🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Anisotropic Conductive Film Market

Anisotropic Conductive Film Market Global Industry Analysis and Forecast (2024-2032) By Type( Polyimide-Based ACF, Epoxy-Based ACF, Others),By Application( Display Panels, Camera Modules, Touch Panels, Chip-On-Glass (COG), Chip-On-Flex (COF), Others),By End-Use Industry( Consumer Electronics, Automotive, Aerospace & Defense, Medical Devices, Others),By Conductive Particle Type( Metal Particles, Polymer Particles, Hybrid Particles) and Region

Feb 2025

Chemicals and Materials

Pages: 138

ID: IMR1822

Anisotropic Conductive Film Market Synopsis

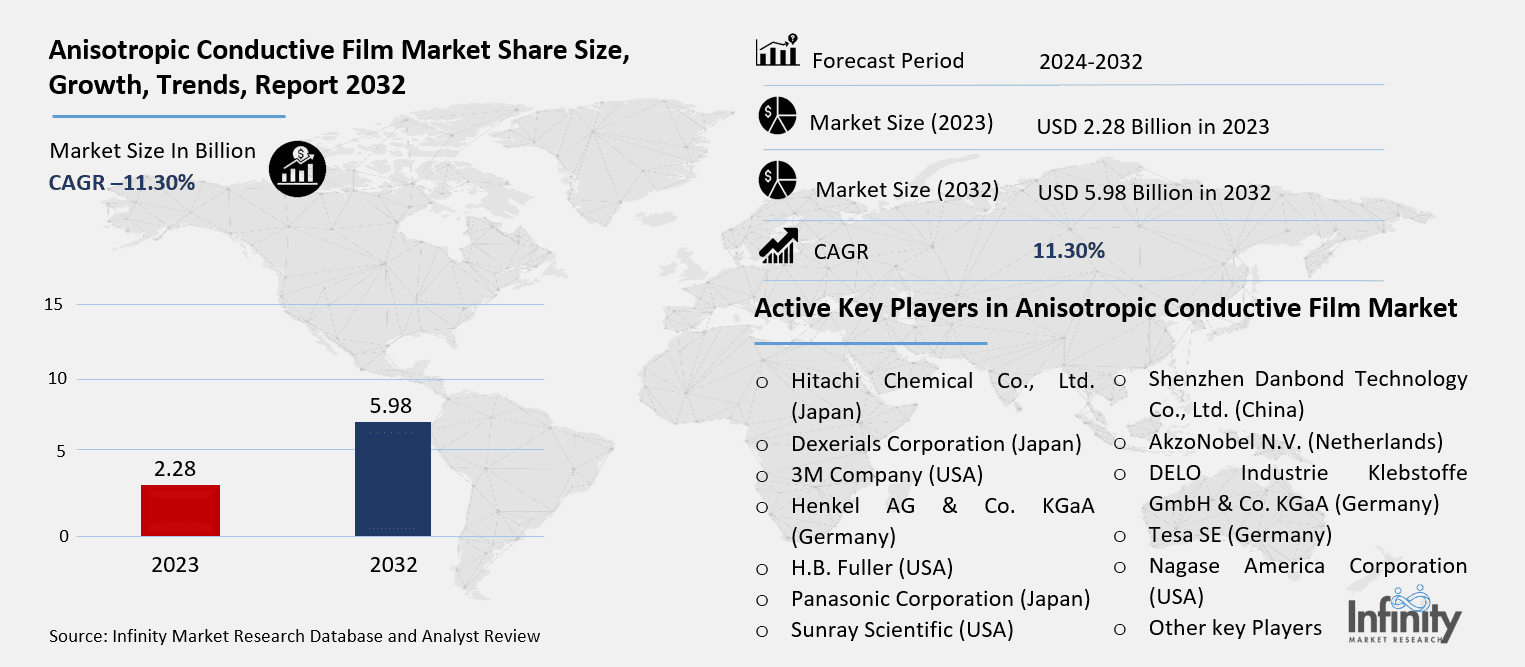

Anisotropic Conductive Film Market Size Was Valued at USD 2.28 Billion in 2023, and is Projected to Reach USD 5.98 Billion by 2032, Growing at a CAGR of 11.30% From 2024-2032.

Made for mechanical bonding and electrical connections in electronic equipment, Anisotropic Conductive Film (ACF) is a specialist adhesive substance. Usually the Z-axis, it has conductive particles suspended in an adhesive polymer matrix that provide electrical conductivity in one direction (usually the Z-axis) while remaining insulating in the other directions, X and Y. Applications like display panels, touch panels, camera modules, and chip-on- glass (COG) or chip-on- flex (COF) connections see ACF extensively employed in the semiconductor and display industries. It is a vital part in small-sized electronic devices since it provides benefits including fine-pitch bonding, low space needs, and better electrical performance.

In the electronics sector, anisotropic conductive film (ACF) is absolutely important since it guarantees consistent electrical connections while preserving structural integrity. Its great conductivity and adhesion qualities help it to be used extensively in consumer electronics, automobile electronics, medical devices, and industrial applications. Particularly in applications needing high-density interconnections, the growing demand for small and light-weight electronic devices has propelled ACF acceptance. Mostly utilized in display panel assembly, chip bonding, and flexible printed circuits (FPCs), ACF allows effective electrical connections with little footprint.

Rising demand for smartphones, tablets, OLED displays, and other cutting-edge electronic items has caused the market to show notable expansion. The move toward flexible and high-resolution displays has driven even more ACF adoption since it allows fine-pitch connections required for contemporary display technologies. Furthermore, the growing necessity for ACF in touch panel production is a result of touch interfaces' increasing integration in consumer electronics.

High-performance ACFs with enhanced adhesive strength, conductivity, and environmental resistance have resulted from technological developments underlined by To support developing uses such foldable displays, wearable electronics, and automobile HUDs (heads-up displays), key producers are concentrating on improving ACF formulations. Furthermore, ACF's capacity to substitute conventional soldering techniques in ultra-fine pitch connections fits the industry's drive toward ecologically benign assembly solutions free of lead.

The market suffers difficulties related to the high cost of manufacture, restricted reworkability, and strict application criteria notwithstanding its benefits. Ongoing research and development (R&D) initiatives, however, seek to overcome these obstacles by raising ACF performance and extending its usage over many sectors.

Anisotropic Conductive Film Market Outlook, 2023 and 2032: Future Outlook

Anisotropic Conductive Film Market Trend Analysis

Trend: Rising Demand for Miniaturized Electronics

Miniaturizing the global electronics sector is causing demand for ultra-fine pitch connecting solutions such as Anisotropic Conductive Film (ACF). Manufacturers need high-density packing solutions that provide reliable and efficient connectivity in small designs as smartphones, wearables, and IoT devices get smaller and more powerful. With less space needed and better thermal control, ACF offers a good substitute for conventional connectivity methods including soldering.

Foldable smartphones and flexible displays, where ACF is crucial in creating safe electrical connections in flexible circuit assemblies, clearly show this trend. Furthermore driving demand for ACF solutions is the fast development of AR/VR gadgets and tiny medical circuits. Leading firms are funding R&D to improve the fine-pitch capabilities of ACF, hence enabling its use in next-generation small electronics with higher durability and performance.

Opportunity: Expansion in Automotive Electronics

In order the Anisotropic Conductive Film market, the growing integration of electronic components in contemporary cars offers a great potential. Reliable and small connecting solutions have become more important as automakers add HUDs, digital instrument clusters, complex infotainment systems, and touch interfaces. Widely used in car display panels and camera modules, ACF offers high-performance electrical connections while preserving flexibility and durability.

Further increasing demand for ACF is the rising acceptance of autonomous driving technology and electric cars (EVs). Advanced electronic systems—battery management units, driver assistance systems, sensor-based connectivity—all of which depend on effective interconnection solutions—are what EVs run on. The continual change towards smart, connected, and autonomous cars is projected to propel constant expansion in the automotive industry, therefore generating a major market potential for ACF makers.

Driver: Growth in OLED and Flexible Display Market

Anisotropic conductive film market is mostly driven by the development of OLED and flexible display technologies. Because of its exceptional image quality, energy efficiency, and design flexibility, OLED panels are increasingly seen in high-end smartphones, smartwatches, TVs, and foldable gadgets. OLED panel assembly depends on ACF, a necessary component since it guarantees dependability and longevity and allows fine-pitch electrical connections.

Advanced connectivity materials like ACF have been more sought for as conventional LCDs give way to OLED and flexible displays. To support next-generation display technologies, manufacturers are always inventing to better ACF formulations, increase adhesive strength, conductivity, and environmental resistance. Adoption of ACF is predicted to climb dramatically as display technology develops towards more flexible, lightweight, and bezel-less designs, hence accelerating market expansion.

Restraints: High Manufacturing Cost and Process Complexity

The great manufacturing expense connected with ACF production is one of the main limitations preventing the expansion of the Anisotropic Conductive Film industry. Higher production costs follow from the formulation and processing of ACF requiring precision engineering, premium raw ingredients, and specialized manufacturing technologies. Furthermore, ACF bonding procedures sometimes require certain tools and knowledge, which makes manufacturing investments expensive.

Moreover, the application of ACF depends on strict process control to guarantee best bonding performance. Any change in temperature, pressure, or alignment may cause flaws, therefore lowering yield rates and raising manufacturing costs. The limited reworkability of ACF-based connections adds even more to the cost load since any flaw may call for whole replacement instead of repair, therefore challenging cost control for electronic makers.

Anisotropic Conductive Film Market Segment Analysis

Anisotropic Conductive Film Market Segmented on the basis of type, conductive particle type ,application and end user.

By Type

o Polyimide-Based ACF

o Epoxy-Based ACF

o Others

By Application

o Display Panels

o Camera Modules

o Touch Panels

o Chip-On-Glass (COG)

o Chip-On-Flex (COF)

o Others

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Type, Polyimide-Based ACF segment is expected to dominate the market during the forecast period

Wide-ranging high-performance applications like aerospace, medical devices, and flexible electronics make polyimide-based ACF—known for its outstanding thermal and chemical stability—highly sought for. For demanding connecting solutions, its capacity to survive high temperatures and hostile surroundings makes it perfect.

Epoxy-based ACF is appropriate for mass-market uses such consumer electronics and display panels since it provides good adhesive qualities and economy of cost. It offers reasonable mechanical strength and electrical conductivity, but under extreme situations it may have restrictions compared to polyimide-based substitutes.

By Application, Display Panels segment expected to held the largest share

LCD and OLED panels are assembled using ACF mostly to guarantee fine-pitch electrical connections between driver ICs and glass substrates.Growing demand for high-resolution smartphone cameras drives ACF's vital function in bonding sensor components and flexible circuits.

Touch Panels: ACF supports the growing acceptance of capacitive touch interfaces in electronics by allowing flawless connections in touchscreen devices.

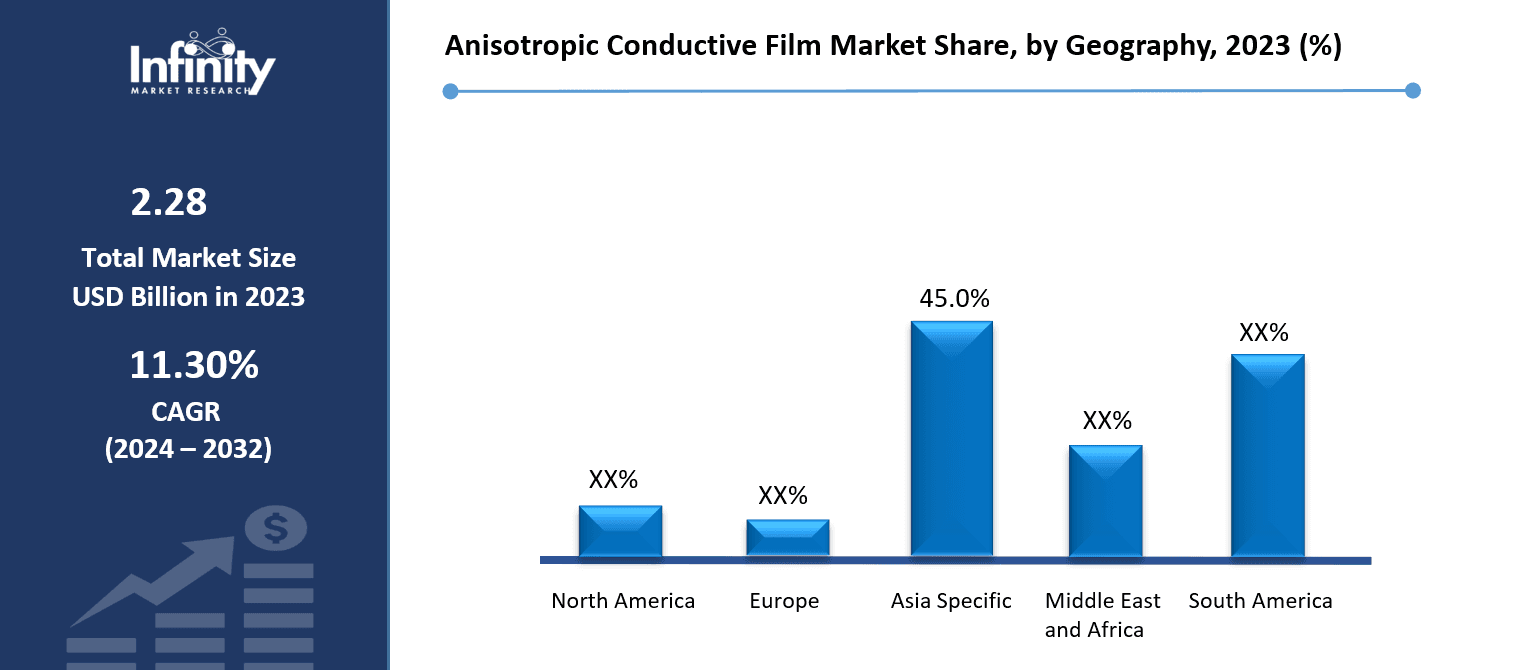

Anisotropic Conductive Film Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Driven by top electronics companies in nations like China, Japan, South Korea, and Taiwan, Asia-Pacific rules the Anisotropic Conductive Film market. Major semiconductor businesses and display panel manufacturers call the area home, therefore ACF adoption finds a center there.

Market expansion is being driven by China's growing consumer electronics sector as well as government support of home semiconductor manufacture. Japan and South Korea still lead in OLED and flexible display manufacturing, which increases demand for high-performance ACF materials even more.

Anisotropic Conductive Film Market Share, by Geography, 2023 (%)

Active Key Players in the Anisotropic Conductive Film Market

o Hitachi Chemical Co., Ltd. (Japan)

o Dexerials Corporation (Japan)

o 3M Company (USA)

o Henkel AG & Co. KGaA (Germany)

o H.B. Fuller (USA)

o Panasonic Corporation (Japan)

o Sunray Scientific (USA)

o Shenzhen Danbond Technology Co., Ltd. (China)

o AkzoNobel N.V. (Netherlands)

o DELO Industrie Klebstoffe GmbH & Co. KGaA (Germany)

o Tesa SE (Germany)

o Nagase America Corporation (USA)

o Other key Players

Global Anisotropic Conductive Film Market Scope

|

Global Anisotropic Conductive Film Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.28 Billion |

|

Forecast Period 2024-32 CAGR: |

11.30% |

Market Size in 2032: |

USD 5.98 Billion |

|

Segments Covered: |

By Type |

· Polyimide-Based ACF · Epoxy-Based ACF · Others | |

|

By Application |

· Display Panels · Camera Modules · Touch Panels · Chip-On-Glass (COG) · Chip-On-Flex (COF) · Others | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Growth in OLED and Flexible Display Market | ||

|

Key Market Restraints: |

· High Manufacturing Cost and Process Complexity | ||

|

Key Opportunities: |

· Expansion in Automotive Electronics | ||

|

Companies Covered in the report: |

· Hitachi Chemical Co., Ltd. (Japan), Dexerials Corporation (Japan), 3M Company (USA), Henkel AG & Co. KGaA (Germany), H.B. Fuller (USA), Panasonic Corporation (Japan), Sunray Scientific (USA), Shenzhen Danbond Technology Co., Ltd. (China) and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Anisotropic Conductive Film Market research report?

Answer: The forecast period in the Anisotropic Conductive Film Market research report is 2024-2032.

2. Who are the key players in the Anisotropic Conductive Film Market?

Answer: Hitachi Chemical Co., Ltd. (Japan), Dexerials Corporation (Japan), 3M Company (USA), Henkel AG & Co. KGaA (Germany), H.B. Fuller (USA), Panasonic Corporation (Japan), Sunray Scientific (USA), Shenzhen Danbond Technology Co., Ltd. (China) and Other Major Players.

3. What are the segments of the Anisotropic Conductive Film Market?

Answer: The Anisotropic Conductive Film Market is segmented into Type, Application, Conductive Particle Type ,End User and region. By Type, the market is categorized into Polyimide-Based ACF, Epoxy-Based ACF, Others. By Application, the market is categorized into Display Panels, Camera Modules, Touch Panels, Chip-On-Glass (COG), Chip-On-Flex (COF), Others. By End-Use Industry, the market is categorized into Consumer Electronics, Automotive, Aerospace & Defense, Medical Devices, Others),By Conductive Particle Type( Metal Particles, Polymer Particles, Hybrid Particles. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Anisotropic Conductive Film Market?

Answer: Made for mechanical bonding and electrical connections in electronic equipment, Anisotropic Conductive Film (ACF) is a specialist adhesive substance. Usually the Z-axis, it has conductive particles suspended in an adhesive polymer matrix that provide electrical conductivity in one direction (usually the Z-axis) while remaining insulating in the other directions, X and Y. Applications like display panels, touch panels, camera modules, and chip-on- glass (COG) or chip-on- flex (COF) connections see ACF extensively employed in the semiconductor and display industries. It is a vital part in small-sized electronic devices since it provides benefits including fine-pitch bonding, low space needs, and better electrical performance.

5. How big is the Anisotropic Conductive Film Market?

Answer: Anisotropic Conductive Film Market Size Was Valued at USD 2.28 Billion in 2023, and is Projected to Reach USD 5.98 Billion by 2032, Growing at a CAGR of 11.30% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.