🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Automotive Rear-View Mirror Market

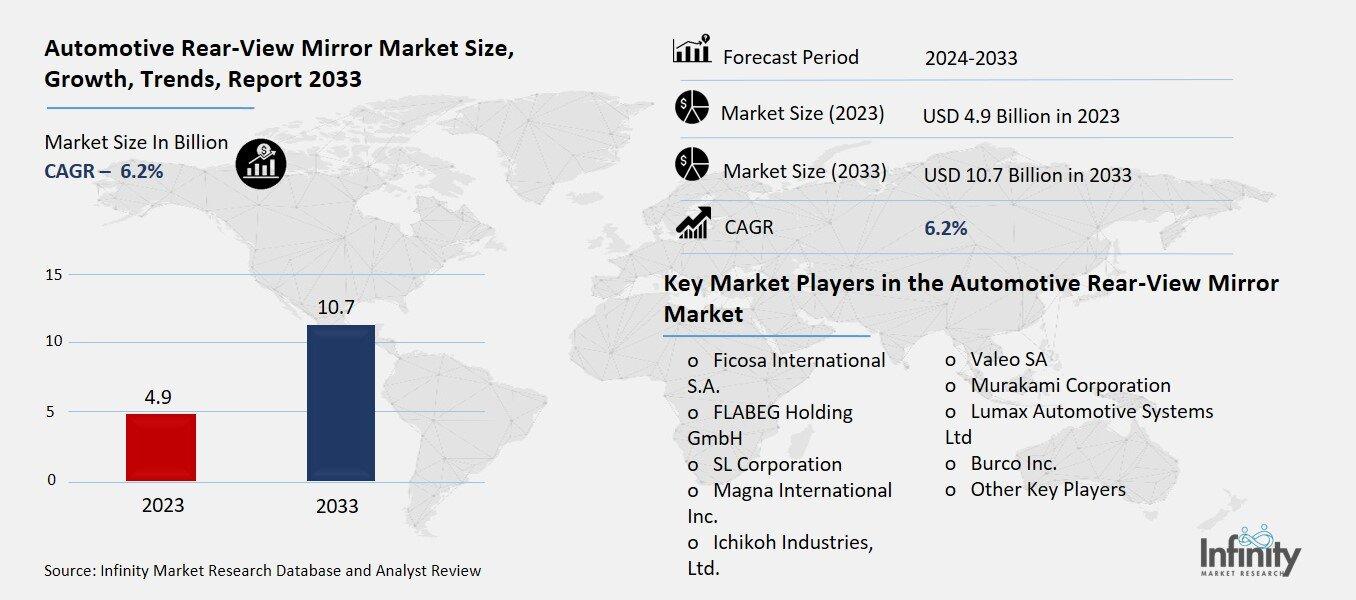

Global Automotive Rear-View Mirror Market (By Type, Interior Mirror and Exterior Mirror; By Application, Passenger Cars and Commercial Vehicles; By Feature, Blind Spot Detection, Power Controlled, Heating function, Auto Foldable, and Other Features; By Sales Channel, OEM and Aftermarket; By Region and Companies), 2024-2033

Oct 2024

Automobiles

Pages: 138

ID: IMR1270

Automotive Rear-View Mirror Market Overview

Global Automotive Rear-View Mirror Market acquired the significant revenue of 4.9 Billion in 2023 and expected to be worth around USD 10.7 Billion by 2033 with the CAGR of 6.2% during the forecast period of 2024 to 2033. The automotive rear-view mirror market has a constant trend of growth due to the growing interests of stakeholders and car owners in car safety systems. Rear view mirrors of the past are being transformed into complex camera and sensor systems incorporating display improvements for better visibility and less blind zones. Such change is driven by progress in automotive autonomy and the increase in use of battery electric vehicles that demand more sophisticated mirror systems for driver aids.

The other dynamic is the general regulatory requirements across different areas for the rearview safety standard is a motivation towards the intended market expansion. Moreover, the growing popularity of smart mirrors that provide haptic controls and connected features, is making it popular among automakers and the customers alike, which is likely to increase the market approaches.

Drivers for the Automotive Rear-View Mirror Market

Increasing Consumer Demand for Better Safety Features

The high demand by the customer for efficient safety measures is another factor that has augmented the incorporation of enhanced rear-view systems’ advancement in the automotive industry. When road safety is high on the agenda drivers will consider a detection of blind spots and parking aid as crucial elements making them better drivers and lowering the risk of an accident. Systems mounted in rear-view mirrors and commonly known as blind-spot detection assist drivers in identifying vehicles or objects that may not be easily seen in blind zones, particularly during a lane change.

Another wanted service is parking assistance where the car incorporates sensors and rear cameras to help the driver park it in narrow spaces without an instance of hitting something. This is because the continually expanding photo environment is characteristic by a higher level of density, where parking and traffic situations are often compact and tight.

Restraints for the Automotive Rear-View Mirror Market

Technical Complexity

The integration of electronic components and software into traditional automotive rear-view mirrors presents several challenges for manufacturers, impacting both production complexity and long-term reliability. As rear-view mirrors evolve from simple reflective devices into advanced systems with embedded cameras, sensors, displays, and connectivity features, the complexity of their design and manufacturing increases significantly. This integration requires precise engineering to ensure that electronic components function seamlessly within a harsh automotive environment, where temperature fluctuations, vibrations, and exposure to elements like dust and moisture can affect performance.

Opportunity in the Automotive Rear-View Mirror Market

Development of Autonomous Vehicles

The development of autonomous vehicles is transforming the role of rear-view mirror systems, creating significant opportunities for their integration into the vehicle’s broader sensor and monitoring architecture. As autonomous driving technology advances, the need for traditional mirrors is diminishing, paving the way for fully digital, camera-based systems that offer a more comprehensive view of the vehicle’s surroundings. These digital systems, also known as Camera-Monitor Systems (CMS), leverage high-resolution cameras to capture real-time footage from multiple angles, which is then displayed on interior screens, providing the driver or the vehicle’s control system with a clearer and broader field of vision than traditional mirrors.

Trends for the Automotive Rear-View Mirror Market

Replacement of Conventional Mirrors with Digital Camera Systems

The replacement of conventional rear-view mirrors with digital camera systems is gaining momentum, particularly in premium and electric vehicle segments, as automakers seek to enhance both aerodynamics and safety. These Camera-Monitor Systems (CMS) use high-definition cameras positioned on the exterior of the vehicle to capture live footage, which is displayed on screens inside the cabin, replacing traditional glass mirrors. One of the key advantages of digital mirrors is their ability to significantly improve aerodynamics. By eliminating the bulky external mirror housings, these systems reduce drag, which is especially crucial for electric vehicles (EVs) that require optimized efficiency to maximize range.

Segments Covered in the Report

By Type

o Interior Mirror

o Exterior Mirror

By Application

o Passenger Cars

o Commercial Vehicles

By Feature

o Blind Spot Detection

o Power Controlled

o Heating function

o Auto Foldable

o Other Features

By Sales Channel

o OEM

o Aftermarket

Segment Analysis

By Type Analysis

On the basis of type, the market is divided into interior mirror and exterior mirror. Among these, interior mirror segment acquired the significant share in the market owing to the growing adoption of auto-dimming mirrors and smart mirrors with integrated technologies. Interior mirrors, especially those equipped with auto-dimming features, improve driver safety by reducing glare from headlights of vehicles behind, enhancing night driving comfort.

Furthermore, the increasing integration of rear-view cameras and display screens in interior mirrors, often referred to as smart mirrors, has further boosted their demand. These mirrors provide a clearer, wider field of vision, and can incorporate additional functionalities such as navigation, connectivity to mobile devices, and even real-time data from driver assistance systems. Their growing importance in enhancing overall vehicle safety and convenience, especially in modern cars, contributes significantly to their dominant market share, particularly in mid-range and premium vehicles.

By Application Analysis

On the basis of application, the market is divided into passenger cars and commercial vehicles. Among these, passenger cars segment held the prominent share of the market due to the high production and sales volume of passenger vehicles globally. The growing demand for passenger cars, driven by rising disposable incomes, urbanization, and increasing consumer preference for personal mobility, particularly in emerging economies, has fueled the adoption of advanced rear-view mirror systems. Additionally, the trend toward incorporating advanced safety features in passenger vehicles, such as blind-spot detection, parking assistance, and auto-dimming mirrors, has boosted the segment's growth.

By Feature Analysis

On the basis of feature, the market is divided into blind spot detection, power controlled, heating function, auto foldable, and other features. Among these, blind spot detection segment held the significant share of the market. Blind spot detection systems, which are typically integrated into exterior mirrors, use sensors to monitor areas not visible to the driver and provide real-time alerts if a vehicle or obstacle is detected in these areas.

The rising consumer demand for enhanced safety features, coupled with regulatory mandates in various regions that encourage or require the inclusion of blind spot monitoring in vehicles, has further driven the adoption of this technology. Automakers are increasingly incorporating blind spot detection into their vehicle designs, particularly in premium and mid-range models, making it a key selling point for safety-conscious consumers.

By Sales Channel Analysis

On the basis of sales channel, the market is divided into OEM and Aftermarket. Among these, OEM segment held the most of the share of the market. OEMs are increasingly equipping vehicles with modern features such as blind spot detection, auto-dimming mirrors, and camera-based systems as part of their standard or optional safety packages.

The OEM segment benefits from long-term contracts with vehicle manufacturers, ensuring a steady demand for rear-view mirrors as automotive production continues to grow globally, particularly in the passenger car and premium vehicle segments. Additionally, the trend toward factory-installed smart mirrors and camera-monitor systems (CMS), which require precise integration with other vehicle systems, further strengthens the OEM channel’s dominance.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 32.5% of the market. The region is home to a robust automotive industry, with major manufacturers and suppliers continuously innovating and introducing advanced technologies to enhance vehicle safety and functionality. The increasing demand for vehicles equipped with advanced driver assistance systems (ADAS) has significantly boosted the adoption of features such as blind spot detection, auto-dimming mirrors, and camera-monitor systems.

Moreover, stringent government regulations regarding vehicle safety, including mandates for rear-view cameras in new vehicles, have accelerated the integration of advanced mirror technologies. The consumer base in North America is also characterized by a strong preference for premium and luxury vehicles, which often come equipped with the latest rear-view mirror innovations.

Competitive Analysis

The competitive landscape of the automotive rear-view mirror market is characterized by a mix of established players and emerging companies, all vying for market share through innovation and technological advancements. Key industry participants such as Gentex Corporation, Magna International, Ficosa International, and Samvardhana Motherson Group lead the market by offering a diverse range of advanced mirror solutions, including auto-dimming, blind spot detection, and camera-monitor systems. These companies invest heavily in research and development to enhance product features and integrate cutting-edge technologies, such as connectivity and augmented reality, into their offerings.

Recent Developments

In September 2022, OMNIVISION has partnered with Analog Devices, Inc. (ADI) to create a camera system that allows automotive OEMs to easily upgrade from SD to HD resolution while maintaining high performance and low costs. The solution features OMNIVISION's OX01F10 1.3-megapixel SoC and ADI's C2B Car Camera Bus technology, aimed at entry-level HD rear-view cameras, surround-view systems, and electronic mirrors.

In April 2022, Magna International, a Canadian mobility technology company, has formed a partnership with LG Electronics to produce battery packs for SK On. Additionally, Magna's manufacturing facility will include a joint battery plant in collaboration with LG Energy Solutions and Stellantis.

Key Market Players in the Automotive Rear-View Mirror Market

o Ficosa International S.A.

o FLABEG Holding GmbH

o SL Corporation

o Magna International Inc.

o Ichikoh Industries, Ltd.

o Valeo SA

o Murakami Corporation

o Lumax Automotive Systems Ltd

o Burco Inc.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 4.9 Billion |

|

Market Size 2033 |

USD 10.7 Billion |

|

Compound Annual Growth Rate (CAGR) |

6.2% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Application, Feature, Sales Channel, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Ficosa International S.A., FLABEG Holding GmbH, SL Corporation, Magna International Inc., Ichikoh Industries, Ltd., Valeo SA, Murakami Corporation, Lumax Automotive Systems Ltd, Burco Inc., and Other Key Players. |

|

Key Market Opportunities |

Development of Autonomous Vehicles |

|

Key Market Dynamics |

Increasing Consumer Demand for Better Safety Features |

📘 Frequently Asked Questions

1. Who are the key players in the Automotive Rear-View Mirror Market?

Answer: Ficosa International S.A., FLABEG Holding GmbH, SL Corporation, Magna International Inc., Ichikoh Industries, Ltd., Valeo SA, Murakami Corporation, Lumax Automotive Systems Ltd, Burco Inc., and Other Key Players.

2. How much is the Automotive Rear-View Mirror Market in 2023?

Answer: The Automotive Rear-View Mirror Market size was valued at USD 4.9 Billion in 2023.

3. What would be the forecast period in the Automotive Rear-View Mirror Market?

Answer: The forecast period in the Automotive Rear-View Mirror Market report is 2024-2033.

4. What is the growth rate of the Automotive Rear-View Mirror Market?

Answer: Automotive Rear-View Mirror Market is growing at a CAGR of 6.2% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.