🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Aluminum Market

Aluminum Market Global Industry Analysis and Forecast (2024-2033) by Product (Cast, Extrusion, Sheet, Plate, and Other Products), Application (Automotive & Transportation, Building & Construction, Consumer Goods, Foil & Packaging, Machinery & Equipment Industrial, Power, and Other Applications) and Region

Apr 2025

Chemicals and Materials

Pages: 138

ID: IMR1905

Aluminum Market Synopsis

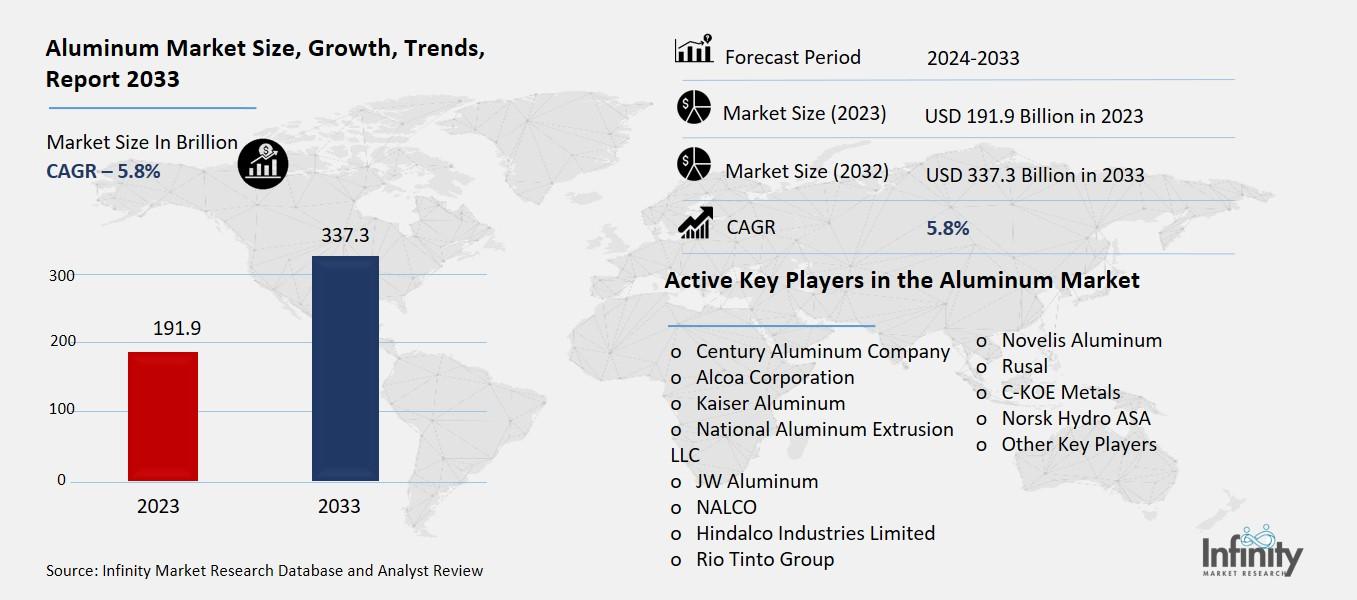

The global aluminum market was valued at USD 191.9 billion in 2023 and is expected to grow from USD 203.0 billion in 2024 to USD 337.3 billion by 2033, reflecting a CAGR of 5.8% over the forecast period.

The aluminum market worldwide keeps growing because of expanding needs within automobile production and aerospace construction as well as building projects along with packaging operations. Human industries chose aluminum because of its weight advantage and resistance to corrosion and ability to recycle which supports sustainable development and fuel conservation efforts. Asia-Pacific leads aluminum market production and consumption through China and India because the two nations accelerate their industrialization and build more infrastructure. The market encounters two main difficulties that involve unpredictable raw material price fluctuations together with bauxite supply issues created by geopolitical tensions and energy-consuming manufacturing operations. The combination of secondary aluminum materials with advanced smelting methods drives industry future direction because manufacturers want economical and ecologically responsible approaches.

Aluminum Market Driver Analysis

Rising Demand in Automotive & Aerospace

Automotive and aerospace sectors rely on these lightweight features of aluminum to enhance fuel economy and lower emissions, driving demand for this material. In relation to ICE vehicles, replacing steel with aluminum reduces overall vehicle weight as compared to traditional passenger cars and has been shown to lead to lower fuel consumption and decreased CO₂ emissions. This move comes on the heels of more stringent worldwide emission standards and sustainability targets. In the booming electric vehicle (EV) sector, demand for aluminum is even higher weight reduction has a direct effect on battery efficiency and driving range. It takes less energy to move lighter vehicles, which means electrical vehicles use less energy to travel farther distances on a single charge, while enhancing overall performance. Aluminum is emerging as a key material in the future of mobility as automakers rapidly leverage the attribute across their vehicles, including battery enclosures, chassis, body panels, and structural components.

Aluminum Market Restraint Analysis

Fluctuating Raw Material Prices

Bauxite and alumina prices are notoriously volatile, affecting the aluminum market. Geopolitical tensions, trade policies, and supply chain disruption are among the culprits driving up these metals. Bauxite is the main raw material in the production of aluminum, and it is produced from only a handful of areas, according to Australia, Guinea, and China. Any political unrest, export bans, or logistical bottlenecks in these regions can cause price fluctuations and supply shortages, not just for aluminum manufacturers in Russia and China but for those worldwide. Likewise, alumina (produced from bauxite) is subject to price volatility due to alterations in demand, energy costs and environmental regulations, leaving the industry unable to predict costs.

Aluminum Market Opportunity Analysis

Technological Advancements in Smelting & Recycling

Low-carbon production technologies are being adopted more widely by the aluminum industry. The most notable is inert anode technology, a non-consumable, non-carbon anode replacing carbon anodes in the Hall-Héroult smelting process. Standard anodes release carbon dioxide (CO₂) emissions in aluminum production thus inverse anodes generate only oxygen, as a result, significantly reducing greenhouse emissions. Companies such as Alcoa and Rusal are at the forefront of this technology, which helps achieve global carbon neutrality commitments while improving production efficiency. Low-carbon aluminum will gain market share as industries move due to stricter sustainability screening on facing materials, particularly in the automotive, aerospace, and packaging industry.

Aluminum Market Trend Analysis

Supply Chain Diversification

China maintains strong control over the worldwide aluminum supply networks including bauxite exploration together with alumina processing and aluminum fabrication. Companies now seek to enlarge their bauxite sourcing bases because of geopolitical tensions combined with trade restrictions and supply chain disruptions. Aluminum producers seek their bauxite supply from both African countries and Australian territories as a direct outcome. Guinea has emerged as a vital bauxite exporter because it contains the largest bauxite reserves in the world thus attracting international mining giants such as Rio Tinto and Alcoa and Rusal. The second-largest bauxite producer in Australia has improved its production capacity to supply the growing market of non-Chinese importers. Diversifying raw material suppliers in Africa and Australia reduces risks to companies operating in aluminum industries allowing them to maintain stable and broadened raw material supply infrastructure.

Aluminum Market Segment Analysis

The Aluminum Market is segmented on the basis of Product, Processing Method, and Application.

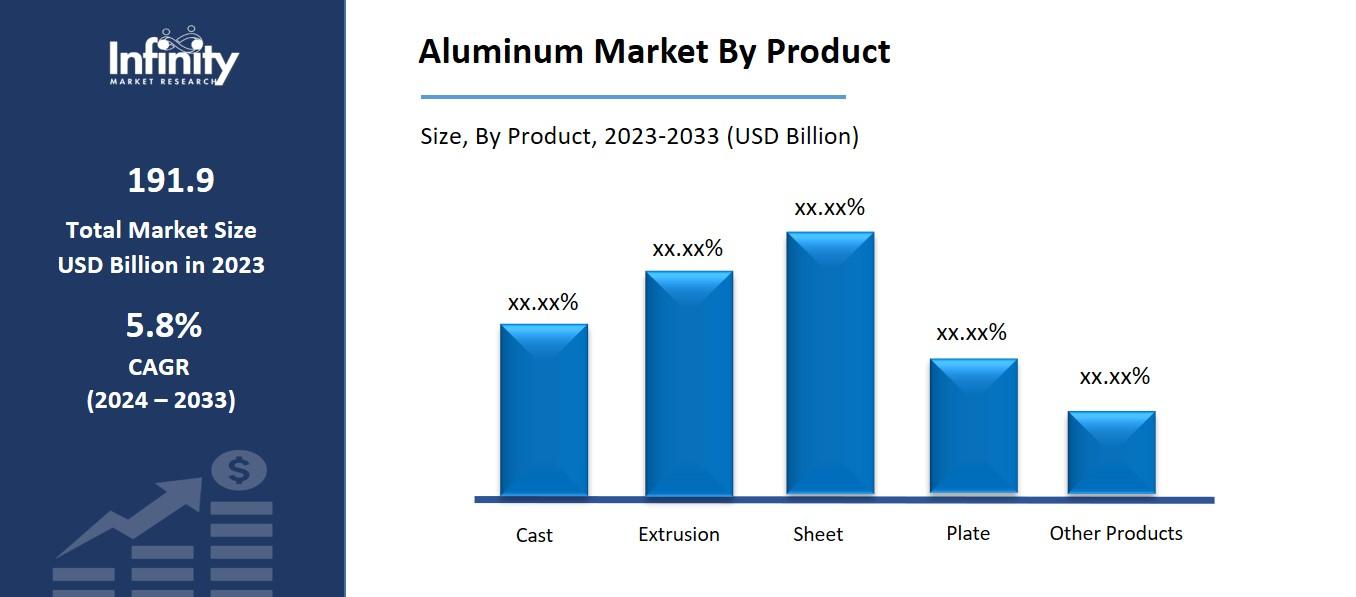

By Product

o Cast

o Extrusion

o Sheet

o Plate

o Other Products

By Application

o Automotive & Transportation

o Building & Construction

o Consumer Goods

o Foil & Packaging

o Machinery & Equipment Industrial

o Power

o Other Applications

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Product, Cast Segment is Expected to Dominate the Market During the Forecast Period

The Products discussed in this research study, the biofuel segment is expected to account for the largest market share of aluminum market in the forecast period. The automotive aerospace and consumer goods industries heavily prefer cast aluminum components because they deliver lightweight features along with great durability at affordable prices. Manufacturers in the automotive sector depend on cast aluminum for fuel efficiency and reduced weight as they use it for engine blocks and transmission housings and structural components. The production rise of electric vehicles (EVs) increases cast aluminum component demand since these materials improve both battery efficiency and vehicle distance capabilities.

By Application, the Automotive & Transportation Segment is Expected to Held the Largest Share

The automotive and transportation segment represents the dominant market share of global aluminum consumption because industry actors utilize light-weight materials to achieve higher efficiency and performance while also decreasing emissions. Aluminum serves as an all-purpose metal in passenger vehicles, commercial vehicles and electric vehicles and rail transport and aerospace industries because of its exceptional strength-to-weight characteristics and its resistance to corrosion alongside its recyclable nature. Manufacturers use aluminum throughout engine parts as well as chassis components and body structures and wheels and transmission units to meet global fuel economy and emission standards established by governments.

Aluminum Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The Asia-Pacific region maintains its position as the leader of the worldwide aluminum market from 2019-2023 because of quick industrial development together with rapid urbanization and established infrastructure networks in major countries including China, India, Japan, and South Korea. China, the world’s largest producer and consumer of aluminum, plays a central role in the market due to its strong manufacturing base, expanding construction industry, and high demand from automotive, aerospace, and electronics sectors. Government support for renewable energy initiatives along with EV manufacturing and high-speed rail system implementation drives increased aluminum consumption for the country.

The rise in smart cities funding along with infrastructure development and Make in India manufacturing programs has made India a growing market for aluminum products. Smelting and refining aluminum operations throughout Asia-Pacific position Australia and Indonesia as leading bauxite suppliers which is the fundamental starting material for aluminum manufacturing processes.

Recent Development

In March 2024, Emirates Global Aluminium introduced the region’s first digital manufacturing platform as part of its Industry 4.0 strategy, aiming to drive innovation and efficiency. This initiative is expected to enhance operational value and strengthen the company’s market position.

In January 2024, Alcoa announced a partnership to supply low-carbon aluminum to global cable manufacturer Nexans, utilizing its ELYSIS technology. ELYSIS is an innovative process that enables aluminum production without direct greenhouse gas emissions, instead generating oxygen as a byproduct.

Active Key Players in the Aluminum Market

o Century Aluminum Company

o Alcoa Corporation

o Kaiser Aluminum

o National Aluminum Extrusion LLC

o JW Aluminum

o NALCO

o Hindalco Industries Limited

o Rio Tinto Group

o Novelis Aluminum

o Rusal

o C-KOE Metals

o Norsk Hydro ASA

o Other Key Players

Global Aluminum Market Scope

|

Global Aluminum Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 191.9 Billion |

|

Market Size in 2024: |

USD 203.0 Billion | ||

|

Forecast Period 2024-33 CAGR: |

5.8% |

Market Size in 2033: |

USD 337.3 Billion |

|

Segments Covered: |

By Product |

· Cast · Extrusion · Sheet · Plate · Other Products | |

|

By Application |

· Automotive & Transportation · Building & Construction · Consumer Goods · Foil & Packaging · Machinery & Equipment Industrial) · Power · Other Applications | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Rising Demand in Automotive & Aerospace | ||

|

Key Market Restraints: |

· Fluctuating Raw Material Prices | ||

|

Key Opportunities: |

· Technological Advancements in Smelting & Recycling | ||

|

Companies Covered in the report: |

· Century Aluminum Company, Alcoa Corporation, Kaiser Aluminum, and National Aluminum Extrusion LLC. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Aluminum Market Research report?

Answer: The forecast period in the Aluminum Market Research report is 2024-2033.

2. Who are the key players in the Aluminum Market?

Answer: Century Aluminum Company, Alcoa Corporation, Kaiser Aluminum, and National Aluminum Extrusion LLC.

3. What are the segments of the Aluminum Market?

Answer: The Aluminum Market is segmented into Product, Processing Method, Application, and Regions. By Product, the market is categorized into Cast, Extrusion, Sheet, Plate, and Other Products. By Application, the market is categorized into Automotive & Transportation, Building & Construction, Consumer Goods, Foil & Packaging, Machinery & Equipment Industrial, Power, and Other Applications. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Aluminum Market?

Answer: The aluminum market represents the worldwide system which produces aluminum products and distributes them to users through multiple channels. The market process starts with bauxite ore extraction followed by alumina refining before completing with aluminum primary smelting. Secondary aluminum manufacturing has become more significant due to sustainability needs. Aluminum serves as an integral element in automotive sectors and aerospace applications and construction activities as well as packaging needs and electronics production and consumer goods manufacturing because of its blend of lightweight properties with durability strength and excellent resistance against corrosion. Raw materials accessibility together with energy expenses and technological development and market regulations alongside environmental standards shape this industry.

5. How big is the Aluminum Market?

Answer: The global aluminum market was valued at USD 191.9 billion in 2023 and is expected to grow from USD 203.0 billion in 2024 to USD 337.3 billion by 2033, reflecting a CAGR of 5.8% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.