🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Ancillary Services for Battery Energy Storage Systems Market

Global Ancillary Services for Battery Energy Storage Systems Market (By Type, Voltage Support, Frequency Regulation, Power Smoothing, Backup Power, Congestion Relief, Grid Reliability & Microgrid Capability, Peak Shaving, Solar Plus Storage, and Other Types; By Battery Energy Storage System Type, Lead Acid, Zinc-Bromide, Lithium-ion, Sodium-Sulphur, Flow Batteries, and Nickel-based Batteries; By End-Use, Industrial, Residential, and Commercial, By Region and Companies), 2024-2033

Nov 2024

Energy and Power

Pages: 138

ID: IMR1312

Ancillary Services for Battery Energy Storage Systems Market Overview

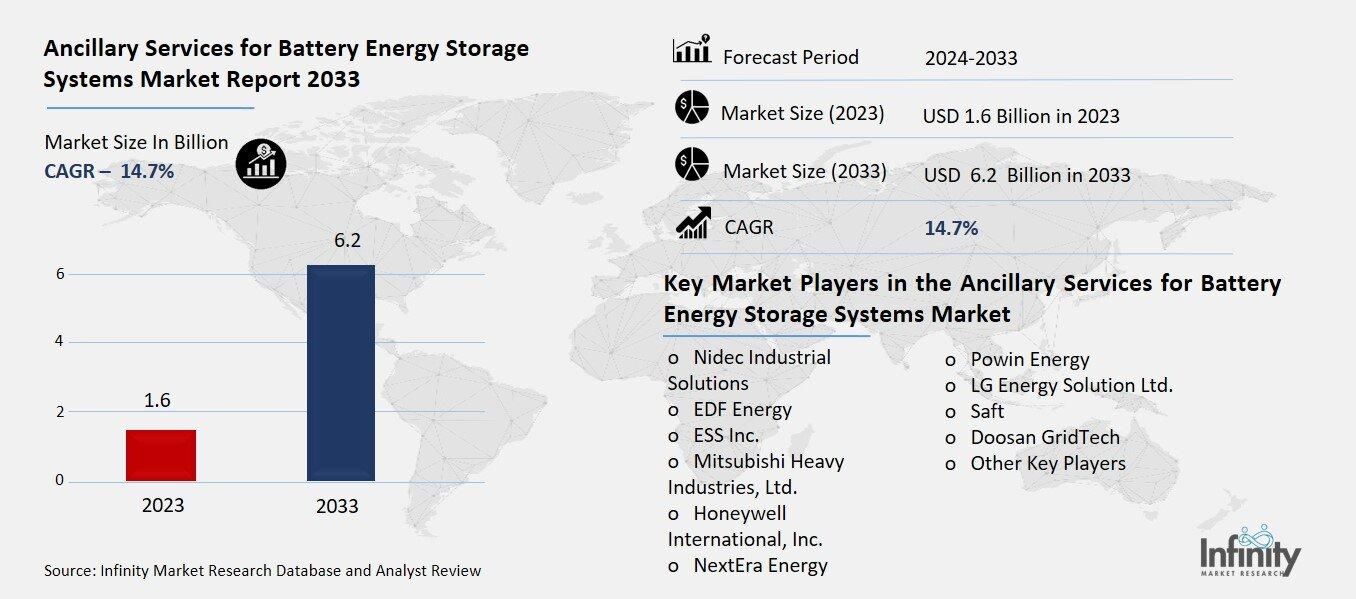

Global Ancillary Services for Battery Energy Storage Systems Market acquired the significant revenue of 1.6 Billion in 2023 and expected to be worth around USD 6.2 Billion by 2033 with the CAGR of 14.7% during the forecast period of 2024 to 2033. Original Equipment Manufacturers (OEMs) of BESS have identified the ancillary services market for battery energy storage systems to be a growing market owing to increasing demand for a stable and reliable grid system and the incorporation of renewable energy into the system. BESS helps the energy grids specifically in service controlling applications including frequency control, voltage control, and peak shaving. These services assist in demand and supply fluctuations or stresses such as from the intermittent renewable sources such as solar and wind energy. BESS can respond quickly to fluctuations in the grid demand, thus making it appropriate for use when it comes to supporting the frequency stability and improvement of the grid.

Also, BESS has been growing cheaper, and with good policies in place, the technology is being embraced. It is growing as more utilities, independent power producers, and commercial and industrial entities seek ancillary services from BESS to enhance power stability, address energy storage requirements.

Drivers for the Ancillary Services for Battery Energy Storage Systems Market

Increasing Demand for Grid Stability

Battery Energy Storage Systems (BESS) can either directly or indirectly support grid stability to meet the demand and supply imbalances. This balancing get more important as more of renewable energy like wind and solar form a greater part of the power mix. Unlike conventional fossil fuel based generation where generation can be called upon at will, renewable generation is based on the state of the climate hence cannot be predictably dispatched.

BESS assist in solving this problem by charging, during situations where the energy generation from the renewable sources outstrips the use or by discharging the stored energy, during situations where generation from the renewable sources is low or demand is high. This rapid, bi-directional energy flow capability enables BESS to react almost instantly to fluctuations in grid parameters along the desired four quadrants to help maintain frequency and voltage.

Restraints for the Ancillary Services for Battery Energy Storage Systems Market

Limited Lifespan and Degradation of Batteries

Battery degradation is a key challenge for Battery Energy Storage Systems (BESS), as it gradually reduces the system’s ability to store and discharge energy effectively. Over time, the capacity of the batteries within BESS to hold charge diminishes, leading to a decrease in efficiency and operational lifespan. Factors like the frequency of charge-discharge cycles, temperature variations, and the depth of discharge significantly accelerate battery wear. As a result, degraded batteries may require more frequent replacement or maintenance, which in turn raises operational costs for BESS operators. Furthermore, lower efficiency and capacity mean the system might need to be cycled more often to meet demand, exacerbating the wear on the batteries and creating a cycle of increasing degradation and cost.

Opportunity in the Ancillary Services for Battery Energy Storage Systems Market

Growing Demand for Electric Vehicle (EV) Charging Infrastructure

Battery Energy Storage Systems (BESS) offer valuable support to electric vehicle (EV) charging stations by managing load and alleviating stress on the grid, especially in high-demand areas. As EV adoption increases, so does the demand for fast, accessible charging infrastructure, which often requires a significant, concentrated power supply. Directly pulling this power from the grid can lead to surges in demand, particularly during peak hours, resulting in grid strain and potential outages. BESS helps to address this issue by storing energy during off-peak times, when demand is lower and electricity costs are cheaper, and then releasing it when needed to power EV chargers during peak periods. This load management not only stabilizes the grid by reducing sudden spikes in demand but also enables charging stations to operate more economically by lowering energy costs.

Additionally, BESS can support faster EV charging times, ensuring that EV stations remain reliable and responsive to drivers’ needs. By enabling more efficient load distribution and reducing reliance on grid supply during high-demand periods, BESS helps to make EV infrastructure scalable and sustainable, paving the way for a broader transition to electric mobility.

Trends for the Ancillary Services for Battery Energy Storage Systems Market

Hybrid Systems Combining BESS with Renewable Sources

Co-locating Battery Energy Storage Systems (BESS) with solar and wind farms has become a prominent trend, as it offers grid operators enhanced flexibility and sustainability in energy management. By placing BESS directly alongside renewable energy sources, operators can capture and store excess energy generated during periods of peak sunlight or strong winds, rather than allowing it to go to waste. This stored energy can then be dispatched during times when renewable generation is low or when grid demand is high, creating a more consistent and reliable power supply. This setup also minimizes transmission losses by storing and using energy closer to the point of generation, which improves overall system efficiency. Moreover, co-locating BESS with renewable sources helps reduce reliance on fossil fuel-based peaker plants, making it easier to meet environmental and regulatory goals aimed at reducing carbon emissions.

Segments Covered in the Report

By Type

o Voltage Support

o Frequency Regulation

o Power Smoothing

o Backup Power

o Congestion Relief

o Grid Reliability & Microgrid Capability

o Peak Shaving

o Solar Plus Storage

o Other Types

By Battery Energy Storage System Type

o Lead Acid

o Zinc-Bromide

o Lithium-Ion

o Sodium-Sulphur

o Flow Batteries

o Nickel-Based Batteries

By End-Use

o Industrial

o Residential

o Commercial

Segment Analysis

By Type Analysis

On the basis of type, the market is divided into voltage support, frequency regulation, power smoothing, backup power, congestion relief, grid reliability & microgrid capability, peak shaving, solar plus storage, and other types. Among these, frequency regulation segment acquired the significant share in the market owing to BESS's rapid response capabilities, which are essential for maintaining grid stability amid the increasing integration of variable renewable energy sources like wind and solar. By swiftly adjusting power output, BESS effectively manages short-term fluctuations in supply and demand, ensuring consistent grid frequency. This capability not only enhances grid reliability but also offers economic benefits, as frequency regulation services often command premium rates in energy markets.

By Battery Energy Storage System Type Analysis

On the basis of battery energy storage system type, the market is divided into lead acid, zinc-bromide, lithium-ion, sodium-sulphur, flow batteries, and nickel-based batteries. Among these, lithium-ion segment held the prominent share of the market due to its superior energy density, longer cycle life, and declining costs. Lithium-ion batteries are highly efficient, capable of fast charging and discharging, and offer a relatively compact design, making them ideal for a wide range of applications, from utility-scale energy storage to smaller, decentralized systems. Over the past decade, advancements in lithium-ion technology, coupled with increased production for electric vehicles, have driven down costs significantly, making these batteries more accessible for large-scale energy storage solutions.

By End-Use Analysis

On the basis of end-use, the market is divided into industrial, residential, and commercial. Among these, industrial segment held the prominent share of the market. Industries, particularly those with high energy consumption or critical operations, require consistent and reliable power supply to prevent downtime and reduce operational costs. BESS enables these facilities to store excess energy during off-peak hours and use it during peak demand, leading to significant savings on energy bills. Furthermore, industries are increasingly adopting renewable energy sources, such as solar or wind, and co-locating BESS to mitigate the variability of these sources and ensure uninterrupted operations.

Regional Analysis

Asia-Pacific Dominated the Market with the Highest Revenue Share

Asia-Pacific held the most of the share of 32.4% of the market driven by rapid industrialization, increasing renewable energy adoption, and significant investments in grid modernization. Countries like China, Japan, and South Korea are leading the charge in energy storage deployment, with ambitious goals to transition toward cleaner energy and enhance grid stability. China, in particular, is the largest market for BESS, supported by its vast renewable energy capacity, including wind and solar power, and a strong focus on reducing carbon emissions.

The region's expanding manufacturing capabilities, particularly in battery production, also contribute to lower costs and greater scalability of BESS solutions. Additionally, the increasing demand for electric vehicles (EVs) in APAC further supports the growth of BESS, as EV infrastructure often integrates energy storage systems to manage load and optimize charging.

Competitive Analysis

The competitive landscape of the Battery Energy Storage System (BESS) market is characterized by a mix of established players and emerging companies, all vying to capture market share in the growing demand for energy storage solutions. Leading global players like Tesla, LG Chem, Samsung SDI, BYD, and Panasonic dominate the market, leveraging their expertise in battery technology, large-scale manufacturing capabilities, and strong financial backing. These companies focus on expanding their portfolios through technological innovations, such as improvements in battery efficiency, lifespan, and cost reduction, as well as offering integrated solutions that combine energy storage with renewable energy sources.

Recent Developments

In December 2024, Nidec Corporation revealed an investment of 15.8 million GBP in Gore Street Energy Storage Fund PLC (GSF), an investment trust fund managing an energy storage system business, through its subsidiary, Nidec Motor Corporation.

In February 2023, EDF and GE signed an exclusive agreement for EDF to acquire part of GE Steam Power’s nuclear power operations. This deal will combine GE’s nuclear steam turbine technology and services with EDF’s expertise, enhancing its commitment to the nuclear sector and creating a leading global provider of steam turbine equipment and services within the EDF Group.

Key Market Players in the Ancillary Services for Battery Energy Storage Systems Market

o Nidec Industrial Solutions

o EDF Energy

o ESS Inc.

o Mitsubishi Heavy Industries, Ltd.

o Honeywell International, Inc.

o NextEra Energy

o Powin Energy

o LG Energy Solution Ltd.

o Saft

o Doosan GridTech

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 1.6 Billion |

|

Market Size 2033 |

USD 6.2 Billion |

|

Compound Annual Growth Rate (CAGR) |

14.7% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Battery Energy Storage System Type, End-Use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

General Mills, Inc., Rich Products Corporation, Wilton Brands LLC., Lawrence Foods, Inc., Dawn Food Products, Inc., Dixie's Icing, Oetker Group.,Macphie Ltd., Conagra Brands, Inc., Cake Décor Ltd., and Other Key Players |

|

Key Market Opportunities |

Growing Demand for Electric Vehicle (EV) Charging Infrastructure |

|

Key Market Dynamics |

Increasing Demand for Grid Stability |

📘 Frequently Asked Questions

1. Who are the key players in the Ancillary Services for Battery Energy Storage Systems Market?

Answer: General Mills, Inc., Rich Products Corporation, Wilton Brands LLC., Lawrence Foods, Inc., Dawn Food Products, Inc., Dixie's Icing, Oetker Group.,Macphie Ltd., Conagra Brands, Inc., Cake Décor Ltd., and Other Key Players

2. How much is the Ancillary Services for Battery Energy Storage Systems Market in 2023?

Answer: The Ancillary Services for Battery Energy Storage Systems Market size was valued at USD 1.6 Billion in 2023.

3. What would be the forecast period in the Ancillary Services for Battery Energy Storage Systems Market?

Answer: The forecast period in the Ancillary Services for Battery Energy Storage Systems Market report is 2024-2033.

4. What is the growth rate of the Ancillary Services for Battery Energy Storage Systems Market?

Answer: Ancillary Services for Battery Energy Storage Systems Market is growing at a CAGR of 14.7% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.