🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Automotive Carbon Fiber Composites Market

Automotive Carbon Fiber Composites Market Global Industry Analysis and Forecast (2024-2032) By Raw Material( Polyacrylonitrile (PAN)-based Carbon Fiber, Pitch-based Carbon Fiber),By Manufacturing Process( Resin Transfer Molding (RTM), Compression Molding, Injection Molding, Hand Lay-up, Others),By Application(Exterior Components, Interior Components, Structural & Chassis Components, Powertrain Components, Others),By Vehicle Type( Passenger Vehicles, Commercial Vehicles, Electric Vehicles),By End-Use( OEMs, Aftermarket) and Region

Feb 2025

Automotive Technology

Pages: 138

ID: IMR1820

Automotive Carbon Fiber Composites Market Synopsis

Automotive Carbon Fiber Composites Market Size Was Valued at USD 30.16 Billion in 2023, and is Projected to Reach USD 78.41 Billion by 2032, Growing at a CAGR of 11.20% From 2024-2032.

The market for carbon fiber composites used in automobiles is known as the automotive carbon fiber composites industry. These composites, made mostly of carbon fibers generated from pitch and polyacrylonitrile (PAN), have a high strength-to-weight ratio, make vehicles more fuel efficient, and perform better overall. The market is being propelled by factors such as stricter pollution laws, innovations in composite production, and the rising desire for lightweight automobiles. A wide range of vehicle types, from electric vehicles to high-performance sports cars, rely on carbon fiber composites for structural, chassis, powertrain, and interior/exterior components.

Over the last decade, stricter emission rules and a greater focus on vehicle lightweighting have propelled the automotive carbon fiber composites market to new heights. Because of their exceptional strength, resistance to fatigue and corrosion, and lightweight nature, carbon fiber composites find extensive use in automotive applications. To meet increasingly strict carbon emission standards imposed by governments across the world, automobile manufacturers are turning to cutting-edge materials like carbon fiber composites to boost performance and fuel economy. The need for lightweight materials to increase efficiency and battery range is being driven by the increasing popularity of electric cars (EVs). While carbon fiber composites were first popular among producers of high-performance and luxury vehicles, their use is now making its way into mass-produced automobiles as a result of falling prices and better production methods.

New manufacturing technologies, such automated fiber placement and resin transfer molding (RTM), are constantly improving production efficiency and cost-effectiveness, which is a hallmark of the market. Furthermore, new carbon fiber-reinforced thermoplastics (CFRTPs) with enhanced recycling and sustainability have been developed via collaborations between automobile original equipment manufacturers (OEMs) and material suppliers. However, there are still obstacles that prevent broad use, including as expensive production prices, complicated manufacturing methods, and a lack of recycling possibilities. The market is experiencing significant expansion in the Asia-Pacific, North American, and European regions. Major companies in the industry are substantially spending in research and development to improve product performance and reduce costs. The market for automotive carbon fiber composites is expected to have consistent growth in the next years, because to the increasing demand for lightweight, high-performance automobiles.

Automotive Carbon Fiber Composites Market Outlook, 2023 and 2032: Future Outlook

Automotive Carbon Fiber Composites Market Trend Analysis

Trend: Increasing Adoption of Carbon Fiber in Electric Vehicles

The use of carbon fiber composites in automobiles has been greatly affected by the trend toward electric vehicles (EVs). Manufacturers of electric vehicles are facing increasing pressure to improve energy efficiency, decrease vehicle weight, and increase driving range. Because of its low density and high specific heat, carbon fiber composites are perfect for electric vehicles because they lighten the vehicles and enhance the efficiency of their batteries. Carbon fiber components have been more widely used by top electric vehicle manufacturers including Lucid Motors, Tesla, and BMW to improve the vehicles' aerodynamics and structural strength.

Also, carbon fiber production methods have improved, so it's now more practical for EV makers to use these materials more extensively. Hybrid carbon fiber composites, made by combining conventional carbon fiber with thermoplastic resins, provide for more efficient and quicker production cycles while reducing costs. A key component of sustainable transportation in the future will be carbon fiber composites, as the demand for lightweight materials is expected to rise due to the ongoing evolution of battery technology.

Opportunity: Rising Demand for Sustainable and Recyclable Carbon Fiber Composites

An excellent opportunity exists in the research and development of carbon fiber composites that are both recyclable and environmentally friendly, as there is an increasing focus on sustainability issues. A major complaint leveled against traditional carbon fiber composites is the difficulty they pose in terms of waste management due to their low recyclability. New recycling methods, such pyrolysis and solvolysis, have made it possible to create carbon fiber solutions that are more environmentally friendly and may be used again in cars.

Research and development efforts to develop carbon fiber-reinforced thermoplastics (CFRTPs) with improved recyclability and reduced production costs are receiving substantial funding from the automotive industry and material suppliers. Reusing and recycling carbon fiber components at the end of their useful life is another example of how the automotive industry is embracing the circular economy. Sustainable composite solution providers stand to gain significantly from this trend, which is in line with automobile manufacturers' sustainability objectives and government regulations aimed at lowering carbon emissions.

Driver: Stringent Emission Regulations and Fuel Efficiency Standards

To address climate change, governments around the world are enacting strict emission rules, which is prompting the automotive industry to seek for lightweight materials such as carbon fiber composites. The corporate average fuel economy (CAFE) rules in the United States, the carbon dioxide emissions objectives in the European Union, and the new energy vehicle (NEV) laws in China all encourage car companies to make lighter vehicles that use less gas. By decreasing the overall bulk of the vehicle, carbon fiber composites greatly contribute to these goals by improving fuel efficiency and decreasing emissions.

The use of carbon fiber composites in structural and body components is also on the rise as automakers try to satisfy regulatory standards without sacrificing performance. After seeing its widespread use in high-performance and luxury vehicles like Lamborghini, Ferrari, and McLaren, mainstream manufacturers are starting to use carbon fiber in electric and hybrid vehicles as a way to achieve pollution requirements without sacrificing durability or safety.

Restraints: High Cost of Production and Limited Mass-Scale Adoption

The high production cost is a big obstacle to the broad use of carbon fiber composites in the car industry. Carbon fiber's energy-intensive procedures and sophisticated material handling needs make it more expensive to manufacture compared to standard materials like aluminum or steel. Its high price tag makes it unattractive for mass-market and economy cars, limiting its application to luxury and performance automobiles.

fabrication time and costs are further increased due to the specific manufacturing procedures used in carbon fiber composite fabrication, such as resin infusion and autoclave curing. Costs are being progressively reduced thanks to technology developments, but widespread mass-scale adoption is still a barrier. Businesses are looking into recycled carbon fiber and inexpensive thermoplastic composites as potential solutions to this problem, as these materials could eventually help close the affordability gap.

Automotive Carbon Fiber Composites Market Segment Analysis

Automotive Carbon Fiber Composites Market Segmented on the basis of Raw Material, Manufacturing Process, Vehicle Type and End User.

By Raw Material

o Polyacrylonitrile (PAN)-based Carbon Fiber

o Pitch-based Carbon Fiber

By Application

o Exterior Components

o Interior Components

o Structural & Chassis Components

o Powertrain Components

o Others

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Raw Material, Polyacrylonitrile (PAN)-based Carbon Fiber segment is expected to dominate the market during the forecast period

The carbon fiber composites market for automobiles is mainly divided into two submarkets, one for carbon fiber based on polyacrylonitrile (PAN) and the other for carbon fiber based on pitch. Because of its low price, high tensile strength, and lightweight characteristics, PAN-based carbon fiber has cornered the market on carbon fiber. Optimal vehicle performance and fuel economy are achieved by the extensive utilization of structural and chassis components, body panels, and carbon fiber derived from PAN.

Carbon fiber derived from Pitch, on the other hand, is well-suited for niche uses like heat shielding and EMI protection due to its high electrical and thermal conductivity. The pitch-based carbon fiber has great potential in the automobile industry, but its high production cost prevents it from being widely used.

By Application, Exterior Components segment expected to held the largest share

A wide range of automotive components, from the outside to the inside, the structural and chassis parts, the powertrain parts, and more are made from carbon fiber composites. Due to the increased emphasis on lightweight materials by automakers for improved crash safety and fuel efficiency, structural and chassis components account for a substantial portion of the market. Carbon fiber is finding more and more uses in electric vehicle engine components as a means to enhance battery efficiency and range by decreasing the overall weight of the vehicle.

For both cosmetic and aerodynamic reasons, carbon fiber-reinforced hoods, fenders, and spoilers are becoming more popular on high-end and sports vehicles. More and more mainstream vehicles will likely use carbon fiber as production processes become more cost-effective due to technological advancements.

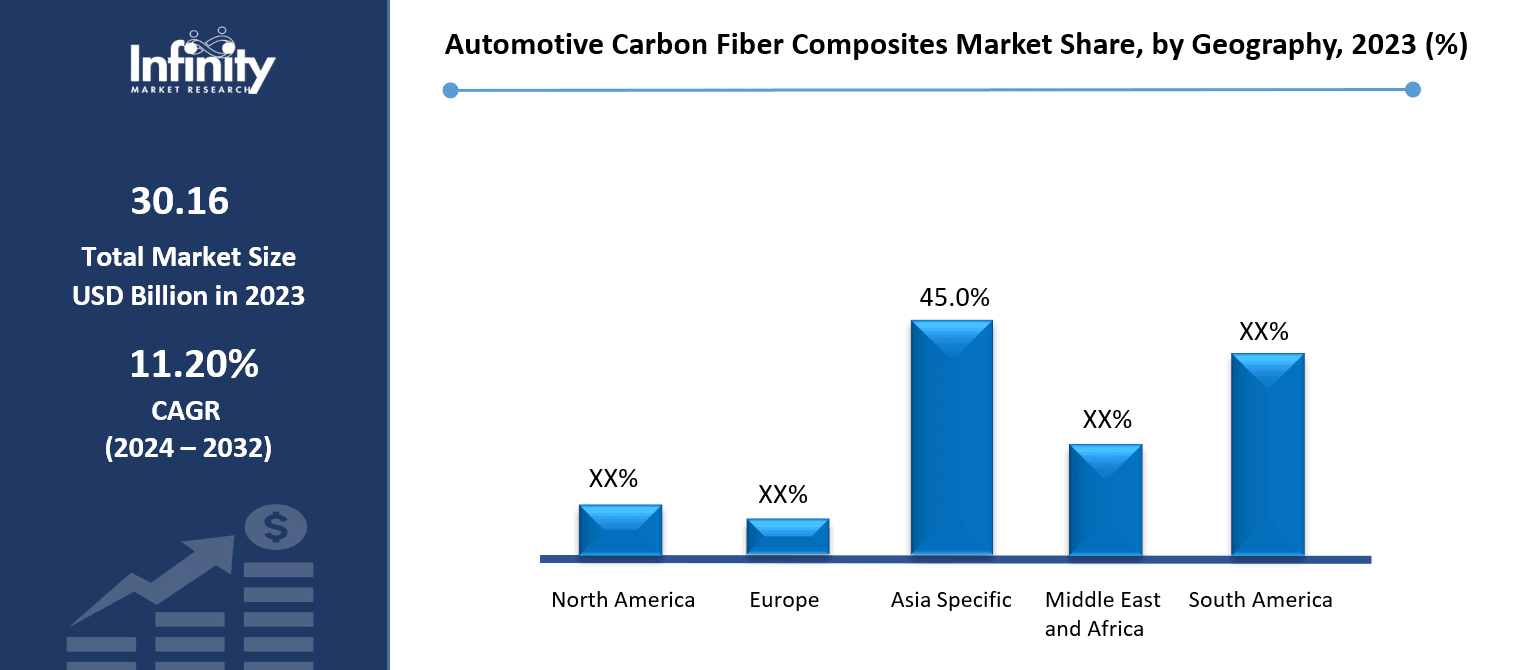

Automotive Carbon Fiber Composites Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

The presence of top-tier automotive manufacturers, innovations in technology, and government programs aimed at improving fuel efficiency have propelled North America—headed by the United States—to the forefront of the automotive carbon fiber composites industry. Major carbon fiber suppliers and automakers are based in the area, so they can afford to spend a lot of money on research and development to find better ways to make their products and find new uses for them in all kinds of vehicles.

The demand for carbon fiber composites is also on the rise due to the increasing number of electric and hybrid vehicles in North America. Manufacturers are focusing on lightweighting solutions to improve battery performance and vehicle efficiency.

Automotive Carbon Fiber Composites Market Share, by Geography, 2023 (%)

Active Key Players in the Automotive Carbon Fiber Composites Market

o Toray Industries (Japan)

o SGL Carbon (Germany)

o Mitsubishi Chemical Corporation (Japan)

o Hexcel Corporation (United States)

o Teijin Limited (Japan)

o Solvay (Belgium)

o Gurit (Switzerland)

o Plasan Carbon Composites (United States)

o Formosa Plastics Corporation (Taiwan)

o U.S. Global Investors (United States)

o DowAksa (Turkey)

o Owens Corning (United States)

o Other key Players

Key Industry Developments in the Automotive Carbon Fiber Composites Market

April 2024: Hyundai Motor Group partnered strategically with Toray Industries to advance material innovation for new-era mobility. The partnership aims to develop lightweight, high-strength materials for environmentally friendly, high-performance vehicles that include carbon fiber-reinforced polymer (CFRP) parts.

March 2024: The Mitsubishi Chemical Group (MCG Group) announced the development of a carbon fiber prepreg material, the BiOpreg #400 series, using plant-derived resin. The fiber is aimed at being used in mobility applications, such as interior and exterior materials for automobiles and industrial applications.

December 2023: Teijin Limited announced plans to start producing and selling Tenax carbon fiber made from environmentally friendly materials. This material helps reduce greenhouse gas emissions during the product's life cycle.

October 2023: Toray Industries Inc. developed TORAYCA T1200 carbon fiber, which boasts the highest strength of 1,160 kilopounds per square inch (Ksi). This advancement aids the company in reducing its environmental footprint by using lighter carbon-fiber-reinforced plastic materials.

Global Automotive Carbon Fiber Composites Market Scope

|

Global Automotive Carbon Fiber Composites Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 30.16 Billion |

|

Forecast Period 2024-32 CAGR: |

11.20% |

Market Size in 2032: |

USD 78.41 Billion |

|

Segments Covered: |

By Raw Material |

· Polyacrylonitrile (PAN)-based Carbon Fiber · Pitch-based Carbon Fiber | |

|

By Application |

· Exterior Components · Interior Components · Structural & Chassis Components · Powertrain Components · Others | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Stringent Emission Regulations and Fuel Efficiency Standards | ||

|

Key Market Restraints: |

· High Cost of Production and Limited Mass-Scale Adoption | ||

|

Key Opportunities: |

· Rising Demand for Sustainable and Recyclable Carbon Fiber Composites | ||

|

Companies Covered in the report: |

· Toray Industries (Japan), SGL Carbon (Germany), Mitsubishi Chemical Corporation (Japan), Hexcel Corporation (United States), Teijin Limited (Japan), Solvay (Belgium), Gurit (Switzerland), Plasan Carbon Composites (United States) and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Automotive Carbon Fiber Composites Market research report?

Answer: The forecast period in the Automotive Carbon Fiber Composites Market research report is 2024-2032.

2. Who are the key players in the Automotive Carbon Fiber Composites Market?

Answer: Toray Industries (Japan), SGL Carbon (Germany), Mitsubishi Chemical Corporation (Japan), Hexcel Corporation (United States), Teijin Limited (Japan), Solvay (Belgium), Gurit (Switzerland), Plasan Carbon Composites (United States) and Other Major Players.

3. What are the segments of the Automotive Carbon Fiber Composites Market?

Answer: The Automotive Carbon Fiber Composites Market is segmented into Raw Material, Manufacturing Process, Vehicle Type, End User and region. By Raw Material, the market is categorized into Polyacrylonitrile (PAN)-based Carbon Fiber, Pitch-based Carbon Fiber. By Manufacturing Process, the market is categorized into Resin Transfer Molding (RTM), Compression Molding, Injection Molding, Hand Lay-up, Others. By Application, the market is categorized into Exterior Components, Interior Components, Structural & Chassis Components, Powertrain Components, Others. By Vehicle Type, the market is categorized into Passenger Vehicles, Commercial Vehicles, Electric Vehicles. By End-Use, the market is categorized into OEMs, Aftermarket. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Automotive Carbon Fiber Composites Market?

Answer: The market for carbon fiber composites used in automobiles is known as the automotive carbon fiber composites industry. These composites, made mostly of carbon fibers generated from pitch and polyacrylonitrile (PAN), have a high strength-to-weight ratio, make vehicles more fuel efficient, and perform better overall. The market is being propelled by factors such as stricter pollution laws, innovations in composite production, and the rising desire for lightweight automobiles. A wide range of vehicle types, from electric vehicles to high-performance sports cars, rely on carbon fiber composites for structural, chassis, powertrain, and interior/exterior components.

5. How big is the Automotive Carbon Fiber Composites Market?

Answer: Automotive Carbon Fiber Composites Market Size Was Valued at USD 30.16 Billion in 2023, and is Projected to Reach USD 78.41 Billion by 2032, Growing at a CAGR of 11.20% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.