🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Automotive Fuel Injection Systems Market

Global Automotive Fuel Injection Systems Market (By Vehicle Type, HCV, LCV, SUV, Midsize, Luxury, and Compact; By Technology, Gasoline Direct Injection, Diesel Direct Injection, and Gasoline Port Injection; By Fuel Type, Diesel and Gasoline, By Region and Companies), 2024-2033

Jan 2025

Energy and Power

Pages: 138

ID: IMR1464

Automotive Fuel Injection Systems Market Overview

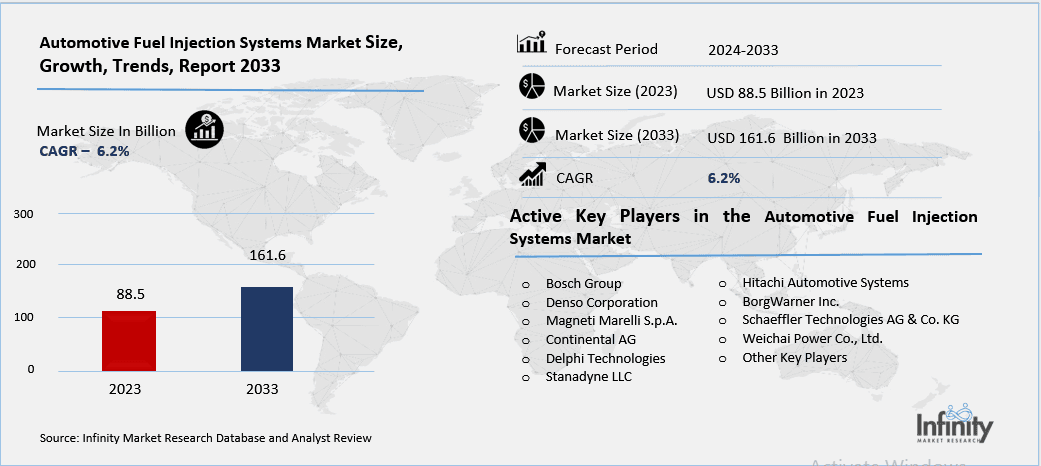

Global Automotive Fuel Injection Systems Market acquired the significant revenue of 88.5Billion in 2023 and expected to be worth around USD 161.6 Billion by 2033 with the CAGR of 6.2% during the forecast period of 2024 to 2033. Automotive fuel injection systems are considered as an indispensable part of automotive industry value chain due to strict legislative standards for fuel consumption and emissions and a continuous search for better performance. Fuel injections are essentially used to control the flow of fuel to the combustor; they distribute fuel in the right proportion in the combustion chamber to improve fuel efficiency and minimize emission of pollutants.

Market is driven by the rising need for high fuel efficient vehicles and growing global norm for emission standards. Technological enhancements in direct injection, the multi-port fuel injection system and hybrid systems are also the growth promoters in the market. Additionally, the current trends in electric vehicles and hybrids and increasing concern for fuel consumption per km and climate change are the forces that are driving the market.

Drivers for the Automotive Fuel Injection Systems Market

Growing Demand for Fuel Efficiency

The awareness of environmental issues and the cost of fuel that continues to rise means that more consumers and manufacturers of cars are paying attention to fuel-efficient cars. This shift is due to fuel conservation, cost cutting exercise and concerns for minimal or no emissions to the atmosphere. High efficiency cars are economical in the long run and also adapts to increasing government measures against emissions. In order to address these demands, contemporary car manufacturers are integrating sophisticated fuel injection systems that maximize fuel economy by providing the engine with exactly the right amount of fuel at any one time.

Some main advancements including the direct fuel injection (DFI) allow for a more accurate control of combustion making for better mileage and fewer emissions. Therefore, these advanced systems are used in the manufacturing of their vehicles because of market competition alongside the achievement and satisfaction of environmental requirements for economical and environmentally friendly vehicles for consumers.

Restraints for the Automotive Fuel Injection Systems Market

High Initial Cost of Advanced Fuel Injection Systems

The complexity and high cost of advanced fuel injection technologies present significant challenges, particularly in price-sensitive markets. Advanced systems, such as direct fuel injection and hybrid fuel injection technologies, require sophisticated components, specialized manufacturing processes, and precise calibration, which contribute to their higher production costs. These systems also demand more advanced engineering and technological expertise to design, install, and maintain, further increasing their overall expense. In regions where consumers prioritize affordability, such as developing economies, the high upfront cost of vehicles equipped with these advanced technologies may deter widespread adoption.

Opportunity in the Automotive Fuel Injection Systems Market

Electric and Hybrid Vehicle Integration

The development of hybrid vehicles, which combine electric power with traditional internal combustion engines (ICEs), presents a new and significant opportunity for fuel injection system manufacturers. Hybrid vehicles leverage both an electric motor and an ICE, requiring sophisticated fuel injection systems that can optimize performance across both power sources. Fuel injection systems in hybrids need to be highly efficient to ensure smooth transitions between electric and gasoline power, as well as to improve fuel economy and reduce emissions during engine operation. This dual functionality creates demand for advanced injection technologies that can work seamlessly within hybrid powertrains.

Manufacturers of fuel injection systems have the opportunity to innovate by designing more adaptable and efficient systems that cater to the specific needs of hybrid vehicles, such as optimizing fuel delivery for both the ICE and the hybrid battery's regenerative braking system.

Trends for the Automotive Fuel Injection Systems Market

Growing Focus on Eco-friendly Solutions

There is a growing global emphasis on sustainable automotive technologies as concerns about climate change, air quality, and resource conservation become more pressing. This shift is prompting governments, consumers, and manufacturers to prioritize the development and adoption of vehicles that are more environmentally friendly and energy-efficient. As a result, there is an increasing demand for advanced fuel injection systems that can significantly reduce harmful emissions and improve overall vehicle efficiency. These advanced systems, such as direct fuel injection (DFI) and variable valve timing (VVT), help optimize fuel combustion, minimize waste, and lower the amount of carbon dioxide (CO2) and other pollutants emitted from internal combustion engines. By ensuring precise fuel delivery and improving engine performance, these systems not only meet stringent environmental regulations but also contribute to reduced fuel consumption, making vehicles more energy-efficient.

Segments Covered in the Report

By Vehicle Type

o HCV

o LCV

o SUV

o Midsize

o Luxury

o Compact

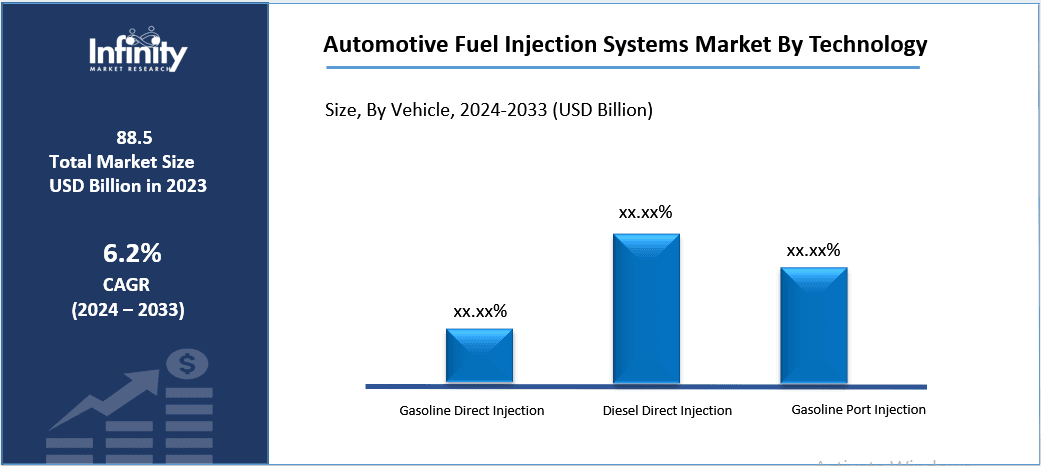

By Technology

o Gasoline Direct Injection

o Diesel Direct Injection

o Gasoline Port Injection

By Fuel Type

o Diesel

o Gasoline

Segment Analysis

By Vehicle Type Analysis

On the basis of vehicle type, the market is divided into HCV, LCV, SUV, midsize, luxury, and compact. Among these, SUV segment acquired the significant share in the market owing to the increasing consumer preference for larger, versatile vehicles that offer greater space, higher safety ratings, and enhanced performance. SUVs have become increasingly popular due to their ability to cater to a wide range of needs, from family transport to off-road adventures. This growing demand is fueled by consumer desires for vehicles that can handle a variety of terrains, provide more seating and cargo space, and offer a combination of power, comfort, and technology. Additionally, the rise of premium and luxury SUV models has further expanded the segment's appeal, attracting affluent buyers looking for advanced features and higher-end specifications.

By Technology Analysis

On the basis of technology, the market is divided into gasoline direct injection, diesel direct injection, and gasoline port injection. Among these, gasoline direct injection segment held the prominent share of the market due to its ability to significantly enhance fuel efficiency and reduce harmful emissions. GDI systems inject fuel directly into the combustion chamber at high pressure, allowing for precise control over fuel delivery and combustion. This results in better power output, improved fuel efficiency, and lower CO2 emissions compared to traditional gasoline port injection systems. With rising consumer demand for fuel-efficient vehicles and stringent environmental regulations requiring reduced emissions, GDI technology has gained widespread adoption in both passenger cars and light commercial vehicles.

By Fuel Type Analysis

On the basis of fuel type, the market is divided into diesel and gasoline. Among these, gasoline segment held the prominent share of the market. Gasoline engines are widely preferred by consumers due to their lower upfront costs, better fuel economy, and smoother driving experience compared to diesel engines. Additionally, gasoline vehicles are often seen as more environmentally friendly in terms of emissions, as they generally produce lower levels of nitrogen oxides (NOx) and particulate matter compared to diesel vehicles. The increasing demand for fuel-efficient and lower-emission vehicles, especially in regions like North America, Europe, and parts of Asia, has driven the popularity of gasoline-powered cars.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 32.5% of the market, driven by the strong presence of major automotive manufacturers, a well-established automotive infrastructure, and high consumer demand for advanced vehicle technologies. The region, particularly the United States, is home to some of the world’s largest automotive companies, including General Motors, Ford, and Tesla, which consistently innovate and adopt cutting-edge fuel injection technologies to meet stringent emission regulations and consumer preferences for fuel efficiency.

Additionally, the region’s mature automotive market is characterized by a growing demand for fuel-efficient, high-performance vehicles, including SUVs and light trucks, which further boost the adoption of advanced fuel injection systems like gasoline direct injection (GDI) and diesel direct injection (DI).

Competitive Analysis

The competitive analysis of the automotive fuel injection systems market reveals a highly dynamic landscape characterized by the presence of several key players, including global automotive component manufacturers, tier-one suppliers, and technology innovators. Leading companies such as Bosch, Delphi Technologies, Denso, and Continental dominate the market by offering a wide range of advanced fuel injection solutions, including gasoline direct injection (GDI), diesel direct injection (DI), and multi-port injection systems. These companies leverage their strong R&D capabilities, established brand reputation, and extensive distribution networks to maintain competitive advantages.

Recent Developments

In December 2023, Marelli introduced its inaugural hydrogen fuel system, featuring specially designed injectors with a patented design and an advanced Engine Control Unit (ECU).

Key Market Players in the Automotive Fuel Injection Systems Market

o Bosch Group

o Denso Corporation

o Magneti Marelli S.p.A.

o Continental AG

o Delphi Technologies

o Stanadyne LLC

o Hitachi Automotive Systems

o BorgWarner Inc.

o Schaeffler Technologies AG & Co. KG

o Weichai Power Co., Ltd.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 88.5 Billion |

|

Market Size 2033 |

USD 161.6 Billion |

|

Compound Annual Growth Rate (CAGR) |

6.2% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Vehicle Type, Technology, Fuel Type, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Bosch Group, Denso Corporation, Magneti Marelli S.p.A., Continental AG, Delphi Technologies, Stanadyne LLC, Hitachi Automotive Systems, BorgWarner Inc., Schaeffler Technologies AG & Co. KG, Weichai Power Co., Ltd., and Other Key Players. |

|

Key Market Opportunities |

Electric and Hybrid Vehicle Integration |

|

Key Market Dynamics |

Growing Demand for Fuel Efficiency |

📘 Frequently Asked Questions

1.

Answer:

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.