🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Calcium Carbonate Market

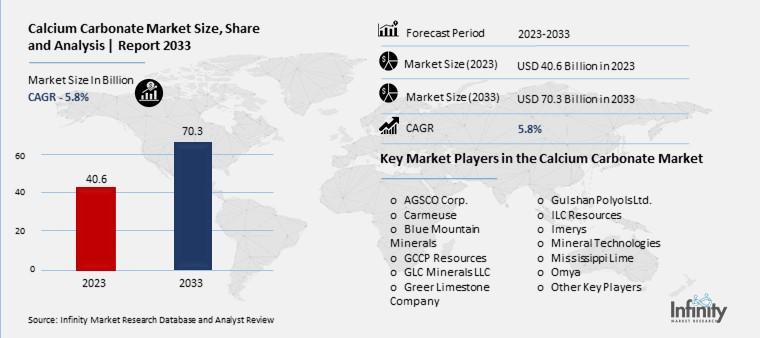

Calcium Carbonate Market (By Type (Ground Calcium Carbonate, Precipitated Calcium Carbonate, Other Types), By Application (Automotive, Building & Construction, Pharmaceutical, Agriculture, Pulp & Paper, Other Applications), By Region and Companies)

Jul 2024

Chemicals and Materials

Pages: 216

ID: IMR1164

Calcium Carbonate Market Overview

Global Calcium Carbonate Market size is expected to be worth around USD 70.3 Billion by 2033 from USD 40.6 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2023 to 2033.

The calcium carbonate market revolves around the production, sale, and use of calcium carbonate, a naturally occurring mineral found in rocks like limestone, chalk, and marble. This market includes industries that extract and process calcium carbonate for various applications. Calcium carbonate is used widely in different sectors, such as construction, where it is a key component in cement and concrete. It's also used in the paper industry as a filler and coating material to make the paper smooth and bright. Additionally, it has applications in the plastics, paints, and coatings industries due to its properties as a white pigment and filler material.

Calcium carbonate is also important in the healthcare and food industries. In healthcare, it is used as a calcium supplement and an antacid. In the food industry, it acts as a dietary calcium additive and a firming agent. The market is driven by the growing demand from these diverse applications. Regions with large construction activities, such as Asia-Pacific, particularly China and India, are major consumers. The market is also influenced by factors like the availability of raw materials, technological advancements in extraction and processing, and environmental regulations related to mining and manufacturing processes.

Drivers for the Calcium Carbonate Market

Rising Demand in the Paper Industry

One of the main drivers for the calcium carbonate market is its extensive use in the paper industry. Calcium carbonate is used as a filler and coating pigment to produce high-quality paper with enhanced brightness, opacity, and smoothness. The shift from kaolin to calcium carbonate in the paper industry, especially for producing lighter and glossier papers, has significantly boosted its demand. The increasing consumption of paper in packaging, printing, and writing applications, particularly in emerging markets, is driving the growth of the calcium carbonate market.

Growth in the Plastics Industry

Calcium carbonate is widely used as a filler in the plastics industry to improve the properties of plastic products and reduce production costs. It enhances the mechanical strength, heat resistance, and durability of plastics. The booming plastics industry, driven by the demand for lightweight and durable materials in packaging, automotive, and consumer goods, is a significant driver for the calcium carbonate market. The trend towards sustainable and cost-effective materials further propels the use of calcium carbonate in plastic production.

Construction and Building Sector Expansion

The construction and building sectors are another significant driver for the calcium carbonate market. It is used in the production of cement, concrete, and lime, which are essential materials for construction. The rapid urbanization and industrialization in developing countries, along with the increasing investments in infrastructure projects, are driving the demand for calcium carbonate. Its application in producing high-quality construction materials that enhance durability and reduce environmental impact is boosting its market growth.

Advancements in Healthcare and Pharmaceuticals

Calcium carbonate is widely used in the healthcare and pharmaceutical industries as an active ingredient in dietary supplements and antacids. The growing awareness about health and wellness, along with the increasing prevalence of calcium deficiency-related diseases, is driving the demand for calcium carbonate in these sectors. The expanding pharmaceutical industry, coupled with the rising demand for over-the-counter calcium supplements and antacids, is significantly contributing to the market growth.

Environmental Benefits and Regulations

The environmental benefits of using calcium carbonate, such as reducing CO2 emissions and enhancing the recyclability of materials, are driving its market growth. The implementation of stringent environmental regulations and the growing emphasis on sustainable development are encouraging the use of calcium carbonate in various industries. Its application in producing eco-friendly and sustainable products aligns with the global trend towards environmental conservation, further boosting its demand.

Geographical Market Expansion

The calcium carbonate market is experiencing significant growth in regions like Asia-Pacific, North America, and Europe. The rapid industrialization and economic growth in countries like China and India are driving the demand for calcium carbonate in the Asia-Pacific region. In North America and Europe, the well-established construction, paper, and plastics industries are major contributors to the market growth. The increasing focus on infrastructure development and the adoption of advanced manufacturing technologies are propelling market expansion in these regions

Restraints for the Calcium Carbonate Market

Fluctuating Raw Material Prices

One of the significant restraints for the calcium carbonate market is the fluctuation in raw material prices. Calcium carbonate is primarily extracted from limestone, marble, and other natural sources. The prices of these raw materials can vary due to factors such as mining regulations, availability of high-purity deposits, and transportation costs. These fluctuations can affect the overall production cost of calcium carbonate, making it challenging for manufacturers to maintain stable pricing and profitability.

Environmental Concerns and Regulations

The extraction and processing of calcium carbonate can have environmental impacts, including habitat disruption, dust generation, and energy consumption. Increasing environmental regulations aimed at reducing the ecological footprint of mining activities can pose challenges to the calcium carbonate market. Compliance with these stringent regulations can lead to increased operational costs for mining and manufacturing companies. The growing emphasis on sustainable practices and the need to mitigate environmental damage further constrain market growth.

Availability of Alternatives

The availability of alternative materials is another restraint for the calcium carbonate market. Other fillers and pigments, such as kaolin, titanium dioxide, and talc, can be used in various applications where calcium carbonate is utilized. These alternatives can offer similar or superior properties in certain applications, making them viable substitutes. The competition from these alternative materials can limit the growth potential of the calcium carbonate market, especially in industries like paper, plastics, and paints.

Technological and Process Limitations

Despite advancements, there are still technological and process limitations in the production and application of calcium carbonate. Achieving the desired particle size, purity, and performance characteristics can be challenging, especially for specialized applications. The need for continuous investment in research and development to improve production processes and product quality adds to the cost burden for manufacturers. These technological constraints can hinder the market's ability to meet evolving industry requirements and customer expectations.

Economic Downturns and Market Volatility

Economic downturns and market volatility can significantly impact the calcium carbonate market. Industries such as construction, paper, and plastics, which are major consumers of calcium carbonate, are susceptible to economic fluctuations. During periods of economic instability, there can be a reduction in demand for products that use calcium carbonate, leading to decreased sales and revenue for manufacturers. Market volatility can also affect investment decisions and expansion plans, further restraining market growth.

Supply Chain Disruptions

Supply chain disruptions are another notable restraint for the calcium carbonate market. Issues such as transportation delays, geopolitical tensions, and logistical challenges can impact the timely availability of raw materials and finished products. These disruptions can lead to production delays, increased costs, and challenges in meeting customer demands. Ensuring a reliable and efficient supply chain is crucial for maintaining the stability and growth of the calcium carbonate market.

Opportunity in the Calcium Carbonate Market

Rising Demand in the Paper and Plastic Industries

The calcium carbonate market is experiencing significant growth due to the rising demand from the paper and plastic industries. In the paper industry, calcium carbonate is used as a filler material, providing smoothness and brightness to the paper. The plastic industry benefits from calcium carbonate as it enhances the properties of plastics, making them more durable and cost-effective. The growth of these industries, especially in the Asia-Pacific region, is driving the market forward. With the increasing urbanization and industrialization, the demand for high-quality paper and plastic products is expected to rise, providing a substantial opportunity for the calcium carbonate market.

Expansion in the Construction Sector

The construction sector is another major area where calcium carbonate is extensively used. It is a key ingredient in cement and concrete, which are fundamental materials in building and infrastructure projects. As global construction activities increase, especially in developing countries, the demand for calcium carbonate is set to grow. The material's properties, such as high strength and durability, make it ideal for construction applications. This expanding construction sector presents a significant opportunity for market growth.

Growing Use in the Pharmaceutical Industry

The pharmaceutical industry is increasingly utilizing calcium carbonate in various applications, such as in the production of calcium supplements and antacids. As the global population ages and health consciousness rises, the demand for these products is expected to increase. Calcium carbonate's role in addressing nutritional deficiencies and digestive issues makes it a valuable component in pharmaceuticals. The growing healthcare expenditure globally further supports this trend, opening up new avenues for market expansion.

Technological Advancements and Product Innovation

Technological advancements and ongoing research and development are leading to the production of specialized grades of calcium carbonate. These innovations cater to specific industrial requirements, such as enhanced particle size distribution, brightness, and oil absorption capacity. The development of nano-calcium carbonate, which has unique optical and mechanical properties, is expanding its application scope in various industries. This trend towards value-added products is creating new opportunities for market growth.

Increasing Environmental Awareness

The shift towards sustainable and eco-friendly materials is also benefiting the calcium carbonate market. It is a naturally occurring mineral that is abundant and environmentally friendly. Its use in industries such as paper and plastics can reduce the reliance on synthetic materials, which are often more harmful to the environment. As environmental regulations become stricter and consumer awareness about sustainability increases, the demand for calcium carbonate is likely to rise, presenting a significant market opportunity.

Trends for the Calcium Carbonate Market

Increasing Use of Nano-Calcium Carbonate

One of the most notable trends in the calcium carbonate market is the increasing use of nano-calcium carbonate. This form of calcium carbonate is prized for its unique properties, including high surface area and enhanced mechanical strength, making it ideal for a wide range of applications. Industries such as plastics, rubber, and coatings are adopting nano-calcium carbonate to improve product quality and performance. For instance, in the plastic industry, it helps to enhance the strength and durability of products while maintaining a lightweight structure. This trend is driven by ongoing research and development efforts to optimize the production processes and expand the application scope of nano-calcium carbonate.

Rising Demand in the Paper and Pulp Industry

The paper and pulp industry continues to be a significant consumer of calcium carbonate, using it as a filler and coating pigment to enhance the brightness, opacity, and smoothness of paper. With the increasing demand for high-quality paper products, the use of calcium carbonate in this industry is on the rise. The shift towards eco-friendly and recyclable paper products is further boosting this trend. Innovations in production techniques are enabling the use of higher proportions of calcium carbonate in paper, which helps reduce the reliance on traditional wood pulp and lowers production costs. This trend is particularly strong in regions with large paper manufacturing bases, such as Asia-Pacific and Europe.

Growing Applications in the Healthcare Sector

Calcium carbonate is witnessing growing applications in the healthcare sector, particularly in pharmaceuticals and nutraceuticals. It is commonly used as a dietary supplement for calcium and as an antacid to relieve heartburn and indigestion. The aging global population and increasing health awareness are driving the demand for calcium carbonate-based products. Additionally, advancements in the formulation and delivery methods of calcium carbonate supplements are making them more effective and easier to consume, thereby increasing their popularity. This trend highlights the material's versatility and expanding role in promoting health and wellness.

Adoption in Environmental Applications

Environmental concerns and regulations are leading to the adoption of calcium carbonate in various eco-friendly applications. It is used in water treatment processes to neutralize acidic waters and remove impurities. In flue gas desulfurization, calcium carbonate helps to reduce sulfur dioxide emissions from power plants, contributing to air pollution control. The push towards sustainable practices and the need to comply with environmental standards are driving the demand for calcium carbonate in these applications. This trend underscores the material's importance in supporting environmental protection efforts and sustainable development goals

Expansion in the Construction Industry

The construction industry remains a key driver for the calcium carbonate market. It is a vital component in the production of cement, concrete, and other construction materials. The ongoing urbanization and infrastructure development projects across the globe are fueling the demand for calcium carbonate. In particular, developing regions such as Asia-Pacific and Latin America are experiencing rapid growth in construction activities, which is boosting the market. The trend towards green building materials and sustainable construction practices is also promoting the use of calcium carbonate due to its eco-friendly nature and contribution to building durability and longevity.

Segments Covered in the Report

By Type

o Ground Calcium Carbonate

o Precipitated Calcium Carbonate

o Other Types

By Application

o Automotive

o Building & Construction

o Pharmaceutical

o Agriculture

o Pulp & Paper

o Other Applications

Segment Analysis

By Type Analysis

In 2023, the ground calcium carbonate segment held a dominant market share of 69.2%. This rise is explained by the fact that GCC powder is more economical than other inorganic powders and has better qualities such as whiteness, inertness, and incombustibility in addition to having low adsorption of water and oil. It is frequently used in polymer composites to increase workability and physical characteristics. The cost of polymer composites can be greatly decreased at the same time by substituting inexpensive GCC fillers for pricey resins.

Over time, precipitated calcium carbonate is another segment that is growing at the quickest rate. It's a new material made from lime that has a lot of uses in industry. High-calcium quicklime is hydrated, and the resulting slurry is then reacted with carbon dioxide to form it. The final product has a homogenous, narrow particle size dispersion and is brilliant white. PCC can be tailored to perform better in a given application by choosing from a range of crystal shapes and sizes. Paints, adhesives & sealants, rubbers, PVC/plastics, food & beverage, pharmaceutical, and thermal & electrical insulators are among the products that use PCC. Because it's a cheap mineral, it's also utilized to make high-quality paper and paperboard instead of wood pulp and additives.

By Application Analysis

In 2023, the paper application segment overtook all others in terms of revenue share, coming in at about 42.2%. Calcium carbonate can be used as a coating pigment or as a filler added to the pulp of paper. Its inclusion improves the paper's opacity and brightness. The market for print media was impacted by the internet, although it did not affect the need for paper in other sectors, like tissue paper and packaging.

The present epidemic has forced manufacturers to increase output to meet the growing demands of the consumer. For example, Celulosa Argentina declared in August 2020 that it would be increasing its production of paper packaging by thirty percent. Due to the industry's explosive growth in demand, the company concentrated on the food sector. The paper application segment is expected to maintain its leadership during the projected period due to the expansion of the e-commerce industry and the rising use of tissue paper.

Over the projection period, building and construction is another industry that is expected to grow. Although the construction industry is a rapidly expanding sector worldwide, its growth has been impeded by the COVID-19 pandemic and government-imposed lockdowns. The industry quickly picked up steam after markets opened.

As per Oxford Economics, the building sector worldwide is anticipated to expand to approximately USD 8 trillion by 2030, primarily propelled by the United States and India. The strong demand for improved public infrastructure, including roads, airports, harbors, and rail transportation systems, is projected to be the primary driver of the growth in the demand for calcium carbonate during the projection period.

Regional Analysis

In 2023, Asia Pacific held the greatest revenue share of almost 36.8%, dominating the global market. It is projected that the region will continue to grow at a consistent CAGR between 2023 and 2033 as a result of growing investments in the industrial and infrastructure development sectors. Nonetheless, the supply chain and industrial processes have been severely disrupted by the pandemic. Every major Asian nation, except China, showed negative GDP growth in the second quarter of 2020.

Economies are working extra hard to preserve the fundamental procedures needed throughout the epidemic to ensure that operations in all sectors run smoothly. Certain businesses have released good news as operations pick back up; for example, car sales in India have increased over the last two months. Additionally, it is projected that the market for cars, paints, and coatings will grow, which will boost the need for calcium carbonate.

India has developed a framework that is ideal for attracting the most international investment. Furthermore, the nation's growing working-age population—roughly two-thirds of the total population—has a significant demographic dividend. India's calcium carbonate market is expanding significantly as a result of increased demand from several end-use sectors, such as paints, paper, and plastics.

Competitive Analysis

In order to expand their product lines, major market players are heavily investing in research and development, which will propel the calcium carbonate market's growth. In order to expand their global reach, market players are also pursuing a variety of strategic measures, such as joint ventures, product launches, contracts, mergers and acquisitions, higher investments, and cooperation with other institutions. If competitors in the calcium carbonate sector want to grow and thrive in a market that is becoming more and more competitive, they need to provide affordable products.

Recent Developments

In April 2023: The well-known calcium carbonate manufacturer Omya India revealed plans to invest USD 25 million in its state-of-the-art calcium carbonate factory located in Gujarat. Omya India is committed to providing high-quality products to fulfill the increasing demand, and this major investment aims to increase the plant's capacity and overall efficiency.

February 2024: On the eve of a new age of industrialization, the groundbreaking ceremony for a 200,000MT coated calcium carbonate factory was attended by the Honorable Commissioner for Mining and Energy, Hon. Ojiefoh Enaholo, and his distinguished team at Lampese, Akoko Edo Local Government Area, Edo State.

Key Market Players in the Calcium Carbonate Market

o AGSCO Corp.

o Carmeuse

o Blue Mountain Minerals

o GCCP Resources

o GLC Minerals LLC

o Greer Limestone Company

o ILC Resources

o Imerys

o Mineral Technologies

o Mississippi Lime

o Omya

o Other Key Players

Report Scope:

|

Report Features |

Description |

|

Market Size 2023 |

USD 40.6 Billion |

|

Market Size 2033 |

USD 70.3 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.8% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

AGSCO Corp., Carmeuse, Blue Mountain Minerals, GCCP Resources, GLC Minerals, LLC, Greer Limestone Company, Gulshan Polyols Ltd., ILC Resources, Imerys, Mineral Technologies, Mississippi Lime, Omya, Other Key Players |

|

Key Market Opportunities |

Technological Advancements and Product Innovation |

|

Key Market Dynamics |

Advancements in Healthcare and Pharmaceuticals |

📘 Frequently Asked Questions

1. Who are the key players in the Calcium Carbonate Market?

Answer: AGSCO Corp., Carmeuse, Blue Mountain Minerals, GCCP Resources, GLC Minerals, LLC, Greer Limestone Company, Gulshan Polyols Ltd., ILC Resources, Imerys, Mineral Technologies, Mississippi Lime, Omya, Other Key Players

2. How much is the Calcium Carbonate Market in 2023?

Answer: The Calcium Carbonate Market size was valued at USD 40.6 Billion in 2023.

3. What would be the forecast period in the Calcium Carbonate Market?

Answer: The forecast period in the Calcium Carbonate Market report is 2023-2033.

4. What is the growth rate of the Calcium Carbonate Market?

Answer: Calcium Carbonate Market is growing at a CAGR of 5.8% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.