polymer Group, Avery Dennison Corporation |

|

Key Market Opportunities |

Increasing Demand from the Automotive Sector |

|

Key Market Dynamics |

Rising Demand in the Packaging Industry |

📘 Frequently Asked Questions

1. How much is the Adhesive Tapes Market in 2023?

Answer: The Adhesive Tapes Market size was valued at USD 77.0 Billion in 2023.

2. What would be the forecast period in the Adhesive Tapes Market report?

Answer: The forecast period in the Adhesive Tapes Market report is 2023-2033.

3. Who are the key players in the Adhesive Tapes Market?

Answer: Rogers Corporation, Scapa Group PLC, 3M Company, Nitto Denko Corporation, Lintec Corporation, Berry Inc, Tesa SE, Lohmann GmbH, Intertape Polymer Group, Avery Dennison Corporation

4. What is the growth rate of the Adhesive Tapes Market?

Answer: Adhesive Tapes Market is growing at a CAGR of 5.9% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.