🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Amino acid (L-Lysine) for Animal Feed or Additives Market

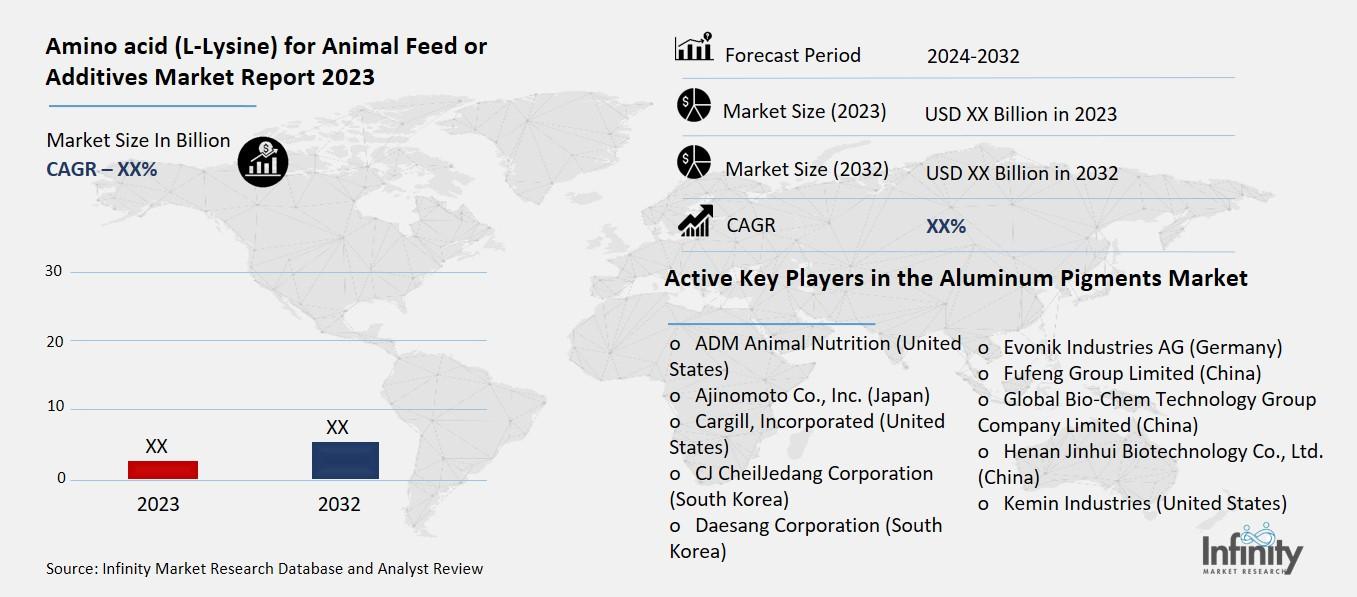

Amino acid (L-Lysine) for Animal Feed or Additives Market Global Industry Analysis and Forecast (2024-2032) by Product Type (L-Lysine Hydrochloride (HCl), L-Lysine Monohydrochloride, L-Lysine Sulfate, Others), Livestock (Swine/Pigs, Poultry, Cattle, Aquaculture, Others), Application (Feed Additives, Dietary Supplements, Others) and Region

Jan 2025

Chemicals and Materials

Pages: 138

ID: IMR1604

Amino acid (L-Lysine) for Animal Feed or Additives Market Synopsis

Amino acid (L-Lysine) for Animal Feed or Additives Market Size Was Valued at USD XX Billion in 2023, and is Projected to Reach USD XX Billion by 2032, Growing at a CAGR of XX% From 2024-2032.

L-Lysine is one of the most important essential amino acids which is capable of enhancing the growth and productivity of animals for which the animal feed additives manufactured through its use. This amino acid cannot be produced internally by the animal, therefore needs to be supplemented in feed for proper development. It is used as a component of muscle building agents, contributing to protein synthesis, promotion of growth in muscles and feeds conversion. The compound is mainly synthesised through microbial conversion where sugar containing substrates are used. It also enhances nutritional value of Animal feeding formula as apart from enhancing feed quality it helps to lower Nitrogen output which is environmentally sensitive. With the steady and growing demand for quality meat and animal products throughout the world, the use of the L-Lysine in animal feed is crucial in fulfilling livestock health and fitness requirements.

Global sales of L-Lysine as the animal feed supplement is on the rise due to the growing global demand for meats, poultry and dairy products. Because livestock farming practices have increased greatly in intensity, there has been a call for cheaper feed formulations that contain adequate nutrients. L-Lysine is slowly becoming an essential feed supplement that increas growth performance, improves FCR and maintain general health of the animals. Also, as consume realize the importance of sustainable farming and particularly sustainable animal farming which greatly affects the environment then adopt L-Lysine since it doesn’t need excessive proteins supplements in feeding.

Moreover, growth in the market is attributed by increasing global population and increasing disposable income, particularly in the developing nations. These trends have led to increase in meat intake especially in China and Brazil and to some extent in India making the demand for high quality feed additives such as L-Lysine high. In developed markets, favorable rules and standards for environmentally friendly farming techniques as well as enhancements in the recipes of feeds have played a major role in market growth. This dynamic market is also experiencing technological improvements in amino acid production, which decreases costs and raises efficiency, making L-Lysine affordable to farmers around the world.

Amino acid (L-Lysine) for Animal Feed or Additives Market Trend Analysis

Trend: Growing Adoption of Fermentation-Based Production

Fermentation based methods of producing L-Lysine has become popular because of the lower costs and environmental impacts they pose. The use of sugar or corn is generally accepted as the successful of microbial fermentation is favored over other production processes for L-Lysine. Such a strategy is the most eco-friendly and provides a rather sustainable and high-quality result in the yield process. Also, regenerated microorganisms due to biotechnology advancement are efficient strains which will increase production output. Considering worldwide tendencies linked with sustainability, the use of fermentation in producing the goods contributes to industry aims at decreasing greenhouse gas emissions while that is environmentally friendly. This situation should help to build the strengthening of the supply chain and make new opportunities for the market players.

Driver: Rising Demand for High-Quality Meat Products

The rising need for meat and especially quality meat products which has been on the rise all over the globe is another reason for the L-Lysine market. A global population and increased income levels within developing world, have made consumption of proteins from animal sources to be on a higher side. Meat products consumers are opting for the leaner meat products that demand for nutrient dense feeds to attain. L-Lysine carries out a very central function of enhancing growth rates in livestock as well as promoting muscle deposition, which made it to be regarded as an important feed additive in today’s industrial animal production. In addition, the fact that the farming industry’s goal is to minimize feed conversion ratio to avoid excessive costs and for profitability is also propelling mass usage of L-Lysine.

Restraint: Volatility in Raw Material Prices

The cost fluctuations are one of the biggest challenges that threatens the profitability of the L-Lysine market, therefore, the prices of the raw materials such as sugar and corn used in the production of L-Lysine will pose a great threat to the market in future. These raw materials’ prices are actually volatile due to climate change, imbalances in the supply and demand in the global market, and political instabilities. Such price changes mean that the price of basic materials for the manufacture of L-Lysine can have a direct effect on its prices and hence the affordability for consumers. Further, high levels of regulation to raw material procurements as well as fermentation by –products in some regions can further restrain the growth of the market.

Opportunity: Increasing Focus on Sustainable Livestock Farming

The increasing demand for sustainable livestock farming practices forms a major opportunity for the L-Lysine market. As the world wakes up to environmental depletion and calling for low-carbon diets in animal production, L-Lysine solve the following problems; More governments, and industry players are encouraging the use of feed additives such as L-Lysine important for better and sustainable farming. Furthermore, the diversification of productive uses of biotechnological tools in the enhancement of effective L-Lysine output forms a compelling growth opportunity for industry members seeking to satisfy the emerging demand from mindful farmers.

Amino acid (L-Lysine) for Animal Feed or Additives Market Segment Analysis

Amino acid (L-Lysine) for Animal Feed or Additives Market Segmented on the basis of Product Type, Livestock and Application.

By Product Type

o L-Lysine Hydrochloride (HCl)

o L-Lysine Monohydrochloride

o L-Lysine Sulfate

o Others

By LiveStock

o Swine/Pigs

o Poultry

o Cattle

o Aquaculture

o Others

By Applications

o Feed Additives

o Dietary Supplements

o Others

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Product Type, L-Lysine Hydrochloride (HCl) segment is expected to dominate the market during the forecast period

L-Lysine Hydrochloride HCl is expected to remain the most lucrative segment in the market throughout the forecast period majorly owing to its high bioavailability as well as low cost. L-Lysine HCl is quite popular in all categories of animals and species since it’s an effective and stable way of enhancing the process of proteins synthesis and nutrient assimilation. It has been consumed and is still consumed by most farmers and feed manufacturers because of the numerous advantages over other feeds in promoting animal growth and feed conversion rate.

Furthermore, increased investment in production technology has resulted in increased economies of scale that has created the needed boost for the manufacture of L-Lysine HCl. Because animal feeding is progressively becoming more concentrated and since many of these markets are still developing, it can be deduced that the demand for L-Lysine HCl will likely remain strong in the future. This product type should be able to maintain its market dominance because it remains widely recognized as a general, highly effective feed supplement.

By Livestock, Swine/Pigs segment expected to held the largest share

In L-Lysine market, the swine/pigs segment is expected to dominate the market as the demand for pork product is high internationally. Pork continues to be popular throughout the globe and specifically in Asia-Pacific region especially China and Vietnam that have large producers of swine. L-Lysine is essential nutrient in swine feed because it promotes rate of gain, the rate of feed intake and thus a profitable outcome for the farmer.

Also the increase of the concentration of pigs and other domestic animals for production leads to use of feed additives in order to enhance production. L-Lysine remains positioned at the forefront of the swine industry, where its cost effectiveness in increasing the animals’ growth rates and feed conversion efficiency fulfils the industry’s constant necessity for new products.

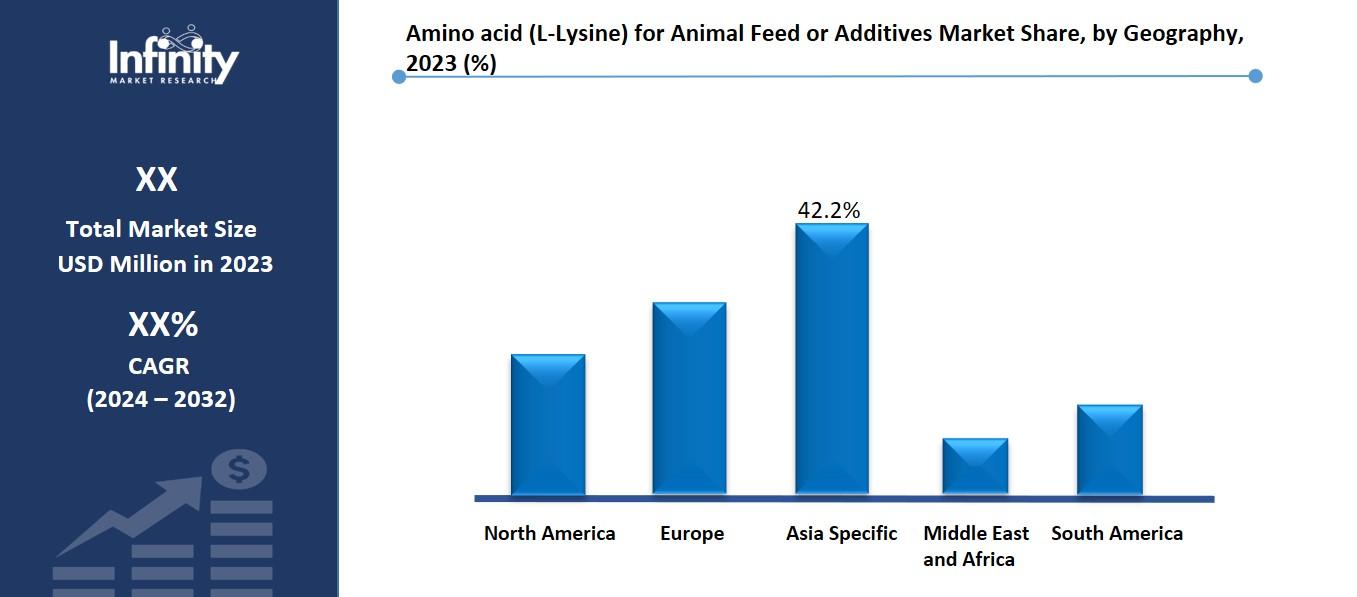

Amino acid (L-Lysine) for Animal Feed or Additives Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Regarding the geographical overview of the L-Lysine market in 2023, Asia-Pacific region contributed, in fact, with nearly 45% share of the overall market. This dominance can be attributed to scaled up livestock farming and high per capita meat frequency in some of the countries in the regions including for instance China, India and Vietnam. China is the largest producer and consumer of pork all across the world and hence it has a considerable affect on the demand of L-Lysine in the entire integrated asia –Pacific region. Also, an increased disposable income in Asia-Pacific and increasing urbanization trends are increasing the quality meat consumption, and this leads to the improvement of nutrient-rich feed additives like L-Lysine. That is why the region has developed important support for sustainable farming and the major market players, which are also critical to the top position.

Amino acid (L-Lysine) for Animal Feed or Additives Market Share, by Geography, 2023 (%)

Active Key Players in the Amino acid (L-Lysine) for Animal Feed or Additives Market

o ADM Animal Nutrition (United States)

o Ajinomoto Co., Inc. (Japan)

o Cargill, Incorporated (United States)

o CJ CheilJedang Corporation (South Korea)

o Daesang Corporation (South Korea)

o Evonik Industries AG (Germany)

o Fufeng Group Limited (China)

o Global Bio-Chem Technology Group Company Limited (China)

o Henan Jinhui Biotechnology Co., Ltd. (China)

o Kemin Industries (United States)

o Meihua Holdings Group Co., Ltd. (China)

o NB Group Co., Ltd. (China)

o Ningxia Eppen Biotech Co., Ltd. (China)

o Shandong Shouguang Juneng Group Golden Corn Co., Ltd. (China)

o Tereos Group (France)

o Other key Players

Global Amino acid (L-Lysine) for Animal Feed or Additives Market Scope

|

Global Amino acid (L-Lysine) for Animal Feed or Additives Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Segments Covered: |

By Product Type |

· L-Lysine Hydrochloride (HCl) · L-Lysine Monohydrochloride · L-Lysine Sulfate · Others | |

|

By Livestock |

· Swine/Pigs · Poultry · Cattle · Aquaculture · Others | ||

|

By Application |

· Feed Additives · Dietary Supplements · Others | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Rising Demand for High-Quality Meat Products | ||

|

Key Market Restraints: |

· Volatility in Raw Material Prices | ||

|

Key Opportunities: |

· Increasing Focus on Sustainable Livestock Farming | ||

|

Companies Covered in the report: |

· ADM Animal Nutrition (United States), Ajinomoto Co., Inc. (Japan), Cargill, Incorporated (United States), CJ CheilJedang Corporation (South Korea), Daesang Corporation (South Korea) and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Amino acid (L-Lysine) for Animal Feed or Additives Market research report?

Answer: The forecast period in the Amino acid (L-Lysine) for Animal Feed or Additives Market research report is 2024-2032.

2. Who are the key players in the Amino acid (L-Lysine) for Animal Feed or Additives Market?

Answer: ADM Animal Nutrition (United States), Ajinomoto Co., Inc. (Japan), Cargill, Incorporated (United States), CJ CheilJedang Corporation (South Korea), Daesang Corporation (South Korea) and Other Major Players.

3. What are the segments of the Amino acid (L-Lysine) for Animal Feed or Additives Market?

Answer: The Amino acid (L-Lysine) for Animal Feed or Additives Market is segmented into Product Type, Livestock, Application and region. By Product Type, the market is categorized into L-Lysine Hydrochloride (HCl), L-Lysine Monohydrochloride, L-Lysine Sulfate, Others. By Livestock, the market is categorized into Swine/Pigs, Poultry, Cattle, Aquaculture, Others. By Application, the market is categorized into Feed Additives, Dietary Supplements, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Amino acid (L-Lysine) for Animal Feed or Additives Market?

Answer: L-Lysine is one of the most important essential amino acids which is capable of enhancing the growth and productivity of animals for which the animal feed additives manufactured through its use. This amino acid cannot be produced internally by the animal, therefore needs to be supplemented in feed for proper development. It is used as a component of muscle building agents, contributing to protein synthesis, promotion of growth in muscles and feeds conversion. The compound is mainly synthesised through microbial conversion where sugar containing substrates are used. It also enhances nutritional value of Animal feeding formula as apart from enhancing feed quality it helps to lower Nitrogen output which is environmentally sensitive. With the steady and growing demand for quality meat and animal products throughout the world, the use of the L-Lysine in animal feed is crucial in fulfilling livestock health and fitness requirements.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.