🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Cargo Shipping Market

Cargo Shipping Market (By Cargo Type (Container Cargo, Bulk Cargo, General Cargo, Liquid Product), By Vessel (Multi-Purpose Vessels, Tankers, Container Vessels), By End Use (Food, Manufacturing, Oil & Ores, Electrical & Electronics), By Region and Companies)

Jul 2024

Packaging and Transports

Pages: 250

ID: IMR1163

Cargo Shipping Market Overview

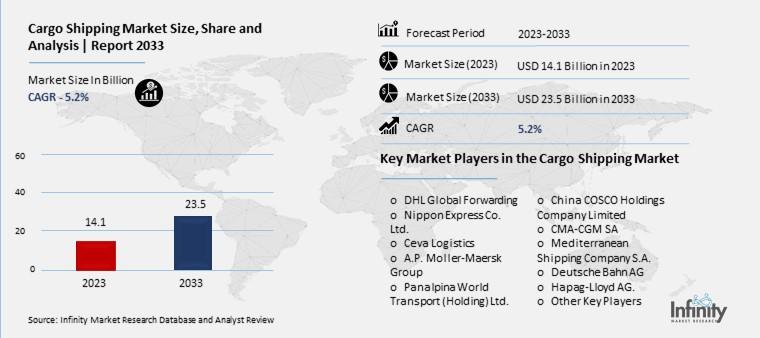

Global Cargo Shipping Market size is expected to be worth around USD 23.5 Billion by 2033 from USD 14.1 Billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2023 to 2033.

The cargo shipping market is the industry involved in transporting goods and commodities by sea. This market includes various types of ships, such as container ships, bulk carriers, tankers, and specialized vessels, that move products like electronics, food, raw materials, oil, and chemicals across the world. Cargo shipping is crucial for international trade, enabling countries to import and export goods efficiently and cost-effectively.

This market is essential for the global economy as it supports the supply chain and ensures the availability of products in different regions. With the growth of e-commerce and globalization, the demand for cargo shipping services has increased, driving the expansion and modernization of shipping fleets, ports, and logistics infrastructure. Companies in this market strive to improve efficiency, reduce environmental impact, and adopt new technologies to meet the ever-changing demands of global trade.

Drivers for the Cargo Shipping Market

Global Trade Growth

One of the primary drivers of the cargo shipping market is the steady increase in global trade volumes. As economies around the world grow and trade barriers decrease, the need for efficient and reliable transportation of goods across borders becomes more critical. This growing demand for international trade directly translates to a higher demand for cargo shipping services.

Economic Conditions

The overall economic conditions significantly impact the cargo shipping market. Factors such as GDP growth, industrial production, and consumer spending levels influence the demand for goods, thereby affecting the demand for shipping services. In times of strong economic growth, companies tend to import and export more goods, increasing the need for cargo shipping. Conversely, economic downturns can reduce demand but also prompt innovations and efficiency improvements within the industry to maintain profitability.

Technological Advancements

Technological advancements play a crucial role in driving the cargo shipping market. Innovations in propulsion systems, cargo handling equipment, and navigation technologies help shipping companies enhance their efficiency and competitiveness. Investments in automation, digitalization, and the Internet of Things (IoT) have optimized cargo transportation processes, reduced costs, and improved service reliability. These technological improvements enable shipping companies to offer better services and maintain a competitive edge in the market.

Environmental Regulations

Stricter environmental regulations aimed at reducing emissions and promoting sustainability have pushed the cargo shipping industry to adopt cleaner and more fuel-efficient vessels. Companies are increasingly investing in eco-friendly technologies and practices to comply with these regulations. This shift not only helps in meeting environmental standards but also provides a competitive advantage, as environmentally conscious customers prefer services that adhere to sustainable practices.

Infrastructure Development

Investments in port infrastructure, terminals, and transportation networks significantly benefit the cargo shipping market. Improved infrastructure enhances operational efficiency by reducing congestion and shortening transit times. Modern ports equipped with advanced handling facilities allow for faster loading and unloading of cargo, which is essential for maintaining the smooth flow of goods. As a result, efficient infrastructure supports the growth of the cargo shipping market by ensuring timely and reliable transportation services.

Changes in Supply Chain Strategies

Evolving supply chain strategies, such as just-in-time inventory management and the rise of e-commerce, have a profound impact on the cargo shipping market. Companies are increasingly looking for flexible and reliable transportation solutions to adapt to these changing dynamics. The need for timely delivery of goods to meet customer expectations in e-commerce and other sectors drives the demand for efficient cargo shipping services. This shift in supply chain strategies continues to fuel the growth of the market.

Restraints for the Cargo Shipping Market

Economic Uncertainty

Economic fluctuations pose significant challenges to the cargo shipping market. Changes in global trade policies, currency valuations, and economic downturns can directly impact shipping volumes and profitability. For instance, during economic recessions, businesses often reduce their trade activities, leading to decreased demand for shipping services. Moreover, unpredictable tariffs and trade tensions between major economies further exacerbate uncertainties in the market, making long-term planning and investment decisions difficult for shipping companies.

Regulatory Compliance

Stringent regulations imposed by international bodies and national governments present a substantial restraint to the cargo shipping industry. These regulations encompass environmental standards, safety protocols, and customs procedures, which vary across different regions and can add complexity and costs to shipping operations. Compliance with these regulations requires continuous monitoring and adaptation, adding administrative burdens and potentially delaying shipments, which can affect delivery schedules and customer satisfaction.

Infrastructure Limitations

Infrastructure deficiencies, such as inadequate port facilities, congestion, and limited intermodal connectivity, hinder efficient cargo shipping operations. Ports, as crucial nodes in global supply chains, often face capacity constraints during peak seasons, leading to delays in vessel turnaround times and increased handling costs. Moreover, insufficient investment in transportation infrastructure, including roads and railways connecting ports to inland destinations, can further restrict the seamless flow of goods and increase logistics costs.

Technological Integration Challenges

The cargo shipping industry is increasingly reliant on technology for efficient operations and customer service. However, integrating new technologies, such as blockchain for supply chain transparency or IoT devices for real-time cargo tracking, presents challenges. Legacy systems, cybersecurity risks, and the high costs associated with technology adoption and training pose barriers to small and medium-sized shipping companies. Moreover, disparities in technological readiness across different regions and stakeholders in the supply chain can hinder the seamless integration of digital solutions.

Environmental Sustainability Pressures

Environmental sustainability has emerged as a critical concern for the cargo shipping market. Stringent emissions regulations, such as the International Maritime Organization's (IMO) sulfur cap and carbon reduction targets, necessitate costly investments in cleaner fuels and emissions abatement technologies. These regulations aim to mitigate the environmental impact of maritime transport but impose financial burdens on shipping companies, particularly smaller operators with limited resources. Balancing compliance with environmental standards while maintaining cost-effectiveness remains a significant challenge for the industry.

Geopolitical Instability

Geopolitical tensions and conflicts in key shipping lanes can disrupt cargo shipping routes and increase operational risks. Instances of piracy, territorial disputes, and political instability in regions such as the South China Sea or the Strait of Hormuz can lead to route diversions, higher insurance premiums, and increased security measures. Such geopolitical uncertainties create operational challenges for shipping companies, affecting vessel schedules and overall supply chain reliability.

Opportunity in the Cargo Shipping Market

Global Trade Expansion

The cargo shipping market stands to benefit significantly from the ongoing expansion of global trade. Increasing international trade agreements and economic integration initiatives, such as the Belt and Road Initiative (BRI) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), are driving growth in maritime transport. These agreements facilitate easier access to new markets, spur demand for shipping services, and encourage investments in port infrastructure and logistics networks to support growing trade volumes.

E-commerce Growth

The rapid growth of e-commerce presents a lucrative opportunity for the cargo shipping industry. The shift towards online shopping has fueled demand for efficient and reliable shipping services to fulfill cross-border orders. E-commerce giants and smaller retailers alike rely on cargo shipping for importing goods from manufacturing hubs to consumer markets worldwide. This trend is expected to continue as digitalization and consumer demand for diverse product choices drive further expansion in global e-commerce sales.

Technological Advancements

Advancements in technology offer opportunities for innovation and efficiency improvements in the cargo shipping sector. Digitalization initiatives, such as blockchain for supply chain transparency, IoT for real-time cargo tracking, and predictive analytics for route optimization, enable shipping companies to streamline operations, reduce costs, and enhance service reliability. Adopting these technologies can provide a competitive edge by improving operational efficiency and customer satisfaction, thereby attracting more business opportunities.

Emerging Markets Development

The development of emerging markets, particularly in Asia, Africa, and Latin America, presents new growth opportunities for the cargo shipping industry. Rising middle-class populations and increasing urbanization in these regions drive demand for imported consumer goods, raw materials, and industrial products. Shipping companies can capitalize on these opportunities by expanding their service networks, establishing strategic partnerships with local logistics providers, and investing in port infrastructure to cater to growing import and export volumes.

Sustainability Initiatives

The growing emphasis on sustainability presents opportunities for the cargo shipping industry to innovate and differentiate its services. Increasing environmental regulations and consumer preferences for eco-friendly products are pushing shipping companies to adopt cleaner technologies and sustainable practices. Investments in alternative fuels, energy-efficient vessels, and carbon offset programs not only help reduce environmental impact but also enhance corporate reputation and attract environmentally conscious customers and partners.

Infrastructure Investments

Continued investments in port infrastructure and intermodal connectivity offer long-term growth prospects for the cargo shipping market. Governments and private sector stakeholders are increasingly investing in port expansions, dredging projects, and multimodal transportation networks to accommodate larger vessels and improve supply chain efficiency. Enhanced infrastructure capabilities enable faster turnaround times, reduced transit costs, and increased capacity to handle growing cargo volumes, supporting sustained market expansion.

Trends for the Cargo Shipping Market

Digitalization and Automation

Digitalization and automation are transforming the cargo shipping industry, enhancing efficiency and operational transparency. Technologies such as blockchain, the Internet of Things (IoT), and artificial intelligence (AI) are increasingly adopted to optimize cargo tracking, streamline documentation processes, and improve supply chain visibility. These advancements enable real-time monitoring of shipments, predictive maintenance of vessels, and automation of routine tasks, thereby reducing costs and minimizing human error.

Shift Towards Sustainable Practices

There is a notable shift towards sustainable practices within the cargo shipping market. Stringent environmental regulations and growing consumer awareness are driving shipping companies to invest in eco-friendly technologies and practices. This includes adopting cleaner fuels, implementing energy-efficient vessel designs, and exploring alternative propulsion systems like LNG and hydrogen. Sustainable shipping practices not only help reduce carbon emissions but also enhance corporate reputation and meet regulatory compliance, thereby appealing to environmentally conscious customers and stakeholders.

Supply Chain Resilience and Agility

The COVID-19 pandemic underscored the importance of supply chain resilience and agility in the cargo shipping industry. Companies are increasingly focusing on building resilient supply chains capable of adapting to disruptions and uncertainties. This involves diversifying sourcing strategies, optimizing inventory management, and enhancing collaboration with logistics partners to ensure uninterrupted supply chain operations. The trend towards resilience is expected to continue as businesses prioritize risk management and contingency planning in a volatile global market environment.

Integration of Big Data Analytics

Big data analytics is playing a pivotal role in transforming decision-making processes within the cargo shipping sector. By harnessing vast amounts of data from various sources including IoT sensors, weather forecasts, and market trends, shipping companies can gain valuable insights into demand patterns, operational efficiencies, and route optimization strategies. Predictive analytics tools enable proactive decision-making, reducing transit times, optimizing fuel consumption, and improving overall supply chain efficiency.

Evolution of Port Infrastructure

There is a notable evolution in port infrastructure to accommodate larger vessels and handle increased cargo volumes. Ports worldwide are investing in dredging projects, terminal expansions, and state-of-the-art handling equipment to improve operational efficiency and reduce turnaround times. Moreover, the development of smart ports equipped with digital technologies enhances port connectivity, facilitates faster cargo processing, and improves overall supply chain connectivity. These infrastructure investments are crucial for meeting growing demand and enhancing competitiveness in the global cargo shipping market.

Adoption of Remote Technologies

The adoption of remote technologies is gaining traction in the cargo shipping industry, particularly in response to operational challenges posed by the pandemic. Remote monitoring systems, autonomous vessels, and remote-controlled cargo handling equipment enable shipping companies to minimize human interaction onboard ships, enhance crew safety, and optimize operational efficiency. These technologies not only mitigate operational risks but also pave the way for future advancements in autonomous shipping, transforming the industry's operational landscape.

Segments Covered in the Report

By Cargo Type

o Container Cargo

o Bulk Cargo

o General Cargo

o Liquid Product

o Other Cargo Type

By Vessel

o Multi-Purpose Vessels

o Tankers

o Container Vessels

o Others

By End Use

o Food

o Manufacturing

o Oil & Ores

o Electrical & Electronics

Segment Analysis

By Cargo Type Analysis

Based on the kind of cargo, the cargo shipping market is divided into four segments: liquid, general, bulk, and containerized cargo. As a result of market features such as high container flexibility, the general cargo category is expected to grow at the quickest rate of compound annual growth.

By Vessel Analysis

With a 40.8% market share in 2023, the tanker segment led the industry. Tankers are cargo shipping vessels that are frequently used to move bulk liquid and gas commodities. They are the best option for moving gas, chemicals, and petrochemicals. refinery. Depending on how much cargo they can transport, some frequent types of tankers utilized for service applications are oil, chemical, and gas tankers. Extended journeys and port visits by a limited number of boats can be advantageous. The projected growth rate for this segment is 4.0% CAGR during the forecast period.

Throughout the projected period, multi-purpose boats are anticipated to increase at a CAGR of 4.1%. Growing global shipping for a range of commodities and growing vessel usage. It is anticipated that these elements will propel

By End-Use Analysis

The Cargo Shipping market is divided into four segments based on End-User: Food, Manufacturing, Oil & Ores, and Electrical & Electronics. It was projected that the Manufacturing sector would lead the market in 2023. The market for cargo shipping is growing due to various factors, one of which is the quickening pace of economic growth, especially in developing countries in the Middle East and Asia Pacific. In the areas of ores, gas, and oil, the cargo shipping sector is also projected to grow rapidly. The growth of this category can be attributed to several factors, such as the surge in US exports and the heightened demand for conventional fuel cars in countries like China and India.

Regional Analysis

With a 39.8% share, the Asia Pacific region led the market in 2023. Growing consumer demand, government assistance, and China the biggest commodity exporter via cargo shipping all play a part. The manufacturing-driven surge in intra-regional trade is a reflection of the production process, which typically involves the manufacturing of parts in numerous places across Asia and their subsequent assembly in other areas. The market in this area is expanding as a result of several causes.

Due to considerable infrastructure investment and port call optimization, which have sped up the loading and unloading of cargo in countries like the U.K., Spain, and Germany, the European cargo Shipping industry is also expected to rise rapidly. On the European continent, the cargo shipping market in Germany held the largest market share, and the cargo shipping market in the United Kingdom grew at the fastest rate. Growing investments and financing for logistics may soon enable manufacturers to take on more large orders, which will grow the cargo shipping sector. Additionally, the German cargo shipping market was expanding at the highest rate in the region, while the UK cargo shipping market retained the largest market share.

Competitive Analysis

Large market companies are heavily funding R&D to diversify their product offerings, which will encourage additional market expansion for the cargo shipping sector. Along with the considerable changes in the industry such as new product releases, contracts, mergers and acquisitions, higher investments, and partnerships with other organizations—market participants are also engaging in a range of strategic initiatives to enhance their market share. To thrive in an increasingly cutthroat market, Cargo Shipping sector rivals need to offer reasonably priced goods.

Recent Developments

August 2022: A.P. Moller-Maersk is updating its network from Europe to the Middle East and Indian Subcontinent to provide customers with more resilience, agility, and dependability. Connecting more goods through the Maersk hub in Colombo gives clients more freedom and agility when transferring freight between markets.

June 2022: Yang Ming Group introduced its newest route, the Far East-West Coast of Latin America. Customers will benefit from increased service coverage and increased dependability in the FE-WCSA trade thanks to the new service.

Key Market Players in the Cargo Shipping Market

o DHL Global Forwarding

o Nippon Express Co. Ltd.

o Ceva Logistics

o Panalpina World Transport (Holding) Ltd.

o China COSCO Holdings Company Limited

o CMA-CGM SA

o Mediterranean Shipping Company S.A.

o Deutsche Bahn AG

o Hapag-Lloyd AG.

o Other Key Players

Report Scope:

|

Report Features |

Description |

|

Market Size 2023 |

USD 14.1 Billion |

|

Market Size 2033 |

USD 23.5 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.2% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Cargo Type, Vessel, End Use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

DHL Global Forwarding, Nippon Express Co., Ltd., Ceva Logistics, A.P. Moller-Maersk Group, Panalpina World Transport (Holding) Ltd., China COSCO Holdings Company Limited, CMA-CGM SA, Mediterranean Shipping Company S.A., Deutsche Bahn AG, Hapag-Lloyd AG., Other Key Players |

|

Key Market Opportunities |

Global Trade Expansion |

|

Key Market Dynamics |

Changes in Supply Chain Strategies |

📘 Frequently Asked Questions

1. Who are the key players in the Outdoor Furniture Market?

Answer: DHL Global Forwarding, Nippon Express Co., Ltd., Ceva Logistics, A.P. Moller-Maersk Group, Panalpina World Transport (Holding) Ltd., China COSCO Holdings Company Limited, CMA-CGM SA, Mediterranean Shipping Company S.A., Deutsche Bahn AG, Hapag-Lloyd AG., Other Key Players

2. How much is the Outdoor Furniture Market in 2023?

Answer: The Outdoor Furniture Market size was valued at USD 14.1 Billion in 2023.

3. What would be the forecast period in the Outdoor Furniture Market?

Answer: The forecast period in the Outdoor Furniture Market report is 2023-2033.

4. What is the growth rate of the Outdoor Furniture Market?

Answer: Outdoor Furniture Market is growing at a CAGR of 5.2% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.