🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Cell-free Protein Expression Market

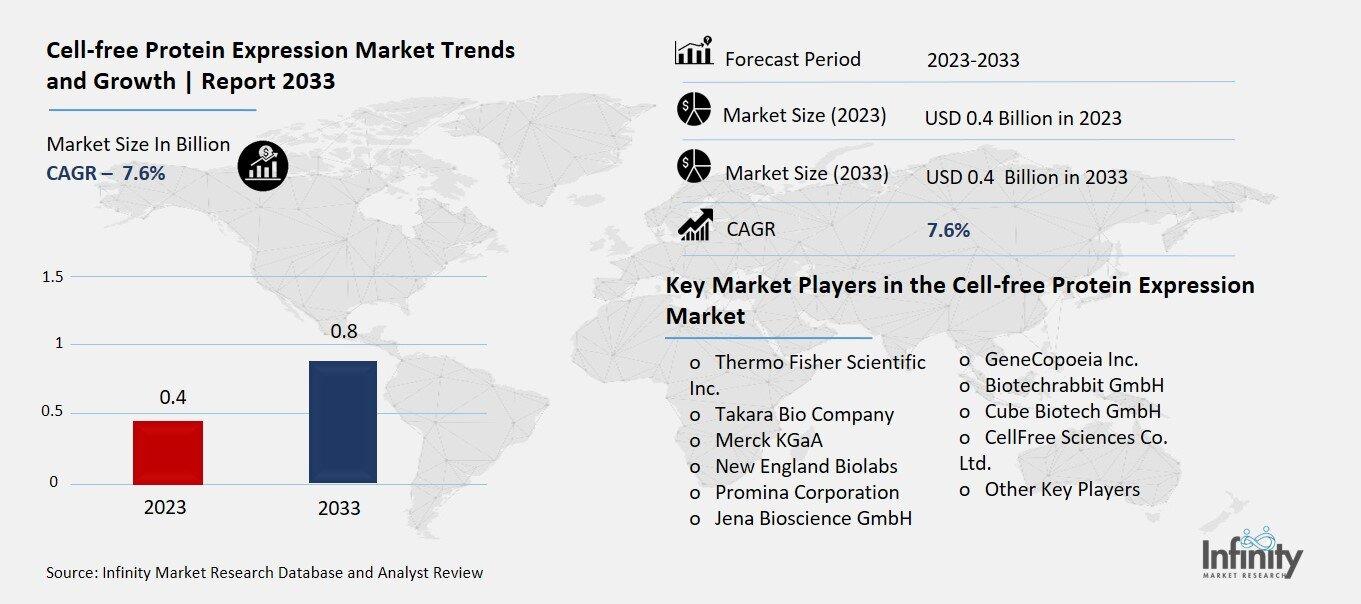

Global Cell-free Protein Expression Market (By Product (Expression Systems, Reagents), By Method (Transcription & Translation systems, Translation systems, Other Methods), By Application (Enzyme Engineering, High Throughput Production, Protein Labeling, Protein-Protein Interaction, Protein Purification, Other Applications), By End-User (Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, Other End-User), By Region and Companies)

Sep 2024

Healthcare

Pages: 138

ID: IMR1216

Cell-free Protein Expression Market Overview

Global Cell-free Protein Expression Market size is expected to be worth around USD 0.8 Billion by 2033 from USD 0.4 Billion in 2023, growing at a CAGR of 7.6% during the forecast period from 2023 to 2033.

The Cell-free Protein Expression Market focuses on a method used to produce proteins without needing living cells. This approach uses a mixture of essential components from cells, like enzymes and ribosomes, to create proteins in a lab setting. It’s faster and more flexible than traditional methods that rely on growing cells in large quantities. This technology is important in research and drug development because it allows scientists to produce proteins quickly for studies, testing, and even creating new treatments.

This market includes the tools, kits, and systems used to perform cell-free protein expression. It's growing because of its benefits in speed, cost-effectiveness, and the ability to produce complex proteins that are hard to make using living cells. Companies and research labs are increasingly using this method for tasks like developing vaccines, studying diseases, and creating new medicines. The market is expanding as more researchers and biotech companies recognize the advantages of this innovative technology.

Drivers for the Cell-free Protein Expression Market

Growing Demand for Protein Engineering

The cell-free protein expression market is experiencing strong growth due to the rising demand for protein engineering in research and development. Pharmaceutical and biotech companies are increasingly using cell-free systems to synthesize proteins more quickly and efficiently. These systems allow for easier manipulation and testing of proteins, speeding up the discovery and development of new drugs and therapies. As research on personalized medicine grows, particularly in areas like cancer treatment, there is a greater need for precision in protein synthesis, which drives the adoption of these technologies.

Advances in High-Throughput Screening

Advances in high-throughput screening (HTS) are also playing a key role in expanding the market. HTS allows researchers to analyze and process large amounts of protein samples rapidly, which is essential for drug discovery. Cell-free systems provide an ideal platform for HTS, as they can produce proteins without the complexities involved in traditional cell-based methods. This capability is leading to wider use in pharmaceutical research and diagnostics, further boosting market demand.

Expansion in Academic Research

The growing importance of academic research institutions in driving innovation is another factor pushing the market forward. Universities and research labs are heavily investing in cell-free systems to explore a wide range of applications, from protein-protein interactions to enzyme engineering. As global research efforts intensify, particularly in Asia-Pacific countries like China, the demand for cell-free protein expression systems is set to rise significantly.

Supportive Government Initiatives

Government support and funding for biotechnology research are positively impacting the market. Several countries, especially in Europe and North America, have initiatives that encourage biotech research and development. These initiatives often include grants and funding for projects involving cell-free protein expression, leading to increased research output and innovation.

Rising Healthcare Needs

The growing prevalence of chronic diseases, especially cancer, is pushing the need for advanced treatments, including precision medicine. Cell-free protein expression systems are crucial in developing targeted therapies and vaccines. With a rising number of cancer cases globally, particularly in regions like Europe and Brazil, there is a growing reliance on these systems for faster and more accurate drug development.

Restraints for the Cell-free Protein Expression Market

High Cost of Cell-Free Systems

The high cost associated with cell-free protein expression systems is a significant restraint in the market. These systems require expensive reagents and specialized equipment, making them less accessible to smaller research labs and academic institutions. While they offer advantages like faster protein production and simpler processes, their high setup and operational costs often limit adoption to larger biotech companies or well-funded research centers. This financial barrier is a significant challenge for widespread market growth, particularly in developing regions where research budgets are limited.

Complexity and Limited Protein Yields

Another restraint is the complexity involved in optimizing cell-free systems to produce high-quality proteins. Compared to traditional cell-based methods, cell-free systems can struggle with low protein yields, especially for complex or large proteins. Researchers often face challenges in fine-tuning reaction conditions and maintaining protein stability. These issues can lead to inconsistent results, limiting the effectiveness and reliability of cell-free protein expression in large-scale production, which can deter some users from adopting these technologies.

Limited Scalability for Industrial Applications

Scalability remains a key challenge for the cell-free protein expression market, especially when it comes to industrial applications like large-scale manufacturing of biologics. While cell-free systems are excellent for research and small-scale production, they often face difficulties when scaled up. This limitation is particularly relevant for pharmaceutical companies that need to produce proteins in bulk. The inability to seamlessly scale up these processes without losing efficiency or increasing costs hinders the broader adoption of cell-free technologies in the commercial space.

Technical Expertise Requirement

The technical expertise required to operate and optimize cell-free systems is another barrier to market growth. These systems demand specialized knowledge and skills, which are not always readily available in all research environments. Smaller labs or companies without in-house expertise may be hesitant to adopt these technologies due to the learning curve involved. Additionally, the need for continuous training and education adds to the overall costs, making it harder for many institutions to justify the investment.

Regulatory Hurdles

Regulatory challenges also act as a restraint for the cell-free protein expression market. The pharmaceutical and biotech sectors are highly regulated, and cell-free systems, being relatively new, face uncertainty regarding regulatory approval. Establishing standardized guidelines and gaining regulatory clearance for cell-free produced proteins can be time-consuming and costly. This uncertainty often leads to delays in product development and market entry, slowing down the overall growth of the market.

Market Competition and Established Methods

The competition from well-established, traditional cell-based expression systems also poses a challenge. These conventional methods have been optimized over decades, offering robust and reliable solutions for protein production. Despite the advantages of cell-free systems, many organizations still prefer sticking to familiar cell-based methods due to their proven track record and lower perceived risk. This preference for traditional approaches limits the market share and growth potential for cell-free protein expression technologies.

Opportunity in the Cell-free Protein Expression Market

Expanding Applications in Drug Development

One significant opportunity in the cell-free protein expression market lies in the expanding applications within drug development. Cell-free systems allow for rapid and flexible protein synthesis, which is crucial in screening and identifying drug targets. As pharmaceutical companies increasingly look for ways to speed up drug discovery processes, these systems present an attractive option. Traditional cell-based methods often require days or weeks to produce proteins, whereas cell-free systems can do so in a matter of hours. This quick turnaround time helps accelerate the drug development pipeline, creating an opportunity for wider adoption in the pharmaceutical sector.

Rising Demand for Personalized Medicine

The growing interest in personalized medicine presents another key opportunity for the market. Personalized medicine relies heavily on the ability to produce specific proteins quickly for diagnostic or therapeutic purposes. Cell-free systems are well-suited for this, as they can be customized to produce proteins tailored to individual patient needs. This flexibility and adaptability make cell-free expression systems a valuable tool in the development of targeted treatments, contributing to their increased demand in the healthcare industry.

Growth in Synthetic Biology Research

The rising prominence of synthetic biology is creating new opportunities in the cell-free protein expression market. Synthetic biology often involves the design and construction of new biological parts or systems, and cell-free expression is essential in testing these innovations. Researchers prefer these systems because they are easier to manipulate and do not require living cells, offering a more controlled environment for experimentation. As synthetic biology continues to grow, the demand for efficient protein synthesis methods like cell-free expression is expected to rise, driving market expansion.

Increasing Government and Private Funding

The availability of government and private funding for research initiatives is another opportunity propelling the market forward. Various research institutions and biotech startups are receiving substantial funding aimed at advancing cell-free technologies. Governments and private entities are recognizing the potential of these systems in revolutionizing biomanufacturing and diagnostics. This influx of capital supports ongoing R&D, enabling further innovation and making cell-free protein expression technologies more accessible to a broader range of users.

Potential in Industrial Biomanufacturing

There is also significant potential for cell-free protein expression systems in industrial biomanufacturing. These systems can be used to produce enzymes and other proteins for various industrial applications, including biofuels, food additives, and chemicals. The ability to quickly produce large quantities of proteins without the need for living cells is appealing to industries looking to optimize production processes. As industries seek more sustainable and cost-effective production methods, the adoption of cell-free systems could grow, presenting a lucrative opportunity for market players.

Expanding Use in Educational and Research Institutions

Lastly, the increasing adoption of cell-free systems in educational and research institutions offers a growth opportunity. As the technology becomes more accessible and user-friendly, it is being integrated into academic curricula and research projects. Universities and research centers use cell-free systems for teaching molecular biology concepts and conducting experiments without the need for complex lab setups. This expanding educational use is likely to contribute to steady market growth as more institutions invest in these technologies.

Trends for the Cell-free Protein Expression Market

Increasing Demand for Rapid and Scalable Protein Synthesis

A prominent trend in the cell-free protein expression market is the rising demand for rapid and scalable protein synthesis solutions. Traditional cell-based methods are often time-consuming and complex, making cell-free systems increasingly popular due to their speed and flexibility. These systems allow for quicker protein production, which is crucial in drug discovery, vaccine development, and other applications requiring rapid prototyping. As research institutions and pharmaceutical companies push for faster turnaround times, the adoption of cell-free protein expression systems is set to grow.

Growth in Synthetic Biology Applications

Another key trend is the growing integration of cell-free systems in synthetic biology. Synthetic biology involves designing and constructing new biological systems or modifying existing ones, which requires efficient protein expression methods. Cell-free systems provide a controlled environment, making them ideal for experiments that require precision and flexibility. This trend is driving market growth as researchers increasingly rely on these systems for developing novel biotechnologies and products, from engineered enzymes to bio-based materials.

Increasing Focus on Personalized Medicine

The cell-free protein expression market is also seeing growth driven by the expanding field of personalized medicine. Personalized treatments often require the production of unique proteins tailored to individual patients. Cell-free systems offer the flexibility needed to produce these custom proteins quickly, allowing for more targeted therapeutic approaches. As the healthcare industry shifts toward more personalized and precision-based care, the demand for cell-free protein expression systems is expected to rise.

Rising Adoption in Academic and Research Institutions

A significant trend is the increasing use of cell-free systems in academic and research settings. These systems are becoming more accessible and easier to use, making them a valuable tool for education and research. Universities and research centers are incorporating cell-free protein expression into their curricula and experiments due to the straightforward setup and rapid results. This trend is contributing to market growth as more educational institutions adopt these technologies for both teaching and research purposes.

Integration with High-Throughput Screening Technologies

Cell-free protein expression systems are also being integrated with high-throughput screening technologies, enabling faster and more efficient drug discovery processes. High-throughput screening allows researchers to test thousands of compounds quickly, and combining it with cell-free expression enhances the speed and precision of identifying potential drug candidates. As pharmaceutical companies seek to streamline the drug discovery process, this trend is driving further adoption of cell-free protein expression systems in the market.

Expansion in Emerging Markets

Lastly, the cell-free protein expression market is witnessing expansion in emerging markets, particularly in regions like Asia-Pacific and Latin America. These regions are investing heavily in biotechnology and life sciences, driving demand for innovative protein expression technologies. With improving healthcare infrastructure and increased research funding, emerging markets are becoming key contributors to the growth of the cell-free protein expression market. As these regions continue to develop, they offer significant opportunities for market players to expand their presence and drive future growth.

Segments Covered in the Report

By Product

o Expression Systems

o E. coli Cell-free Protein Expression System

o Wheat Germ Cell-free Protein Expression System

o Rabbit Reticulocytes Cell-free Protein Expression System

o Insect Cells Cell-free Protein Expression System

o Human Cell-free Protein Expression System

o Others

o Reagents

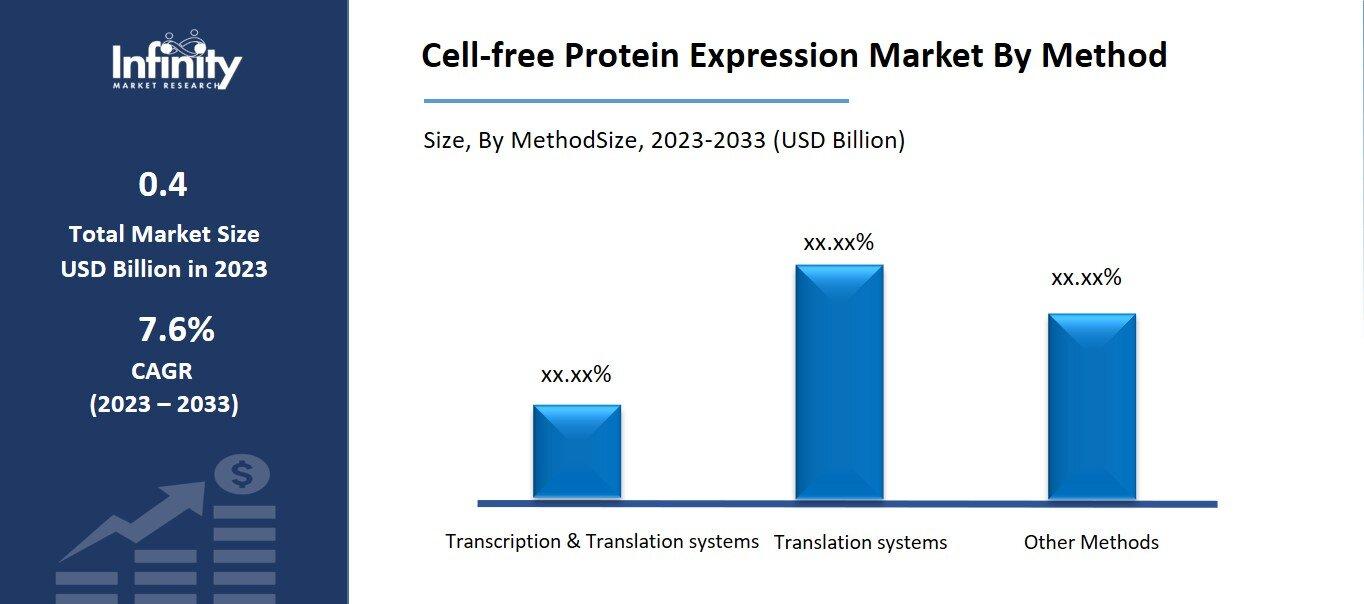

By Method

o Transcription & Translation systems

o Translation systems

o Other Methods

By Application

o Enzyme Engineering

o High Throughput Production

o Protein Labeling

o Protein-Protein Interaction

o Protein Purification

o Other Applications

By End-User

o Pharmaceutical and Biotechnology Companies

o Academic and Research Institutes

o Other End-User

Segment Analysis

By Product Analysis

The expression systems segment accounted for the largest market share in 2023. E. coli lysates are one of the most popular commercial lysates due to their low cost and excellent protein production. Furthermore, E. coli-based systems in recombinant technology are employed for a variety of biological treatments, including insulin.

Wheat Germ Cell-free Protein Expression System is projected to grow at the quickest CAGR. The wheat germ system has the highest translation efficiency among eukaryotic CFPE techniques, as well as an extremely high success rate for the expression of high-quality soluble proteins. Furthermore, this method is a preferred alternative for several applications in protein research, including choices for protein labeling and protein expression, such as multiple protein complexes.

By Method Analysis

In 2023, the transcription and translation systems segment had the biggest market revenue share. Coupled translation and transcription systems give researchers time-saving options for eukaryotic in vitro translation and transcription by combining both activities in a single tube. Transcription and translation systems have a wide range of applications in functional proteome and genome investigations, from low to high throughput.

By Application Analysis

In 2023, the enzyme engineering segment dominated the market, accounting for 35.2%. With the advancement of enzyme engineering, it has become increasingly significant in biomanufacturing, synthetic biology, and medicine. Recently, cell-free synthetic biology approaches to enzyme engineering have been explored as an alternate strategy. This approach places no constraints on the cell membrane and does not require cell viability, and each of the biochemical routes is very adaptable.

Furthermore, the high-throughput production system is predicted to have the fastest CAGR. The use of CFPS for high-throughput enzyme screening is an effective method for discovering better enzyme variations and new biocatalysts. The combination of cutting-edge high-throughput technology enables the use of a cell-free protein expression system for rapid prototyping to accelerate the screening method for enzymes with improved properties.

By End-User Analysis

The pharmaceutical and biotechnology businesses category had the largest revenue share of the market in 2023. The development of current biopharmaceutical production capacities increases demand for cell-free protein expression products. Takara Bio Inc., for example, announced in February 2022 the expansion of its production plant in Shiga, Japan, known as the Center for Gene and Cell Processing.

The GMP facility construction will satisfy the rising demand for contract development and manufacturing enterprises. It will also address the need for a wider range of raw materials and manufacturing processes. Regenerative medicines, RNA and DNA vaccines, cancer immunotherapy treatments, and gene therapy will all be included in manufactured items.

Other end-user segments are predicted to grow at the fastest rate during the study period. Growing investment in pharmaceutical R&D, as well as an increase in the number of clinical studies for Antibody-Drug Conjugates, are among the factors driving market expansion. For example, more than 50 antibody-drug conjugates are now in clinical trials worldwide, with another 250 in development.

The product quality aspects of antibody-drug conjugates are frequently more complex than those of therapeutic proteins alone. Cell-free synthesis allows for the inclusion and scaling of powerful toxins as loads, as well as quick prototyping of proteins, and control over the number of conjugation sites and their position.

Regional Analysis

North America dominated the regional market in 2023, accounting for 35.8%. This significant stake can be attributed to the rise of the biotechnology and pharmaceutical sectors, technologically improved products, and the rising incidence of diseases such as cancer, combined with investments and funding in drug discovery research. For example, in April 2021, Promega announced the opening of its newly constructed R&D building (Kornberg Center) on the Fitchburg, WI site. The facility will provide critical technology and product development in genetic identification, cellular and molecular biology, life science research, scientific applications, clinical diagnostics, and training.

The Asia Pacific region is expected to be the fastest-growing due to the strategic operations of leading industry players. For example, in July 2021, a Japanese firm, CELLFREE SCIENCES CO., LTD, won money from Ehime Prefecture through the Ehime Prefecture New Growth Manufacturing Firm Comprehensive Support Program. The company will leverage its technologies, including a protein bead array platform, to identify new therapeutic concepts and medication targets.

Competitive Analysis

Leading market players are investing extensively in R&D to increase their service offerings, which will help the Cell-free Protein Expression market grow even more. Market participants are also engaging in several strategic initiatives to grow their worldwide footprint, with significant market developments including new service launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. To grow and thrive in a more competitive and expanding market, the Cell-free Protein Expression sector must provide affordable products.

Recent Developments

In September 2023: VantAI, a major essential firm that specializes in drug discovery using artificial intelligence, announced the formation of its latest "Scientific Advisory Board" (SAB). The Scientific Advisory Board members are experts in whole-proteome structural interactomics, generative AI for small-molecule drug creation, and protein design.

In October 2023: Scientists Louis Brus, Moungi Bawendi, and Alexei Ekimov earned the Nobel Prize in Chemistry 2023 for discovering the synthesis of quantum dots, which light up television displays and computer monitors used by physicians or doctors to diagnose cancers.

Key Market Players in the Cell-free Protein Expression Market

o Thermo Fisher Scientific Inc.

o Takara Bio Company

o Merck KGaA

o New England Biolabs

o Promega Corporation

o Jena Bioscience GmbH

o GeneCopoeia Inc.

o Biotechrabbit GmbH

o Cube Biotech GmbH

o CellFree Sciences Co. Ltd.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 0.4 Billion |

|

Market Size 2033 |

USD 0.8 Billion |

|

Compound Annual Growth Rate (CAGR) |

7.6% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product, Method, Application, End-User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Thermo Fisher Scientific Inc., Takara Bio Company, Merck KGaA, New England Biolabs, Promega Corporation, Jena Bioscience GmbH, GeneCopoeia Inc., Biotechrabbit GmbH, Cube Biotech GmbH, CellFree Sciences Co., Ltd., Other Key Players |

|

Key Market Opportunities |

Expanding Use in Educational and Research Institutions |

|

Key Market Dynamics |

Growing Demand for Protein Engineering |

📘 Frequently Asked Questions

1. Who are the key players in the Cell-free Protein Expression Market?

Answer: Thermo Fisher Scientific Inc., Takara Bio Company, Merck KGaA, New England Biolabs, Promega Corporation, Jena Bioscience GmbH, GeneCopoeia Inc., Biotechrabbit GmbH, Cube Biotech GmbH, CellFree Sciences Co., Ltd., Other Key Players

2. How much is the Cell-free Protein Expression Market in 2023?

Answer: The Cell-free Protein Expression Market size was valued at USD 0.4 Billion in 2023.

3. What would be the forecast period in the Cell-free Protein Expression Market?

Answer: The forecast period in the Cell-free Protein Expression Market report is 2023-2033.

4. What is the growth rate of the Cell-free Protein Expression Market?

Answer: Cell-free Protein Expression Market is growing at a CAGR of 7.6% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.