🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Automotive Software Market

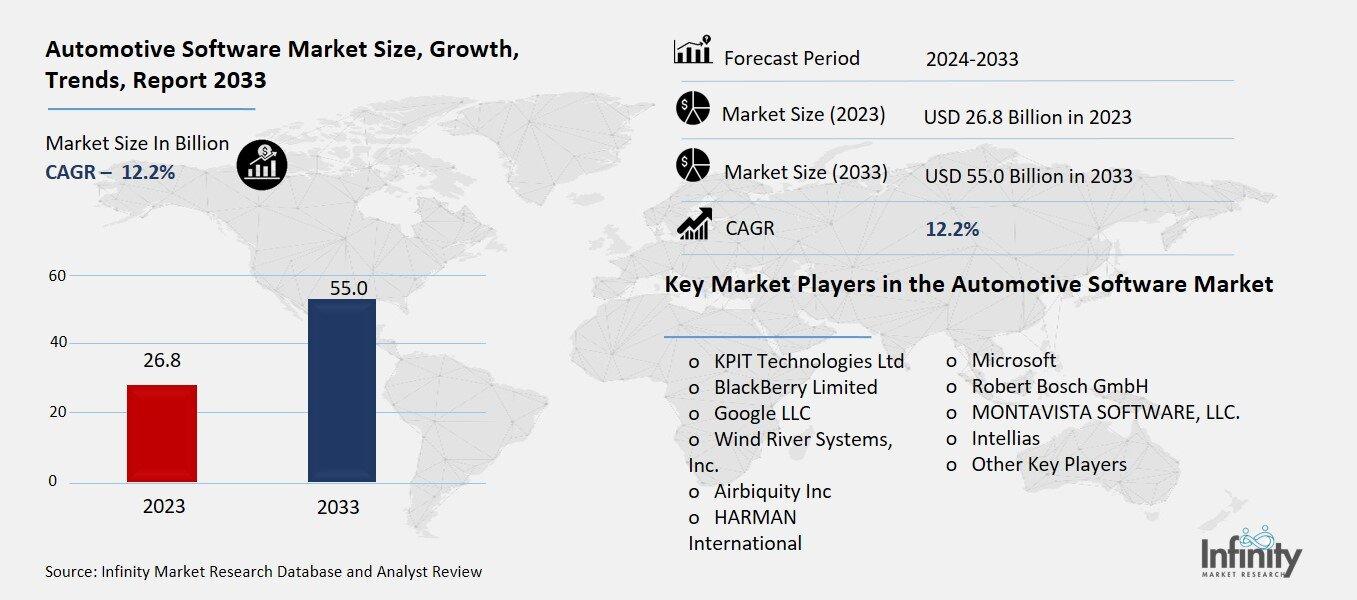

Global Automotive Software Market (By Product Type, Software Application, Middleware, and OS; By Propulsion Type, ICE and EV; By Vehicle Type, Passenger Cars and Commercial Vehicle; By Application, ADAS & Safety, Infotainment, Navigation, Autonomous Driving, Engine & Transmission, Smart Diagnostics & Predictive, Maintenance, and Other Applications; By Region and Companies), 2024-2033

Oct 2024

Automobiles

Pages: 138

ID: IMR1268

Automotive Software Market Overview

Global Automotive Software Market acquired the significant revenue of 26.8 Billion in 2023 and expected to be worth around USD 55.0 Billion by 2033 with the CAGR of 12.2% during the forecast period of 2024 to 2033. The demands for connected cars, advanced driver-assitance systems (ADAS), and autonomous cars are rising exponentially and this is has placed the automotive software market into a high growth trajectory. Automotive software is fast emerging as a comprehensive market since cars are increasingly being controlled by software for navigation, entertainment, and safety, not to mention vehicle management. Some of the emerging segments are EV software, connected car and OTA, where manufacturers can remotedly enhance the vehicle performance and or features.

Many industry giants are planning and implementing artificial intelligence, machine learning, cloud solutions for improving car performance and customer experience. Besides, such legal requirements as vehicle safety regulations and emissions requirements urge manufacturers to incorporate better software solutions.

Drivers for the Automotive Software Market

Increasing Demand for Connected Vehicles

Consumer demand for automobiles that are capable of acting as a continuation of their online presence is fueling the desire for better connected car, infotainment, and telematics solutions. These systems allow specific connectivity with smart phones envisaging navigation menu, streaming, voice control, and real time traffic updates. Connectivity improves the car experience by providing safe interaction with the surroundings, entertainment, as well as vehicle information, which are considered mundane requirements by today’s drivers.

Besides those, telematics systems may provide real-time vehicle surveillance, fleet control, and urgent assistance which also enhances the claimed benefits for both car buyers and business customers. Car makers are addressing these needs through feature-rich software architectures that address the intricately inter-connected sensors, data flows, and cloud interfaces.

Restraints for the Automotive Software Market

Complex Regulatory Requirements

Meeting global safety, emissions, and data protection standards is a significant challenge for the automotive software market, as manufacturers must navigate a complex regulatory landscape that varies across regions. Stringent safety standards require rigorous testing and validation of automotive software, particularly for systems like advanced driver-assistance systems (ADAS) and autonomous driving technologies, where even minor errors can have critical consequences. Ensuring compliance with these regulations can extend development timelines, as software must undergo extensive simulations, real-world testing, and third-party certifications.

Opportunity in the Automotive Software Market

Growth in Electric and Autonomous Vehicles

The expanding electric vehicle (EV) market and advancements in self-driving technology are creating significant opportunities for new automotive software solutions, particularly in the areas of energy management, predictive maintenance, and autonomous navigation. As EV adoption grows, software that optimizes battery performance, manages energy usage, and integrates with charging networks is essential for enhancing the driving experience and extending vehicle range. Sophisticated energy management systems can help drivers monitor energy consumption in real time, make route adjustments based on available charging stations, and improve battery efficiency, addressing common concerns around range anxiety.

In the realm of predictive maintenance, software solutions are increasingly being developed to monitor vehicle health through sensors and real-time data analysis. These systems can detect potential issues before they become serious problems, notifying drivers or fleet managers of necessary repairs or maintenance. This not only improves vehicle reliability and reduces downtime but also minimizes costs for both consumers and commercial operators by preventing major breakdowns.

Trends for the Automotive Software Market

AI and Machine Learning Integration

Automotive software is increasingly integrating artificial intelligence (AI) and machine learning (ML) to revolutionize various aspects of vehicle performance and user interaction. One of the key applications is in optimizing driving behavior, where AI and ML analyze vast amounts of data from sensors, cameras, and real-time traffic information to make smart driving decisions. These systems can adjust vehicle speed, lane positioning, and braking to improve safety and fuel efficiency, while also adapting to different driving environments, such as city traffic or highways. In autonomous vehicles, AI plays a critical role in enabling self-driving capabilities by learning from real-world scenarios and continuously improving decision-making algorithms.

Segments Covered in the Report

By Product Type

o Software Application

o Middleware

o OS

By Propulsion Type

o ICE

o EV

By Vehicle Type

o Passenger Cars

o Commercial Vehicle

By Application

o ADAS & Safety

o Infotainment

o Navigation

o Autonomous Driving

o Engine & Transmission

o Smart Diagnostics & Predictive Maintenance

o Other Applications

Segment Analysis

By Product Type Analysis

On the basis of product type, the market is divided into software application, middleware, and os. Among these, software application segment acquired the significant share around 42.1% in the market owing to the increasing demand for in-car connectivity, infotainment systems, and advanced driver-assistance systems (ADAS), all of which rely heavily on specialized software applications. These applications are responsible for delivering enhanced user experiences, integrating with smartphones, managing navigation systems, and enabling safety features like collision avoidance, lane-keeping assist, and adaptive cruise control.

Additionally, the rise in electric vehicles (EVs) has boosted the need for energy management and battery optimization software, further driving the growth of the software application segment. As vehicles become more software-defined, automakers are increasingly focused on developing and updating software applications that enhance vehicle performance, provide over-the-air (OTA) updates, and offer personalized features to consumers.

By Propulsion Type Analysis

On the basis of propulsion type, the market is divided into ICE and EV. Among these, ICE segment held the prominent share of the market due to the dominance of conventional gasoline and diesel-powered vehicles globally. Despite the growing momentum of electric vehicles, ICE vehicles continue to represent the majority of vehicles on the road, particularly in developing regions where EV infrastructure is still limited. This has resulted in a sustained demand for software solutions that optimize engine performance, improve fuel efficiency, and comply with stringent emissions regulations.

Software applications for ICE vehicles are critical for enhancing fuel economy, managing engine control units (ECUs), and integrating advanced driver-assistance systems (ADAS). These systems help automakers meet environmental standards and improve vehicle safety while extending the lifespan of conventional vehicles.

By Vehicle Type Analysis

On the basis of vehicle type, the market is divided into passenger cars and commercial vehicle. Among these, passenger cars segment held the significant share of the market due to the increasing consumer demand for advanced features and enhanced driving experiences. As consumers seek vehicles that offer connectivity, infotainment, and advanced driver-assistance systems (ADAS), automakers are investing heavily in software solutions tailored to passenger cars. This includes applications for navigation, voice recognition, and integrated entertainment systems, which enhance the overall user experience.

By Application Analysis

On the basis of application, the market is ADAS & safety, infotainment, navigation, autonomous driving, engine & transmission, smart diagnostics & predictive, maintenance, and other applications. Among these, food industry held the most of the share of the market. Advanced Driver Assistance Systems (ADAS) are increasingly being integrated into new vehicles to enhance safety by reducing the risk of accidents. Features such as automatic emergency braking, lane departure warning, adaptive cruise control, and parking assistance are becoming standard offerings in many passenger vehicles, driven by consumer demand for enhanced safety and convenience.

Furthermore, as governments worldwide implement stricter safety regulations and testing protocols, automakers are compelled to invest in advanced software solutions that support these systems. The increasing awareness of road safety and the rising incidence of traffic accidents have further propelled the demand for ADAS technologies.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 34.1% of the market. North America's significant consumer base exhibits a strong preference for high-tech features in vehicles, driving demand for sophisticated software applications that enhance safety, connectivity, and user experience. The increasing adoption of electric vehicles (EVs) in the region, supported by government incentives and a growing charging infrastructure, further fuels the need for specialized software solutions focused on energy management and vehicle performance.

Moreover, stringent regulatory standards regarding safety and emissions in North America compel automakers to implement advanced software solutions to comply with these requirements. The emphasis on cybersecurity in connected vehicles also plays a critical role, as manufacturers seek to protect sensitive data and ensure safe operation.

Competitive Analysis

The competitive landscape of the automotive software market is characterized by a mix of established automotive manufacturers, technology companies, and specialized software developers, all vying for market share in a rapidly evolving industry. Major players such as Tesla, Bosch, Continental, and Siemens are at the forefront, leveraging their expertise in automotive engineering and software development to create innovative solutions that enhance vehicle performance, safety, and user experience. Additionally, technology giants like Apple, Google, and Microsoft are making significant inroads by offering platforms and services that integrate with vehicles, emphasizing connectivity and data management.

Recent Developments

In August 2020, a vehicle rental platform, Zoomcar, introduced a software stack designed to monitor driver behavior and the real-time status of vehicles. This system enabled the company to enhance customer service, minimize vehicle damage, and prevent reckless driving.

Key Market Players in the Automotive Software Market

o KPIT Technologies Ltd

o BlackBerry Limited

o Google LLC

o Wind River Systems, Inc.

o Airbiquity Inc

o HARMAN International

o Microsoft

o Robert Bosch GmbH

o MONTAVISTA SOFTWARE, LLC.

o Intellias

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 26.8 Billion |

|

Market Size 2033 |

USD 55.0 Billion |

|

Compound Annual Growth Rate (CAGR) |

12.2% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product Type, Propulsion Type, Vehicle Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

KPIT Technologies Ltd, BlackBerry Limited, Google LLC, Wind River Systems, Inc., Airbiquity Inc., HARMAN International, Microsoft, Robert Bosch GmbH, MONTAVISTA SOFTWARE, LLC., Intellias, and Other Key Players. |

|

Key Market Opportunities |

Growth in Electric and Autonomous Vehicles |

|

Key Market Dynamics |

Increasing Demand for Connected Vehicles |

📘 Frequently Asked Questions

1. Who are the key players in the Automotive Software Market?

Answer: KPIT Technologies Ltd, BlackBerry Limited, Google LLC, Wind River Systems, Inc., Airbiquity Inc., HARMAN International, Microsoft, Robert Bosch GmbH, MONTAVISTA SOFTWARE, LLC., Intellias, and Other Key Players.

2. How much is the Automotive Software Market in 2023?

Answer: The Automotive Software Market size was valued at USD 26.8 Billion in 2023.

3. What would be the forecast period in the Automotive Software Market?

Answer: The forecast period in the Automotive Software Market report is 2023-2033.

4. What is the growth rate of the Automotive Software Market?

Answer: Automotive Software Market is growing at a CAGR of 12.2% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.