🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Ceramic Tiles Market

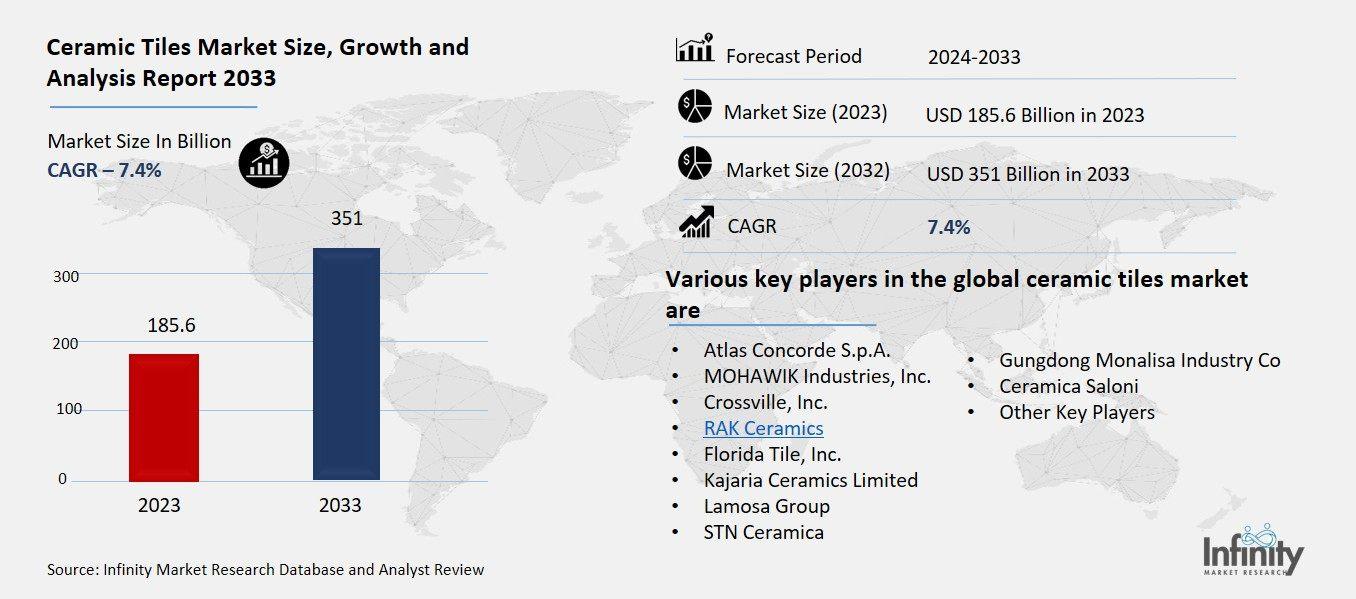

Ceramic Tiles Market By Product Type (Porcelain tiles, Glazed Ceramic Tiles, Scratch Free Ceramic Tiles, and Others), By Application (Wall Tiles, Floor Tiles, and Others), By End-User (Residential and Commercial), By Region (North America, Europe, APAC, South America and MEA), Key Market Players- Forecast (2023-2032)

May 2024

Chemicals and Materials

Pages: 138

ID: IMR1031

Market Overview

The Ceramic Tiles Market size is expected to be valued at USD 185.6 billion in 2023 and is anticipated to reach upto USD 351.7 billion in 2033, exhibiting a CAGR of 7.4% during the forecast period from 2024 to 2033.

Ceramic tiles are flat, hard pieces made from clay or other materials, typically used for covering floors, walls, or other surfaces in buildings. They are manufactured through processes involving shaping, drying, firing, and glazing, resulting in durable and often decorative tiles that offer both functional and aesthetic benefits in construction and interior design projects.

The ceramic tiles market encompasses manufacturers, suppliers, distributors, retailers, and other stakeholders involved in the production and supply chain of ceramic tiles worldwide. It also includes factors such as market trends, growth drivers, challenges, regulations, and technological advancements impacting the industry's dynamics. Factors such as urbanization, population growth, and increasing disposable incomes have fueled the demand for new construction and renovation projects, thereby boosting the ceramic tiles market. Moreover, sustainability concerns have propelled the adoption of eco-friendly ceramic tiles made from recycled materials or produced using energy-efficient building processes.

Segment Overview

By Product Type Analysis

On the basis of product type segment, the market is divided into porcelain tiles, glazed ceramic tiles, and scratch free ceramic tiles, and others. The porcelain tiles segment is expected to dominate the market during the forecast period with the 54% of market revenue. Porcelain tiles are created from fine, thick dirt. These are heavy and hard-like stones; however, they are free from pores that make them highly resistant to moisture. Moreover, mold and bacteria resistance offered by resistant porcelain tiles leads to their long-term value for use in flooring applications. In addition, these tiles are free from fading and are easy to maintain. Because porcelain tiles are so resistant to chemicals, stains, mildew, and fungal development, they are typically employed in flooring applications. They can be used in institutional buildings, hotels, and shopping centers, among other commercial locations. Porcelain tile consumption in the Asia-Pacific region is anticipated to benefit from the growing usage of sustainable building materials due to the ecologically benign nature of their production process.

Glazed tiles are used in general and wet areas, such as bathrooms, kitchens, and laundry areas. These tiles are water and stain resistant because they include an additional protective layer made of glass, which is not present in unglazed tiles. Scratch-resistant tiles are generally used in high-traffic locations including parking lots, paths, gardens, and store floors where there is heavy traffic.

By Application Analysis

On the basis of application segment, the market is categorized into wall tiles, floor tiles, and others. Among these, the floor tiles segment is anticipated to hold the prominent market share of 53% in the overall market. Technological developments that improve digital printing procedures, for example, are contributing to the industry need. Excellent qualities including high resolution, nanometer grade, and multi-layer printing on flat, curved, or textured surfaces are available in newly designed printers.

Additionally, post-combustion methods are versatile and compatible with a wide array of diesel engine types and vehicle applications, making them a preferred choice across diverse industries such as automotive, transportation, agriculture, and construction.

By End-User Analysis

On the basis of end-user segment, the market is classified into residential and commercial. Among these, commercial segment was expected to acquire most of the market share of 57% in the market. This success underscores the importance of the residential segment as a major driver of ceramic tile consumption. The growth in residential construction projects, renovation activities, and the increasing disposable income of homeowners have all contributed to the strong demand for ceramic tiles in residential applications.

Moreover, the rising approval of porcelain tiles in commercial and residential projects has mainly boosted their market presence. Thus, manufacturers and stakeholders in the ceramic tile industry have been usefully concentrating on the production and advancement of porcelain tiles to capitalize on this lucrative market segment.

Market Segments

By Product Type

Porcelain tiles

Glazed Ceramic Tiles

Scratch Free Ceramic Tiles

Others

By Application

Wall Tiles

Floor Tiles

Others

By End-User

Residential

Commercial

Regional Overview

North America

o The US

o Canada

Europe

o Germany

o United Kingdom

o France

o Italy

o Spain

o Rest of Europe

Asia-Pacific

o China

o India

o Japan

o South Korea

o Rest of Asia-Pacific

South America

o Brazil

o Argentina

o Rest of South America

Middle East and Africa

o GCC

o South Africa

o Rest of MEA

Driver

Increasing Construction Activities

One of the main factors propelling the ceramic tile market is the continuous worldwide building boom, particularly in emerging markets. The usage of ceramic tiles in residential and commercial buildings is being driven by increased urbanization, infrastructural development, and the need for aesthetically beautiful interiors.

Restraint

Fluctuating Raw Material Prices

Fluctuations in raw material prices pose a major challenge to the ceramic market. Production costs in molds may increase due to recent increases in industrial gas prices in some countries, which is an important raw material for the molding industry. Lack of availability of high-quality raw materials high costs, high input costs and low levels of environmentally conscious working conditions. The ceramics market is highly dependent on raw materials such as clay, feldspar, kaolin, and quartz, and any fluctuations in their prices can significantly impact the market. The rising cost of raw materials can lead to an increase in the production cost of ceramic products, which can make them less competitive in the international market.

Opportunity

Innovation in Products

Ceramic tile manufacturers can take advantage of new opportunities by introducing unique shapes, for example, big format tiles with rough surfaces and a modern feature like antimicrobial properties, which enable them to search for new markets.

Trends

Rising Adoption Digitalization and Technology Adoption

Rising adoption of digital printing technology was revolutionizing the ceramic tiles industry, allowing for intricate designs, patterns, and textures with high precision and customization. Manufacturers were investing in advanced digital printing machinery to meet the growing demand for aesthetically appealing tiles.

Regional Analysis

Asia-Pacific dominated the ceramic market with the highest revenue share of 54% owing to the driven by rapid urbanization, infrastructure development, and a booming construction industry in countries like China, India, and Southeast Asian nations. Europe is a mature market for ceramic tiles, characterized by high standards of living and a well-established construction sector. Growth in this region is driven by renovation activities, particularly in residential construction, and demand for premium and customized ceramic tiles. North America witnessed significant growth. Due to driven by factors such as residential and commercial construction activities, remodeling projects, and increasing demand for sustainable and energy-efficient building materials. Innovations in tile designs, patterns, and sizes, along with the adoption of digital printing technology, are shaping the market dynamics in this region.

Competitive Analysis

The global ceramic tiles market is characterized by fierce competition driven by factors such as technological advancements, product innovations and market mergers by key players in the industry, led by companies such as Mohawk Industries, Inc. , including mergers and acquisitions of RAK Ceramics and Siam Cement Group, despite moving to increase its market presence through initiatives such as geographic expansion and partnerships, the market is witnessing a growing trend of eco-friendly and sustainable clay frames, causing manufacturers to invest in R&D to deliver eco-friendly products though maintaining a competitive edge. The companies are focused on improving operational efficiencies, optimizing supply chain management and implementing digital technologies such as automation and data analytics.

Key Players

Various key players in the global ceramic tiles market are:

Atlas Concorde S.p.A.

MOHAWIK Industries, Inc.

Crossville, Inc.

Florida Tile, Inc.

Kajaria Ceramics Limited

Lamosa Group

STN Ceramica

Gungdong Monalisa Industry Co

Ceramica Saloni

Other Key Players

|

Report Attribute |

Details |

|

Market Size 2023 |

USD 185.6 Bn |

|

Market Size 2033 |

USD 351.7Bn |

|

Compound Annual Growth Rate (CAGR) |

7.4% |

|

Market Forecast Period |

2023-2033 |

|

Historical Data |

2018-2022 |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East and Africa |

|

Market Scope |

Product Type, Application, End-User, and Region |

|

Key Players |

Atlas Concorde S.p.A.,MOHAWIK Industries, Inc.,Crossville, Inc., RAK Ceramics ,Florida Tile, Inc., Kajaria Ceramics Limited,Lamosa Group, STN Ceramica, Gungdong, Monalisa Industry Co ,Ceramica Saloni, and Other Key Players

|

📘 Frequently Asked Questions

1. Who are the key players in the Ceramic Tiles Market?

Answer: Atlas Concorde S.p.A.,MOHAWIK Industries, Inc.,Crossville, Inc., RAK Ceramics ,Florida Tile, Inc., Kajaria Ceramics Limited,Lamosa Group, STN Ceramica, Gungdong, Monalisa Industry Co ,Ceramica Saloni, and Other Key Players

2. How much is the Ceramic Tiles Market in 2023?

Answer: The Ceramic Tiles Market size was valued at USD 185.6 Billion in 2023.

3. What would be the forecast period in the Ceramic Tiles Market?

Answer: The forecast period in the Ceramic Tiles Market report is 2023-2033.

4. What is the growth rate of the Ceramic Tiles Market?

Answer: Ceramic Tiles Market is growing at a CAGR of 7.4% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.