🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Automotive e-Call Market

Global Automotive e-Call Market (By Vehicle Type, Passenger Cars and Commercial Vehicles; By Trigger Type, Automatically Initiated eCall (AIeC) and Manually Initiated eCall (MIeC); By Propulsion Type, IC Engine and Electric, By Region and Companies), 2024-2033

Oct 2024

Automobiles

Pages: 138

ID: IMR1273

Automotive e-Call Market Overview

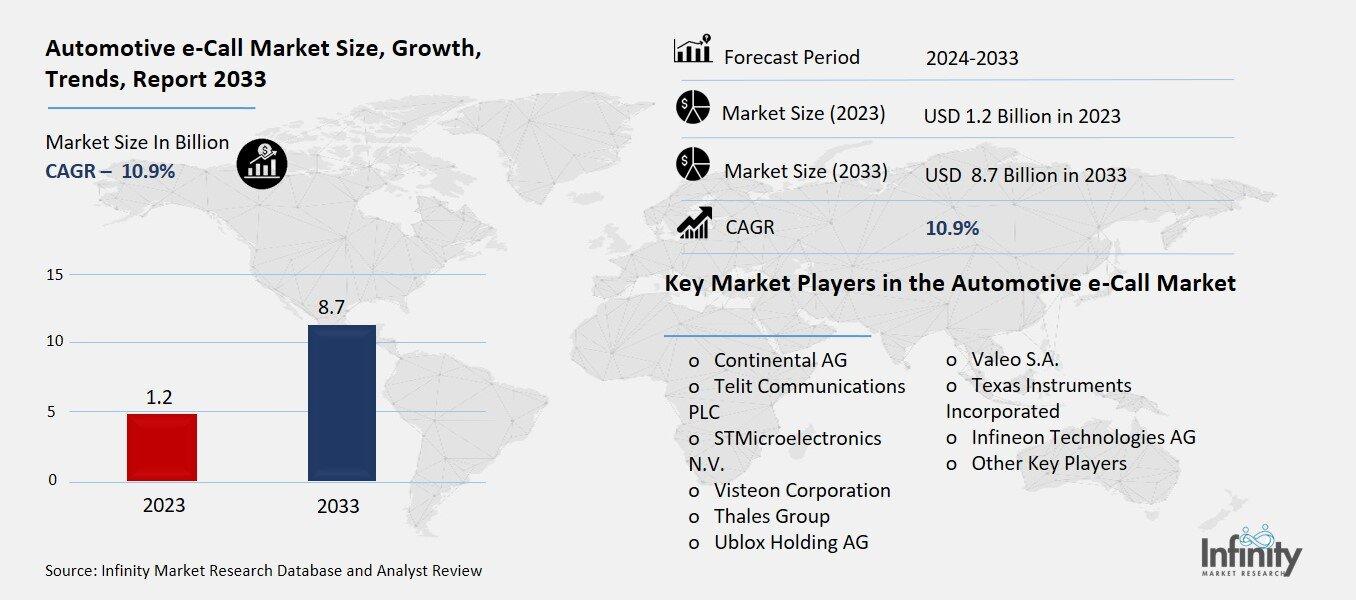

Global Automotive e-Call Market acquired the significant revenue of 1.2 Billion in 2023 and expected to be worth around USD 8.7 Billion by 2033 with the CAGR of 10.9% during the forecast period of 2024 to 2033. Automotive eCall market can be defined as the integrated services that send a direct call to the emergency centres in the cases of a severe road accident, making drivers and passengers safer and lowering the response time of the emergency services. Many of the countries inside the European Union have adopted the systems obligatory as they can be activated either mechanically by a passenger or automatically in case of activating built-in sensors perceiving a critical car crash.

These systems are emerging as a result of enhanced and existing safety regulatory systems in cars, innovations in telematics, and sustained consumer demand for technology in automobiles. The stakeholders are the automotive manufacturers, the technology firms and the telematics service providers. Moreover, e-Call systems have been incorporated into a larger IoT family that also offers more uses for the car aside from the e-Call over REC in case of an accident.

Drivers for the Automotive e-Call Market

Increased Vehicle Safety Awareness

An increase in consumer knowledge on car safety aspects contribute to the use of automotive e-Call systems. The awareness of drivers and passengers on the usage of advanced safety technologies has led to the increase of demand for such features in vehicles. More particularly e-Call systems that can trigger emergency services in case of a serious road traffic accident with real-time data such as location and crash severity. This quick response minimizes first-responder response-time – which can be a matter of life and death or minimize extremity of the injuries sustained by the survivors. Indeed, consumer awareness initiatives, government actions, and insurance promotion have also enhanced the general population understanding and belief in the functionality of the e-Call systems.

Restraints for the Automotive e-Call Market

Limited Awareness in Emerging Markets

The adoption rate of automotive e-Call systems in developing countries remains relatively low due to several key challenges. One of the primary barriers is limited consumer awareness. In many of these regions, drivers and vehicle owners may not be fully informed about the benefits of e-Call systems, such as their ability to automatically alert emergency services in the event of a crash. Without widespread knowledge of these safety features, there is less consumer demand, slowing down market growth.

Another significant factor is the lack of regulatory enforcement. Unlike in regions like the European Union, where e-Call systems are mandatory in all new cars, many developing countries have not yet established or enforced similar regulations. Without strong legal requirements, automotive manufacturers and consumers are less likely to prioritize the installation of these systems, further limiting adoption.

Opportunity in the Automotive e-Call Market

Integration with Connected Car Ecosystem

The integration of e-Call systems with advanced vehicle telematics opens up a wide array of additional services beyond emergency response. Modern telematics technology allows e-Call systems to interface with other vehicle systems, creating opportunities for features such as vehicle diagnostics, which monitor the health of the vehicle in real-time. This means that drivers can receive alerts about potential maintenance issues before they become serious problems, improving vehicle longevity and safety.

Additionally, the integration enables real-time tracking capabilities. Fleet managers, for example, can use e-Call systems to track the location and status of their vehicles, optimizing route management and ensuring quick response in the event of an accident. This capability is not only beneficial for fleet management but also for personal vehicles, providing enhanced security in case of theft.

Trends for the Automotive e-Call Market

Increased Adoption of Electric and Autonomous Vehicles

The rapid growth of electric vehicles (EVs) and autonomous driving technologies is significantly influencing the automotive industry's approach to safety, driving the integration of advanced systems like e-Call. As the adoption of EVs continues to rise, manufacturers are under increasing pressure to meet stringent safety standards, ensuring that these vehicles are equipped with cutting-edge technologies to protect passengers. e-Call systems are a critical part of this safety framework, as they can automatically notify emergency services in the event of a crash, providing vital information such as vehicle location and crash severity.

Segments Covered in the Report

By Vehicle Type

o Passenger Cars

o Commercial Vehicles

By Trigger Type

o Automatically Initiated eCall (AIeC)

o Manually Initiated eCall (MIeC)

By Propulsion Type

o IC Engine

o Electric

Segment Analysis

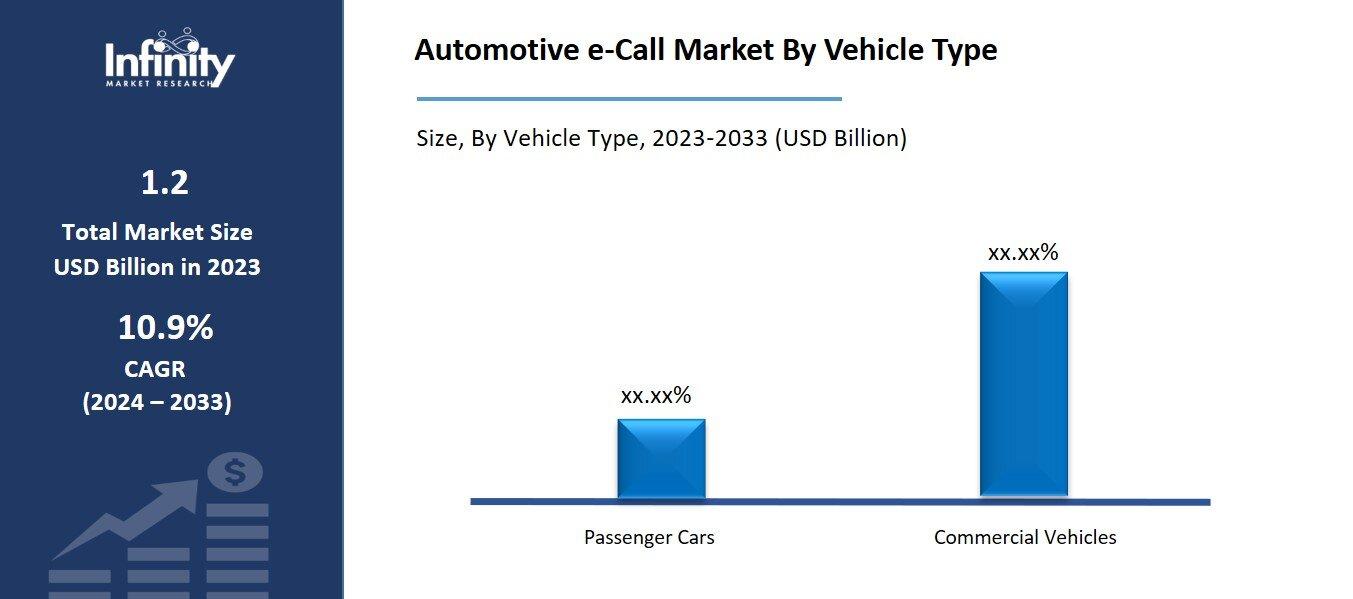

By Vehicle Type Analysis

On the basis of vehicle type, the market is divided into passenger cars and commercial vehicles. Among these, passenger cars segment acquired the significant share around 43.2% in the market. The rising demand for connected car technologies among individual consumers is contributing to the growth of the passenger car segment. Consumers are increasingly prioritizing vehicle safety features, including e-Call systems, when purchasing new vehicles. This is driven by greater awareness of the benefits of rapid emergency response in reducing fatalities and injuries during accidents.

By Trigger Type Analysis

On the basis of trigger type, the market is divided into automatically initiated eCall (AIeC) and manually initiated eCall (MIeC). Among these, automatically initiated eCall (AIeC) segment held the prominent share of the market. The rising preference for automated safety systems is also driving the growth of AIeC. As regulatory bodies and vehicle safety standards emphasize the importance of proactive safety measures, AIeC systems have become increasingly favored due to their reliability in critical situations. Additionally, AIeC technology is often integrated with advanced vehicle sensors and telematics, which further enhances its precision in detecting accidents and transmitting accurate data regarding the crash location, severity, and vehicle details.

By Propulsion Type Analysis

On the basis of propulsion type, the market is divided into IC engine and electric. Among these, IC engine segment held the prominent share of the market. The majority of vehicles currently in operation globally are powered by internal combustion engines. As a result, the demand for e-Call systems in this segment is inherently higher, driven by the need to enhance safety features in these widely used vehicles. The established presence of IC engine vehicles provides a substantial customer base for e-Call installations.

Additionally, market penetration of e-Call systems is often higher among IC engine vehicles due to their longer presence in the automotive market, where manufacturers have had more time to integrate advanced safety technologies.

Regional Analysis

Europe Dominated the Market with the Highest Revenue Share

Europe held the most of the share of 30.1% the market. The region boasts a mature automotive industry with a high concentration of major automotive manufacturers who are investing in advanced safety technologies, including e-Call systems. The presence of established players, alongside a competitive landscape, fosters innovation and drives the development of sophisticated telematics solutions that integrate seamlessly with e-Call functionalities.

Consumer awareness and demand for safety features are particularly high in Europe, where buyers prioritize vehicles equipped with advanced safety systems. This cultural inclination towards safety contributes to the higher penetration of e-Call systems in new vehicle purchases.

Competitive Analysis

The competitive landscape of the automotive e-Call market is characterized by a diverse array of players, including automotive manufacturers, technology providers, and telematics companies. Key automotive manufacturers, such as Volkswagen, BMW, and Ford, are actively integrating e-Call systems into their vehicles to meet regulatory requirements and enhance safety features. These manufacturers often collaborate with technology firms specializing in telematics and connectivity solutions, creating partnerships that facilitate the development of advanced e-Call systems.

Recent Developments

In December 2023, Applus and Rohde & Schwarz combined their eCall testing services within electromagnetic compatibility (EMC) environments. They have incorporated eCall analysis features into an EMC test chamber across various configurations.

In August 2023, IH Mobile Limited (FIH), a subsidiary of Hon Hai Technology Group, announced that it is the first automotive supplier in Taiwan to achieve eCall certification. The company successfully passed the testing conducted by TÜV Rheinland, earning the certification for its Emergency Call (eCall) systems.

Key Market Players in the Automotive e-Call Market

o Robert Bosch GmbH

o Continental AG

o Telit Communications PLC

o STMicroelectronics N.V.

o Visteon Corporation

o Thales Group

o U-blox Holding AG

o Valeo S.A.

o Texas Instruments Incorporated

o Infineon Technologies AG

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 1.2 Billion |

|

Market Size 2033 |

USD 8.7 Billion |

|

Compound Annual Growth Rate (CAGR) |

10.9% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Vehicle Type, Trigger Type, Propulsion Type, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Robert Bosch GmbH, Continental AG, Telit Communications PLC, STMicroelectronics N.V., Visteon Corporation, Thales Group, U-blox Holding AG, Valeo S.A., Texas Instruments Incorporated, Infineon Technologies AG, and Other Key Players. |

|

Key Market Opportunities |

Integration with Connected Car Ecosystem |

|

Key Market Dynamics |

Increased Vehicle Safety Awareness |

📘 Frequently Asked Questions

1. Who are the key players in the Automotive e-Call Market?

Answer: Robert Bosch GmbH, Continental AG, Telit Communications PLC, STMicroelectronics N.V., Visteon Corporation, Thales Group, U-blox Holding AG, Valeo S.A., Texas Instruments Incorporated, Infineon Technologies AG, and Other Key Players.

2. How much is the Automotive e-Call Market in 2023?

Answer: The Automotive e-Call Market size was valued at USD 1.2 Billion in 2023.

3. What would be the forecast period in the Automotive e-Call Market?

Answer: The forecast period in the Automotive e-Call Market report is 2024-2033.

4. What is the growth rate of the Automotive e-Call Market?

Answer: Automotive e-Call Market is growing at a CAGR of 10.9% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.