🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Automotive IoT Market

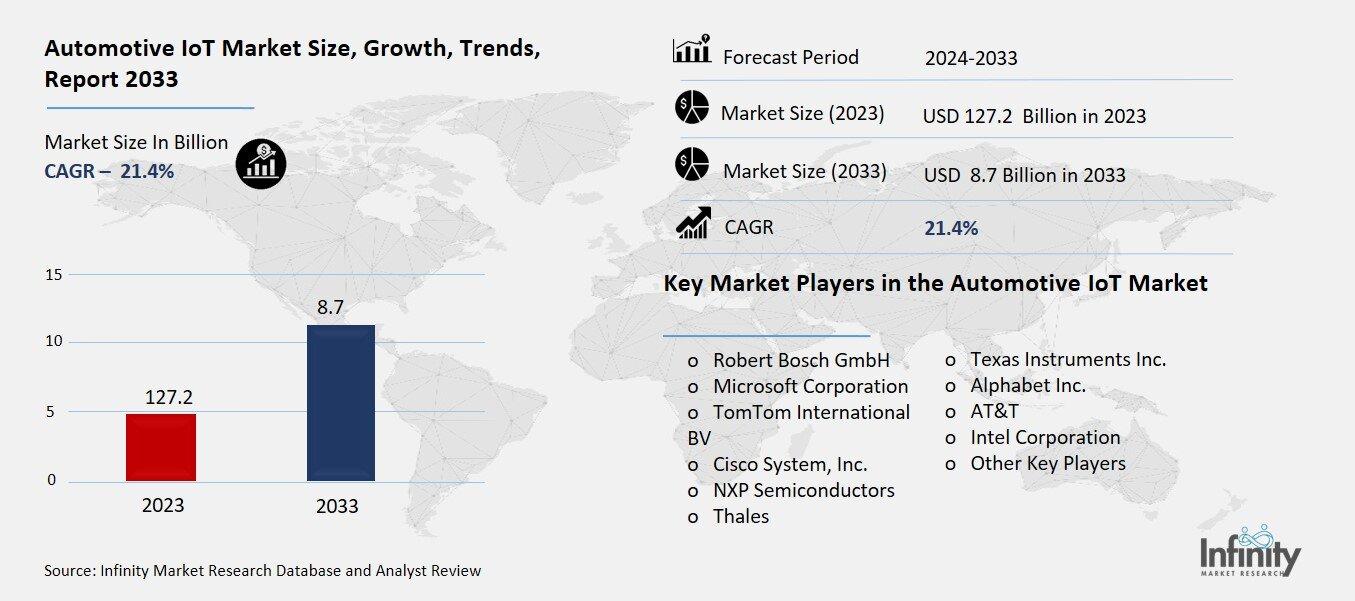

Global Automotive IoT Market (By Offering, Software, Hardware, and Services; By Connectivity Form, Embedded, Integrated, and Tethered; By Communication, Vehicle to Vehicle, Vehicle to Infrastructure, and In Vehicle Communication; By Application, Telematics, Navigation, and Infotainment; By Region and Companies), 2024-2033

Oct 2024

Automobiles

Pages: 138

ID: IMR1274

Automotive IoT Market Overview

Global Automotive IoT Market acquired the significant revenue of 127.2 Billion in 2023 and expected to be worth around USD 890.3 Billion by 2033 with the CAGR of 21.4% during the forecast period of 2024 to 2033. Automotive IoT market is expanding as vehicles with the capability of connecting to the internet and communicating with other devices and senses are becoming integrated in the automobile business. IoT can be used to control the communication between vehicles, the infrastructures, and other devices around resulting to more safety, efficiency, and convenience. The most important use cases include in-car networking, autonomous vehicles, vehicle-to-everything (V2X), and telecommunication services. This market is being fueled by growth in consumer desire for smart connected vehicles and the pursuit of autonomous automobiles. Moreover, other factors like the changes in government regulations to ensure automobile safety, increased adoption of electric cars, and the improvement in artificial intelligence and cloud computing underpin its growth.

Drivers for the Automotive IoT Market

Rising Consumer Demand for Connected Cars

The changing consumer demand for smart vehicles with new infotainment systems, safety, and connectivity features is becoming a leading force in the automotive IoT market. Higher standards mean higher expectations for consumer comfort and for that reason vehicles equipped with advanced, state of the art technologies such as voice recognition, high definition touch screen, and smartphone linkages are at the fore. The latest infotainment systems offer control over media streaming, maps, and enhanced applications further improving the comfort and fun. On the safety front; items such as ADAS, which include IoT sensors and cameras for identifying lanes and keeping them, automatic breaking systems and collision avoidance are now considered standard.

Connectivity through Vehicle-to-Everything (V2X) communication also ensures that vehicles are capable of interacting with infrastructure and other vehicles to enhance driving efficiency and safety. This trend is further fueled by consumers' growing interest in smart home integration, where connected vehicles become part of a broader IoT ecosystem. Automakers are responding by offering more IoT-enabled features, positioning smart vehicles not only as modes of transport but as hubs of entertainment, safety, and digital connectivity.

Restraints for the Automotive IoT Market

High Costs of IoT Integration

The cost of implementing advanced IoT systems and sensors in vehicles can be prohibitive, particularly for mid- and low-priced segments of the market. Integrating IoT technology involves installing a wide array of sophisticated components, such as sensors, communication modules, and data processing units, which come with high production and development costs. These systems require robust software platforms, real-time data analytics capabilities, and cloud services, all of which add to the expense. For premium vehicles, these costs are often absorbed due to their higher price points and target consumers' expectations for cutting-edge technology.

Opportunity in the Automotive IoT Market

Expansion in Electric Vehicles (EVs)

The growing adoption of electric vehicles (EVs) presents a significant opportunity for IoT technology, particularly in areas such as battery management, vehicle health monitoring, and smart charging solutions. As EVs become more mainstream, efficient battery performance and management are critical. IoT enables real-time monitoring of battery health, charge levels, and energy consumption, providing predictive analytics to extend battery life and improve overall vehicle performance. Through connected IoT systems, EVs can optimize charging cycles, prevent overcharging, and predict maintenance needs, reducing the likelihood of battery degradation and enhancing safety.

In addition, IoT solutions play a crucial role in vehicle health monitoring, where sensors continuously track the performance of key components, from the drivetrain to the tires. This data enables predictive maintenance, allowing issues to be addressed before they become major problems, thus reducing repair costs and downtime for EV owners.

Trends for the Automotive IoT Market

AI and Machine Learning Integration

The use of artificial intelligence (AI) in connected vehicles is rapidly increasing, particularly for predictive maintenance, real-time diagnostics, and intelligent decision-making. AI-powered systems enable vehicles to constantly monitor and analyze data from various sensors, allowing them to detect potential issues before they lead to costly failures or breakdowns. This predictive maintenance capability not only reduces maintenance costs but also minimizes vehicle downtime by identifying when and where repairs or part replacements are needed.

In terms of real-time diagnostics, AI enables vehicles to assess their own performance while driving, monitoring everything from engine health to tire pressure. AI algorithms can process vast amounts of data instantaneously, diagnosing problems as they arise and offering immediate solutions or alerts to the driver. This improves safety and ensures that minor issues are resolved before escalating into serious mechanical failures.

Segments Covered in the Report

By Offering

o Software

o Hardware

o Services

By Connectivity Form

o Embedded

o Integrated

o Tethered

By Communication

o Vehicle to Vehicle

o Vehicle to Infrastructure

o In Vehicle Communication

By Application

o Telematics

o Navigation

o Infotainment

Segment Analysis

By Offering Analysis

On the basis of offering, the market is divided into software, hardware, and services. Among these, software segment acquired the significant share around 42.1% in the market owing to the increasing demand for sophisticated software solutions that enable vehicle connectivity, data processing, and intelligent decision-making. Software plays a critical role in managing IoT functions such as vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, real-time data analytics, and advanced safety features like ADAS.

Additionally, the rise of connected vehicles and autonomous driving technologies has intensified the need for robust software systems to integrate and manage complex sensor networks, cloud platforms, and AI-based decision-making tools.

By Connectivity Form Analysis

On the basis of connectivity form, the market is divided into embedded, integrated, and tethered. Among these, commercial held the prominent share of the market. Embedded systems are favored for their reliability, performance, and ability to support various advanced features such as real-time data exchange, vehicle tracking, and over-the-air (OTA) updates. The growing demand for connected vehicle services and applications, such as navigation, safety features, and infotainment systems, drives the preference for embedded solutions, making them an essential component in modern vehicles. Additionally, as manufacturers increasingly focus on enhancing vehicle safety and consumer experience through integrated technology, embedded connectivity is expected to continue leading the market in the coming years.

By Communication Analysis

On the basis of communication, the market is divided into vehicle to vehicle, vehicle to infrastructure, and in-vehicle communication. Among these, in-vehicle communication held the significant share of the market due to the Embedded systems are favored for their reliability, performance, and ability to support various advanced features such as real-time data exchange, vehicle tracking, and over-the-air (OTA) updates. The growing demand for connected vehicle services and applications, such as navigation, safety features, and infotainment systems, drives the preference for embedded solutions, making them an essential component in modern vehicles. Additionally, as manufacturers increasingly focus on enhancing vehicle safety and consumer experience through integrated technology, embedded connectivity is expected to continue leading the market in the coming years.

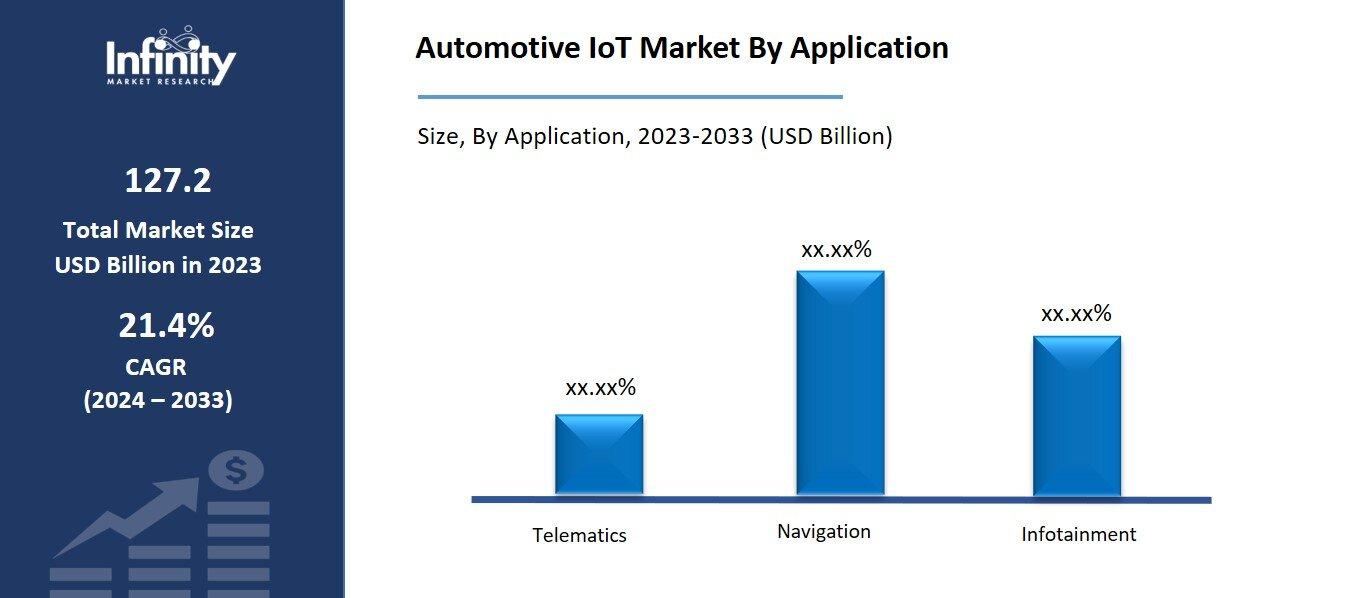

By Application Analysis

On the basis of application, the market is divided into telematics, navigation, and infotainment. Among these, navigation segment held the most of the share of the market. Modern navigation systems leverage IoT technology to provide real-time traffic updates, route optimization, and adaptive navigation based on current conditions, significantly improving travel efficiency.

The growing popularity of features such as real-time GPS tracking, location-based services, and integration with smart devices further drives the demand for sophisticated navigation solutions. Consumers increasingly expect accurate and user-friendly navigation applications that offer seamless connectivity and enhanced functionalities, such as voice commands and augmented reality overlays.

Regional Analysis

Asia-Pacific Dominated the Market with the Highest Revenue Share

Asia-Pacific held the most of the share of 32.1% of the market. The region is home to some of the largest automotive manufacturers and technology companies, such as Toyota, Hyundai, Honda, and BYD, which are leading the integration of IoT solutions in vehicles. The rapid urbanization and growing adoption of electric vehicles (EVs) in countries like China, Japan, South Korea, and India further fuel the demand for IoT-enabled technologies, including connected car solutions, smart mobility services, and autonomous driving systems.

Moreover, government initiatives in Asia-Pacific, such as subsidies for EVs, investments in 5G technology, and the development of smart cities, are also accelerating the adoption of automotive IoT solutions. Additionally, the increasing penetration of smartphones, advancements in telematics and infotainment, and the rising demand for improved safety features are contributing to the region's leadership in the market.

Competitive Analysis

The automotive IoT market is highly competitive, with a diverse landscape of global players vying for market share. Major companies in the space include Bosch, Cisco Systems, Intel, Qualcomm, Continental AG, and NXP Semiconductors, all of which are leading innovation in connected vehicle solutions. These key players focus on developing advanced IoT technologies such as vehicle-to-everything (V2X) communication, autonomous driving systems, telematics, and infotainment platforms. Partnerships between automotive manufacturers and technology providers are increasingly common, enabling companies to leverage each other’s expertise in software, hardware, and AI-powered solutions.

Recent Developments

In January 2023, VinFast and NXP Semiconductors announced a partnership to collaborate on VinFast's next generation of automotive applications. This collaboration aligns with VinFast's mission to develop smarter, cleaner, and connected electric vehicles, leveraging advanced technologies to enhance vehicle performance and connectivity.

In January 2023, HARMAN introduced HARMAN Ready on Demand, a groundbreaking software platform designed to deliver branded audio features, enhancements, upgrades, and monetization opportunities through an intuitive app.

Key Market Players in the Automotive IoT Market

o Robert Bosch GmbH

o Microsoft Corporation

o TomTom International BV

o Cisco System, Inc.

o NXP Semiconductors

o Thales

o Texas Instruments Inc.

o Alphabet Inc.

o AT&T

o Intel Corporation

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 127.2 Billion |

|

Market Size 2033 |

USD 890.3 Billion |

|

Compound Annual Growth Rate (CAGR) |

21.4% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Offering, Connectivity Form, Communication, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Robert Bosch GmbH, Microsoft Corporation, TomTom International BV, Cisco System, Inc., NXP Semiconductors, Thales, Texas Instruments Inc., Alphabet Inc., AT&T, Intel Corporation, and Other Key Players. |

|

Key Market Opportunities |

Expansion in Electric Vehicles (EVs) |

|

Key Market Dynamics |

Rising Consumer Demand for Connected Cars |

📘 Frequently Asked Questions

1. Who are the key players in the Automotive IoT Market?

Answer: Robert Bosch GmbH, Microsoft Corporation, TomTom International BV, Cisco System, Inc., NXP Semiconductors, Thales, Texas Instruments Inc., Alphabet Inc., AT&T, Intel Corporation, and Other Key Players.

2. How much is the Automotive IoT Market in 2023?

Answer: The Automotive IoT Market size was valued at USD 127.2 Billion in 2023.

3. What would be the forecast period in the Automotive IoT Market?

Answer: The forecast period in the Automotive IoT Market report is 2024-2033.

4. What is the growth rate of the Automotive IoT Market?

Answer: Automotive IoT Market is growing at a CAGR of 21.4% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.