🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Ceramic Additive Manufacturing Market

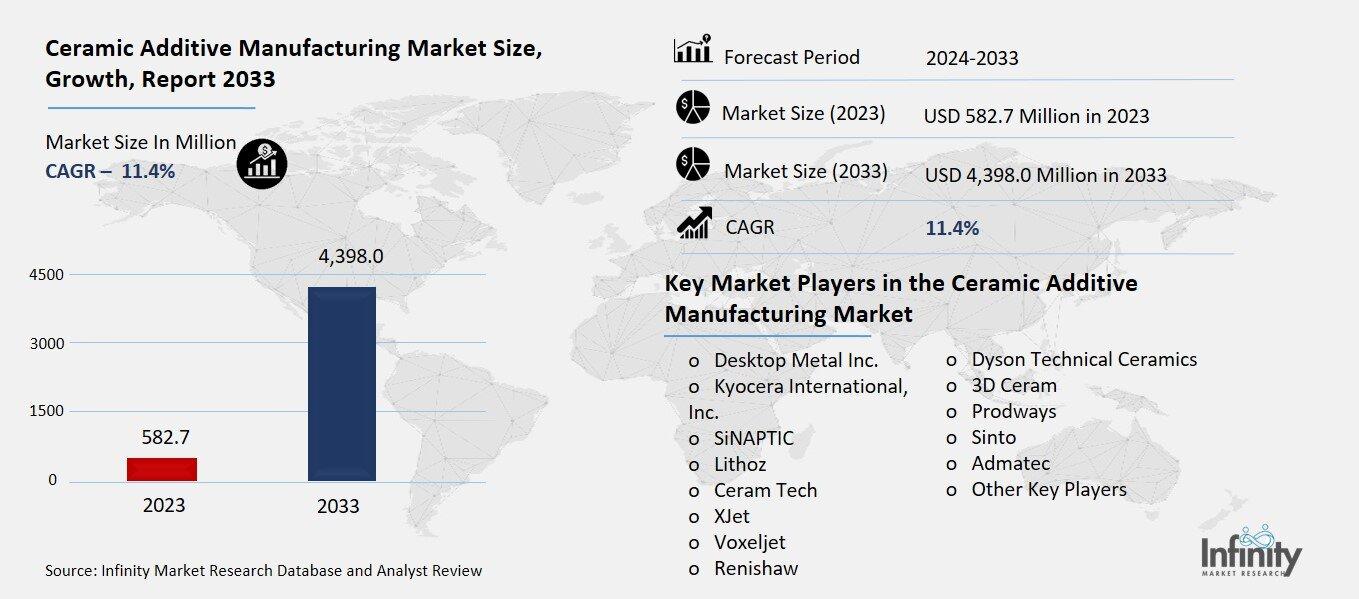

Global Ceramic Additive Manufacturing Market (By Type, Oxide Ceramics, Bioceramics, Non-Oxide, Ceramics, and Other Types; By Process, Pellet Material Extrusion, Powder, Filament Material Extrusion, and Dispersion; By End-Use, Automotive, Aerospace & Defense, Consumer Electronic, Construction, Healthcare, Oil & Gas, Semiconductor, Energy & Power, and Other Applications, By Region and Companies), 2024-2033

Oct 2024

Chemicals and Materials

Pages: 138

ID: IMR1280

Ceramic Additive Manufacturing Market Overview

Global Ceramic Additive Manufacturing Market acquired the significant revenue of 582.7 Million in 2023 and expected to be worth around USD 4.398.0 Million by 2033 with the CAGR of 22.4% during the forecast period of 2024 to 2033. The global CAM market is progressing at a high rate because of the development of 3D printing and the application of ceramics that is growing in various industries that demand high-performance materials. CAM also allows for accurate and intricate fabrication of ceramics needed in industries such as aerospace, healthcare, auto-mobile and electronics industries. This transforms the technology into one that enables the production of geometrically complex forms that would be difficult or even impossible to achieve by other technologies, for example, turbine blades, dental implants, and bio-compatible structures.

Advancements in material science have increased the range of ceramics which can be used and improved the properties such as hardiness, heat tolerance and biocompatibility. While its uses continue to assert their relevance in medical and dental industries, CAM meets the market’s requirement for small lot sizes, short runs, and precision components used in the volume production and prototyping segments. Market is further supported by funds being invested in order to enhance its research and development, with a focus on modifying the technology for a higher capacity, faster and cheaper ceramic 3D printing.

Drivers for the Ceramic Additive Manufacturing Market

Growing Demand in High-Performance Industries

Ceramic AD is especially important in the aerospace and automobile industries, as well as in medicine given the need for substantial wear- and heat-resistant structures that require extremely fine tolerances. For example, Aerospace: ceramics are utilized to develop lightweight resistant from heat components for jet engines and turbines used in serve conditions. Ceramics is also used in auto mobile industry the applications of ceramics include exhaust systems and the sensor which requires high temperature and wear resistance materials. In the healthcare sector, ceramics have gained popularity in the production of implants and dental applications as they present custom designs that can only be made of ceramics so as to meet demanded life span and high sterility standards.

Restraints for the Ceramic Additive Manufacturing Market

Need for Specialized Equipment and Expertise

Ceramic additive manufacturing (CAM) relies on specialized, high-precision equipment and skilled labor, creating accessibility challenges for many organizations. The advanced equipment used in CAM, such as high-resolution 3D printers and precise sintering systems, often comes with high costs, making initial investment significant. Additionally, handling ceramic materials and achieving consistent print quality require specialized knowledge and training, increasing labor demands and operational complexity. These requirements can be particularly restrictive for smaller companies or those without dedicated R&D budgets, limiting the technology’s accessibility and slowing its broader adoption across industries.

Opportunity in the Ceramic Additive Manufacturing Market

Expanding Application in Medical and Dental Fields

Ceramic additive manufacturing (CAM) presents notable growth potential in healthcare due to its ability to produce biocompatible ceramics for applications like implants, prosthetics, and dental devices. Bioceramics, known for their strength, bio-inertness, and compatibility with human tissue, are ideal for implants, where stability and minimal immune response are critical. CAM enables the customization of each implant or prosthetic to meet individual patient anatomy, which is particularly advantageous for complex shapes, ensuring a perfect fit and improved patient outcomes.

In dental applications, CAM allows for the rapid, precise production of crowns, bridges, and implants that match the unique contours of patients' teeth. As demand grows for personalized and durable medical solutions, CAM’s biocompatible ceramic capabilities position it as a promising technology in the healthcare industry, paving the way for advancements in patient-specific treatments and innovative medical devices.

Trends for the Ceramic Additive Manufacturing Market

Improved Software Integration and Automation

Enhanced software capabilities are significantly advancing ceramic additive manufacturing (CAM) by streamlining workflows, enhancing design flexibility, and enabling integration with automation systems. Advanced CAM software allows for more sophisticated design processes, accommodating complex geometries and intricate structures that traditional methods struggle to produce. Features like simulation tools and real-time process monitoring help optimize part quality and reduce errors, enhancing overall production efficiency.

Additionally, software integration with automation systems enables end-to-end automation of CAM processes, from design to post-processing, which reduces manual intervention and speeds up production times. As CAM software continues to evolve, it is also becoming more user-friendly, opening access for operators with varying skill levels. These improvements in software-driven automation and design functionality are propelling CAM forward, making it more scalable and adaptable for a wider range of industries.

Segments Covered in the Report

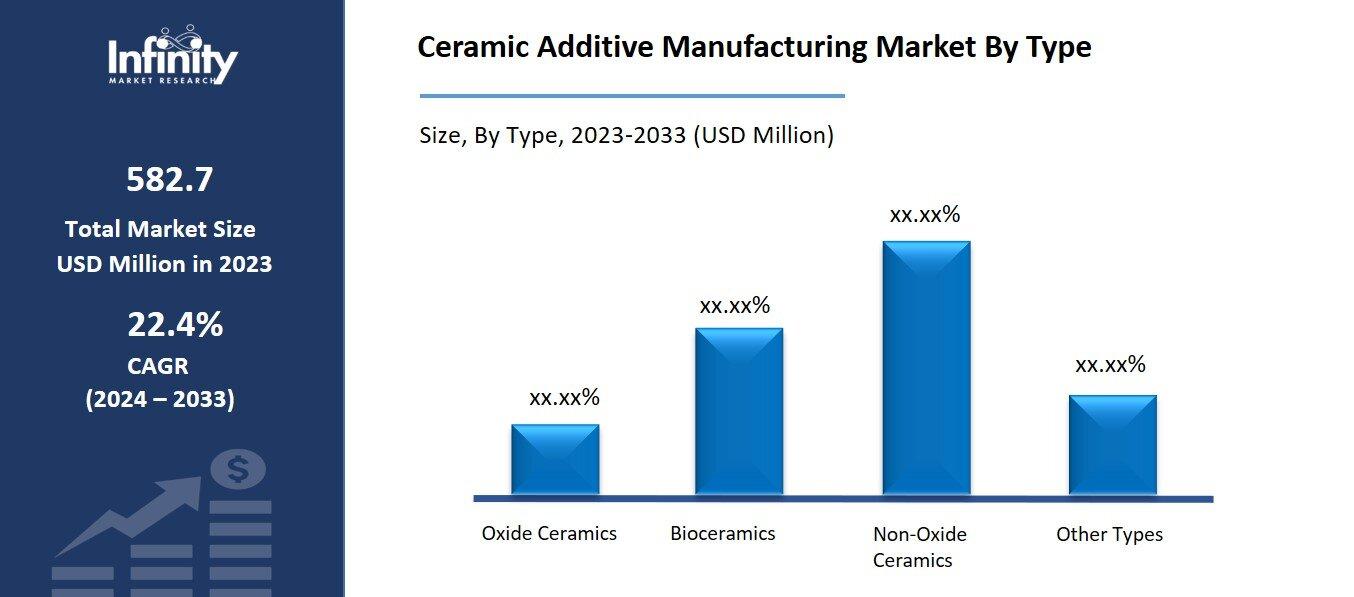

By Type

o Oxide Ceramics

o Bioceramics

o Non-Oxide Ceramics

o Other Types

By Process

o Pellet Material Extrusion

o Powder

o Filament Material Extrusion

o Dispersion

By End-Use

o Automotive

o Aerospace & Defense

o Consumer Electronic

o Construction

o Healthcare

o Oil & Gas

o Semiconductor

o Energy & Power

o Other Applications

Segment Analysis

By Type Analysis

On the basis of type, the market is divided into oxide ceramics, bioceramics, non-oxide, ceramics, and other types. Among these, oxide ceramics segment acquired the significant share in the market owing to its desirable properties such as high chemical stability, excellent electrical insulation, and resistance to heat and wear. Oxide ceramics, including materials like alumina (Al₂O₃) and zirconia (ZrO₂), are commonly used in applications that require high performance in extreme conditions, such as aerospace components, electronics, and industrial machinery. These ceramics also offer superior hardness and durability, making them ideal for applications that need long-lasting, resilient parts.

Additionally, oxide ceramics are relatively easier to process compared to non-oxide ceramics, contributing to their dominance in the CAM market as industries increasingly adopt additive manufacturing for high-precision, high-strength parts.

By Process Analysis

On the basis of process, the market is divided into pellet material extrusion, powder, filament material extrusion, and dispersion. Among these, powder segment held the prominent share of the market. Powder-based processes, such as selective laser sintering (SLS) and binder jetting, enable the creation of detailed, high-resolution parts from a range of ceramic powders, including both oxide and non-oxide ceramics. This method also offers enhanced control over part density and microstructure, allowing for the production of durable, high-performance components that meet the specific demands of industries like aerospace, healthcare, and electronics. Additionally, powder-based CAM is well-suited for scaling production, as it accommodates both prototyping and full production runs with reduced material waste.

By End-Use Analysis

On the basis of end-use, the market is divided into automotive, aerospace & defense, consumer electronic, construction, healthcare, oil & gas, semiconductor, energy & power, and other applications. Among these, automotive segment held the prominent share of the market due to the demand for high-performance ceramic parts that enhance vehicle durability, efficiency, and thermal stability. Ceramics are increasingly used in automotive components like engine parts, braking systems, and exhaust components because of their exceptional heat resistance, wear resistance, and lightweight properties. CAM enables the production of complex, precision-engineered ceramic parts that contribute to fuel efficiency and emissions reduction, aligning with industry goals for sustainability and performance optimization.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 32.1% of the market. The region is home to a robust aerospace and defense industry, where the demand for high-performance ceramic components is significant. Companies in North America are heavily investing in research and development to innovate and enhance additive manufacturing technologies, positioning themselves at the forefront of CAM advancements. Additionally, the presence of major automotive manufacturers and a growing healthcare sector further drive demand for customized, high-strength ceramic parts.

Moreover, North America benefits from a well-established infrastructure for manufacturing and supply chains, facilitating the rapid adoption of CAM technologies. The region’s emphasis on advanced manufacturing practices, coupled with a skilled workforce and supportive government initiatives, promotes the growth of the CAM market.

Competitive Analysis

The competitive landscape of the ceramic additive manufacturing (CAM) market is characterized by a diverse range of players, including established industrial manufacturers, specialized additive technology companies, and research institutions. Key players like 3D Systems, EOS GmbH, and XJet are leading the market by offering advanced 3D printing technologies tailored for ceramics, focusing on enhancing material properties and process efficiency. These companies invest heavily in research and development to innovate new materials and improve production techniques, aiming to meet the growing demand for high-performance components across various industries.

Recent Developments

In September 2021, CeramTec has announced the opening of a new production facility for medical technology in Marktredwitz, Germany. This expansion enhances CeramTec's manufacturing capabilities in Germany and underscores the growing global demand for advanced ceramics in the healthcare sector.

Key Market Players in the Ceramic Additive Manufacturing Market

o Desktop Metal Inc.

o Kyocera International, Inc.

o SiNAPTIC

o Lithoz

o Ceram Tech

o XJet

o Voxeljet

o Renishaw

o Dyson Technical Ceramics

o 3D Ceram

o Prodways

o Sinto

o Admatec

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 582.7 Million |

|

Market Size 2033 |

USD 4,398.0 Million |

|

Compound Annual Growth Rate (CAGR) |

22.4% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Million) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Process, End-Use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Desktop Metal Inc., Kyocera International, Inc., SiNAPTIC, Lithoz, Ceram Tech, XJet, Voxeljet, Renishaw, Dyson Technical Ceramics, 3D Ceram, Prodways, Sinto, Admatec, and Other Key Players. |

|

Key Market Opportunities |

Expanding Application in Medical and Dental Fields |

|

Key Market Dynamics |

Growing Demand in High-Performance Industries |

📘 Frequently Asked Questions

1. Who are the key players in the Ceramic Additive Manufacturing Market?

Answer: Desktop Metal Inc., Kyocera International, Inc., SiNAPTIC, Lithoz, Ceram Tech, XJet, Voxeljet, Renishaw, Dyson Technical Ceramics, 3D Ceram, Prodways, Sinto, Admatec, and Other Key Players.

2. How much is the Ceramic Additive Manufacturing Market in 2023?

Answer: The Ceramic Additive Manufacturing Market size was valued at USD 582.7 Billion in 2023.

3. What would be the forecast period in the Ceramic Additive Manufacturing Market?

Answer: The forecast period in the Ceramic Additive Manufacturing Market report is 2024-2033.

4. What is the growth rate of the Ceramic Additive Manufacturing Market ?

Answer: Ceramic Additive Manufacturing Market is growing at a CAGR of 22.4% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.