🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Bioalcohol Market

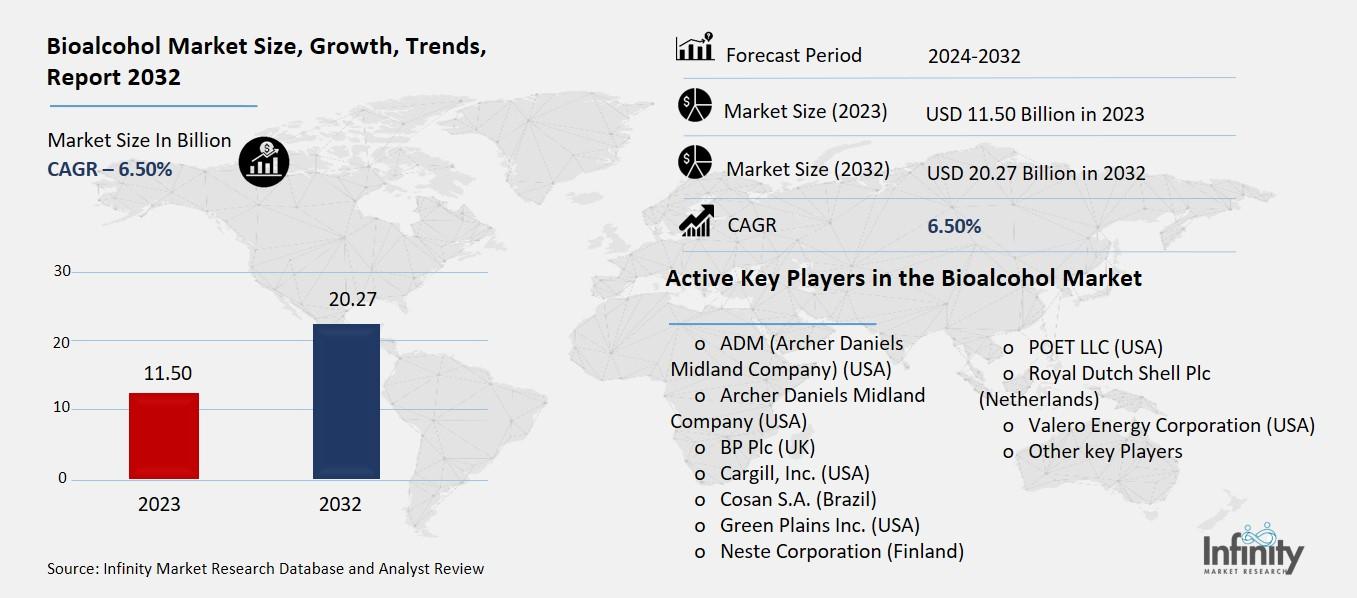

Bioalcohol Market Global Industry Analysis and Forecast (2024-2032) By Type (Ethanol, Butanol, Methanol, Others), By Source (Sugar Crops, Starch Crops, Cellulosic Biomass, Algae, Others), By Application (Automotive Fuel, Industrial Solvents, Pharmaceuticals, Food & Beverages, Cosmetics & Personal Care, Others) and Region

Jan 2025

Chemicals and Materials

Pages: 138

ID: IMR1481

Bioalcohol Market Synopsis

Bioalcohol Market Size Was Valued at USD 11.50 Billion in 2023, and is Projected to Reach USD 20.27 Billion by 2032, Growing at a CAGR of 6.50 % From 2024-2032.

The Bioalcohol market relates to the marketing of alcohols synthesized from biological materials, used predominantly as fuel, solvent and in other commercial uses. The Bioalcohol entail ethanol, butanol, and methanol and are manufactured through fermentation or distillation of biomass, they are thus a sustainable source of energy in replacement of fossil energy. The market is further fuelled by the environmental concerns, customer demand for sustainable and low carbon products, and the global directors towards clean energy.

The market for bioalcohol has expanded hugely over the course of few years mainly in line with the market trends of using renewable energy and to reduce carbon footprint. Ethanol is currently the most consumed bioalcohol in the global market with primary use in the transportation sector. Bio-based solutions are mushrooming in the market with increasing investments resulting from governments’ efforts to encourage for the reduction on fossil fuel usage. The growth of the bioalcohol market is also facilitated by new technologies that have increased bioalcohol production and its uses.

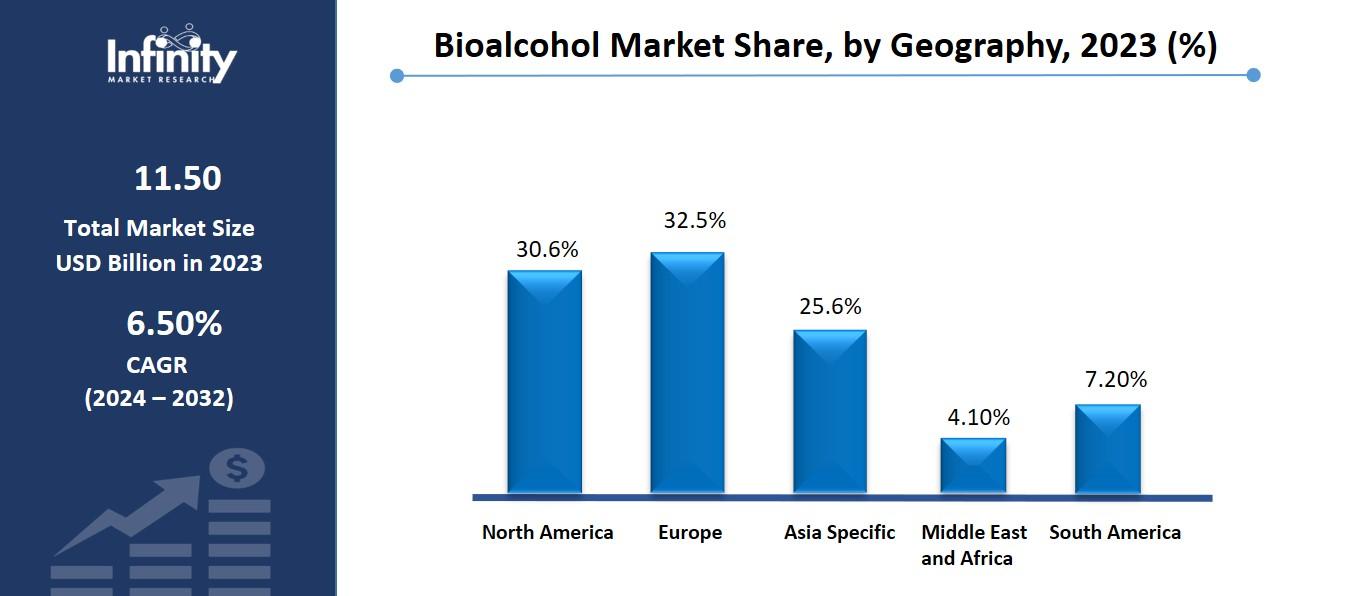

By region, North America and Europe control he bulk of bioalcohol production due to its large scale ethanol production and an existing use of biofuel. On the other hand, Asia Pacific region has revealed a massive potential as bioalcohol markets proceed with industrialization and energy necessity. Forces like increasing consumer consciousness towards clean power, together with regulatory and environmental trends supporting the shift to clean energy, will remain major forces behind bioalcohol production and usage globally.

Bioalcohol Market Outlook, 2023 and 2032: Future Outlook

Bioalcohol Market Trend Analysis

Shift Towards Advanced Biofuels

The trends found in the bioalcohol are first generation bioalcohol from sugar and starchy feedstocks, but the focus is now shifting to second and third generation bioalcohol like butanol and cellulosic ethanol produced from ligno cellulosic feed stocks including agricultural residues and waste. The shift is mainly attributed by changes in consumer perception and increase in awareness on food security and food production. Studies are also being done to enhance the processes required to produce bioalcohol such as advancing fermentation procedures and advanced biomass conversion methods.

Bioalcohols are another notable trends that started coming to the market recently and its usage goes beyond energy and goes to pharma, cosmetic, and food and beverages. Many industries are looking for new areas for application given the unique qualities bioalcohols possess, these include solvents preservatives and flavours. This diversification of applications are expected over the years to propel the market as industries look for the green options to conventional chemicals and fuels.

Rising Demand for Renewable Energy Solutions

The latest trend that is having a positive influence over the bioalcohol market is the search for fresh sources of energy that are eco-friendly and renewable, to minimize carbon emissions and the usage of fossil fuel. Bioalcohols, especially ethanol, therefore continues to be used in place of gasoline and diesel in the transport sector with a view of reducing emission. Other industry drivers include government regulations that support the use of renewable power sources such as wind, solar and hydroelectricity for car manufactures and subsidies for bio fuel producers, tax pleasures for manufactures of bio alcohol are also stimulating the growth of the bioalcohol market.

Also, innovation in technology for bioalcohol production is propelling the market which is making the prices of biofuels comparable with normal fuels. The advancements in the technologies of feedstock conversion for second and third generation biofuels including cellulosic ethanol production and algae-based feedstock biofuels, have brought bioalcohols closer to become feasible for large scale energy solutions. These technological advancements assist to bring down costs of production and increase availability of raw materials that bioalcohols can be made from so as to penetrate more markets all over the world.

High Production Costs and Feedstock Competition

However, the market for bioalcohols has been facing a few challenges of which high costs of biofuel production from food crops is a major flaw. Although biofuels are on the increase, the conflict for farmland between food and energy crops brings the price of raw materials into focus. Besides, objections to biofuel production with regard to environmental impacts, including deforestation, or water consumption may check its expansion in some areas. Such matters could slow down the use of bioalcohols as the conventional source of energy.

The fourth regulation is high reliance on government support and policies the supply of which can be unpredictable depending on the political context. Currently, the bioalcohol market depends on savvy measures like tax credits, subsidies for producers as well as blending requirements for bioalcohol with gasoline. If any of these policies are cut down or completely done away with, then there will be a slowdown of the markets. In addition, availability of raw materials, which is an important determining factor in production of bioalcohol may be threatened by market factors such as trade barriers or tensions.

Expanding Bioalcohol Markets in Emerging Economies

The scope of the bioalcohol market has a vast potential for expansion especially in the developing countries for the simple reason that people are realizing the necessity for renewable and less harming sources of energy. If the Asia Pacific and Latin America continue to industrialize, the demand for the biofuels will rise leading to more opportunities to produce bioalcohol. Besides, global governments are determined to add more renewable power quotas thus making bioalcohols leverage such policies for market growth.

In addition, there are significant market opportunities in the Research and Development for second generation biofuels especially using algae and other biomass materials. These sources can solve the food vs fuel problems and offer a better supply of bioalcohols free from the controversies. The growing acceptance of bioalcohols to be used in industrial sectors such as pharmaceuticals, cosmetics and food & beverages also symbolises a maturing market for the producers bioalcohol to expand into.

Bioalcohol Market Segment Analysis

Bioalcohol Market Segmented on the basis of By Type, By Source and By Application.

By Type, Ethanol segment is expected to dominate the market during the forecast period

Bioalcohols are ethanol, butanol, methanol, and any other form of alcohol customary within the chemical series. Ethanol is the most produced and consumed bioalcohol globally, and is majorly utilised in transportation fuel. Butanol is the other alcohol that is being considered for use as a biofuel because of its superior energy content to ethanol. Methanol is mainly an intermediate in the chemical industry but is also claimed as a new generation bio-fuel. Other bioalcohols may include isopropanol and propanol, although are not frequently used in biofuel production.

By Source, Sugar Crops segment expected to held the largest share

Bioalcohols come out from different feedstock categories but sugar-based crops such as sugarcane and corn are the most frequently utilized feedstock for ethanol. Wheat and barley are also employed here, but they’re less efficient than sugar crops would be. Another important source of feedstock is cellulosic biomass that encompasses agricultural residues and forestry waste because of their better prospects in a sustainable biofuel production. Algae and him other non-food feedstocks are appearing as new opportunities to yield bioalcohols in ways that do not intrude with the production of food crops.

Bioalcohol Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

North America bioalcohol market is led by United State where ethanol takes precedence as the bioalcohol used in transportation fuels. The General The U.S has an advanced biofuel infrastructure aided by policies like the Renewable Fuel Standard (RFS) that requires incorporation of biofuel and gasoline. It has encouraged competition among producers and major players have set capacity plants for ethanol production. Consumption of bio fuels particularly in the transportation industry is expected to continue growing strongly because of favourable policies, rising consumer consciousness for environment friendly products and ongoing campaigns to minimize carbon footprint.

Canada similarly to Brazil but on a smaller scale is a dynamically developing market for bioalcohols, including ethanol. In this case, the Canadian government has laid down renewable energy standards and comes with various measures to promote investments in biofuel production. Contrary to the large market of the United States, the Canadian market is also expanding towards the ethanol blending especially to transportation fuels. Further growth in the North American bioalcohol market is expected to be stimulated by technological development of bioalcohol specifically cellulosic ethanol and algae based.

Bioalcohol Market Share, by Geography, 2023 (%)

Active Key Players in the Bioalcohol Market

o ADM (Archer Daniels Midland Company) (USA)

o Archer Daniels Midland Company (USA)

o BP Plc (UK)

o Cargill, Inc. (USA)

o Cosan S.A. (Brazil)

o Green Plains Inc. (USA)

o Neste Corporation (Finland)

o POET LLC (USA)

o Royal Dutch Shell Plc (Netherlands)

o Valero Energy Corporation (USA)

o Other key Players

Global Bioalcohol Market Scope

|

Global Bioalcohol Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 11.50 Billion |

|

Forecast Period 2024-32 CAGR: |

6.50% |

Market Size in 2032: |

USD 20.27 Billion |

|

Segments Covered: |

By Type |

· Ethanol · Butanol · Methanol · Others | |

|

By Source |

· Sugar Crops · Starch Crops · Cellulosic Biomass · Algae · Others | ||

|

By Application |

· Automotive Fuel · Industrial Solvents · Pharmaceuticals · Food & Beverages · Cosmetics & Personal Care · Others | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Technological Advancements in Bioalcohol Production | ||

|

Key Market Restraints: |

· Government Policy Dependency and Market Uncertainty | ||

|

Key Opportunities: |

· Innovation in Non-Food Feedstocks and Advanced Biofuels | ||

|

Companies Covered in the report: |

· Archer Daniels Midland Company (USA), Cargill, Inc. (USA), POET LLC (USA), Green Plains Inc. (USA), Royal Dutch Shell Plc (Netherlands), BP Plc (UK), Neste Corporation (Finland), Valero Energy Corporation (USA), ADM (Archer Daniels Midland Company) (USA), Cosan S.A. (Brazil). and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Bioalcohol Market research report?

Answer: The forecast period in the Bioalcohol Market research report is 2024-2032.

2. Who are the key players in the Bioalcohol Market?

Answer: Archer Daniels Midland Company (USA), Cargill, Inc. (USA), POET LLC (USA), Green Plains Inc. (USA), Royal Dutch Shell Plc (Netherlands), BP Plc (UK), Neste Corporation (Finland), Valero Energy Corporation (USA), ADM (Archer Daniels Midland Company) (USA), Cosan S.A. (Brazil). and Other Major Players.

3. What are the segments of the Bioalcohol Market?

Answer: The Bioalcohol Market is segmented into By Type, By Source, By Application and region. By Type, the market is categorized into Ethanol, Butanol, Methanol, Others. By Source, the market is categorized into Sugar Crops, Starch Crops, Cellulosic Biomass, Algae, Others. By Application, the market is categorized into Automotive Fuel, Industrial Solvents, Pharmaceuticals, Food & Beverages, Cosmetics & Personal Care, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Bioalcohol Market?

Answer: The Bioalcohol market relates to the marketing of alcohols synthesized from biological materials, used predominantly as fuel, solvent and in other commercial uses. The Bioalcohol entail ethanol, butanol, and methanol and are manufactured through fermentation or distillation of biomass, they are thus a sustainable source of energy in replacement of fossil energy. The market is further fuelled by the environmental concerns, customer demand for sustainable and low carbon products, and the global directors towards clean energy.

5. How big is the Bioalcohol Market?

Answer: Bioalcohol Market Size Was Valued at USD 11.50 Billion in 2023, and is Projected to Reach USD 20.27 Billion by 2032, Growing at a CAGR of 6.50 % From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.