🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Calcium Propionate Market

Calcium Propionate Market Global Industry Analysis and Forecast (2024-2033) by Form (Powder, Granular, and Liquid), Grade (Feed Grade, Food Grade, Industrial Grade, and Pharmaceutical Grade), Application (Animal Feed, Bakery, Meat Processing, Dairy, and Other Applications) and Region

May 2025

Chemicals and Materials

Pages: 138

ID: IMR1942

Calcium Propionate Market Synopsis

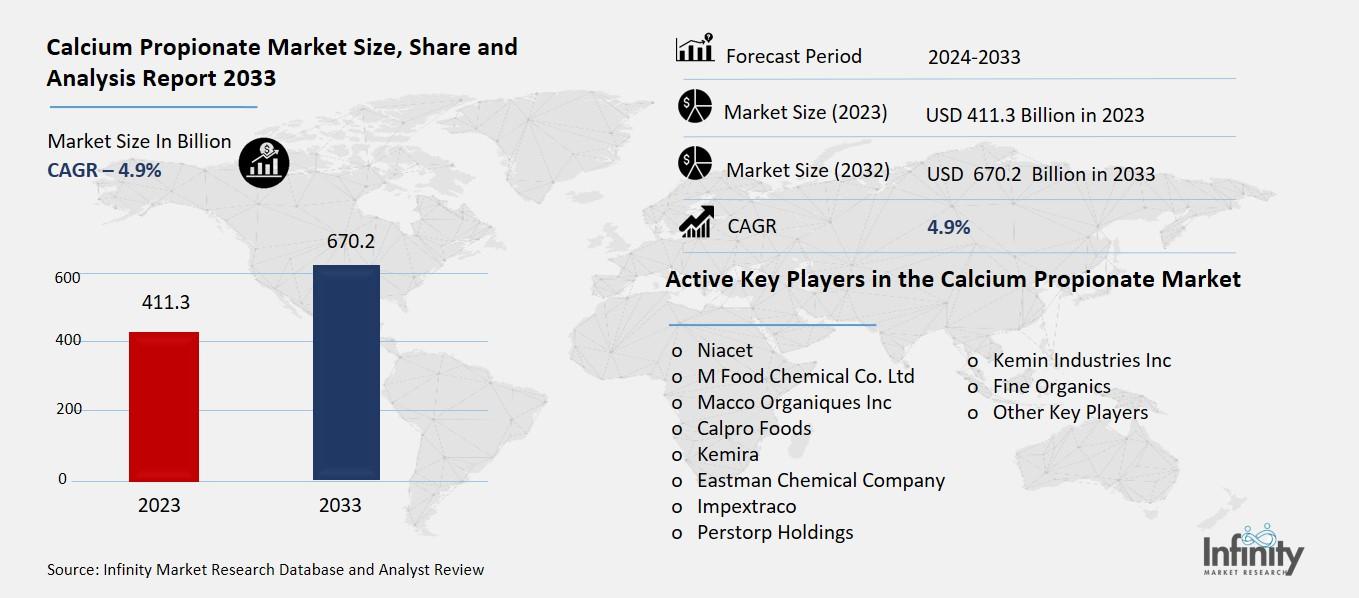

The Global Calcium Propionate Market was valued at USD 411.3 billion in 2023 and is expected to grow from USD 431.7 billion in 2024 to USD 670.2 billion by 2033, reflecting a CAGR of 4.9% over the forecast period.

The global calcium propionate market shows consistent growth since producers maintain increasing food additive needs within food and beverage industries. Manufacturers commonly employ calcium propionate mold inhibitor for bakery products since it allows both product preservation and longer shelf life in dairy items and processed foods. The market growth becomes stronger through increasing consumer interest in food safety while they increasingly recognize the importance of efficient preservation techniques.

The use of calcium propionate extends throughout the animal feed market to stop bacterial and mold growth which leads to better animal wellness. The market receives support from regulatory approvals and guidelines that have confirmed the safety of calcium propionate in food additives. Changing market dynamics will be influenced by both health risks associated with large doses of consumption and competitive pressure from alternative food preservatives.

Calcium Propionate Market Driver Analysis

Growing Awareness of Food Safety and Shelf Life

Food manufacturers in different sectors are focusing more intensely on product shelf extension to satisfy consumer needs for convenience while decreasing spoilage incidents and cutting food waste amounts. Food items including bread and dairy together with ready-to-eat meals benefit heavily from the shelf-life extension provided by calcium propionate because microorganisms cannot grow on these perishable products. The anti-microbial properties of calcium propionate serve as an essential tool to stop mold growth and bacteria development which enables food expansion by several weeks. The addition of calcium propionate to product formulations enables manufacturers to secure product quality as well as safety throughout shipping and holding periods together with retail visibility. The use of calcium propionate helps satisfy customers and minimizes both economic expenses and environmental impact from wasted food products.

Calcium Propionate Market Restraint Analysis

Health Concerns Related to Chemical Preservatives

Public knowledge about food additives' health risks has become a key buying factor which chiefly affects markets with developed economies. The trend of customers choosing minimally processed foods with natural ingredients causes decreasing acceptance of chemical preservatives such as calcium propionate. The PLUS Vision Research suggests that the market needs clean-label products whose ingredients are easy to understand while containing no artificial ingredients. People who value organic living together with health-consciousness choose to buy food items without synthetic preservatives because they believe these items have superior safety along with greater wholesomeness. Many food manufacturers began renovating their products with natural substances while seeking different alternatives to diminish their dependency on calcium propionate additives.

Calcium Propionate Market Opportunity Analysis

Shift Towards Blended or Multi-Preservative Solutions

The rising awareness among consumers about synthetic food additives risks to health prompts them to change their buying choices most noticeably in markets that have developed. Many consumers currently choose natural food items and minimally processed ingredients over chemical preservatives which includes calcium propionate. The marketplace now demands products bearing the clean-label designation which means they contain straightforward recognizable components that lack artificial additives. Health-oriented buyers and organic consumers prefer products without synthetic additives since these items seem both safer and more wholesome to them. The demand for clean-label products has forced manufacturers to rework their products and find natural ingredient options for reducing their dependence on preservatives such as calcium propionate. The approval status from food safety authorities does not prevent certain market segments focused on both health and transparency from shying away from using this compound.

Calcium Propionate Market Trend Analysis

Technological Advancements in Food Preservation

The food and feed industries experience improved performance and acceptance of calcium propionate through present-day formulation and delivery method advancements. Modern encapsulation technologies together with controlled-release systems develop improved stability features and better solubility and directed effects for calcium propionate to ensure effective performance during product shelf duration. Through innovative approaches the performance of calcium propionate improves by maximizing dosage levels while minimizing ingredient conflicts and food quality retention. New formulations have enhanced the functionality of calcium propionate allowing it to efficiently perform in environments with high moisture content and high pH value thus expanding its use possibilities.

Calcium Propionate Market Segment Analysis

The Calcium Propionate Market is segmented on the basis of Form, Grade, and Application.

By Form

o Powder

o Granular

o Liquid

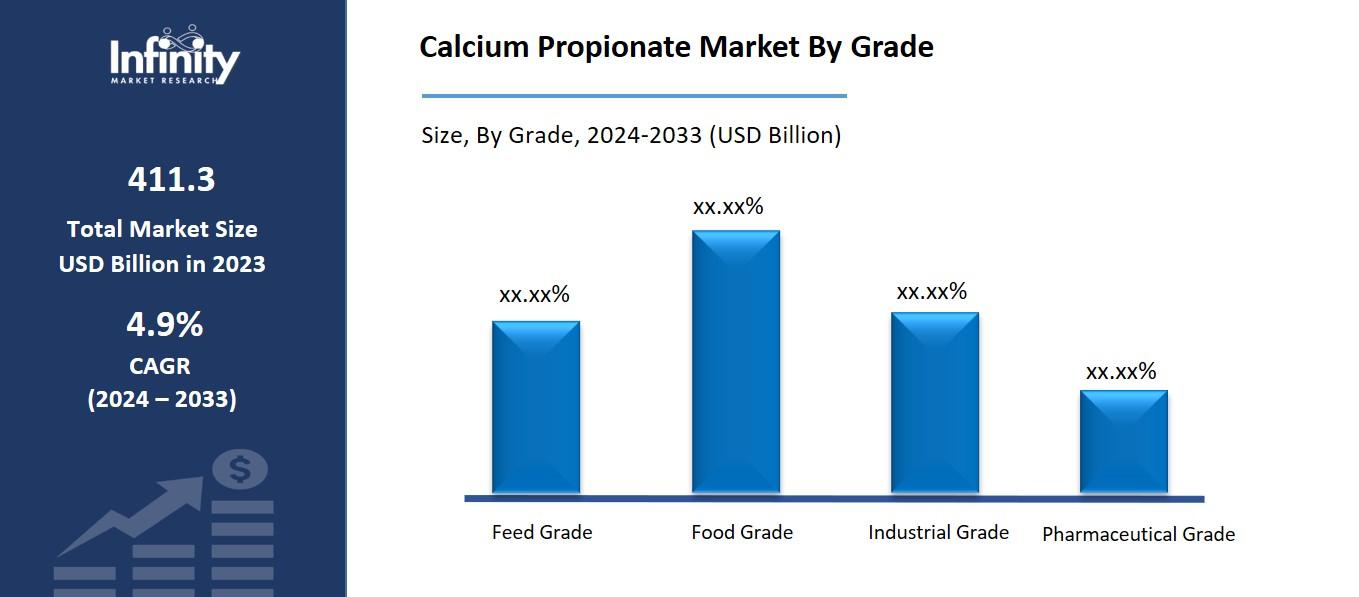

By Grade

o Feed Grade

o Food Grade

o Industrial Grade

o Pharmaceutical Grade

By Application

o Animal Feed

o Bakery

o Meat Processing

o Dairy

o Other Applications

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Form, Cast Segment is Expected to Dominate the Market During the Forecast Period

The Forms discussed in this research study, the biofuel segment is expected to account for the largest market share of calcium propionate market in the forecast period. The prevalence of powdered calcium propionate in the market stems from the characteristics which include its broad applicability and extended shelf life and ease of operation and compatibility with many food products particularly in baked foods. Powdered calcium propionate functions as a mold inhibitor because it dissolves perfectly within dry food products to establish consistent and effective protection against mold formation. This ingredient stands out through its economical character and storage behaviour which makes food and feed manufacturers worldwide choose it as their best option. Liquid and granular forms of the product maintain reduced market presence because of reduced versatility along with brief expiration timelines.

By Grade, the Food Grade Segment is Expected to Held the Largest Share

Food grade calcium propionate dominates the market because food manufacturers use it extensively to preserve baked goods along with dairy products and processed foods and beverages. Food grade calcium propionate plays its main role to stop mold growth and increase shelf stability which safeguards food quality and food safety standards particularly in markets focused on packaged and convenience products. The food industry utilizes food grade calcium propionate because of official regulatory approvals combined with strong market acceptance by consumers. The food grade segment represents the largest and most commercially significant section even though feed grade and pharmaceutical grade segments show increased growth especially for animal nutrition and specialized health applications.

By Application, the Bakery Segment is Expected to Held the Largest Share

The bakery segment is likely to dominate the market on account of calcium propionate’s effectiveness as a mold inhibitor in bread, cakes, pastries, and other baked goods, which are highly susceptible to microbial spoilage due to their moisture content. The increasing worldwide consumption of packaged and convenience bakery items drives market demand trends. The baking industry depends on calcium propionate as its essential preservative because these chemical enables manufacturers to preserve freshness and increase shelf life while reducing waste. The bakery sector surpasses all other applications such as animal feed and dairy in market dominance because of its high volume requirements as well as necessity for preservatives.

Calcium Propionate Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Asia Pacific is expected to dominate the calcium propionate market during the forecast period due to several key factors driving growth in the region. The demand for packaged food products continues to grow due to industrial developments and decreasing calcium propionate consumption being used as an important food preservation agent. Both China and India together with Southeast Asian nations continue to expand their animal feed sector by implementing calcium propionate as food quality enhancers and microbial growth controllers thus demonstrating market expansion aspects. Food safety standards improvements along with emerging modern retail infrastructure systems work together to increase regional demand for preservatives. Manufacturers operate more and more in this area because it enables them to fulfill local market requirements and benefit from economical production and distribution networks. The region's consumption along with its production of calcium propionate will make Asia Pacific the market leader worldwide.

Recent Development

In August 2024, As part of its strategy to expand its presence in the country, Manuchar gained control of Proquiel Químicos, ensuring a diverse range of products, including calcium propionate, that cater to the nutrition, mining, and industrial sectors.

Active Key Players in the Calcium Propionate Market

o Niacet

o M Food Chemical Co. Ltd

o Macco Organiques Inc

o Calpro Foods

o Kemira

o Eastman Chemical Company

o Impextraco

o Perstorp Holdings

o Kemin Industries Inc

o Fine Organics

o Other Key Players

Global Calcium Propionate Market Scope

|

Global Calcium Propionate Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 411.3 Billion |

|

Market Size in 2024: |

USD 431.7 Billion | ||

|

Forecast Period 2024-33 CAGR: |

4.9% |

Market Size in 2033: |

USD 670.2 Billion |

|

Segments Covered: |

By Form |

· Powder · Granular · Liquid | |

|

By Grade |

· Feed Grade · Food Grade · Industrial Grade · Pharmaceutical Grade | ||

|

By Application |

· Animal Feed · Bakery · Meat Processing · Dairy · Other Applications | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Growing Awareness of Food Safety and Shelf Life | ||

|

Key Market Restraints: |

· Health Concerns Related to Chemical Preservatives | ||

|

Key Opportunities: |

· Shift Towards Blended or Multi-Preservative Solutions | ||

|

Companies Covered in the report: |

· Niacet, M Food Chemical Co. Ltd, Macco Organiques Inc., Calpro Foods and Other Key Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Calcium Propionate Market Research report?

Answer: The forecast period in the Calcium Propionate Market Research report is 2024-2033.

2. Who are the key players in the Calcium Propionate Market?

Answer: Niacet, M Food Chemical Co. Ltd, Macco Organiques Inc., Calpro Foods and Other Key Players.

3. What are the segments of the Calcium Propionate Market?

Answer: The Calcium Propionate Market is segmented into Form, Grade, Application, and Regions. By Form, the market is categorized into Powder, Granular, and Liquid. By Grade, the market is categorized into Feed Grade, Food Grade, Industrial Grade, and Pharmaceutical Grade. By Application, the market is categorized into Animal Feed, Bakery, Meat Processing, Dairy, and Other Applications. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Calcium Propionate Market?

Answer: The global industry responsible for generating and distributing calcium propionate performs under the name of calcium propionate market. The food preservation compound calcium propionate functions as an additive to control microbial growth in bakery products along with dairy foodstuffs and processed food products thus improving their storage duration and ensuring product security. The market encompasses various end-use sectors such as food and beverages, animal feed, and pharmaceuticals. The market expands due to heightened convenience food requirements together with food spoilage apprehensions and the demand for longer shelf life in perishable goods.

5. How big is the Calcium Propionate Market?

Answer: The Global Calcium Propionate Market was valued at USD 411.3 billion in 2023 and is expected to grow from USD 431.7 billion in 2024 to USD 670.2 billion by 2033, reflecting a CAGR of 4.9% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.