🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Battery Chemicals Market

Battery Chemicals Market Global Industry Analysis and Forecast (2024-2032) by Battery Type (Nickel Cadmium Batteries, Zinc Carbon Batteries, Lead Acid Batteries, Lithium Ion Batteries, Alkaline Batteries, Others), Chemical Type (Cathode Battery Chemicals, Anode Battery Chemicals, Electrolyte Battery Chemicals), End User (Automotive Industry, Consumer Electronics, Household Appliances, Security & Monitoring Systems, Utilities & Backup Power) and Region

Jan 2025

Energy and Power

Pages: 138

ID: IMR1443

Battery Chemicals Market Synopsis

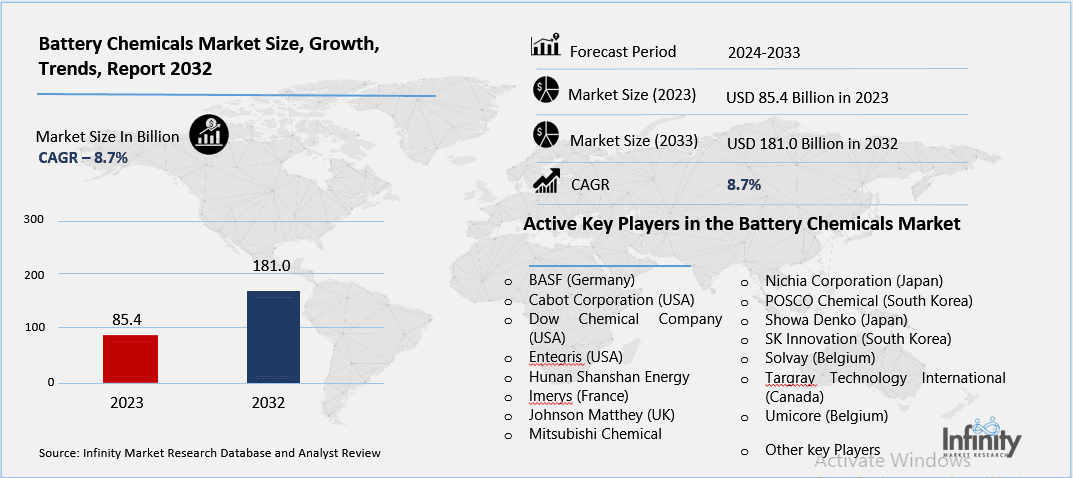

Battery Chemicals Market Size Was Valued at USD 85.4 Billion in 2023, and is Projected to Reach USD 181.0 Billion by 2032, Growing at a CAGR of 8.7% From 2024-2032.

The Battery Chemicals Market is a broad segment of products relevant to batteries’ production, ranging from cathode, anode, electrolytes, and some types of separators. These chemicals are critical in defining the abilities, energy magnitude, security, and sturdiness of battery. The popularity of renewable energy sources, electric vehicle and portable consumer electronics has soared –hence, raising the demand for high performing battery chemistries. Advancements in lithium-ion, nickel-metal hydride, nickel-cadmium, and novel solid-state batteries are causing new chemical compositions to be sought. With the market changing dynamically, battery chemicals are shifting to be designed for a variety of possible functions, preparing the market for a sustainable future of energy storage.

The Battery Chemicals Market across the world has been expanding at a relatively higher growth rate during the recent past in response to the higher demand for electric vehicles and the general trend toward the use of renewable energy sources. The world authorities are spending lavishly on the formation of EV infrastructure along with implementing even more rigorous carbon emission standards, which have created a ramp-up of demand for battery chemicals. Further, the constant innovation in battery types; lithium-ion and solid-state batteries is also contributing to market growth. The market also continues to be forced by the growth of consumer electronics, specifically batteries for powering smartphones, laptops, and wearables among others.

Furthermore, there is a growing demand in the market from more industrial and utility applications that are using large scale battery systems for storage of the grid electricity. The use of renewable energy such as solar and wind power has promoted higher use of battery chemicals used for longer durations of storage, better cycles, and efficiency. The gradual use of environmentally friendly materials in the industry and the latest trends towards recycling have contributed to these changes, promoting cooperation between chemical producers, battery makers, and technology developers.

Battery Chemicals Market Outlook, 2023 and 2032: Future Outlook

Battery Chemicals Market Trend Analysis

Trend: Growing Focus on Sustainability in Battery Chemistry

The drive for green battery chemistry is reshaping the environment-friendly Battery Chemicals Market as more players look toward the improved sustainability of the materials they are using. The authorities, non-governmental organizations striving for environmental protection, and manufacturers work together to lessen the impact of batteries in the environment. Innovations in the green battery technologies like the use of aqueous-based electrolytes, bio-sourced anode materials are increasing. In addition, the reintegration of major materials like lithium, cobalt, and nickel within the used batteries is being establishing as a prominent trend. Businesses are using closed-loop recycling to avoid the reliance on resources in a bid to support both organizational financial returns makes sense and environmental standards.

Driver: Rising Adoption of Electric Vehicles (EVs)

The major demand-generating factor for the Battery Chemicals Market as a whole is the rapidly growing trend of EVs. Currently subhead governments provide incentives to firms to sell EVs or offer direct subsidies to consumers, as well as emissions standards remain stringent. Therefore, battery manufacturers continue to scale up production, thus generating a large market for battery chemicals including lithium-ion cathode and novel electrolytes. These specifications specifically derived from the EV sector have given rise to the improved battery chemistry, where chemical manufacturers have even stepped up to come up with an ideal product to service the calls for longer ranges, faster charging, and a safer battery.

Restraint: Supply Chain Challenges and Raw Material Scarcity

Another restraints of the Battery Chemicals Market are supply chain disruptions and limited availability of materials for production. Lithium, cobalt and nickel sources are fixed in certain geographic locations, therefore; supply chain risks vary with geopolitical factors and trade barriers. Also, the increased need for such materials has made the prices to fluctuate hindering the cost profiles of battery manufacturers. The aforementioned issues are being addressed by attempting to source the chemicals from other companies and by researching and developing technologically altemative chemistries such as sodium-ion or solid-state batteries.

Opportunity: Expansion in Energy Storage Systems (ESS)

ESS is an emerging market which gives the battery chemical manufacturers window of opportunities for new business. In light of widespread green energy initiatives, correspondingly, there is a rising demand for the mass storage of batteries to regulate the irregular patterns of supply that occur with renewable energy projects. New battery chemistries including and extending flow and hybrid chemistries to rack up longer discharge cycles and increased energy densities are providing a vast market for new chemical advancements. ESS projects are being developed by governments and private players making available an opportunity for battery chemical suppliers to supply to this growing market segment.

Battery Chemicals Market Segment Analysis

Battery Chemicals Market Segmented on the basis of Battery Type, Chemical Type and end user.

By Battery Type

o Nickel Cadmium Batteries

o Zinc Carbon Batteries

o Lead Acid Batteries

o Lithium Ion Batteries

o Alkaline Batteries

o Others

By Chemical type

o Cathode Battery Chemicals

o Anode Battery Chemicals

o Electrolyte Battery Chemicals

By End User

o Automotive Industry

o Consumer Electronics

o Household Appliances

o Security & Monitoring Systems

o Utilities & Backup Power

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Battery Type, Nickel Cadmium Batteries segment is expected to dominate the market during the forecast period

The Nickel Cadmium Batteries segment is expected to remain the largest market in the forecast period due to its key features like without corroding at low temperatures and also the longer service life and reliability. These batteries are however commonly utilized in industries such as the aerospace, telecommunication and in the manufacture of medical instruments. While their usage in consumer electronic products has reduced due to environmental effects, there is booming demand in industries particularly in areas of high climatic conditions.

Further, the development in technologies of recycling is paying way to separate the cadmium and nickel batterie. Thus, their relevance for increasing numbers of applications confirmed by recent research proves the fact that they are still competitive despite the growing popularity of lithium-ion technologies.

By Chemical Type, Cathode Battery Chemicals segment expected to held the largest share

The Cathode Battery Chemicals segment stood at the largest market share because cathode materials are pivotal in dictating the battery performances. LCO, NCA and LFP are the most common cathode chemistries which are used for different purposes including EVs as well as consumer electronics and energy storage applications. Growing EV demand has particularly driven an increase in demand for nickel-rich cathodes due to higher energy density and cycle life as compared to other cathode materials.

Further, advancements in cathode recipes for example through the use of cobalt free or low cobalt materials are helping address cost and sustainability issues. This trend keeps on enhancing the status of cathode battery chemicals since most manufacturers focus on performance and eco-friendliness.

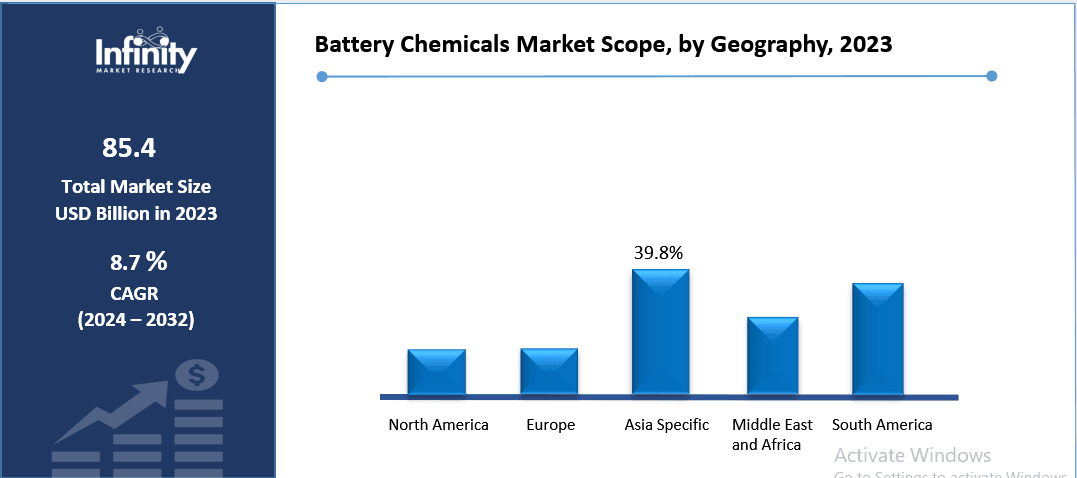

Battery Chemicals Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Asia-Pacific was the largest consumer for the Battery Chemicals Market in 2023 with a market share of more than 45%. The leadership is however attributed by the established battery manufacturing industry in the region especially in China, Japan and South Korea. They are some of the world’s leading battery producers and contain key inputs required for the manufacture of batteries. Further, the policies related to the implementation of EVs and the interconnection of renewables have strengthened the market in Asia-Pacific too. Existence of well developed players in this field along with massive investments on R&D makes the region as battery chemical hub of the world.

Battery Chemicals Market Share, by Geography, 2023 (%)

Active Key Players in the Battery Chemicals Market

o BASF (Germany)

o Cabot Corporation (USA)

o Dow Chemical Company (USA)

o Entegris (USA)

o Hunan Shanshan Energy (China)

o Imerys (France)

o Johnson Matthey (UK)

o Mitsubishi Chemical (Japan)

o Nichia Corporation (Japan)

o POSCO Chemical (South Korea)

o Showa Denko (Japan)

o SK Innovation (South Korea)

o Solvay (Belgium)

o Targray Technology International (Canada)

o Umicore (Belgium)

o Other key Players

Global Battery Chemicals Market Scope:

|

Global Battery Chemicals Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 85.4 Billion |

|

Forecast Period 2024-32 CAGR: |

8.7% |

Market Size in 2032: |

USD 181.0 Billion |

|

Segments Covered: |

By Battery Type |

· Nickel Cadmium Batteries · Zinc Carbon Batteries · Lead Acid Batteries · Lithium Ion Batteries · Alkaline Batteries · Others | |

|

By Chemical Type |

· Cathode Battery Chemicals · Anode Battery Chemicals · Electrolyte Battery Chemicals | ||

|

By End User |

· Automotive Industry · Consumer Electronics · Household Appliances · Security & Monitoring Systems · Utilities & Backup Power | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Rising Adoption of Electric Vehicles (EVs) | ||

|

Key Market Restraints: |

· Supply Chain Challenges and Raw Material Scarcity | ||

|

Key Opportunities: |

· Expansion in Energy Storage Systems (ESS) | ||

|

Companies Covered in the report: |

· BASF (Germany), Cabot Corporation (USA), Dow Chemical Company (USA), Entegris (USA), Hunan Shanshan Energy (China), Imerys (France), Johnson Matthey (UK), Mitsubishi Chemical (Japan) and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Battery Chemicals Market research report?

Answer: The forecast period in the Battery Chemicals Market research report is 2024-2032.

2. Who are the key players in the Battery Chemicals Market?

Answer: BASF (Germany), Cabot Corporation (USA), Dow Chemical Company (USA), Entegris (USA), Hunan Shanshan Energy (China), Imerys (France), Johnson Matthey (UK), Mitsubishi Chemical (Japan) and Other Major Players.

3. What are the segments of the Battery Chemicals Market?

Answer: The Battery Chemicals Market is segmented into Battery Type, Chemical Type, End User and region. By Battery Type, the market is categorized into Nickel Cadmium Batteries, Zinc Carbon Batteries, Lead Acid Batteries, Lithium Ion Batteries, Alkaline Batteries, Others. By Chemical Type, the market is categorized into Cathode Battery Chemicals, Anode Battery Chemicals, Electrolyte Battery Chemicals. By End User, the market is categorized into Automotive Industry, Consumer Electronics, Household Appliances, Security & Monitoring Systems, Utilities & Backup Power. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Battery Chemicals Market?

Answer: The Battery Chemicals Market is a broad segment of products relevant to batteries’ production, ranging from cathode, anode, electrolytes, and some types of separators. These chemicals are critical in defining the abilities, energy magnitude, security, and sturdiness of battery. The popularity of renewable energy sources, electric vehicle and portable consumer electronics has soared –hence, raising the demand for high performing battery chemistries. Advancements in lithium-ion, nickel-metal hydride, nickel-cadmium, and novel solid-state batteries are causing new chemical compositions to be sought. With the market changing dynamically, battery chemicals are shifting to be designed for a variety of possible functions, preparing the market for a sustainable future of energy storage.

5. How big is the Battery Chemicals Market?

Answer: Battery Chemicals Market Size Was Valued at USD 85.4 Billion in 2023, and is Projected to Reach USD 181.0 Billion by 2032, Growing at a CAGR of 8.7% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.