🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

BDP Flame Retardants Market

BDP Flame Retardants Market Global Industry Analysis and Forecast (2024-2032) By Type ( Halogenated, Non-halogenated),By Application( Plastics, Textiles, Coatings, Electronics, Others),By End-User Industry( Building & Construction, Automotive, Electronics & Electrical, Industrial, Furniture, Others) and Region

Jan 2025

Chemicals and Materials

Pages: 138

ID: IMR1611

BDP Flame Retardants Market Synopsis

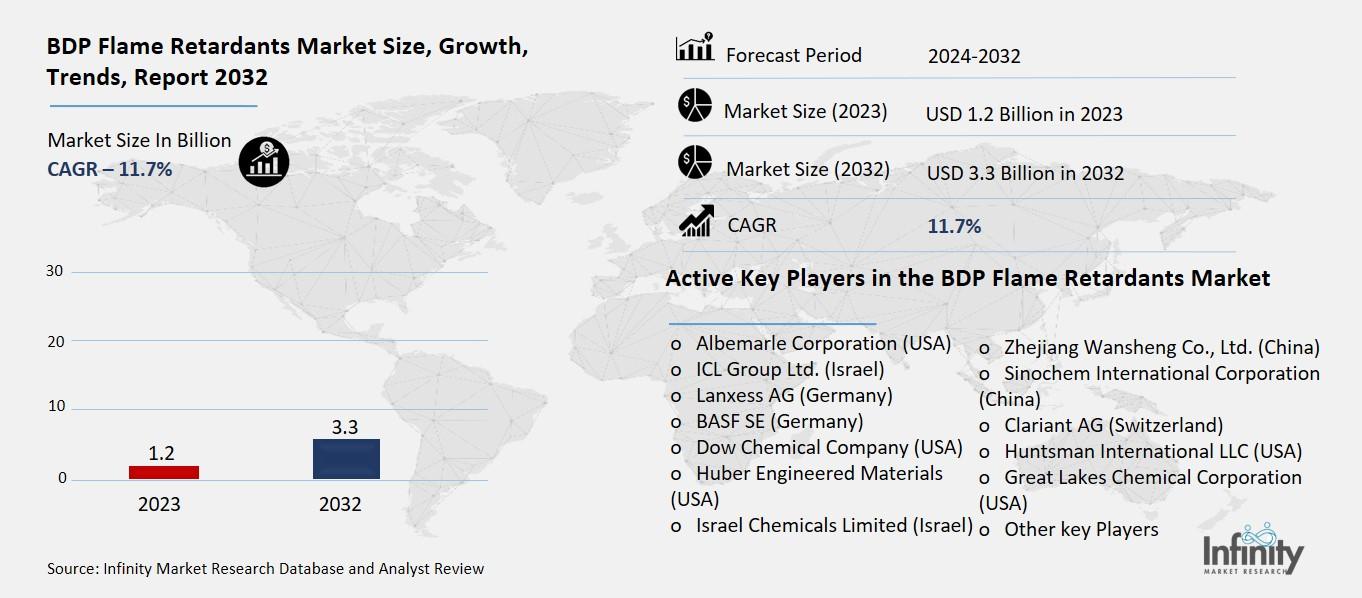

BDP Flame Retardants Market Size Was Valued at USD 1.2 Billion in 2023, and is Projected to Reach USD 3.3 Billion by 2032, Growing at a CAGR of 11.78% From 2024-2032.

BDP or Brominated Diphenyl Ether flame retardants market is the application of chemicals particularly the brominated compounds that when added to substrates such as plastic, textile or electronic material prevent the substrates from igniting or slows down the process of burning. BDP flame retardants are widely used in automotive, construction and electronics industries to meet and/or exceed regulatory measures on fire danger and enhance fire safety on various applications.

The operational flame retardants market in BDP is also gradually expanding because of the rising demand for fire protective materials in construction, electronics, automobile and textile application segments. With increasing number of restrictions on safety from fire around the world, the application of flame retardants has become inevitable. BDP flame retardants containing bromine show high efficiency in terms of an inhibitory effect on fire spread. These compounds are utilized to treat many materials such as plastics, textiles and coatings that improve the fire resistance of these material. Consequently, they enable the manufacturers to meet the safety requirements of their products and prevent fire incidences.

BDP flame retardants are also experiencing gradual expansion in the global market as people become more conscious of fire risks and fire standards are implemented increasingly around the globe. Technical advancements in flame retardant technology therefore enabling development of lighter and high performance materials in industries such electronics also influence market growth. BDP for instance has wide usability in many industrial fields as a flame retardant that offers protection against fire besides conforming to set norms.

In addition, regulatory and environmental aspects are driving the creation of new more environmentally sound flame retardants. Even though flame retardants like BDP are effective, their use is restricted by their possible negative effects on the environment and health so that safe replacements have been sought. Substitutes in vacuum of these concerns are non-halogenated flame retardants for traditional brominated compounds being developed in the market.

The need for BDP flame retardants is expected to remain high to answer to the emerging concerns in the growing industries including construction, electronics, and automotive among others, which should embrace fire safety. , nonethe same it suffers from some threats which include, Regulatory policies on the adverse effects of brominated compounds on the environment, threat from non-halogenated substitutes. The imitative pressure, propelled by production functions is a canonical example that has forced manufacturers to consider efficiency into sustainability while seeking innovation in flame retardants market.

BDP Flame Retardants Market Outlook, 2023 and 2032: Future Outlook

BDP Flame Retardants Market Trend Analysis

Trend: Sustainable and Non-Halogenated Alternatives

As the concern of the environment in the use of Halogenated Flame Retardants BDP increases, the market of non-halogenated have been increasing. Flame retardants which are non-halogenated are considerably safer for human beings and the environment because they are free from the dangerous halogenated products when they catch fire. This change is compelling industries to seek flame retardant which are efficient for prevention of fire and are relatively not hazardous to the environment.

As more and more clients realize the potential hazards of using flame retardants and as more and more countries put bans and reinforcemenst on the use of those products, there has been a growing trend among manufacturers to formulate new and improved so-called non-halogenated flame retardants that exhibit similar or even better fire resistance than halogenated compounds such as BDP. These FR are thus obtained from diverse natural and synthetic sources and have little or no harm on the environment. Forworld non-halogenated flame retardants are expected to dominate the market and especially in the regions where regulation on environmental standards is tight.

Opportunity: Regulatory Compliance and Growing Demand in Electronics

The rising usage of flame retardants in electronics vertical adds an opportunity to the BDP flame retardants market. It is evident that as the electronics industry grows and new products are produced especially client electronics there is HUGE demand for more heat excursion and better flame retardants. They are commonly employed in electronics products such as circuit boards, cables and housings for product safety applications.

Also, there is a new trend of electronics industry around the world with new generation compact in size energy efficient with high performing attributes. The miniaturization of electronics is seen as the motion towards having more sophisticated devices and this means that chances of having fires breakout due to overheating are very high and this implies that better fire safety solutions are needed. Since consumers are looking for better flame retardant solutions in BDP flame retardants market, it will open a good chance for companies to meet the growing needs especially those regions that have stringent rules on regulating fire hazards on electronic products.

Driver: Stringent Fire Safety Regulations

The leading factor that will fuel the BDP flame retardants market is the rising standard of fire prevention policies in a range of sectors. Accompanying the increased usage, governments across the globe have heightened their standards on contents that may be used for construction or other structures including vehicles, electronics and other zones considered to be challenging and risky. Such regulations are putting a lot of pressure on the manufactures to put fire retardants that have capability to reduce the possibility of fire in the bodies, particularly in plastics, textiles, and coatings.

As these safety regulations tightens, the market for flame retardants especially for effective ones like BDP will still experience an uplift. As for the scrap application, construction and automotive industries are most affected by flame retardant regulations and boosting the BDP flame retardants market. It means that regulation by moving towards safer fire resistant materials ensures the flame retardants remain an important component in many industries.

Restraints: Environmental and Health Concerns

Although BDP flame retardants have been known to be useful, there is a lot of pushback because of the environmentally unfriendly effects or potentially adverse health effects. BDP for instance falls under the class of brominated compounds that can build up in the environment and available data points that the compound may be potentially hazardous to human beings especially whenever its disposal is done or when one is exposed to it for long term. Such factors have raised questions in some of the regions and this might affect the development of the BDP flame retardants market.

Because environmental and health issues amplify in importance, specialized agencies make efforts to restrain the application of flame retardants, including BDP. The above has in turn shifted the market focus to non-halogenated type as they are thought to be safer to the environment and human use. The main issue of the market, which resulted from the evolvement of the demand among consumers and tendency of manufacturers towards phasing of halogenated flame retardants, is that manufacturers face a new regulation.

BDP Flame Retardants Market Segment Analysis

BDP Flame Retardants Market Segmented on the basis of type, application and end user.

By Type, Halogenated segment is expected to dominate the market during the forecast period

The BDP flame retardants market is categorized into two primary types: Halogenated and non-halogenated flame retardants. BDP and other related halogenated flame retardants are excellent flame retardants, which are widely used in rotating applications in various fields, especially in electronic, automotive, and construction industries. But, these compounds are on the spotlight due to issues of environmental and health concerns.

On the other hand, non halogenated FRs are becoming prevalent in the market as environmentally friendly alternatives due to pertinent environmental standards and customer pressure. This is in spite of the fact that the non-halogenated flame retardants may not be able to achieve the same performance level as the halogenated flame retardants in some of the use formulations, developments in the non-halogenated flame retardants formulations are gradually closing the performance gap. The demand for halogen-free flame retardants should rise in the future as more markets and laws will be influenced by environmental issues.

By Application, Plastics segment expected to held the largest share

BDP flame retardants is divided by its application area which are polymer and resin, textile and apparel, coating and others. Construction, automotive, and electronics are significant end user for flame retardants especially plastics that take approximately 38% of the application share. BDP as a Flame retardants assist in non ignition of plastic material and assist in controlling fire making it an important addition for any safety standard.

As a fire protector in textiles, BDP flame retardants work to increase fire resistant characteristics of materials such as upholstery or curtain and fabrics in general. There is increased demand for flame retardants in coatings, which are added to make paints and finishes applied to different surfaces less flammable. Flame retardants such as BDP are used in the electronics industry for printed circuit boards and cables as well as for housing applications to reduce fire hazards of consumer and industrial products.

BDP Flame Retardants Market Regional Insights

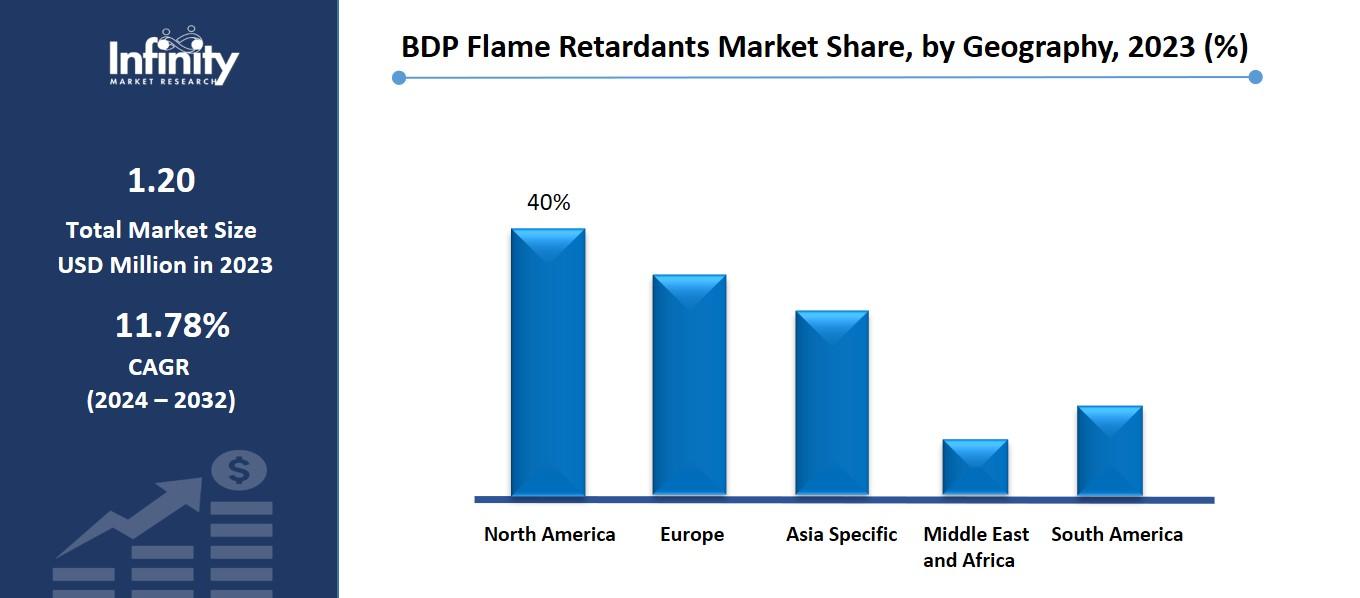

North America is Expected to Dominate the Market Over the Forecast period

The flame retardants market in BDP is most prominent in North America due to strict fire safety norms and a need for appliance flame retardant products particularly in construction industry, electronics and automotive electronics industries. Flame retardants are used extensively in the region owing to the strong manufacturing industry and the technology that insists on its use.

Furthermore, North America has good legislation covering fire safety standards which has in turn driven the need for flame retardants such as BDP. Moreover, the high concern for sustainability concurrently with the safety environment among the regional markets is continuing to spur development of non-halogenated flame retardants, in addition to boosting the frequency of new innovations of the product line.

BDP Flame Retardants Market Share, by Geography, 2023 (%)

Active Key Players in the BDP Flame Retardants Market

o Albemarle Corporation (USA)

o ICL Group Ltd. (Israel)

o Lanxess AG (Germany)

o BASF SE (Germany)

o Dow Chemical Company (USA)

o Huber Engineered Materials (USA)

o Israel Chemicals Limited (Israel)

o Zhejiang Wansheng Co., Ltd. (China)

o Sinochem International Corporation (China)

o Clariant AG (Switzerland)

o Huntsman International LLC (USA)

o Great Lakes Chemical Corporation (USA)

o Other key Players

Global BDP Flame Retardants Market Scope

|

Global BDP Flame Retardants Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.2 Billion |

|

Forecast Period 2024-32 CAGR: |

11.78% |

Market Size in 2032: |

USD 3.3 Billion |

|

Segments Covered: |

By Type |

· Halogenated · Non-halogenated | |

|

By Application |

· Plastics · Textiles · Coatings · Electronics · Others | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Stringent Fire Safety Regulations | ||

|

Key Market Restraints: |

· Environmental and Health Concerns | ||

|

Key Opportunities: |

· Regulatory Compliance and Growing Demand in Electronics | ||

|

Companies Covered in the report: |

· Albemarle Corporation (USA), ICL Group Ltd. (Israel), Lanxess AG (Germany), BASF SE (Germany), Dow Chemical Company (USA), Huber Engineered Materials (USA), Israel Chemicals Limited (Israel), Zhejiang Wansheng Co., Ltd. (China) and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the BDP Flame Retardants Market research report?

Answer: The forecast period in the BDP Flame Retardants Market research report is 2024-2032.

2. Who are the key players in the BDP Flame Retardants Market?

Answer: Albemarle Corporation (USA), ICL Group Ltd. (Israel), Lanxess AG (Germany), BASF SE (Germany), Dow Chemical Company (USA), Huber Engineered Materials (USA), Israel Chemicals Limited (Israel), Zhejiang Wansheng Co., Ltd. (China) and Other Major Players.

3. What are the segments of the BDP Flame Retardants Market?

Answer: The BDP Flame Retardants Market is segmented into Type, Application, End User and region. By Type, the market is categorized into Halogenated, Non-halogenated. By Application, the market is categorized into Plastics, Textiles, Coatings, Electronics, Others. By End-User Industry, the market is categorized into Building & Construction, Automotive, Electronics & Electrical, Industrial, Furniture, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the BDP Flame Retardants Market?

Answer: BDP or Brominated Diphenyl Ether flame retardants market is the application of chemicals particularly the brominated compounds that when added to substrates such as plastic, textile or electronic material prevent the substrates from igniting or slows down the process of burning. BDP flame retardants are widely used in automotive, construction and electronics industries to meet and/or exceed regulatory measures on fire danger and enhance fire safety on various applications.

5. How big is the BDP Flame Retardants Market?

Answer: BDP Flame Retardants Market Size Was Valued at USD 1.2 Billion in 2023, and is Projected to Reach USD 3.3 Billion by 2032, Growing at a CAGR of 11.78% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.