🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Automotive Natural Gas Vehicle (NGV) Market

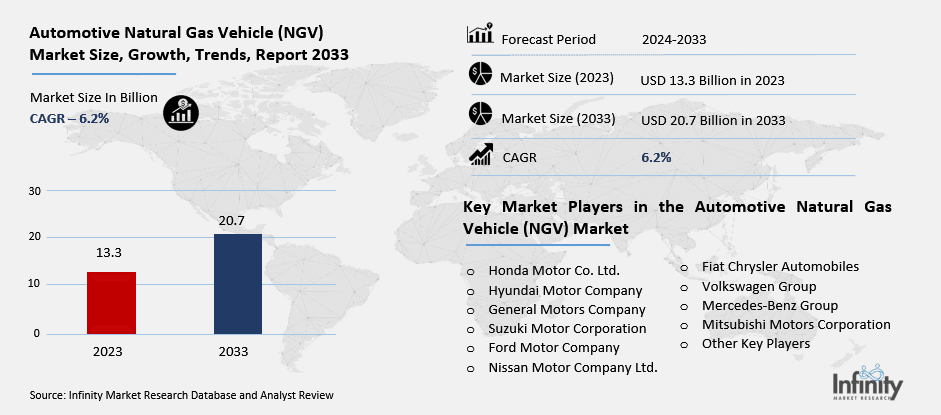

Global Automotive Natural Gas Vehicle (NGV) Market (By Fuel Type, Compressed Natural Gas (CNG) and Liquefied Petroleum Gas (LPG); By Vehicle Type, Passenger Cars and Commercial Vehicles; By Region and Companies), 2024-2033

Jan 2025

Automotive Technology

Pages: 138

ID: IMR1479

Automotive Natural Gas Vehicle (NGV) Market Overview

Global Automotive Natural Gas Vehicle (NGV) Market acquired the significant revenue of 13.3 Billion in 2023 and expected to be worth around USD 20.7 Billion by 2033 with the CAGR of 6.2% during the forecast period of 2024 to 2033. The global market for Automotive Natural Gas Vehicles (NGVs) has been steadily progressing with the rising calls for environmental friendly, cost effective, and efficient means of transportation. NGVs run on compressed natural gas (CNG) or liquefied natural gas (LNG) and have a set of advantages compared with their gasoline or diesel counterparts, including a lowered emission of CO2, NOx, and particulate matter. This market is as a result of increasing environmental awareness, enhanced emission standards, and the soaring cost convention sources of energy. The governments of different regions have been putting in extreme efforts supporting the use of NGVs through offering tax credits, subsidies and support the establishment of CNG fueling stations. The market is also backed by increase in natural gas storage, and improvement in the engines of NGVs.

Drivers for the Automotive Natural Gas Vehicle (NGV) Market

Advancements in Technology

Techniques in natural gas storage, engines, and with overall effectiveness are enhancing the feasibility and the costs of Natural Gas Vehicles (NGVs) within the current generation more than ever. Among the most important trends is the advancements in storage technologies – light high pressure tanks; tanks allow vehicles themselves, to store much greater volumes of natural gas on board without occupying as much space and weight. This improvement the driving range of NGVs thereby solving one of the biggest problem that consumers have. At the same time the engine technology has also developed with additional facilities in the burning technology and electronics that has provided better performance, reduced emission and better mileage ratio through NGVs than the earlier models.

Further, advances in technology in all aspects of the drives train, including better and advanced turbo charging and enhanced energy management systems have made operating of NGVs cheaper. These technological advancements have lessened the overall cost participants while making NGVs favorable compared to standard gasoline and diesel automobiles.

Restraints for the Automotive Natural Gas Vehicle (NGV) Market

Limited Refueling Infrastructure

88The limited availability of CNG refueling stations remains a significant barrier to the widespread adoption of Natural Gas Vehicles (NGVs) in many regions. While NGVs offer clear environmental and economic benefits, their practicality is hindered by the challenge of accessing refueling infrastructure. In areas where CNG stations are scarce, vehicle owners may struggle to find convenient refueling options, especially for long-distance travel or in remote locations. This limited infrastructure makes it difficult for individuals and businesses to rely on NGVs as their primary mode of transportation, particularly for those who do not have access to private refueling facilities. Furthermore, the cost and logistics involved in setting up CNG refueling stations can deter investment, particularly in regions with lower vehicle penetration.

Opportunity in the Automotive Natural Gas Vehicle (NGV) Market

Integration with Renewable Energy

The blending of Renewable Natural Gas (RNG) with conventional natural gas offers a significant opportunity to further reduce the carbon footprint and enhance the environmental benefits of Natural Gas Vehicles (NGVs). RNG is produced from organic waste sources such as agricultural residues, landfills, and wastewater treatment facilities. It is chemically identical to conventional natural gas, meaning it can be used in NGVs without requiring modifications to the vehicle's engine or fueling infrastructure. However, unlike conventional natural gas, RNG is carbon-neutral, as the carbon dioxide (CO2) released during its combustion is offset by the carbon absorbed by the organic materials during their growth phase. By incorporating RNG into the fuel mix, NGVs can operate with a much lower net carbon emission, contributing to more sustainable transportation solutions.

Trends for the Automotive Natural Gas Vehicle (NGV) Market

Growing Role of LNG in Heavy-Duty Vehicles

Liquefied Natural Gas (LNG) is gaining significant traction in the heavy-duty and long-haul trucking sectors, providing a viable and more sustainable alternative to traditional diesel fuel. LNG offers several advantages for long-distance and heavy-duty trucks, which typically consume large amounts of fuel due to the extensive mileage and weight of the cargo they carry. One of the main benefits of LNG is its lower cost compared to diesel, making it an attractive option for logistics companies seeking to reduce operational expenses. Additionally, LNG has a higher energy density compared to compressed natural gas (CNG), allowing trucks to travel longer distances on a single tank, which is crucial for long-haul operations.

Furthermore, LNG vehicles produce lower emissions of particulate matter, nitrogen oxides (NOx), and carbon dioxide (CO2) compared to their diesel counterparts, contributing to cleaner air quality and helping companies meet stricter environmental regulations. The growing availability of LNG fueling infrastructure, particularly along major transportation corridors and in logistics hubs, is making it more feasible for fleet operators to transition to LNG-powered trucks.

Segments Covered in the Report

By Fuel Type

o Compressed Natural Gas (CNG)

o Liquefied Petroleum Gas (LPG)

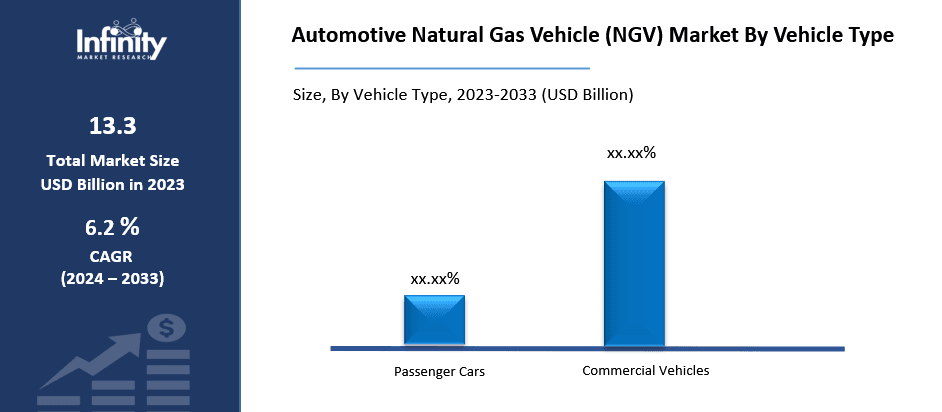

By Vehicle Type

o Passenger Cars

o Commercial Vehicles

Segment Analysis

By Fuel Type Analysis

On the basis of fuel type, the market is divided into compressed natural gas (CNG) and Liquefied Petroleum Gas (LPG). Among these, compressed natural gas (CNG) segment acquired the significant share in the market owing to its environmental and economic advantages, as well as its widespread availability. CNG is widely recognized for its lower emissions of harmful pollutants such as carbon dioxide (CO2), nitrogen oxides (NOx), and particulate matter, making it an attractive alternative to traditional gasoline and diesel fuels. This has led to its adoption in various sectors, especially in passenger vehicles, buses, and fleet transportation, where environmental regulations are becoming increasingly stringent.

By Vehicle Type Analysis

On the basis of vehicle type, the market is divided into passenger cars and commercial vehicles. Among these, commercial vehicles segment held the prominent share of the market. Commercial vehicles, such as trucks, buses, and delivery vehicles, typically have higher fuel consumption, which makes fuel cost a critical factor in their overall operational expenses. Natural gas, particularly in the form of Compressed Natural Gas (CNG) or Liquefied Natural Gas (LNG), is often more affordable than conventional diesel or gasoline, providing substantial savings for businesses that rely on these vehicles for long-haul transportation, logistics, and urban delivery services.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 33.1% of the market. One of the primary drivers is the availability of abundant natural gas reserves, particularly in countries like China, India, and Japan, which provide a stable and cost-effective source of fuel for NGVs. The economic advantages of using natural gas, such as lower fuel costs compared to gasoline and diesel, are particularly appealing in developing economies where transportation costs represent a significant portion of operational expenses. Additionally, the region is facing increasing urbanization, which leads to greater demand for cleaner, more sustainable transportation options to address air quality concerns and meet stricter environmental regulations.

Governments in the Asia Pacific region are also actively supporting the growth of the NGV market through incentives such as subsidies, tax breaks, and investments in CNG and LNG fueling infrastructure. For example, China has made substantial investments in CNG refueling stations and has set ambitious goals for expanding the adoption of NGVs in both the passenger and commercial vehicle sectors.

Competitive Analysis

The competitive landscape of the Natural Gas Vehicle (NGV) market is characterized by a growing number of key players, including vehicle manufacturers, energy companies, and infrastructure providers, all vying for market share in a sector driven by environmental and economic factors. Major automakers like Fiat Chrysler, Volvo, Iveco, and MAN are leading the charge in producing NGVs, offering a range of passenger cars, trucks, and buses powered by compressed natural gas (CNG) and liquefied natural gas (LNG). These companies are focusing on innovation, improving fuel efficiency, and lowering emissions to meet the growing demand for sustainable transportation solutions. Additionally, many manufacturers are investing in partnerships with fuel suppliers and infrastructure developers to ensure the availability of refueling stations, which is a critical factor in market adoption.

Recent Developments

In September 2020, Westport Fuel Systems Inc. and its joint venture partner, UNO MINDA Group, finalized an agreement that enables them to better serve the rapidly growing NGV market in India.

Key Market Players in the Automotive Natural Gas Vehicle (NGV) Market

o Honda Motor Co. Ltd.

o Hyundai Motor Company

o General Motors Company

o Suzuki Motor Corporation

o Ford Motor Company

o Nissan Motor Company Ltd.

o Fiat Chrysler Automobiles

o Volkswagen Group

o Mercedes-Benz Group

o Mitsubishi Motors Corporation

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 13.3 Billion |

|

Market Size 2033 |

USD 20.7 Billion |

|

Compound Annual Growth Rate (CAGR) |

6.2% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Fuel Type, Vehicle Type, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Honda Motor Co. Ltd., Hyundai Motor Company, General Motors Company, Suzuki Motor Corporation, Ford Motor Company, Nissan Motor Company Ltd., Fiat Chrysler Automobiles, Volkswagen Group, Mercedes-Benz Group, Mitsubishi Motors Corporation, and Other Key Players. |

|

Key Market Opportunities |

Integration with Renewable Energy |

|

Key Market Dynamics |

Advancements in Technology |

📘 Frequently Asked Questions

1. Who are the key players in the Automotive Natural Gas Vehicle (NGV) Market?

Answer: Honda Motor Co. Ltd., Hyundai Motor Company, General Motors Company, Suzuki Motor Corporation, Ford Motor Company, Nissan Motor Company Ltd., Fiat Chrysler Automobiles, Volkswagen Group, Mercedes-Benz Group, Mitsubishi Motors Corporation, and Other Key Players.

2. How much is the Automotive Natural Gas Vehicle (NGV) Market in 2023?

Answer: The Automotive Natural Gas Vehicle (NGV) Market size was valued at USD 13.3 Billion in 2023.

3. What would be the forecast period in the Automotive Natural Gas Vehicle (NGV) Market?

Answer: The forecast period in the Automotive Natural Gas Vehicle (NGV) Market report is 2024-2033.

4. What is the growth rate of the Automotive Natural Gas Vehicle (NGV) Market?

Answer: Automotive Natural Gas Vehicle (NGV) Market is growing at a CAGR of 6.2% during the forecast period, from 2024 to 2033

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.