🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Antimicrobial Coatings for Medical Devices Market

Antimicrobial Coatings for Medical Devices Market (By Coating Material (Metallic Coatings, Non-Metallic Coatings), By Device Type (Catheters, Implantable Devices, Surgical Instruments, Others), By Application (In-Vitro Diagnostics, Orthodontics/Dentistry Procedures, Cardiovascular Surgeries, Bio Implants, Orthopedics, Gynecology, Other General Surgical Procedures), By End-User (Hospitals, Cancer Treatment Centers, ASCs, Research & Diagnostic Facilities, Others), By Region and Companies)

Aug 2024

Healthcare

Pages: 138

ID: IMR1209

Antimicrobial Coatings for Medical Devices Market Overview

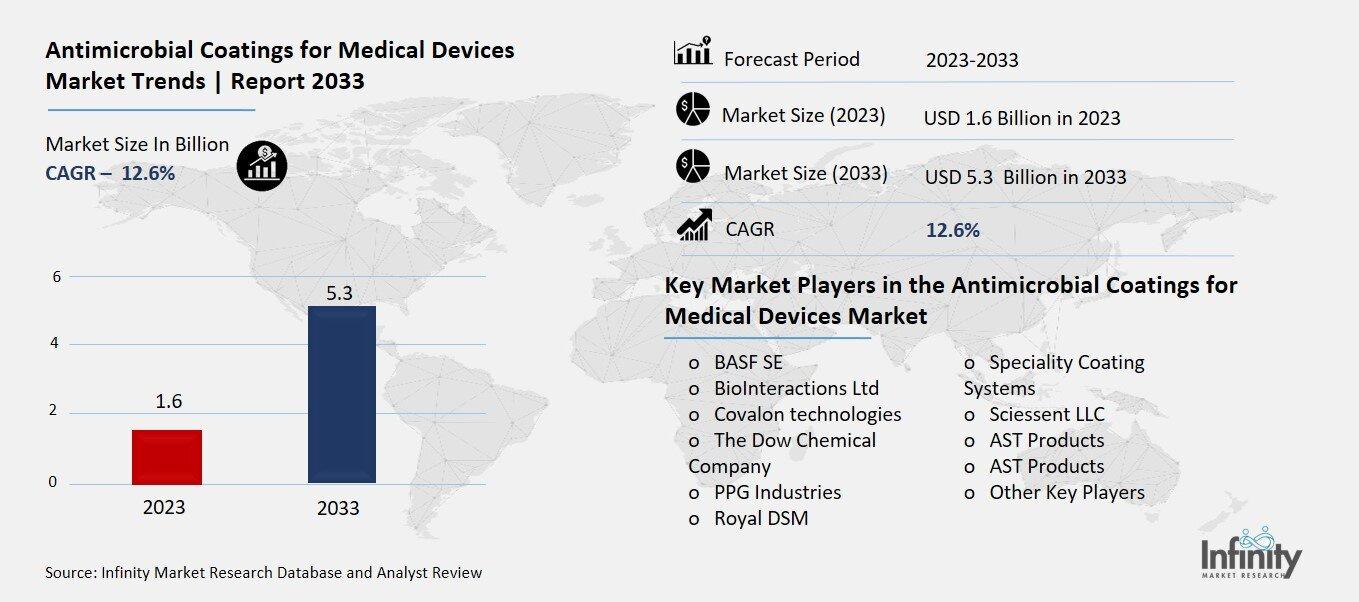

Global Antimicrobial Coatings for Medical Devices Market size is expected to be worth around USD 5.3 Billion by 2033 from USD 1.6 Billion in 2023, growing at a CAGR of 12.6% during the forecast period from 2023 to 2033.

Antimicrobial coatings for medical devices are special types of coatings applied to medical equipment to prevent the growth of harmful bacteria, viruses, and other microorganisms. These coatings are designed to keep surfaces clean and reduce the risk of infections that can occur when medical devices come into contact with patients. By using these coatings, hospitals, and clinics aim to improve the safety and effectiveness of medical treatments.

The market for these coatings is growing because healthcare facilities are increasingly aware of the importance of infection control. With the rise of antibiotic-resistant bacteria and the need for safer medical environments, the demand for antimicrobial coatings is rising. Companies that produce these coatings are working on advanced technologies to make medical devices safer and more reliable, which is crucial for improving patient outcomes and reducing healthcare costs.

Drivers for the Antimicrobial Coatings for Medical Devices Market

Increasing Need for Infection Control

Antimicrobial coatings for medical devices are gaining traction due to the rising need for effective infection control in healthcare settings. With an increase in hospital-acquired infections and the growing awareness of the risks associated with microbial contamination, healthcare providers are prioritizing technologies that can help mitigate these risks. These coatings are applied to surfaces of medical devices such as catheters, surgical instruments, and implants to inhibit the growth of harmful microorganisms, thereby reducing the chances of infections in patients.

Rising Incidence of Healthcare-Associated Infections

The surge in healthcare-associated infections (HAIs) is a significant driver for the antimicrobial coatings market. HAIs are infections that patients acquire while receiving treatment for other conditions within healthcare settings. They pose serious risks to patient safety and can lead to prolonged hospital stays, increased healthcare costs, and even higher mortality rates. Antimicrobial coatings offer a proactive approach to minimize these risks by providing an additional layer of protection against bacterial and viral contamination on medical devices.

Advances in Coating Technologies

Technological advancements in antimicrobial coatings are also fueling market growth. Innovations such as the development of new antimicrobial agents and improved coating processes enhance the effectiveness and durability of these coatings. For instance, researchers are working on coatings that release antimicrobial agents in a controlled manner, ensuring long-term protection. These advancements not only improve the functionality of medical devices but also contribute to their overall safety and performance, making them more attractive to healthcare providers.

Increasing Adoption of Preventive Healthcare Measures

The shift towards preventive healthcare measures is another key factor driving the demand for antimicrobial coatings. Healthcare systems worldwide are focusing more on preventing infections rather than just treating them. This shift has led to increased investments in technologies that help prevent infections, including antimicrobial coatings for medical devices. By integrating these coatings into their infection control strategies, healthcare facilities aim to improve patient outcomes and reduce the burden of infectious diseases.

Growing Awareness and Regulatory Support

Awareness about the benefits of antimicrobial coatings is growing among healthcare professionals and patients. This increased awareness, combined with supportive regulations and standards, is driving the adoption of these coatings. Regulatory bodies are recognizing the importance of infection control technologies and are providing guidelines and approvals that encourage the use of antimicrobial coatings. This supportive environment helps accelerate market growth by making these coatings more accessible and widely accepted in the healthcare sector.

Economic Considerations and Cost Savings

Economic factors also play a role in driving the antimicrobial coatings market. While the initial cost of applying antimicrobial coatings may be higher, the long-term savings resulting from reduced infection rates and shorter hospital stays can offset these costs. Healthcare providers are increasingly considering the economic benefits of investing in these coatings, as they contribute to overall cost savings and improved patient care. This cost-effectiveness makes antimicrobial coatings a valuable investment for healthcare facilities aiming to enhance their infection control measures.

Restraints for the Antimicrobial Coatings for Medical Devices Market

High Costs and Budget Constraints

One of the main restraints for the antimicrobial coatings market in medical devices is the high cost associated with these advanced technologies. The development and application of antimicrobial coatings can be expensive due to the sophisticated materials and processes involved. For many healthcare facilities, especially those with limited budgets, investing in these coatings can be a significant financial burden. This cost issue can limit the adoption of antimicrobial coatings, particularly in smaller or underfunded healthcare settings where budget constraints are a major concern.

Limited Long-Term Efficacy

Another challenge facing the antimicrobial coatings market is the limited long-term efficacy of some coatings. While antimicrobial coatings are designed to protect microbial growth, their effectiveness can diminish over time due to factors like wear and tear, chemical degradation, or loss of antimicrobial activity. As a result, the coatings may need to be reapplied or replaced more frequently, which can add to the overall cost and complexity of using these technologies in medical devices. This limitation can affect the perceived value and long-term benefits of antimicrobial coatings.

Regulatory and Compliance Challenges

Navigating the regulatory landscape for antimicrobial coatings can also be a restraint. Medical devices with antimicrobial coatings must meet stringent regulatory requirements and standards set by health authorities. Ensuring compliance with these regulations can be a complex and time-consuming process, involving extensive testing and documentation. Additionally, regulatory approvals can vary by region, which may further complicate the market for manufacturers aiming to introduce their products globally. These challenges can slow down the market growth and limit the availability of antimicrobial coatings.

Potential Toxicity and Safety Concerns

There are concerns about the potential toxicity and safety of some antimicrobial agents used in coatings. While these coatings are intended to prevent infections, there is a risk that the antimicrobial substances could have adverse effects on patients or healthcare workers. For instance, some antimicrobial agents might cause allergic reactions or other health issues. Ensuring the safety of these coatings requires rigorous testing and validation, which can be both costly and time-consuming. These safety concerns may impact the adoption and acceptance of antimicrobial coatings in the healthcare sector.

Market Competition and Innovation Pressure

The antimicrobial coatings market is highly competitive, with numerous players striving to develop and offer innovative solutions. This competition can lead to pricing pressures, which might affect the profitability of companies producing antimicrobial coatings. Additionally, the rapid pace of technological advancements in this field means that companies must continually invest in research and development to stay ahead. This constant need for innovation can strain resources and limit the financial viability of some market participants, further impacting the market's growth and stability.

Opportunity in the Antimicrobial Coatings for Medical Devices Market

Expanding Applications and Emerging Technologies

The antimicrobial coatings market for medical devices presents significant opportunities driven by expanding applications and emerging technologies. As healthcare facilities strive to improve patient safety and reduce infection rates, the demand for advanced antimicrobial solutions continues to grow. Medical devices, including catheters, implants, and surgical instruments, are increasingly being coated with antimicrobial agents to enhance their safety and effectiveness. This expanding application range offers substantial growth potential for companies specializing in antimicrobial coatings.

Growth in Preventive Healthcare Trends

The shift towards preventive healthcare is a major driver of opportunities in the antimicrobial coatings market. As healthcare systems worldwide emphasize prevention over treatment, the focus is on minimizing infection risks before they occur. Antimicrobial coatings align with this trend by providing an additional layer of protection for medical devices. This preventive approach not only helps in reducing the incidence of healthcare-associated infections but also supports overall patient health and safety, creating a strong market demand for these coatings.

Increasing Investment in Research and Development

Investment in research and development (R&D) is opening up new avenues for innovation in antimicrobial coatings. Companies are actively exploring new materials and technologies to enhance the effectiveness and longevity of these coatings. Innovations such as smart coatings that release antimicrobial agents in response to environmental changes and coatings with improved durability are gaining traction. These advancements can lead to more effective and versatile coatings, meeting the diverse needs of the medical device market and creating additional opportunities for market growth.

Rising Awareness and Regulatory Support

Rising awareness about the benefits of antimicrobial coatings is also contributing to market opportunities. Healthcare professionals and patients are increasingly recognizing the importance of infection control, which drives demand for innovative solutions. Additionally, regulatory bodies are providing support and establishing guidelines to ensure the safety and effectiveness of antimicrobial coatings. This supportive regulatory environment helps accelerate the development and adoption of these coatings, further expanding market opportunities.

Emerging Markets and Global Expansion

Emerging markets present significant growth opportunities for the antimicrobial coatings industry. As healthcare infrastructure improves in regions such as Asia-Pacific, Latin America, and the Middle East, there is a growing need for advanced medical technologies, including antimicrobial-coated devices. Companies can tap into these emerging markets by tailoring their products to meet local needs and regulatory requirements, thereby expanding their global reach and increasing market share.

Focus on Cost-Effectiveness and Value Proposition

There is an increasing focus on demonstrating the cost-effectiveness of antimicrobial coatings. Healthcare providers are looking for solutions that not only enhance safety but also offer long-term economic benefits. By proving that antimicrobial coatings can reduce infection rates, lower healthcare costs, and improve patient outcomes, companies can strengthen their value proposition and attract more customers. This focus on cost-effectiveness helps in positioning antimicrobial coatings as a worthwhile investment in the healthcare sector.

Trends for the Antimicrobial Coatings for Medical Devices Market

Adoption of Advanced Coating Technologies

One major trend is the adoption of advanced coating technologies. Innovations in materials science and chemistry have led to the development of more effective antimicrobial agents and improved coating processes. New types of coatings, such as those using nanotechnology or incorporating silver nanoparticles, are gaining popularity due to their enhanced antimicrobial properties and durability. These advanced technologies are designed to provide long-lasting protection and address the limitations of traditional coatings, driving their increased use in medical devices.

Focus on Biocompatibility and Safety

Another significant trend is the emphasis on biocompatibility and safety of antimicrobial coatings. As healthcare providers and patients become more conscious of potential side effects and long-term impacts, there is a growing demand for coatings that are both effective and safe. Manufacturers are focusing on developing coatings that minimize adverse reactions and are compatible with human tissues. This trend aligns with the broader movement towards safer medical technologies and is crucial for gaining regulatory approvals and market acceptance.

Integration of Smart Coating Solutions

The integration of smart coating solutions is also becoming a prominent trend. Smart coatings are designed to respond dynamically to environmental changes, such as the presence of bacteria or changes in pH levels. These coatings can release antimicrobial agents in a controlled manner, providing targeted protection when and where it is needed most. The development of smart coatings represents a significant advancement in the field, offering improved functionality and effectiveness compared to traditional antimicrobial coatings.

Growth in Preventive Healthcare

The shift towards preventive healthcare is driving demand for antimicrobial coatings. With an increasing focus on preventing infections before they occur, healthcare facilities are investing more in technologies that enhance infection control. Antimicrobial coatings are seen as a proactive measure to reduce the risk of healthcare-associated infections. This trend is expected to continue as healthcare systems worldwide prioritize prevention and patient safety.

Expansion into Emerging Markets

There is a growing trend of expansion into emerging markets. As healthcare infrastructure improves in regions like Asia-Pacific, Latin America, and the Middle East, there is a rising demand for advanced medical technologies, including antimicrobial coatings. Companies are targeting these markets to tap into new growth opportunities and cater to the increasing need for infection control solutions. This geographical expansion is helping to drive overall market growth and increase the global reach of antimicrobial coatings.

Increased Collaboration and Partnerships

Increased collaboration and partnerships among industry players, research institutions, and healthcare providers are also shaping the market. These collaborations are aimed at accelerating innovation, improving coating technologies, and addressing challenges in the field. By working together, stakeholders can share expertise, resources, and insights, leading to the development of more effective and versatile antimicrobial coatings. This trend highlights the importance of collective efforts in advancing the market and meeting evolving healthcare needs.

Segments Covered in the Report

By Coating Material

o Metallic Coatings

o Silver Coatings

o Copper Coatings

o Others Metallic Coatings

o Non-Metallic Coatings

o Polymeric Coatings

o Organic Coating

By Device Type

o Catheters

o Implantable Devices

o Surgical Instruments

o Others

By Application

o In-Vitro Diagnostics

o Orthodontics/Dentistry Procedures

o Cardiovascular Surgeries

o Bio Implants

o Orthopedics

o Gynecology

o Other General Surgical Procedures

By End-User

o Hospitals

o Cancer Treatment Centers

o ASCs

o Research & Diagnostic Facilities

o Others

Segment Analysis

By Coating Material Analysis

Antimicrobial coatings for medical devices. Metallic Coatings (Silver Coatings, Copper Coatings, Other Metallic Coatings) and Non-Metallic Coatings (Polymeric Coatings, Organic Coatings) are the market segments by type. Metallic Coatings dominated the market in 2023, accounting for 34.8% of total revenue, owing to their inherent antibacterial qualities and durability. These coatings, which are often created from metals like silver, copper, and zinc, provide broad-spectrum antibacterial activity against a variety of diseases. Furthermore, metallic coatings provide long-lasting protection, making them appropriate for usage on a variety of medical devices, such as implants and surgical instruments. Metallic coatings are the favored choice for healthcare institutions and device manufacturers because of their proven efficacy and adaptability, and they hold the industry's highest market share.

Non-metallic coatings have the greatest compound annual growth rate (CAGR) in the antimicrobial coatings for medical devices market due to a variety of variables. These coatings, which are primarily comprised of polymers or ceramics, have several advantages, including biocompatibility, flexibility, and ease of application. Furthermore, non-metallic coatings can be designed to gradually release antimicrobial chemicals, ensuring long-term protection without the risk of metal ion toxicity. As a result, healthcare providers and device manufacturers are increasingly using non-metallic coatings, resulting in significant market expansion.

By Device Type Analysis

Catheters, Implantable Devices, Surgical Instruments, and Others make up the Device Type section of the Antimicrobial Coatings for Medical Devices Market. Catheters generated the largest revenue in 2023 because of their broad use in healthcare settings and the high risk of infection associated with long-term use. Antimicrobial coatings on catheters serve to minimize bacterial colonization on the device's surface, lowering the risk of catheter-related infections. Given the enormous impact of catheter-related infections on patient outcomes and healthcare expenses, healthcare providers emphasize the use of coated catheters, which contributes to their market domination.

Implantable devices have the greatest compound annual growth rate (CAGR) in the antimicrobial coatings for medical devices market due to a variety of factors. Implantable devices, such as orthopedic implants and cardiovascular stents, are susceptible to infections, which can cause catastrophic consequences. Antimicrobial coatings on these devices serve to inhibit bacterial colonization, lowering the likelihood of implant-related illnesses. With the growing incidence of implantable medical procedures and increased awareness of infection management, demand for coated implantable devices is fast expanding, resulting in a high market CAGR.

By Application Analysis

The Antimicrobial Coatings for Medical Devices Market can be divided into several application types, including in-vitro diagnostics, orthodontics/dentistry procedures, cardiovascular surgeries, bio-implants, orthopedics, gynecology, and other general surgical operations. The orthopedics segment had the greatest share in 2023. The rise is attributed to the increasing occurrence of orthopedic issues such as congenital malformations, joint pains, lower back discomfort, scoliosis, and other injuries related to car accidents and sports. Lower back pain and arthritis problems are the most common reasons for orthopedic surgery. In 2021, the United States will see approximately 58-59 million cases of arthritis. On the other hand, given the advantages of ultra-modern lifestyles in the twenty-first century, many have become averse to manual labor. As a result of insufficient physical activity and poor posture, the number of orthopedic treatments has increased.

Nonetheless, cardiovascular illness and orthodontic operations are expected to be the fastest-growing segments, with a CAGR of 14.3% for the projected period 2023-2033. This increase is due to the high prevalence of cardiovascular diseases such as cancer and heart attacks. Treatment for these consequences is so time-consuming that they necessitate regular medical attention, increasing demand for long-lasting antimicrobial coatings. Furthermore, as people become more aesthetically conscious due to the influence of movie stars, orthodontic procedures are increasing in popularity.

By End-User Analysis

The Antimicrobial Coatings for Medical Devices Market can be divided into end-user segments such as hospitals, cancer treatment centers, ASCs, research and diagnostic institutes, and others. The hospital segment had the biggest share in 2023. The increase is due to the rising prevalence of chronic illnesses around the world. COVID-19 is another reason why millions of people have been hospitalized around the world since 2019. Increasing respiratory and communicable infections are putting additional strain on hospital management.

Furthermore, the hospital segment is expected to grow the quickest, at a CAGR of 14.9% from 2023 to 2033. This increase is due to rising demand for governments to improve healthcare infrastructure so that their different countries can better handle emergencies such as COVID-19. With the proliferation of healthcare costs, hospital infrastructure is being refined. Doctors and personnel are critical assets for hospitals since they contribute to growth. As a result of technological improvements and widespread access to the internet, many students who might otherwise have missed out on an education are now studying and emerging as top-tier professionals.

Regional Analysis

In 2023, North America held the greatest share of the entire market, accounting for 33.8%. The increase in this area is attributed to reasons such as the general public's high level of health awareness as a result of their high standard of life. Unlike many Asian countries, such as India, many people in the United States seek a doctor's prescription for even a mild cold. Furthermore, hundreds of breast cancer cases are reported in the United States each year. For example, about 280,000 women in the United States were diagnosed with breast cancer in 2021. On the other hand, obesity appears to have established a permanent abode in America as a result of the country's widespread consumption of fast food. As a result, chronic obstructive lung disorders are on the rise, inundating hospitals with patients.

However, Asia-Pacific is predicted to be the fastest-growing segment from 2023 to 2033. This increase is due to the increased prevalence of chronic diseases. India and China are among the world's most populous countries. More than 35% of the world's population lives in these countries, which are home to approximately 2.9-3 billion people. A significant portion of this 35% of the population is getting older, hence the number of hospitalizations is rapidly increasing. Furthermore, due to the rapid speed of economic growth, Asia is becoming the new Europe. As a result, the healthcare infrastructure is strengthening as governments devote vast sums of money to development.

Competitive Analysis

Leading companies in the antimicrobial coatings for medical devices market are strengthening their market position through strategic initiatives such as mergers and acquisitions, alliances, and product advancements. They invest in research and market development to create improved coatings with greater efficacy and longevity. Furthermore, corporations prioritize regulatory compliance and seek certification for their coated products. Collaborations with healthcare institutes and research organizations also help to create unique coating technologies, assuring market competitiveness in the long run.

Recent Developments

April 2022: BioInteractions, a biomaterials technology firm based in the United Kingdom, has unveiled TridAnt, a novel coating technology for medical devices. TridAnt is a significant achievement in infection prevention and pathogen protection, representing a watershed moment in the area.

January 2022: BASF cooperated with Permionics Membranes, a membrane company based in Vadodara, India, to use BASF Ultrason E (PESU: polyether sulfone) in coated fabrics. These fabrics function as particle and bacterial filters in face masks.

Key Market Players in the Antimicrobial Coatings for Medical Devices Market

o BASF SE

o Covalon technologies

o Royal DSM

o Speciality Coating Systems

o Sciessent LLC

o AST Products

o AST Products

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 1.6 Billion |

|

Market Size 2033 |

USD 5.3 Billion |

|

Compound Annual Growth Rate (CAGR) |

12.6% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Coating Material, Device Type, Application, End-User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

BASF SE, BioInteractions Ltd, Covalon technologies, The Dow Chemical Company, PPG Industries, Royal DSM, Speciality Coating Systems, Sciessent LLC, AST Products, AST Products, Other Key Players |

|

Key Market Opportunities |

Expanding Applications and Emerging Technologies |

|

Key Market Dynamics |

Increasing Need for Infection Control |

📘 Frequently Asked Questions

1. What is the growth rate of the Xenotransplantation Market?

Answer: Xenotransplantation Market is growing at a CAGR of 12.6% during the forecast period, from 2023 to 2033.

2. Who are the key players in the Xenotransplantation Market?

Answer: BASF SE, BioInteractions Ltd, Covalon technologies, The Dow Chemical Company, PPG Industries, Royal DSM, Speciality Coating Systems, Sciessent LLC, AST Products, AST Products, Other Key Players

3. How much is the Xenotransplantation Market in 2023?

Answer: The Xenotransplantation Market size was valued at USD 1.6 Billion in 2023.

4. What would be the forecast period in the Xenotransplantation Market?

Answer: The forecast period in the Xenotransplantation Market report is 2024-2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.