🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Automotive Parts Manufacturing Market

Global Automotive Parts Manufacturing Market (By Component, Automotive Filters, Batteries, Underbody Components, Lighting Components, Electrical Components, Engine Components, and Cooling System; By Vehicle Type, Passenger Vehicles and Commercial Vehicles; By Sales Channel, OEMs and Aftermarket; By Region and Companies), 2024-2033

Sep 2024

Automobiles

Pages: 138

ID: IMR1236

Automotive Parts Manufacturing Market Overview

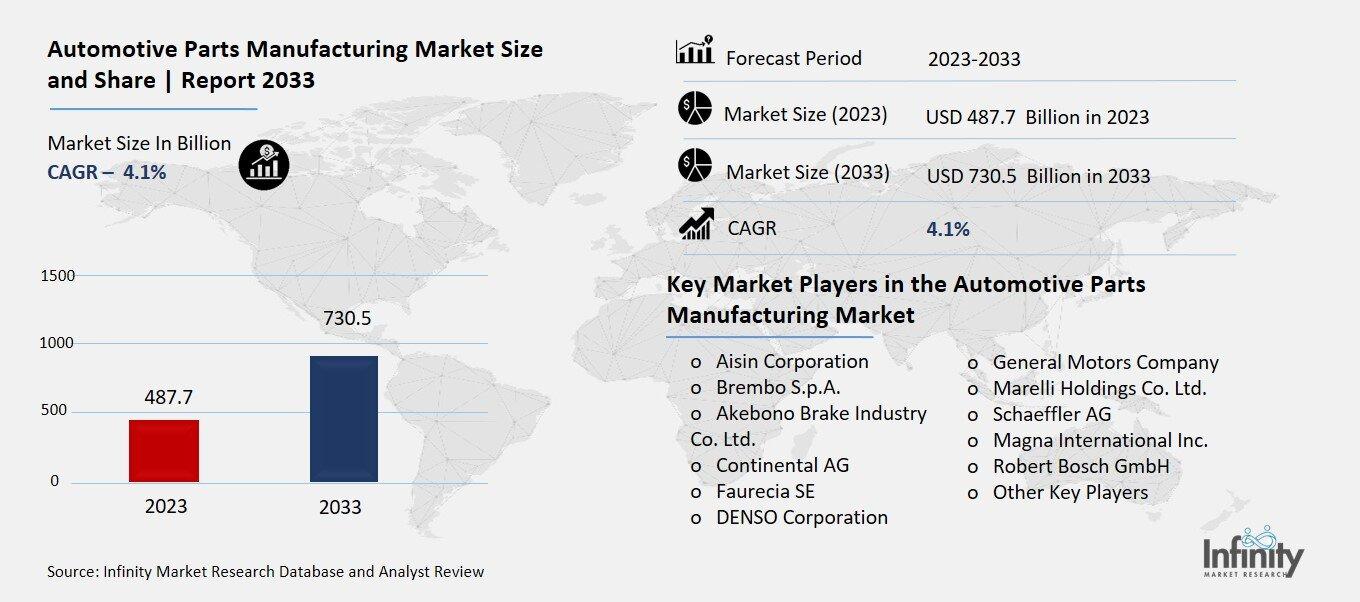

Global Automotive Parts Manufacturing Market acquired the significant revenue of 487.7 Billion in 2023 and expected to be worth around USD 730.5 Billion by 2033 with the CAGR of 4.1% during the forecast period of 2024 to 2033. The automotive parts manufacturing market is a critical component of the global automotive industry, providing essential parts and systems for vehicle production and maintenance. This market encompasses a wide range of components, including engine parts, electrical systems, and body components, which are produced by both Original Equipment Manufacturers (OEMs) and aftermarket suppliers.

To Get An Overview , Request For Sample

Moreover, the market is driven by factors such as growing automotive production, increased vehicle sales, technological advancements in manufacturing processes, and consumer demand for fuel efficiency and safety features. Recent trends include a shift towards electric vehicle (EV) components, with manufacturers increasingly investing in new technologies and partnerships to support the EV ecosystem.

Drivers for the Automotive Parts Manufacturing Market

Rising Automotive Production and Sales

Increased production and sales of vehicles, especially in emerging markets, are significantly driving the demand for automotive parts. Countries like China, India, and Brazil are experiencing rapid economic growth, urbanization, and rising disposable incomes, which are contributing to an increase in vehicle ownership. As more people in these regions gain access to vehicles, automakers are ramping up production to meet the growing demand, which in turn boosts the need for a wide variety of automotive components.

This growth presents substantial opportunities for automotive parts manufacturers to expand their operations and invest in new technologies to enhance production capacity. Furthermore, the expansion of infrastructure and favorable government policies, such as incentives for local manufacturing and foreign direct investment (FDI), are encouraging global automotive companies to set up production facilities in these regions

Restraints for the Automotive Parts Manufacturing Market

Rising Raw Material Costs

Fluctuations in the prices of key raw materials, such as steel, aluminum, and plastic compounds, have a direct impact on the profit margins of automotive parts manufacturers, presenting a significant challenge to the industry. These materials are essential for the production of various automotive components, from engine parts and chassis to interior and exterior fittings. When raw material prices rise, manufacturers face increased production costs, which can be difficult to pass on to automakers or end consumers due to competitive pricing pressures. This often results in squeezed profit margins and increased financial strain on manufacturers, especially smaller players with less flexibility to absorb such costs. Moreover, the volatility of raw material prices is influenced by factors such as geopolitical tensions, supply chain disruptions, and changing trade policies, which add another layer of unpredictability for manufacturers.

Opportunity in the Automotive Parts Manufacturing Market

Expansion of Aftermarket Services

The growing number of vehicles in use worldwide, particularly older vehicles, is creating significant opportunities for the aftermarket segment, including replacement parts and maintenance services. As vehicles age, their components wear out, necessitating regular maintenance and the replacement of parts such as brakes, filters, tires, and engine components. This drives a steady demand for aftermarket products, offering a lucrative revenue stream for manufacturers and suppliers of replacement parts. Older vehicles, especially in regions with high vehicle retention rates like North America and parts of Europe, require ongoing maintenance to stay roadworthy, leading to increased demand for both OEM and aftermarket parts. Additionally, with the increasing trend of consumers opting to repair and maintain their vehicles instead of buying new ones, especially during economic downturns, the aftermarket segment has become an attractive growth avenue.

Trends for the Automotive Parts Manufacturing Market

Focus on Lightweight Materials

To enhance fuel efficiency and comply with increasingly stringent emission standards, automotive manufacturers are increasingly turning to lightweight materials, such as aluminum, magnesium, high-strength steel, and composite materials, to reduce vehicle weight. By lowering the overall weight, vehicles require less energy to operate, which leads to improved fuel efficiency and reduced greenhouse gas emissions. This shift is being driven not only by government regulations aimed at reducing the environmental impact of vehicles but also by consumer demand for more fuel-efficient options. Aluminum, for instance, is being used extensively in the production of engine components, body panels, and frames due to its favorable strength-to-weight ratio and corrosion resistance. Meanwhile, carbon fiber composites, though costlier, offer even greater weight reductions and are gaining popularity in high-performance and electric vehicles, where efficiency is paramount.

Segments Covered in the Report

By Component

o Automotive Filters

o Batteries

o Underbody Components

o Lighting Components

o Electrical Components

o Ignition Switch

o Ignition Coil

o Others

o Engine Components

o Pump

o Alternator

o Starter

o Others

o Cooling System

o Radiator

o Compressor

o Pump

o Others

By Vehicle

o Passenger Vehicles

o Commercial Vehicles

By Sales Channel

o OEMs

o Aftermarket

Segment Analysis

By Component Analysis

On the basis of component, the market is divided into automotive filters, batteries, underbody components, lighting components, electrical components, engine components, and cooling system. Among these, engine components segment acquired the significant share around 40.1% in the market owing to the essential role engine components play in vehicle performance and efficiency. Engine components, such as pistons, camshafts, valves, and crankshafts, are critical to the functioning of both traditional internal combustion engines and hybrid powertrains, leading to high demand from automakers. Additionally, the need for regular replacement and maintenance of these components, especially in regions with a high number of vehicles on the road, further drives market growth.

By Vehicle Analysis

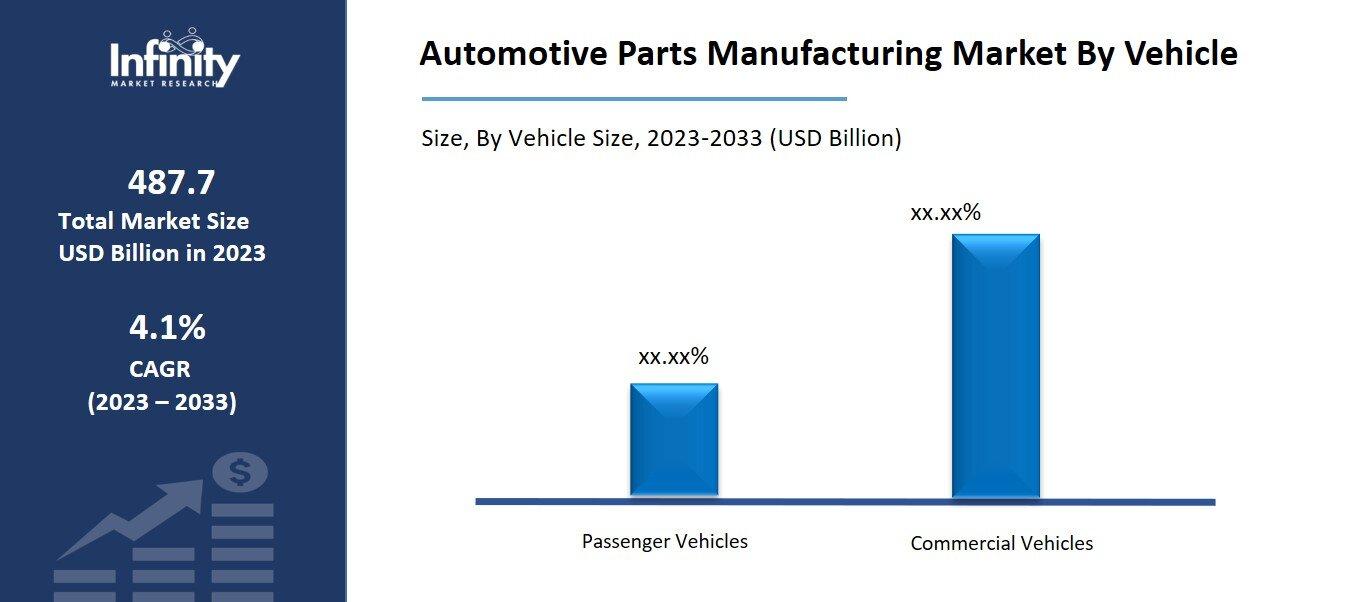

On the basis of vehicle, the market is divided into passenger vehicles and commercial vehicles. Among these, passenger vehicles held the prominent share of the market due to the the increasing global demand for personal vehicles, driven by rising disposable incomes, urbanization, and the growing preference for private transportation. Passenger vehicles are produced in larger volumes compared to commercial vehicles, which naturally leads to higher demand for automotive parts. Additionally, the expanding middle-class population in emerging economies such as China and India has fueled the growth of the passenger vehicle market, leading to increased production and sales. Technological advancements, such as the integration of safety features, infotainment systems, and improved fuel efficiency, are also boosting consumer interest in passenger vehicles, further contributing to the segment's market dominance.

To Learn More About This Report , Request For Sample

By Sales Channel Analysis

On the basis of sales channel, the market is divided into OEMs and aftermarket. Among these, OEMs held the prominent share of the market. OEMs benefit from direct partnerships with vehicle manufacturers, ensuring that their parts meet the exact specifications and quality standards required for new vehicle production. This segment captures a significant portion of the market as it caters to the demand for high-quality, reliable components that are essential for vehicle assembly. Additionally, the growing focus on technological innovations and advancements in automotive design has led to an increased reliance on OEM parts, as these components are typically designed to work seamlessly with the vehicle’s systems.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 34.1% of the market owing to the including a strong automotive manufacturing base, high vehicle ownership rates, and a well-established aftermarket sector. The region is home to major automotive manufacturers and suppliers, driving significant investments in technology and innovation within the automotive parts industry. Additionally, consumer preferences for advanced safety features and fuel-efficient vehicles have fueled demand for high-quality automotive components. The robust infrastructure for vehicle maintenance and repair further supports the growth of the market, allowing North America to maintain its position as a leader in automotive parts manufacturing.

Competitive Analysis

The competitive landscape of the automotive parts manufacturing market is characterized by a mix of established players and emerging companies, all vying for market share in a rapidly evolving industry. Major global OEMs, such as Bosch, Denso, and Magna International, dominate the market, leveraging their extensive experience, advanced technology, and robust supply chain networks to maintain a competitive edge. These companies invest heavily in research and development to innovate and adapt to changing consumer preferences and regulatory requirements, particularly concerning electric vehicles and sustainability.

Recent Developments

In February 2024, Fenix Parent LLC, doing business as Fenix Parts and located in Hurst, Texas, has successfully acquired the assets of Pacific Rim Auto Parts in Fort Worth, Texas. Fenix Parts specializes in recycling and reselling original equipment manufacturer (OEM) automotive parts.

In December 2023, Valeo and Stellantis entered into a collaboration and partnership agreement to launch the first windshield-mounted car video camera, which has been refurbished at Valeo's Circular Electronics Lab.

Key Market Players in the Automotive Parts Manufacturing Market

o Aisin Corporation

o Brembo S.p.A.

o Akebono Brake Industry Co. Ltd.

o Continental AG

o Faurecia SE

o DENSO Corporation

o General Motors Company

o Marelli Holdings Co. Ltd.

o Schaeffler AG

o Magna International Inc.

o Robert Bosch GmbH

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 487.7 Billion |

|

Market Size 2033 |

USD 730.5 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.1% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Component, Vehicle, Sales Channel, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Aisin Corporation, Brembo S.p.A., Akebono Brake Industry Co. Ltd., Continental AG, Faurecia SE, DENSO Corporation, General Motors Company, Marelli Holdings Co. Ltd., Schaeffler AG, Magna International Inc., Robert Bosch GmbH, and Other Key Players. |

|

Key Market Opportunities |

Expansion of Aftermarket Services |

|

Key Market Dynamics |

Rising Automotive Production and Sales |

📘 Frequently Asked Questions

1. Who are the key players in the Automotive Parts Manufacturing Market?

Answer: Aisin Corporation, Brembo S.p.A., Akebono Brake Industry Co. Ltd., Continental AG, Faurecia SE, DENSO Corporation, General Motors Company, Marelli Holdings Co. Ltd., Schaeffler AG, Magna International Inc., Robert Bosch GmbH, and Other Key Players.

2. How much is the Automotive Parts Manufacturing Market in 2023?

Answer: The Automotive Parts Manufacturing Market size was valued at USD 487.7 Billion in 2023.

3. What would be the forecast period in the Automotive Parts Manufacturing Market?

Answer: The forecast period in the Automotive Parts Manufacturing Market report is 2023-2033.

4. What is the growth rate of the Automotive Parts Manufacturing Market?

Answer: Automotive Parts Manufacturing Market is growing at a CAGR of 4.2% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.