🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Atomized Metal Powder Market

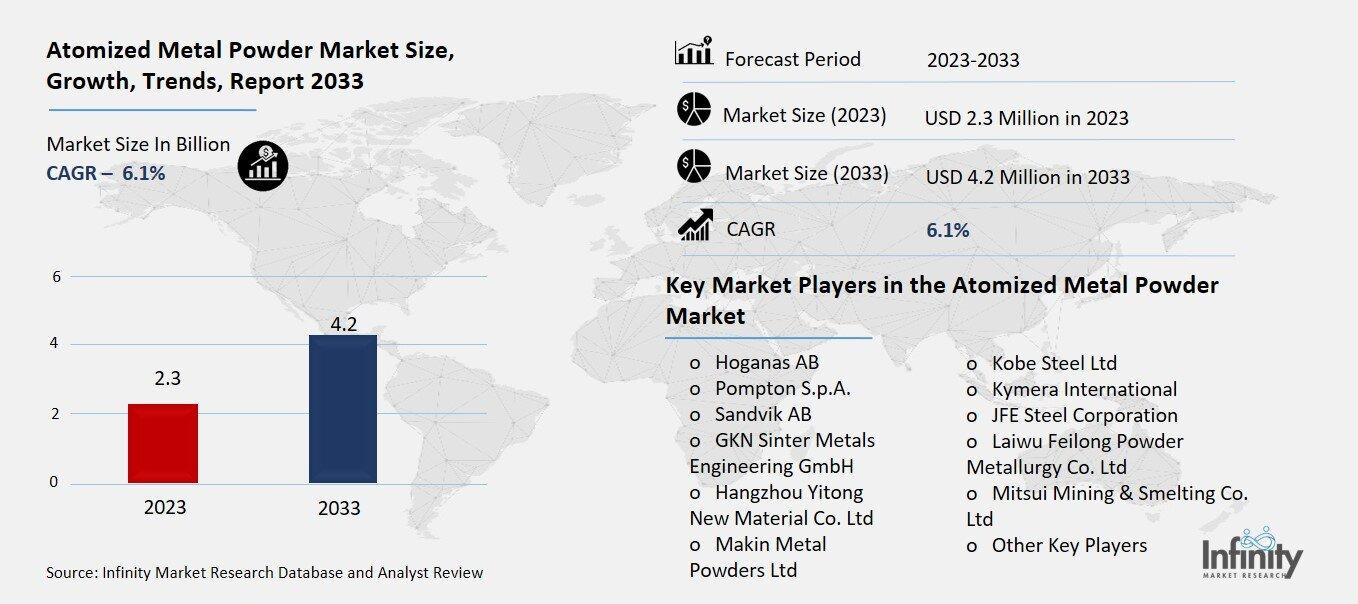

Global Atomized Metal Powder Market (By Powder Type, Atomizing Iron Powder, Atomizing Aluminium Powder, Atomizing Steel Powder, Atomizing Copper Powder, and Other Power Types; By Application, Metallurgy Industry, Electronic Materials, Chemical Industry, Welding, Diamond Tools, and Other Applications; By Region and Companies), 2024-2033

Oct 2024

Chemicals and Materials

Pages: 138

ID: IMR1250

Atomized Metal Powder Market Overview

Global Atomized Metal Powder Market acquired the significant revenue of 2.3 Billion in 2023 and expected to be worth around USD 4.2 Billion by 2033 with the CAGR of 6.1% during the forecast period of 2024 to 2033. The market for atomized metal powder is quickly changing in the materials industry due to advancements in manufacturing techniques and the rising need for metal powders.

Metal powders are created using methods like water and gas atomization where liquid metal is transformed into particles. Its applications span fields including powder metallurgy and surface coatings due to its characteristics such, as consistent particle size distribution. The automotive and aerospace sectors stand out among the industries that heavily rely upon these metal powders for crafting parts and intricate shapes.

Drivers for the Atomized Metal Powder Market

Growing Demand in Additive Manufacturing (3D Printing)

The growth in the adoption of 3D printing in various industries including aerospace, automotive, and healthcare is significantly fueling the growth of demand for atomized metal powders. Due to its advantages 3D printing always offers the opportunity for innovation in the form of complex designs which are hard or even impossible to realize using conventional types of manufacturing. Such lightweight components needed to increase the efficiency of fuel consumption and minimize the emissions are achievable using this technology mapping within the aerospace sector.

The automotive sector leverages 3D printing to produce custom parts, optimize vehicle weight, and accelerate prototyping, leading to faster product development cycles. In healthcare, 3D printing with metal powders is used to produce patient-specific implants, surgical tools, and prosthetics with a high degree of precision and biocompatibility.

Restraints for the Atomized Metal Powder Market

Health and Safety Concerns

The fine nature of atomized metal powders presents significant health risks, primarily due to the potential inhalation of these particles, which can lead to respiratory issues. When metal powders are handled without adequate safety precautions, workers are exposed to airborne particles, which can accumulate in the lungs, causing chronic respiratory conditions and even more severe health issues over time. Certain metals, like nickel and cobalt, can also be toxic or allergenic, posing additional health hazards. Due to these risks, strict regulations have been put in place by occupational health and safety authorities to ensure safe handling, storage, and processing of metal powders. These regulations often mandate the use of protective equipment, proper ventilation systems, and dust control measures to minimize worker exposure.

Opportunity in the Atomized Metal Powder Market

Increasing Adoption in Electronics and Energy Storage

The growing use of atomized metal powders in the production of electronic components and energy storage solutions, such as batteries, is creating significant opportunities for the market. In the electronics industry, these metal powders are employed in manufacturing components like capacitors, resistors, and electromagnetic shielding materials, where their small particle size and high conductivity are advantageous. The shift towards miniaturization in electronic devices also increases the demand for fine, uniform metal powders that allow precise and efficient production. In the energy storage sector, metal powders, such as those made from lithium, nickel, and cobalt, are being used for the development of advanced battery technologies. These powders play a key role in improving the energy density, efficiency, and overall performance of batteries used in electric vehicles, consumer electronics, and renewable energy storage systems.

Trends for the Atomized Metal Powder Market

Shift Towards Sustainable and Recycled Materials

The rising focus on environmental sustainability is driving increased use of recycled metals for atomized powder production, as industries strive to minimize their environmental footprint and reduce waste. Utilizing recycled metals, such as scrap iron, aluminum, and copper, not only helps in conserving natural resources but also significantly lowers energy consumption compared to the extraction and processing of virgin metals. This approach aligns with the circular economy model, which emphasizes resource efficiency and waste reduction.

The metal powder industry is embracing these sustainable practices by developing efficient recycling processes that convert scrap materials into high-quality powders suitable for various applications. Moreover, the use of recycled materials is gaining popularity in industries like automotive, aerospace, and construction, which are under pressure to meet strict environmental regulations and reduce carbon emissions.

Segments Covered in the Report

By Powder Type

o Atomizing Iron Powder

o Atomizing Aluminium Powder

o Atomizing Steel Powder

o Atomizing Copper Powder

o Other Power Types

By Application

o Metallurgy Industry

o Electronic Materials

o Chemical Industry

o Welding

o Diamond Tools

o Other Applications

Segment Analysis

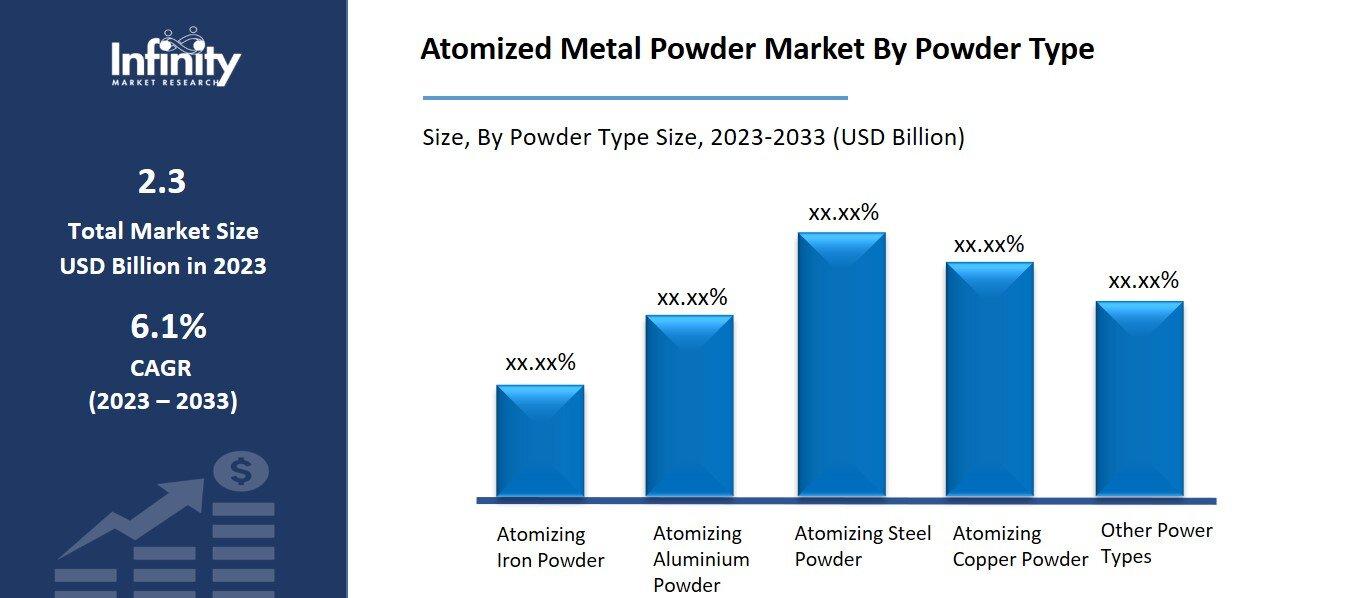

By Powder Type Analysis

On the basis of powder type, the market is divided into atomizing iron powder, atomizing aluminium powder, atomizing steel powder, atomizing copper powder, and other power types. Among these, atomizing iron powder segment acquired the significant share around 42.1% in the market owing to the high demand for iron powder in various applications, particularly in the automotive and construction industries.

Atomizing iron powder is widely used in powder metallurgy for manufacturing automotive components such as gears, bearings, and sintered parts due to its excellent mechanical properties and cost-effectiveness. The growing adoption of powder metallurgy for lightweight, durable automotive parts has fueled the demand for atomizing iron powder. Additionally, iron powder is utilized in welding, surface coating, and chemical processes, further contributing to its significant market share.

By Application Analysis

On the basis of application, the market is divided into metallurgy industry, electronic materials, chemical industry, welding, diamond tools, and other applications. Among these, metallurgy industry segment held the prominent share of the market due to the widespread use of metal powders in powder metallurgy processes, which are extensively employed in the production of high-strength components across various industries. The metallurgy industry benefits from atomized metal powders for creating parts with complex geometries and superior mechanical properties, making them ideal for use in sectors such as automotive, aerospace, and industrial machinery. The efficiency of powder metallurgy in reducing material waste, along with its cost-effectiveness for mass production, has driven the demand for atomized metal powders in this segment.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 35.1% of the market. The region has advanced manufacturing capabilities and is a leader in adopting new technologies like additive manufacturing (3D printing), where atomized metal powders are extensively used. The well-established automotive and aerospace sectors in the United States and Canada have driven the demand for high-quality metal powders to produce lightweight, durable, and complex components. Additionally, the region’s focus on research and development, along with substantial investments in innovative manufacturing techniques, has contributed to the market's growth.

Competitive Analysis

The competitive landscape of the atomized metal powder market is characterized by a mix of established players and emerging companies, all vying for market share through strategic initiatives such as mergers, acquisitions, partnerships, and technological innovations. Key players like Höganäs AB, GKN Powder Metallurgy, and Carpenter Technology Corporation leverage their extensive experience and broad product portfolios to cater to diverse industrial needs. These companies focus on developing high-quality metal powders with enhanced properties for specific applications, such as aerospace, automotive, and healthcare.

Recent Developments

In August 2023, Outokumpu inaugurated its new inert gas atomization plant for producing metal powder in Krefeld, Germany.

Key Market Players in the Atomized Metal Powder Market

o Hoganas AB

o Pompton S.p.A.

o Sandvik AB

o GKN Sinter Metals Engineering GmbH

o Hangzhou Yitong New Material Co. Ltd

o Makin Metal Powders Ltd

o Kobe Steel Ltd

o Kymera International

o JFE Steel Corporation

o Laiwu Feilong Powder Metallurgy Co. Ltd

o Mitsui Mining & Smelting Co. Ltd

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 2.3 Billion |

|

Market Size 2033 |

USD 4.2 Billion |

|

Compound Annual Growth Rate (CAGR) |

6.1% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Powder Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Hoganas AB, Pompton S.p.A., Sandvik AB, GKN Sinter Metals, Engineering GmbH, Hangzhou Yitong New Material Co. Ltd, Makin Metal Powders Ltd, Kobe Steel Ltd, Kymera International, JFE Steel Corporation, Laiwu Feilong Powder Metallurgy Co. Ltd, Mitsui Mining & Smelting Co. Ltd, and, Other Key Players. |

|

Key Market Opportunities |

Increasing Adoption in Electronics and Energy Storage |

|

Key Market Dynamics |

Growing Demand in Additive Manufacturing (3D Printing) |

📘 Frequently Asked Questions

1. How much is the Atomized Metal Powder Market in 2023?

Answer: The Atomized Metal Powder Market size was valued at USD 2.3 Billion in 2023.

2. What would be the forecast period in the Atomized Metal Powder Market?

Answer: The forecast period in the Atomized Metal Powder Market report is 2024-2033.

3. Who are the key players in the Atomized Metal Powder Market?

Answer: Hoganas AB, Pompton S.p.A., Sandvik AB, GKN Sinter Metals, Engineering GmbH, Hangzhou Yitong New Material Co. Ltd, Makin Metal Powders Ltd, Kobe Steel Ltd, Kymera International, JFE Steel Corporation, Laiwu Feilong Powder Metallurgy Co. Ltd, Mitsui Mining & Smelting Co. Ltd, and, Other Key Players.

4. What is the growth rate of the Atomized Metal Powder Market?

Answer: Atomized Metal Powder Market is growing at a CAGR of 6.1% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.