🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Automatic Transfer Switch Market

Automatic Transfer Switch Market (By Switching Mechanism (Contactor, Circuit Breaker), By Transition (Closed, Open), By Installation (Emergency Systems, Legally Required Systems, Critical Operations Power Systems, Optional Standby Systems), By Region and Companies)

Jul 2024

Energy and Power

Pages: 138

ID: IMR1187

Automatic Transfer Switch Market Overview

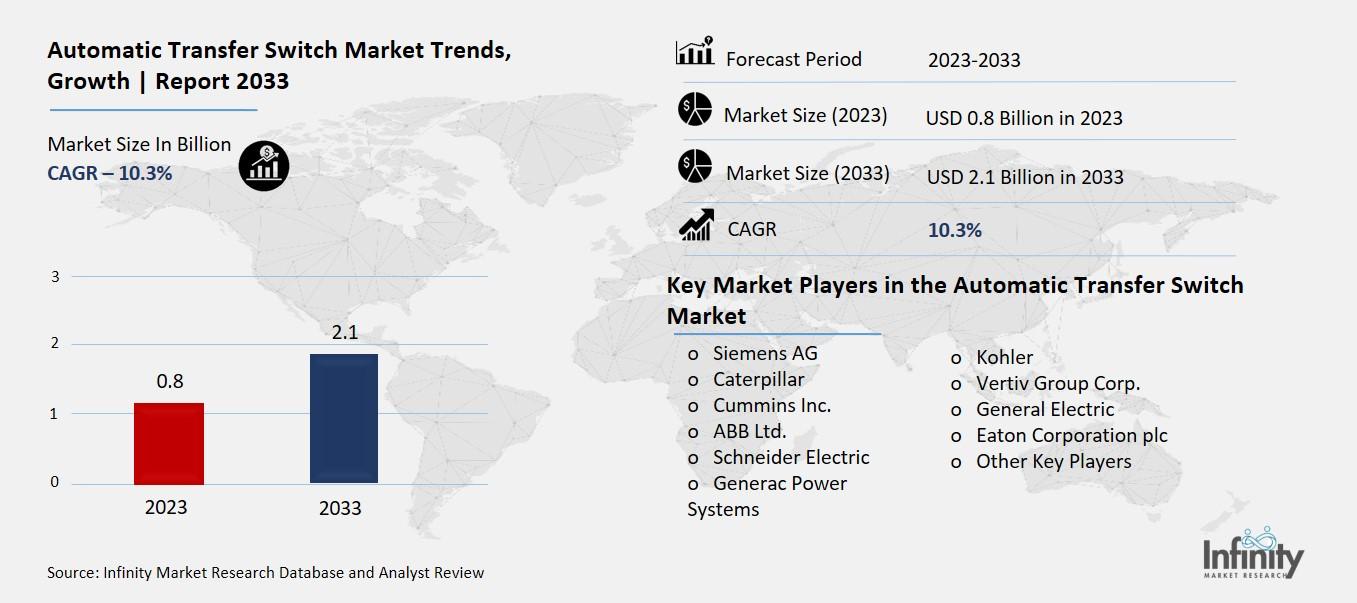

Global Automatic Transfer Switch Market size is expected to be worth around USD 2.1 Billion by 2033 from USD 0.8 Billion in 2023, growing at a CAGR of 10.3% during the forecast period from 2023 to 2033.

The automatic transfer switch (ATS) market involves the production and sale of devices that automatically switch a power supply from its primary source to a backup source when the primary source fails. These switches are crucial for ensuring uninterrupted power supply in various settings like homes, businesses, hospitals, and data centers. When the main power goes out, an ATS instantly switches to a backup generator or alternative power source, preventing downtime and protecting sensitive equipment.

In simple terms, the ATS market is all about making sure that electricity keeps flowing smoothly and without interruptions, no matter what. As more places rely on constant power for their operations, the demand for automatic transfer switches is growing. This market includes different types of ATS systems, catering to the needs of various industries and applications where reliable power is essential.

Drivers for the Automatic Transfer Switch Market

Growing Demand for Uninterrupted Power Supply

One of the primary drivers for the Automatic Transfer Switch (ATS) market is the increasing demand for an uninterrupted power supply. This is particularly important for data centers, hospitals, and industrial facilities where even a brief power outage can cause significant disruptions. As these sectors continue to grow and become more critical in the modern economy, the need for reliable backup power systems also increases. ATS ensures a seamless power transfer from the main supply to a backup generator during outages, maintaining continuous operations and preventing costly downtime.

Smart Grid Projects and Modernization

The ongoing development and modernization of smart grids are also driving the ATS market. Smart grids integrate advanced digital technology to improve electricity distribution efficiency, reliability, and sustainability. Automatic Transfer Switches are a key component of these grids, allowing for the smooth transition between different power sources and enhancing grid stability. Countries worldwide are investing heavily in smart grid projects, which boosts the demand for ATS as an essential part of the infrastructure.

Rise of Renewable Energy Integration

The integration of renewable energy sources into the power grid is another significant factor fueling the ATS market. As the global energy mix increasingly incorporates solar, wind, and other renewable sources, the need for systems that can manage the variability and intermittency of these energy types becomes crucial. ATS helps in managing the transition between renewable energy and traditional power sources, ensuring a consistent power supply and promoting the use of cleaner energy.

Increasing Investments in Data Centers

The rapid expansion of data centers globally is also a major driver for the ATS market. Data centers require a highly reliable power supply to prevent data loss and ensure continuous service availability. With the growth of cloud computing, big data, and IoT, the demand for data centers is skyrocketing. Consequently, the need for robust backup power solutions, including ATS, is also increasing, as they play a vital role in maintaining the uptime and reliability of data center operations.

Growing Industrialization and Urbanization

Industrialization and urbanization, particularly in developing regions, are contributing to the rising demand for ATS. As new industrial facilities and urban infrastructures are developed, there is a heightened need for reliable power solutions to support these activities. ATS provides a crucial safety net, ensuring that power disruptions do not hinder industrial operations or urban services, thereby supporting economic growth and development.

Technological Advancements and Automation

Advancements in technology and automation are enhancing the capabilities and efficiency of ATS. Modern ATS systems are now equipped with advanced features such as remote monitoring, predictive maintenance, and integration with other smart grid components. These innovations make ATS more reliable, user-friendly, and cost-effective, encouraging more industries and facilities to adopt them. The continuous improvement in ATS technology is a significant driver for its market growth, as it meets the evolving demands of a modern, interconnected world.

Restraints for the Automatic Transfer Switch Market

High Initial Costs

One significant restraint for the automatic transfer switch (ATS) market is the high initial cost associated with these devices. Automatic transfer switches can be quite expensive due to their sophisticated technology and components. For businesses and homeowners, this upfront expense can be a barrier, especially for smaller operations or individuals with limited budgets. While ATS units are crucial for ensuring continuous power supply by automatically switching to backup power sources during outages, the high purchase and installation costs can deter potential buyers. This financial concern can limit market growth, particularly in regions where economic conditions are challenging.

Maintenance and Operating Costs

Another challenge faced by the ATS market is the ongoing maintenance and operating costs. Automatic transfer switches require regular maintenance to ensure they function correctly during power interruptions. This includes periodic inspections, testing, and potential repairs. These maintenance requirements can add to the overall cost of ownership and may discourage some customers from investing in ATS solutions. Additionally, the need for skilled technicians to perform maintenance tasks further increases operational expenses, making it less attractive for cost-conscious buyers.

Limited Awareness and Understanding

Limited awareness and understanding of automatic transfer switches pose another significant restraint. Many potential customers may not fully comprehend the benefits and importance of ATS systems, especially in regions where power outages are less frequent. This lack of awareness can result in a lower demand for ATS products, as consumers may not see the value in investing in such systems. Efforts to educate potential buyers about the importance of uninterrupted power supply and the role of ATS in achieving it could help mitigate this issue, but it remains a challenge for market expansion.

Technological Complexity

The technological complexity of automatic transfer switches is also a restraint. ATS systems are equipped with advanced features and require proper configuration to operate efficiently. This complexity can be a deterrent for customers who prefer simpler solutions or lack the technical expertise to manage and operate these systems. Additionally, rapid technological advancements in the industry can lead to concerns about system obsolescence, where newer models may offer better performance or features, prompting buyers to delay their purchases in anticipation of future innovations.

Market Competition and Substitutes

Lastly, intense market competition and the availability of alternative solutions can limit the growth of the ATS market. There are various backup power solutions available, such as uninterruptible power supplies (UPS) and portable generators, which can serve similar purposes as automatic transfer switches. The presence of these substitutes can create competitive pressure and potentially reduce the market share for ATS products. Companies in the ATS market need to differentiate their offerings and highlight the unique advantages of their systems to remain competitive amidst a crowded marketplace.

Opportunity in the Automatic Transfer Switch Market

Growing Demand for Reliable Power Solutions

The automatic transfer switch (ATS) market is experiencing significant growth opportunities due to the increasing demand for reliable power solutions. As power outages become more frequent and critical for both residential and commercial sectors, the need for ATS systems has surged. These switches are essential for ensuring an uninterrupted power supply by automatically switching to backup generators or other power sources when the main supply fails. This growing reliance on continuous power highlights the opportunity for ATS manufacturers to meet the rising demand and expand their market presence.

Expanding Infrastructure Development

Infrastructure development is another key driver for the ATS market. As new infrastructure projects, such as data centers, hospitals, and industrial facilities, are constructed, there is a heightened need for reliable power backup solutions. These facilities require robust ATS systems to maintain operations during power interruptions. The expansion of infrastructure, particularly in emerging economies, presents a significant opportunity for market growth. By targeting new construction projects and offering tailored solutions, ATS providers can capture a larger share of this expanding market.

Technological Advancements

Technological advancements in ATS systems present another promising opportunity. Modern ATS units are becoming more sophisticated, offering features such as remote monitoring, advanced diagnostics, and enhanced energy efficiency. These innovations not only improve the performance of ATS systems but also make them more appealing to customers seeking cutting-edge solutions. By investing in research and development to stay ahead of technological trends, ATS manufacturers can differentiate their products and attract a broader customer base.

Increasing Awareness of Power Reliability

Increasing awareness about the importance of power reliability is driving demand for ATS systems. As individuals and businesses recognize the critical role of uninterrupted power supply in maintaining operations and protecting sensitive equipment, they are more likely to invest in reliable backup solutions. Educational campaigns and awareness programs about the benefits of ATS systems can further boost market growth. By highlighting the value of ATS in preventing downtime and ensuring smooth operations, manufacturers can enhance market adoption.

Growth in Residential and Commercial Sectors

The growth in both residential and commercial sectors provides additional opportunities for the ATS market. In residential settings, the increasing prevalence of home-based businesses and reliance on electronic devices is driving the need for reliable power backup solutions. Similarly, commercial establishments, including retail stores and office buildings, require ATS systems to safeguard their operations from power disruptions. By catering to these diverse sectors, ATS providers can tap into new market segments and expand their reach.

Emerging Markets and Regional Expansion

Emerging markets represent a significant opportunity for ATS manufacturers. Countries with rapidly developing economies and improving infrastructure are experiencing increased demand for reliable power solutions. Expanding into these emerging markets allows ATS companies to tap into new growth areas and benefit from rising investments in infrastructure and industrialization. By focusing on regional expansion and customizing offerings to meet local needs, manufacturers can capture new market opportunities and drive overall growth.

Trends for the Automatic Transfer Switch Market

Increased Adoption of Smart Technology

One of the most significant trends in the automatic transfer switch (ATS) market is the increased adoption of smart technology. Modern ATS systems are integrating advanced features such as remote monitoring, automation, and predictive maintenance. Smart ATS devices allow users to monitor the status of their power systems from anywhere using mobile apps or web interfaces. This capability enhances the efficiency of managing the power supply and enables proactive maintenance, reducing downtime and extending the lifespan of the equipment. As technology advances, the demand for these smart solutions is expected to rise, driving innovation and growth in the ATS market.

Focus on Energy Efficiency

Energy efficiency is becoming a crucial focus in the ATS market. With growing awareness of environmental sustainability and the need to reduce energy consumption, ATS manufacturers are developing products that offer better energy management. Newer ATS models are designed to minimize energy waste and optimize power usage. This trend aligns with global efforts to promote green technologies and reduce carbon footprints. By incorporating energy-efficient features, ATS systems help users save on energy costs and contribute to broader environmental goals, making them more attractive to eco-conscious consumers.

Growing Demand in Emerging Markets

Emerging markets are witnessing a surge in demand for automatic transfer switches. As developing economies invest in infrastructure and industrialization, the need for reliable power backup solutions is increasing. Countries with expanding urban areas and new commercial developments are driving this demand. ATS manufacturers are focusing on these regions to capitalize on growth opportunities. By tailoring products to meet the specific needs of emerging markets and providing cost-effective solutions, companies can tap into a significant customer base and expand their global reach.

Integration with Renewable Energy Sources

The integration of automatic transfer switches with renewable energy sources is another prominent trend. As the use of renewable energy, such as solar and wind power, grows, there is a need for ATS systems that can seamlessly switch between renewable and traditional power sources. Modern ATS solutions are being designed to accommodate these diverse energy inputs, ensuring a stable and reliable power supply regardless of the source. This trend reflects the broader shift towards sustainable energy solutions and highlights the role of ATS in supporting the transition to cleaner power generation.

Enhanced Focus on Safety and Compliance

Safety and regulatory compliance are increasingly important in the ATS market. As industries face stricter safety standards and regulations, ATS manufacturers are prioritizing features that enhance safety and ensure compliance with industry standards. This includes improved fault detection, emergency shutoff capabilities, and compliance with international safety codes. The focus on safety not only protects equipment and personnel but also helps companies avoid potential legal and financial repercussions. As regulatory requirements continue to evolve, ATS providers must adapt their products to meet these demands.

Customization and Flexibility

Customization and flexibility are becoming key trends in the ATS market. Businesses and consumers are seeking solutions that can be tailored to their specific power needs and operational requirements. Manufacturers are responding by offering more customizable ATS options, allowing users to select features and configurations that best suit their applications. This trend towards flexibility helps address diverse customer needs and preferences, enhancing the appeal of ATS systems across various sectors.

Segments Covered in the Report

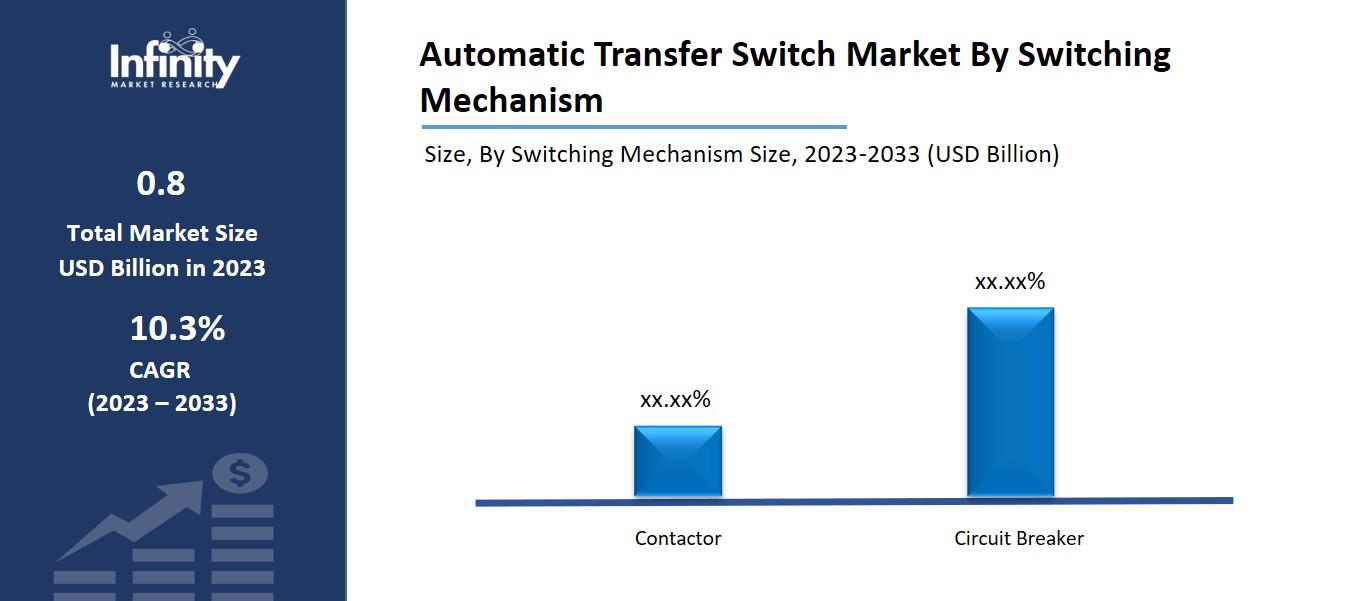

By Switching Mechanism

o Contactor

o Circuit Breaker

By Transition

o Closed

o Open

By Installation

o Emergency Systems

o Legally Required Systems

o Critical Operations Power Systems

o Optional Standby Systems

Segment Analysis

By Switching Mechanism Analysis

With the bulk of global market revenue, the contactor sector became the prominent player in the automatic transfer switch market in 2023. Because contractors can withstand high electrical currents and voltages, they can be used for power transfer in a variety of contexts, including both industrial and domestic ones. They are capable of dependable power load switching across a wide range of sizes, including large loads found in commercial and industrial settings. These devices are made to endure severe operating environments and high electrical currents. They are made with strong materials and long-lasting parts to guarantee performance and dependability over time. This qualifies them for harsh settings where reliable and constant power switching is required.

Furthermore, when considering other options such as solid-state devices or mechanical switches, contactors are comparatively simpler to install and maintain. They may be integrated into current electrical systems with little to no change thanks to their simple wiring configuration. Furthermore, contractors are widely available on the market, making upgrades or replacements easily accessible. This drives the market for contractors in the automatic transfer switch industry.

By Transition Analysis

Because of its cost-effectiveness and capacity to stop in-rush current, open transition ATS units accounted for 54.8% of the market share for automatic transfer switches in 2023. These switches offer operational flexibility to satisfy unique needs because they are available in delayed transition and in-phase varieties. One of the main factors expected to propel the use of open transition transfer switches is the need for reasonably priced electrical equipment for use in small-scale industrial and residential settings.

By Installation Analysis

As important activities require a constant supply of power, the market for automatic transfer switches from the critical operations power systems category is predicted to grow at a compound annual growth rate (CAGR) of 5.9% through 2033. These units include government installations, data centers, healthcare institutions, and emergency response centers, among other establishments where even a brief power outage can have serious repercussions. For this reason, dependable transfer switch technology is vital.

The implementation of automatic transfer switches is encouraged in these types of facilities because they allow for quick restoration of power during crucial operations. The transfer switch unit immediately switches to a backup power source, like a generator, as soon as it senses a power outage and recognizes the lack of utility power. In time-sensitive operations like emergency response centers or healthcare facilities, this quick transition guarantees that there is as little disturbance to key operations as possible and shortens the time needed to restore electricity.

Regional Analysis

With 45.5% of the market, North America dominated. Throughout the projected period, the North American region is expected to develop significantly at a CAGR of 5.3%. The US held a larger share of the North American transfer switch market than any other country, accounting for almost 69.8%, as the demand to replace the current grid infrastructure grew.

Smart control-switching technology and the growing use of bespoke products will benefit the corporate environment. In 2022, the Department of Energy relaunched the Building America program to guarantee the integration of a sustainable electrical network nationwide. The market environment will now profit from continuous regulatory modifications in addition to the growing adoption of emerging switching technologies.

The second-largest market share is held by the Automatic Transfer Switch Market in Europe. The region's growing investments in data centers and smart cities offer automatic transfer switch vendors enormous prospects. In addition, the UK Automatic Transfer Switch Market was the one in Europe that was expanding at the fastest rate, while the German Automatic Transfer Switch Market had the most market share.

Owing to its rapid industrialization, the Asia-Pacific Automatic Transfer Switch Market is anticipated to develop at the quickest CAGR between 2023 and 2033. Furthermore, the Automatic Transfer Switch Market in China commanded the most market share, while the Automatic Transfer Switch Market in India grew at the fastest rate in the Asia-Pacific area.

Competitive Analysis

Prominent firms in the automatic transfer switch sector are prioritizing large-scale production and allocating substantial resources towards research and development. The development of cutting-edge control and protection technologies is their goal. Additionally, to meet the growing need for flexible product integration, these businesses are expanding their manufacturing facilities and prioritizing the manufacture of high-end bespoke items. These strategic efforts are essential in determining how the industry's competitive dynamics are shaped.

Recent Developments

March 2023: Cummins Inc. introduced the PowerCommand® B-Series transfer switches to the North American market, expanding its product line. These transfer switches have bypass-isolation capabilities and range in amp capacity from 1200 to 3000. This most recent product release is consistent with Cummins' dedication to providing innovative, trustworthy, and comprehensive power solutions.

August 2022: General Electric and EY partnered to help businesses use data-driven manufacturing to increase productivity.

Key Market Players in the Automatic Transfer Switch Market

o ABB Ltd.

o Kohler

o Vertiv Group Corp.

o General Electric

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 0.8 Billion |

|

Market Size 2033 |

USD 2.1 Billion |

|

Compound Annual Growth Rate (CAGR) |

10.3% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Switching Mechanism, Transition, Installation, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Siemens AG, Caterpillar, Cummins Inc., ABB Ltd., Schneider Electric, Generac Power Systems, Kohler, Vertiv Group Corp., General Electric, Eaton Corporation plc, Other Key Players |

|

Key Market Opportunities |

Expanding Infrastructure Development |

|

Key Market Dynamics |

Growing Demand for Uninterrupted Power Supply |

📘 Frequently Asked Questions

1. What would be the forecast period in the Automatic Transfer Switch Market?

Answer: The forecast period in the Automatic Transfer Switch Market report is 2024-2033.

2. How much is the Automatic Transfer Switch Market in 2023?

Answer: The Automatic Transfer Switch Market size was valued at USD 0.8 Billion in 2023.

3. Who are the key players in the Automatic Transfer Switch Market?

Answer: Siemens AG, Caterpillar, Cummins Inc., ABB Ltd., Schneider Electric, Generac Power Systems, Kohler, Vertiv Group Corp., General Electric, Eaton Corporation plc, Other Key Players

4. What is the growth rate of the Automatic Transfer Switch Market?

Answer: Automatic Transfer Switch Market is growing at a CAGR of 10.3% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.