🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Asthma and COPD Drugs Market

Asthma and COPD Drugs Market (By Disease Type (COPD and Asthma), By Medication Class (Long-term Asthma Control Medications and Quick-Relief Medications), By Route of Administration (Inhaled, Oral, Others), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Pharmacies), By Region and Companies)

Jun 2024

Healthcare

Pages: 161

ID: IMR1094

Asthma and COPD Drugs Market Overview

Global Asthma and COPD Drugs Market size is expected to be worth around USD 69.0 Billion by 2033 from USD 39.3 Billion in 2023, growing at a CAGR of 5.7% during the forecast period from 2023 to 2033.

The Asthma and COPD (Chronic Obstructive Pulmonary Disease) drugs market refers to the global industry focused on the development, Disease type, and distribution of medications used to treat these chronic respiratory conditions. Asthma and COPD are prevalent respiratory diseases characterized by breathing difficulties and reduced airflow due to inflammation and obstruction in the airways. The market for these drugs is driven by the increasing incidence of these conditions worldwide, advancements in drug development, and a growing geriatric population, which is more susceptible to respiratory diseases.

The market is highly competitive and fragmented, with major pharmaceutical companies such as GlaxoSmithKline, AstraZeneca, Boehringer Ingelheim, and Novartis leading the industry. These companies are engaged in continuous research and development to introduce innovative and more effective treatments. Recent trends in the market include the rise of inhaler-based treatments, the growing emphasis on real-world data and preventative care, and the increasing use of digital health technologies to improve patient management and adherence to medication. Additionally, the introduction of biosimilars and combination therapies has provided more cost-effective and comprehensive treatment options for patients.

Drivers for the Asthma and COPD Drugs Market

Increasing Prevalence and Incidence of Respiratory Diseases

The Asthma and COPD drugs market is experiencing significant growth due to the rising prevalence and incidence of respiratory diseases. Asthma and COPD are becoming more common globally, with millions of people affected. Factors such as increased pollution, urbanization, and lifestyle changes like smoking are contributing to this rise. In the United States alone, over 25 million people suffer from asthma, while COPD affects more than 15 million adults. This growing patient population is driving the demand for effective treatments, leading to the expansion of the asthma and COPD drugs market.

Advances in Drug Development and Strategic Collaborations

Continuous advancements in drug development and strategic collaborations among pharmaceutical companies are also key drivers of the market. Significant investments in research and development have led to the introduction of new and more effective drugs. Companies like GlaxoSmithKline and AstraZeneca are actively engaged in clinical trials to develop innovative therapies for severe asthma and COPD. These advancements not only improve treatment efficacy and safety but also expand the range of available medications, enhancing patient outcomes. Moreover, mergers, acquisitions, and partnerships help in pooling resources and expertise, accelerating the development of new treatments.

Technological Innovations in Drug Delivery

Technological innovations in drug delivery systems are playing a crucial role in market growth. The development of advanced inhalers, combination therapies, and biologics is significantly improving treatment effectiveness and patient adherence. These innovations are enhancing the efficacy of treatments and making them more user-friendly, thereby increasing their adoption among patients. For example, combination inhalers that offer bronchodilators and corticosteroids are becoming increasingly popular as they comprehensively manage asthma and COPD symptoms.

Supportive Government Policies and Increased Healthcare Expenditure

Supportive government policies and increased healthcare expenditure are further boosting the market. Many governments are implementing policies to ensure better access to healthcare and medications, including asthma and COPD drugs. The expansion of healthcare infrastructure, particularly in developing regions, is making these drugs more accessible to a broader population. Additionally, increased funding for research and development by both government bodies and private organizations is leading to the introduction of more effective treatment options.

Strategic Market Movements by Major Pharmaceutical Companies

Strategic movements by major pharmaceutical companies also influence the market. Leading players like GlaxoSmithKline, AstraZeneca, and Boehringer Ingelheim are engaging in mergers, acquisitions, and collaborations to enhance their market presence and Disease Type offerings. Recent Disease Type launches and the introduction of novel fixed-dose combination drugs have been notable trends. These strategic initiatives are essential for maintaining competitive advantage and driving market growth.

Restraints for the Asthma and COPD Drugs Market

Stringent Regulatory Framework

The market for asthma and COPD drugs faces significant restraints due to stringent regulatory frameworks governing drug approvals. Regulatory bodies such as the FDA and EMA impose rigorous testing and approval processes to ensure the safety and efficacy of new medications. This lengthy and costly process often delays the introduction of new therapies, creating barriers for smaller companies to enter the market and limiting the availability of new drugs for patients. Additionally, these stringent regulations can lead to significant delays in bringing new treatments to market, impacting the overall growth of the industry.

High Cost of Medications

Another major restraint is the high cost of asthma and COPD drugs, especially advanced therapies and biologics. The expensive nature of these medications limits their accessibility for many patients, particularly in low- and middle-income countries where healthcare systems may not provide sufficient subsidies. The chronic nature of asthma and COPD, which require long-term medication use, further exacerbates the financial burden on patients. This financial barrier remains a significant challenge for the market, as it restricts patient access to necessary treatments and impacts overall market growth.

Side Effects and Patient Hesitancy

The potential side effects associated with asthma and COPD drugs also present a substantial restraint on market growth. Common side effects include an increased risk of infections, cardiovascular issues, and adverse reactions, which can lead to hesitancy among patients and healthcare providers in adopting these treatments. This hesitancy can impact the uptake and consistent use of these drugs, ultimately affecting the overall market demand and growth.

Competition from Generic Drugs

The presence of generic drugs in the market poses another challenge for the asthma and COPD drugs market. Generic medications offer more affordable alternatives to brand-name drugs, intensifying competition and leading to reduced profit margins for pharmaceutical companies. While generics increase accessibility for patients, they also create a highly competitive environment that pressures companies to lower prices and impacts overall profitability. This competitive landscape necessitates ongoing innovation and differentiation by pharmaceutical companies to maintain market share and growth.

Opportunity in the Asthma and COPD Drugs Market

The Asthma and COPD drugs market is poised for significant growth due to the development and anticipated approval of new biologic drugs. Notable advancements include Sanofi and Regeneron’s Development and Approval of New Biologic Drugs

Dupixent (dupilumab) and Verona Pharma’s ensifentrine, are expected to introduce new treatment paradigms. Dupixent targets inflammatory pathways in asthma and COPD, showing promising results in reducing exacerbations and improving lung function. Similarly, ensifentrine offers a novel dual mechanism combining bronchodilator and anti-inflammatory effects, potentially providing comprehensive treatment options for COPD patients. These advancements could significantly enhance therapeutic options and patient outcomes in the coming years.

Rising Prevalence in Developing Regions

Another substantial opportunity lies in the rising prevalence of asthma and COPD, particularly in developing regions. Increasing urbanization, industrialization, and environmental pollution contribute to the growing incidence of these respiratory conditions. Asia-Pacific is expected to witness the highest growth rates due to its large population base, improving healthcare infrastructure, and increasing healthcare expenditure. The expanding market in these regions presents a lucrative opportunity for pharmaceutical companies to introduce new and effective treatments. Government initiatives aimed at improving the diagnosis and treatment of respiratory diseases, along with increased funding for research and development, are expected to further drive market growth. This combination of factors underscores the significant potential for the asthma and COPD drugs market to expand globally, providing enhanced care for millions of patients.

Trends for the Asthma and COPD Drugs Market

Increasing Prevalence of Respiratory Diseases

One of the most prominent trends in the asthma and COPD drugs market is the rising prevalence of these respiratory conditions globally. Factors such as urbanization, air pollution, and an aging population are contributing to this increase. According to recent reports, the prevalence of asthma and COPD is steadily climbing, leading to a higher demand for effective treatments. For instance, the Australian Bureau of Statistics reported that over 2.7 million Australians had asthma in 2021, and similar trends are observed worldwide.

Advancements in Drug Delivery Systems

Technological advancements in drug delivery systems are significantly enhancing the treatment efficacy for asthma and COPD patients. Innovations such as smart inhalers and nebulizers are making it easier for patients to manage their conditions. These devices not only ensure accurate dosage but also provide real-time data to healthcare providers, improving patient compliance and treatment outcomes. Companies are investing heavily in research and development to bring these advanced systems to market, which is expected to drive growth further.

Development of Biologic Therapies

The introduction and growing adoption of biological therapies represent another crucial trend in the market. Biologics are designed to target specific pathways involved in the inflammatory processes of asthma and COPD, offering a new level of precision in treatment. Drugs such as monoclonal antibodies have shown promising results in reducing symptoms and improving the quality of life for patients with severe asthma and COPD. Major pharmaceutical companies are conducting extensive clinical trials to expand the availability of these treatments.

Focus on Personalized Medicine

There is a growing emphasis on personalized medicine in the treatment of asthma and COPD. This approach tailors treatment plans based on individual patient profiles, including genetic, environmental, and lifestyle factors. Personalized medicine aims to improve treatment efficacy and minimize adverse effects by selecting the most appropriate therapy for each patient. Advances in genetic research and biomarker identification are facilitating this trend, making it a significant area of focus for future drug development.

Strategic Collaborations and Partnerships

Strategic collaborations and partnerships among pharmaceutical companies are also driving market growth. These collaborations are aimed at accelerating the development and commercialization of new therapies. By pooling resources and expertise, companies can bring innovative treatments to market more efficiently. Notable examples include partnerships for clinical trials and co-development agreements for new biologics and drug delivery systems.

Expansion in Emerging Markets

Lastly, the expansion into emerging markets presents substantial growth opportunities for the asthma and COPD drugs market. Regions such as Asia-Pacific and Latin America are witnessing a rise in the incidence of respiratory diseases due to increasing pollution levels and changing lifestyles. These markets are becoming focal points for pharmaceutical companies looking to extend their global reach. Investment in healthcare infrastructure and rising awareness about respiratory health in these regions are expected to drive significant market growth in the coming years.

Segments Covered in the Report

By Disease Type

o COPD

o Asthma

By Medication Class

Ø Long-term Asthma Control Medications

· Combination Drugs

o Seretide/Advair

o Symbicort

o Relvar/Breo Ellipta

o Flutiform

o Dulera

o Others

· Anticholinergics

o Spiriva

o Others

· Inhaled Corticosteroids

o Pulmicort

o Flovent

o Qvar

o Others

Ø Quick-Relief Medications

· Short-acting beta agonists

o Ventolin

o ProAir

o Others

· Ipratropium bromide (Atrovent)

· Oral and Intravenous Corticosteroids

· Others

By Route of Administration

o Inhaled

o Oral

o Others

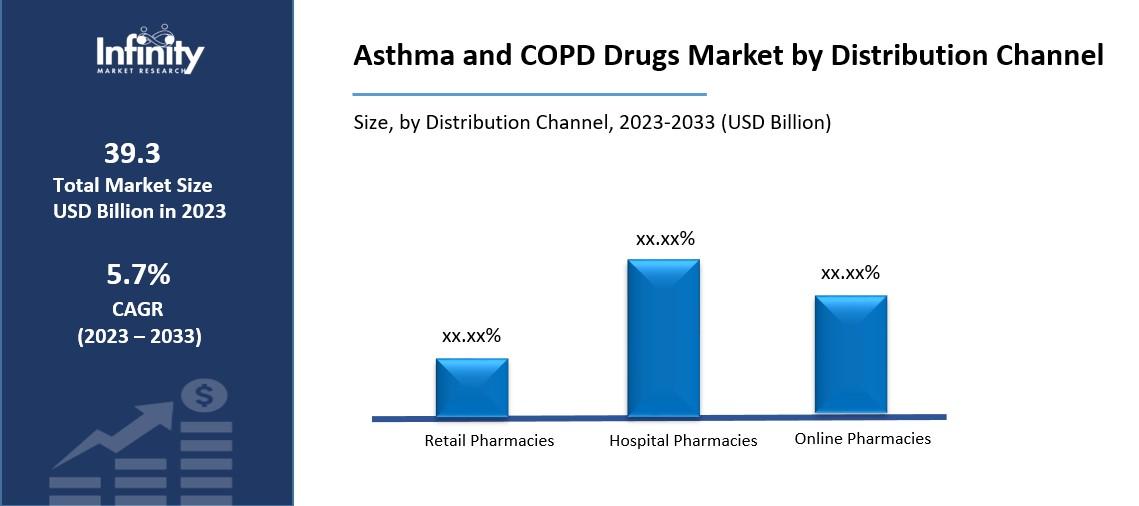

By Distribution Channel

o Retail Pharmacies

o Hospital Pharmacies

o Online Pharmacies

Segment Analysis

By Disease Type Analysis

The market for asthma and COPD drugs is often divided into two segments: asthma and chronic obstructive pulmonary disease. In the global market for asthma and COPD drugs, the asthma sector emerged as a leader, capturing an impressive 60.8% of market value in 2023.

The reason for this domination is that asthma is a common, potentially fatal illness all across the world. Asthma symptoms can be managed with inhaled medications and pharmaceuticals, which can help children with the disease live healthy lives.

The World Health Organization estimates that 263 million people worldwide suffered from asthma in 2019, accounting for 46,1000 cases of the disease.

Conversely, COPD is the fastest-expanding group due to global emissions of harmful chemicals and rising air pollution.

The Global Burden of Disease Study from the Institute of Health Metrics and Evaluation (2016) estimated that there were 215 million COPD cases worldwide.

By Medication Class Analysis

The market is divided into two segments based on the medication class: those for long-term asthma control and those for immediate relief. Long-acting beta-agonists, combination medications, inhaled corticosteroids, anticholinergics, theophylline, and other medications are produced by the sub segmentation of long-term asthma control medications. Combination medications are further divided into subcategories such as dura, flutiform, relvar/Breo ellipta, symbicort, and seretide/advair.

A subset of anticholinergics is Spiriva and other similar medications. On the other hand, subtypes of inhaled corticosteroids include Flovent, qvar, Pulmicort, and others. In 2023, the long-term asthma control medication segment will hold a significant market share of 70.9% in the global market for asthma and COPD pharmaceuticals. The dominance is due to drugs' support in suppressing severe symptoms for an extended length of time.

Under the brand name Indamet, Glenmark introduced a novel fixed-dose combination called Indacaterol Plus Mometasone for patients in India with uncontrolled asthma.

Conversely, short-acting beta-agonists, ipratropium bromide (Atrovent), oral and injectable corticosteroids, and other drugs are further subdivided under the category of rapid relief therapies.

By Route of Administration Analysis

The market is divided into groups for oral and inhaled routes based on the route of administration. Of these, the oral method of administration category leads the market for COPD and asthma medications, accounting for a respectable 66.1% of the market in 2023. The reason this particular sector is so well-liked is because of how frequently medicines, such as Symbicort and Foradil, are used to provide relief quickly.

The market is also strongly driven by the fact that it is the least costly, safest, and most convenient, which has increased its acceptance in the healthcare industry. In cases of acute asthma, oral medicine is typically chosen, particularly for children whose usage of inhalers appears to be challenging.

By Distribution Channel Analysis

The market is divided into divisions for hospital pharmacies, retail pharmacies, online pharmacies, and drug stores based on the distribution channel. Among all of them, the retail pharmacies category plays a crucial role, with a significant market share of 50.7% in the worldwide market for asthma and COPD drugs.

When compared to hospital pharmacies, the number of retail pharmacies has increased recently, which has contributed significantly to the segment's expansion in terms of drug availability. When doctors prescribe medication, individuals with asthma and COPD typically choose retail pharmacies for both initial and recurring purchases of the relevant pharmaceuticals.

Regional Analysis

In 2023, North America will hold a commanding 33.2% of the global market for asthma and COPD. Rising COPD and asthma cases, an aging population, the presence of well-known market players, and increased R&D activity in related fields are all major factors contributing to the region's growth. The market is significantly boosted by the increasing prevalence of COPD and asthma among these mix of variables.

Apart from the previously mentioned aspects, an additional significant driver of the market expansion is the increasing amount of financing provided by governmental and non-governmental organizations. This has resulted in heightened knowledge of asthma, which in turn has increased the adoption rate of asthma therapies. The region's cutting-edge healthcare system and the existence of regional pharmaceutical companies that prioritize the creation of innovative therapeutic drugs are key factors supporting the area's recent growth.

Competitive Analysis

Developing significant players are focused on different approaches to grow their specific businesses in international marketplaces. Many organizations in the COPD and asthma sector are focusing on expanding their current operations and research and development centers. Through mergers, investments, and acquisitions, companies in the COPD and asthma sector are also expanding their product lines and building a portfolio. Furthermore, several important firms are currently focusing on alternative marketing approaches, like raising awareness of cutting-edge characteristics, which is accelerating the growth of target items.

Key Market Players in the Asthma and COPD Drugs Market

o Novartis AG

o Teva Pharmaceutical Industries Ltd

o Merck and Co Inc.

o Roche Holdings AG

o Pfizer

o Sanofi

o Suvonion Pharmaceuticals Inc.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 39.3 Billion |

|

Market Size 2033 |

USD 69.0 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.7% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

Disease Type, Medication Class, Route of Administration, Distribution Channel, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

GlaxoSmithKline Plc., Novartis AG, AstraZeneca Plc., Teva Pharmaceutical Industries Ltd, Merck and Co Inc., Roche Holdings AG, Pfizer, Sanofi, Suvonion Pharmaceuticals Inc., Vectura Group, Other Key Players |

|

Key Market Opportunities |

The Asthma and COPD drugs market is poised for |

|

Key Market Dynamics |

Increasing Prevalence and Incidence of Respiratory Diseases |

📘 Frequently Asked Questions

1. How much is the Asthma and COPD Drugs Market in 2023?

Answer: The Asthma and COPD Drugs Market size was valued at USD 39.3 Billion in 2023.

2. What would be the forecast period in the Asthma and COPD Drugs Market report?

Answer: The forecast period in the Asthma and COPD Drugs Market report is 2023-2033.

3. Who are the key players in the Asthma and COPD Drugs Market?

Answer: GlaxoSmithKline Plc., Novartis AG, AstraZeneca Plc., Teva Pharmaceutical Industries Ltd, Merck and Co Inc., Roche Holdings AG, Pfizer, Sanofi, Suvonion Pharmaceuticals Inc., Vectura Group, Other Key Players

4. What is the growth rate of the Asthma and COPD Drugs Market?

Answer: Asthma and COPD Drugs Market is growing at a CAGR of 5.7% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.