🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Battery Energy Storage Systems Market

Battery Energy Storage Systems Market (By Battery Type (Flywheel battery, Lead acid battery, Lithium-ion Battery, Other Battery Type), By Energy Capacity (Below 100 MWh, Between 100 to 500 MWh, above 500 MWh, Other Battery Capacity), By Connection Type (On-grid, Off-grid, Other Connection Type), By Application (Telecommunication, Data Center, Medical, Industrial, Marine, Other Applications), By Region and Companies)

Aug 2024

Energy and Power

Pages: 138

ID: IMR1201

Battery Energy Storage Systems Market Overview

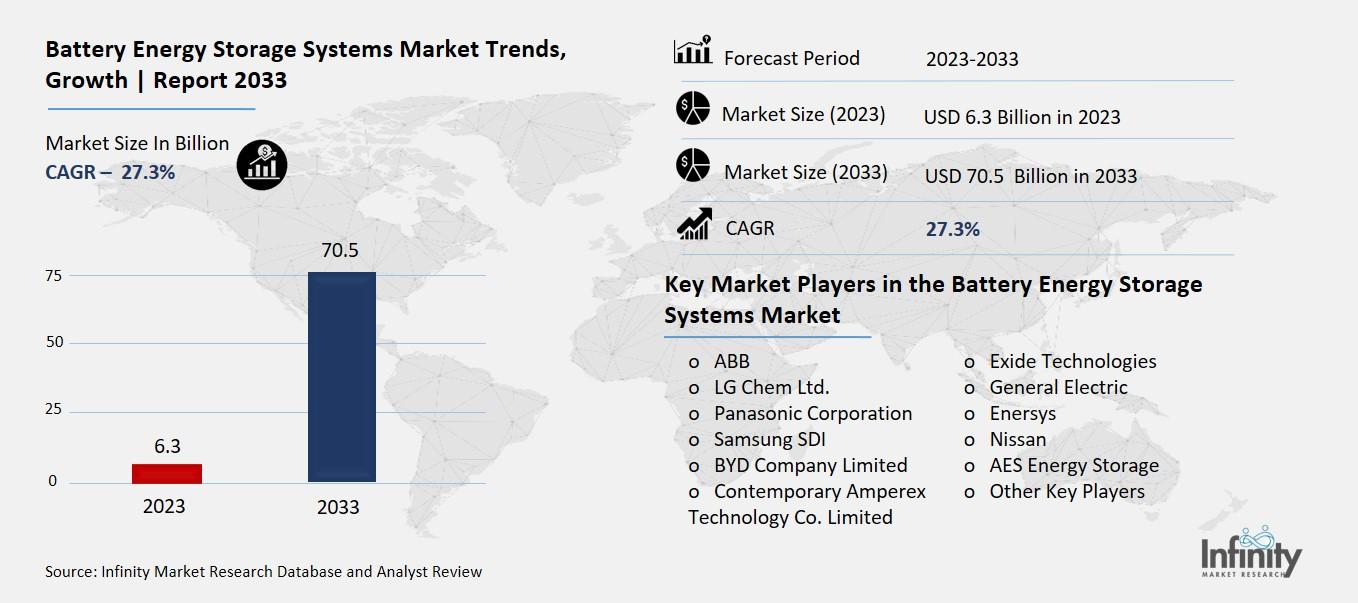

Global Battery Energy Storage Systems Market size is expected to be worth around USD 70.5 Billion by 2033 from USD 6.3 Billion in 2023, growing at a CAGR of 27.3% during the forecast period from 2023 to 2033.

The Battery Energy Storage Systems Market refers to the industry that designs, manufactures, and sells systems used to store energy generated by batteries. These systems are crucial for managing energy supply, particularly from renewable sources like solar and wind power. They help store excess energy when production is high and release it when demand exceeds production, ensuring a stable and reliable energy supply. This market includes a wide range of battery technologies, including lithium-ion, lead-acid, and flow batteries, each with its advantages and applications.

Battery energy storage systems are essential for the transition to renewable energy. They address the intermittent nature of renewable energy sources, providing a solution for when the sun isn’t shining or the wind isn’t blowing. By storing energy, these systems help balance the grid, prevent power outages, and reduce the need for fossil fuel-based power plants. Additionally, they can help lower energy costs and increase the efficiency of energy use in various applications, from residential homes to large industrial facilities. As the world moves towards cleaner energy, the demand for effective and efficient energy storage solutions continues to grow, making this market increasingly important.

Drivers for the Battery Energy Storage Systems Market

Increasing Renewable Energy Integration

One of the primary drivers is the rising integration of renewable energy sources. As the world shifts towards cleaner energy, the need to store energy from intermittent sources like solar and wind has become essential. Battery energy storage systems provide the necessary stability to the grid by storing excess energy and releasing it when needed. This capability helps balance supply and demand, reduces the need for fossil fuel-based power plants, and supports global decarbonization efforts.

Technological Advancements and Cost Reductions

Technological advancements in battery technology have significantly improved the performance and affordability of BESS. The development of lithium-ion batteries, known for their high energy density and long cycle life, has been a game-changer. Continuous research and innovation have led to a decrease in the cost per kilowatt-hour, making these systems more accessible and attractive to a broader range of applications, from residential to industrial uses.

Government Policies and Incentives

Government policies and incentives play a crucial role in driving the adoption of battery energy storage systems. Many countries have implemented regulatory frameworks and financial incentives to promote the deployment of BESS. For instance, the European Union's Clean Energy Package and the U.S. Department of Energy's Grid Modernization Initiative have spurred investments in energy storage projects. These initiatives aim to enhance grid reliability, integrate renewable energy, and reduce carbon emissions.

Growing Electric Vehicle Market

The rapid growth of the electric vehicle (EV) market is another significant driver. As EV adoption increases, the demand for charging infrastructure also rises. Battery energy storage systems are being used to support EV charging stations, especially in areas with limited grid capacity. By providing on-site energy storage, BESS can mitigate the strain on the grid, enable fast charging, and ensure a stable power supply for EVs.

Industrial and Commercial Applications

Battery energy storage systems are increasingly being adopted in industrial and commercial sectors. Businesses are using BESS for various applications such as peak shaving, backup power, and integration with on-site renewable energy systems. These systems help reduce energy costs, enhance energy security, and improve operational efficiency. Industries such as telecommunications, data centers, and manufacturing are particularly benefiting from the deployment of BESS.

Environmental and Sustainability Goals

Environmental concerns and sustainability goals are also driving the demand for battery energy storage systems. As more organizations commit to reducing their carbon footprint and achieving sustainability targets, the adoption of BESS becomes a critical component of their energy strategy. These systems not only support the use of renewable energy but also provide a cleaner and more efficient alternative to traditional backup power solutions like diesel generators.

Restraints for the Battery Energy Storage Systems Market

High Initial Investment Costs

One of the main restraints in the battery energy storage systems (BESS) market is the high initial investment costs. Setting up these systems requires significant capital, making it difficult for smaller enterprises to enter the market. This high cost can be attributed to the advanced technology and materials needed to manufacture and install battery storage solutions. Moreover, integrating these systems with existing power grids adds to the overall expenses, which can deter potential investors and slow market growth.

Technical Challenges and Maintenance

Battery energy storage systems face several technical challenges, such as efficiency losses, degradation over time, and maintenance issues. The efficiency of batteries can decrease over time due to repeated charging and discharging cycles, which leads to reduced storage capacity and the need for frequent replacements. Additionally, maintaining these systems requires specialized skills and knowledge, which can be scarce and expensive. This increases operational costs and can pose a significant barrier to widespread adoption.

Regulatory and Safety Concerns

Regulatory hurdles and safety concerns also pose significant restraints for the BESS market. Different countries have varying regulations regarding the deployment and operation of battery storage systems. Navigating these regulations can be complex and time-consuming. Safety concerns, particularly related to the risk of battery fires or explosions, further complicate the deployment process. Ensuring compliance with safety standards requires additional investment in safety measures, which can increase the overall costs,

Environmental Impact and Disposal Issues

The environmental impact of battery production and disposal is another major restraint. The production of batteries, especially lithium-ion batteries, involves the extraction of raw materials like lithium, cobalt, and nickel, which can have significant environmental consequences. Additionally, the disposal of used batteries poses a challenge due to the hazardous materials they contain. Proper disposal and recycling processes are crucial but often costly and not widely available, which hampers the sustainability of BESS.

Market Competition and Technological Alternatives

Intense market competition and the emergence of alternative technologies also act as restraints. The BESS market is highly competitive, with many established players and new entrants vying for market share. This competition can drive prices down, making it difficult for companies to achieve profitability. Moreover, alternative energy storage technologies, such as flywheel and supercapacitor systems, are continuously being developed and can provide different advantages, potentially reducing the demand for traditional battery storage solutions.

Opportunity in the Battery Energy Storage Systems Market

Growing Demand for Renewable Energy Integration

The Battery Energy Storage Systems (BESS) market is experiencing significant growth due to the increasing adoption of renewable energy sources. As countries and companies strive to reduce their carbon footprints, there is a rising need for efficient storage solutions to manage the intermittent nature of renewable energy like solar and wind. Battery storage systems are essential for storing excess energy generated during peak production times and releasing it when generation is low or demand is high. This capability enhances the reliability and efficiency of renewable energy systems, making BESS a crucial component in the global transition to clean energy.

Technological Advancements Enhancing Efficiency

Technological advancements in battery technology are creating new opportunities in the BESS market. Innovations such as lithium-ion batteries, solid-state batteries, and advanced lead-acid batteries are improving energy density, lifespan, and charging speeds. These improvements make battery systems more viable for a range of applications, from residential to large-scale utility projects. As technology continues to evolve, we can expect further enhancements in performance and cost-effectiveness, driving greater adoption and expanding market potential.

Government Incentives and Support

Government policies and incentives play a significant role in boosting the BESS market. Many governments worldwide are introducing subsidies, tax credits, and financial incentives to encourage the adoption of energy storage systems. These policies are designed to support the integration of renewable energy, improve grid stability, and reduce greenhouse gas emissions. By creating favorable conditions for investment and development, governments are helping to accelerate the growth of the BESS market and drive down costs for consumers and businesses alike.

Rising Demand for Grid Stability and Reliability

The need for improved grid stability and reliability is another factor driving the growth of the BESS market. With increasing energy demands and more frequent extreme weather events, traditional grid infrastructure is facing significant stress. Battery storage systems provide a solution by offering backup power during outages and helping to balance supply and demand. This capability is particularly important for remote areas and regions with unreliable power grids. As the importance of grid resilience continues to grow, so does the demand for advanced storage solutions.

Expansion of the Electric Vehicle Market

The expansion of the electric vehicle (EV) market is also contributing to the growth of the BESS market. As EV adoption increases, the need for efficient charging infrastructure and energy storage solutions becomes more pressing. Battery storage systems are integral to managing the energy requirements of EV charging stations and ensuring a stable power supply. The synergies between EV technology and energy storage are fostering new opportunities for market growth and innovation, benefiting both sectors.

Growing Investment from the Private Sector

Finally, private sector investment is driving the expansion of the BESS market. Venture capital firms, private equity investors, and major corporations are increasingly funding battery storage projects and technologies. This influx of capital supports research and development, accelerates commercial deployment, and facilitates market growth. As private sector interest continues to grow, it will further enhance the market’s potential and drive advancements in battery storage solutions.

Trends for the Battery Energy Storage Systems Market

Increased Focus on Sustainability and Clean Energy

The Battery Energy Storage Systems (BESS) market is trending towards greater emphasis on sustainability and clean energy. As the world faces the challenges of climate change and the push for greener solutions, there is a growing focus on technologies that reduce carbon emissions. Battery storage systems are critical in this context, as they facilitate the use of renewable energy sources like solar and wind, which are inherently clean but intermittent. This trend towards sustainability is driving innovation in battery technologies and increasing their adoption across various sectors.

Advancements in Battery Technologies

Recent years have seen significant advancements in battery technologies, which are shaping the current trends in the BESS market. Innovations such as solid-state batteries, flow batteries, and high-energy-density lithium-ion batteries are enhancing performance and safety. Solid-state batteries, for example, offer greater energy density and longer life compared to traditional lithium-ion batteries, making them ideal for both residential and large-scale applications. These technological advancements are making battery storage more efficient, reliable, and cost-effective.

Growing Integration with Smart Grids

The integration of battery storage systems with smart grid technology is a notable trend. Smart grids use digital technology to manage and improve the efficiency of electricity distribution. When combined with battery storage, smart grids can better balance supply and demand, reduce outages, and optimize energy usage. This synergy allows for more sophisticated energy management strategies and enhances the overall reliability of the power grid. As smart grid technology advances, the role of battery storage systems becomes increasingly vital.

Expansion of Commercial and Industrial Applications

There is a growing trend towards the use of battery energy storage systems in commercial and industrial applications. Businesses are increasingly adopting these systems to manage energy costs, improve operational efficiency, and enhance energy reliability. For example, large commercial facilities are using battery storage to shift energy consumption to off-peak times, thereby reducing electricity bills and easing strain on the grid. This expansion into commercial and industrial sectors is broadening the market's reach and driving new growth opportunities.

Rise of Hybrid Storage Systems

Hybrid storage systems, which combine different types of energy storage technologies, are becoming more popular. These systems can integrate various battery technologies, such as lithium-ion and flow batteries, with other forms of storage like pumped hydro or compressed air. The advantage of hybrid systems is that they can leverage the strengths of each technology to provide more flexible and efficient storage solutions. This trend towards hybrid systems reflects a growing demand for versatile and high-performance storage options.

Increased Investment and Market Competition

Investment in battery energy storage systems is on the rise, with both public and private sectors contributing significantly. Major technology companies, venture capitalists, and government bodies are funding research and development to accelerate innovation and commercialization. This influx of investment is fostering competition in the market, leading to faster advancements and more diverse product offerings. As more players enter the market, competition is likely to drive down costs and enhance the quality of battery storage solutions.

Segments Covered in the Report

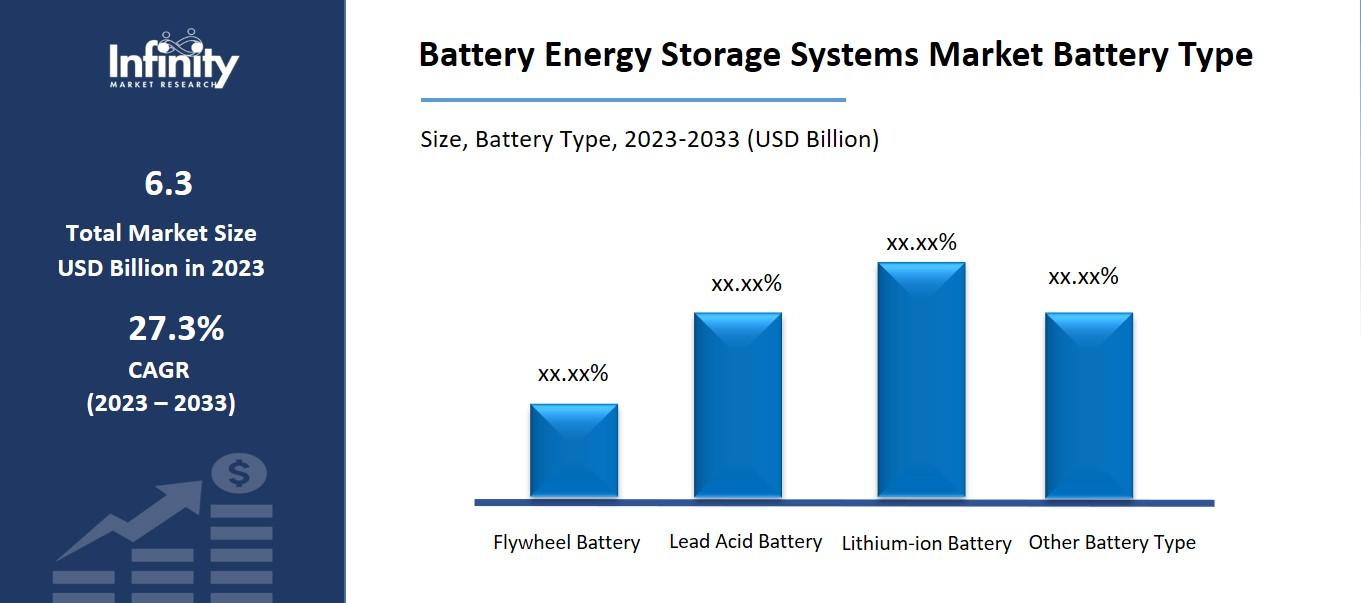

By Battery Type

o Flywheel Battery

o Lead Acid Battery

o Lithium-ion Battery

o Other Battery Type

By Energy Capacity

o Below 100 MWh

o Between 100 to 500 MWh

o Above 500 MWh

o Other Battery Capacity

By Connection Type

o On-grid

o Off-grid

o Other Connection Type

By Application

o Telecommunication

o Data Center

o Medical

o Industrial

o Marine

o Other Applications

Segment Analysis

By Battery Type Analysis

At 54.8% of the market, lithium-ion batteries had the biggest revenue share. Because of their small weight, inexpensive cost, and restricted coverage area, lithium-ion batteries are expected to become more and more in demand for energy storage systems. In the upcoming years, the market expansion for lithium-ion battery energy storage systems will also be supported by rising infrastructure spending from the residential, commercial, and industrial sectors.

Toshiba Corporation, Panasonic Corporation, Hitachi Chemical Co. Ltd., GS Yuasa International Ltd., Samsung SDI Co. Ltd., LG Chem Power (LGCPI), and China BAK Battery Co. Ltd. are some of the major producers of Li-ion batteries. Applications for lithium-ion batteries include backup power sources, UPSs, wind and solar power storage, autonomous guided vehicles, and battery forklift trucks.

When it comes to battery energy storage systems, lead-acid batteries hold the second-largest revenue share in the industry. Because lead-acid batteries are easier to make using relatively low-tech equipment and are comparatively less expensive than other batteries, system expansion will be fueled by them shortly. Over the next seven years, however, the development of Li-ion batteries and fluctuating raw material prices are anticipated to impede the segment's growth.

Flywheel battery technology is anticipated to expand at the quickest rate due to its ability to provide the grid with a constant, uninterrupted power supply as well as instantaneous response, frequency regulation, and improved electricity quality. Compared to alternative battery options, flywheel batteries are more cost-effective. This is primarily because, in comparison to the battery, the flywheel has a longer service life and requires less maintenance, which makes up for its higher initial installation costs.

By Energy Capacity Analysis

The market has been divided into three segments based on energy capacity category analysis: below 100 MWh, between 100 and 500 MWh, and above 500 MWh. In 2023, the battery energy storage system segment with a market share exceeding 500 MWh held the greatest share, around 55.8%.

Large factories, oil and gas exploration firms, the utility industry, and other places with significant energy demand are the primary locations for the installation of batteries with a capacity greater than 500 MWh. For industrial applications, a practical way to get a steady power supply is with a battery that is larger than capacity. These batteries also provide long-term cost savings, grid stability and reliability, and encouragement of the use of renewable energy sources.

By Connection Type Analysis

At almost 62.6% of the market share in 2023, on-grid connections dominated the battery energy storage systems (BESS) market. On-grid technologies play a critical role in peak demand management, main power grid stabilization, and the effective integration of renewable energy sources such as wind and solar power.

An additional segment that serves locations without access to the main power grid is off-grid connections. Reliable power supply in remote areas or places where it is difficult to create traditional power infrastructure is made possible by off-grid BESS technologies.

The noteworthy commercial supremacy of On-grid connections underscores their vital function in stabilizing power grids and facilitating the integration of renewable energy sources. In contrast, off-grid connections are essential for guaranteeing dependable power access in isolated or underdeveloped places where conventional power supply alternatives are scarce.

By Application Analysis

The data center application category is anticipated to grow at a significant compound annual growth rate (CAGR) throughout the forecast period, from its market share of 38.9% in 2023. An uninterruptible power source is crucial for data centers. The losses brought on by such a power outage are enormous. An estimated USD 50.0 billion is lost each year in the United States alone as a result of power outages and associated issues.

Energy dips and spikes are examples of irregularities that might negatively impact data center equipment and cause losses. In addition to filtering power that enters the UPS and modifying the output to ensure a steady and uninterrupted supply reaches the internal systems, a line-interactive UPS system can also function as a refiner.

The telecom industry's transition from diesel generators to highly efficient batteries is anticipated to support the market expansion for battery energy storage systems. Contracts between telecom industry participants and battery energy storage system manufacturers enable a consistent and economical power supply. Telecom tower installations have increased as a result of growing telecom subscriptions, and this is anticipated to have a favorable impact on the market for battery energy storage systems.

Regional Analysis

In 2023, the Asia Pacific market held a substantial revenue share of 42.9%. In growing economies, there is a greater demand for power due to rapid population growth. Over the next seven years, grid operators will be using battery energy storage devices to improve grid flexibility and reduce power disruptions.

The need for distributed power generation in various Asia Pacific economies is predicted to rise in tandem with the increasing penetration of renewable energy, which will accelerate the expansion of the regional industry. When demand is at its highest, excess renewable energy is stored in battery systems and used to generate electricity locally and supply the grid.

Furthermore, the Asia-Pacific region's nations including Australia, South Korea, China, Japan, India, and others—are exhibiting rapid urbanization and population expansion, which tends to raise the power demand. As a result, during the projection period, the demand for a steady supply of electricity is rising, which supports the expansion of the battery energy storage market in the area.

With the United States playing a vital role in the region's growth, North America holds the second-largest proportion of the market for battery energy storage systems. The safety of these energy storage systems is one of the top concerns for industry executives since energy storage has become a vital component of all energy planning in the United States due to the increasing number of utilities and organizations. The explosion at a Public Service plant in Arizona prompted the need for uniform safety standards for the integration and monitoring of energy storage systems.

Competitive Analysis

To expand their product lines, major market players are heavily investing in research and development, which will propel the battery energy storage systems market's growth. To expand their global reach, market players are also pursuing a variety of strategic measures, such as joint ventures, product launches, contracts, mergers and acquisitions, higher investments, and cooperation with other institutions. Battery Energy Storage Systems Market rivals need to provide reasonably priced goods to grow and endure in a market that is becoming more and more competitive.

Recent Developments

In June 2022: General Electric revealed the construction of a renewable hybrid factory, increasing its ability to produce power electronics solutions for solar and battery energy storage. In the unlikely event that the report mentioned above does not precisely match your needs, we will tailor the research for you.

December 2023: For a grid-scale battery energy storage project, Namibia Power Corporation (NamPower) signed major EPC contracts with Narada Power and Shandong Electrical, Engineering, and Equipment Group (SDEE). The 54MW/54MWh battery energy storage system (BESS) is anticipated to be delivered to Namibia's Omburu substation in the Erongo region by the joint venture between the two Chinese companies.

Key Market Players in the Battery Energy Storage Systems Market

o ABB

o LG Chem Ltd.

o Samsung SDI

o BYD Company Limited

o Contemporary Amperex Technology Co. Limited

o Exide Technologies

o General Electric

o Enersys

o Nissan

o AES Energy Storage

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 6.3 Billion |

|

Market Size 2033 |

USD 70.5 Billion |

|

Compound Annual Growth Rate (CAGR) |

27.3% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2029-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Battery Type, Energy Capacity, Connection Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

ABB, LG Chem Ltd., Panasonic Corporation, Samsung SDI, BYD Company Limited, Contemporary Amperex Technology Co. Limited, Exide Technologies, General Electric, Enersys, Nissan, AES Energy Storage, Other Key Players |

|

Key Market Opportunities |

Growing Demand for Renewable Energy Integration |

|

Key Market Dynamics |

Technological Advancements and Cost Reductions |

📘 Frequently Asked Questions

1. How much is the Battery Energy Storage Systems Market in 2023?

Answer: The Battery Energy Storage Systems Market size was valued at USD 6.3 Billion in 2023.

2. What would be the forecast period in the Battery Energy Storage Systems Market?

Answer: The forecast period in the Battery Energy Storage Systems Market report is 2023-2033.

3. Who are the key players in the Battery Energy Storage Systems Market?

Answer: ABB, LG Chem Ltd., Panasonic Corporation, Samsung SDI, BYD Company Limited, Contemporary Amperex Technology Co. Limited, Exide Technologies, General Electric, Enersys, Nissan, AES Energy Storage, Other Key Players

4. What is the growth rate of the Battery Energy Storage Systems Market?

Answer: Battery Energy Storage Systems Market is growing at a CAGR of 27.3% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.