🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Chiplets Market

Chiplets Market (By Type (CPU Chiplets, GPU Chiplets, Memory Chiplets, Networking Chiplets, Sensor Chiplets), By Application (Consumer Electronics, Data Centers, Automotive, Industrial, Healthcare, Other Applications), By End-User (Telecommunications, IT and Telecommunication Services, Automotive, Healthcare and Life Sciences, Consumer Electronics, Other End-Users), By Region and Companies)

Jun 2024

Semiconductor and Electronics

Pages: 110

ID: IMR1080

Chiplets Market Overview

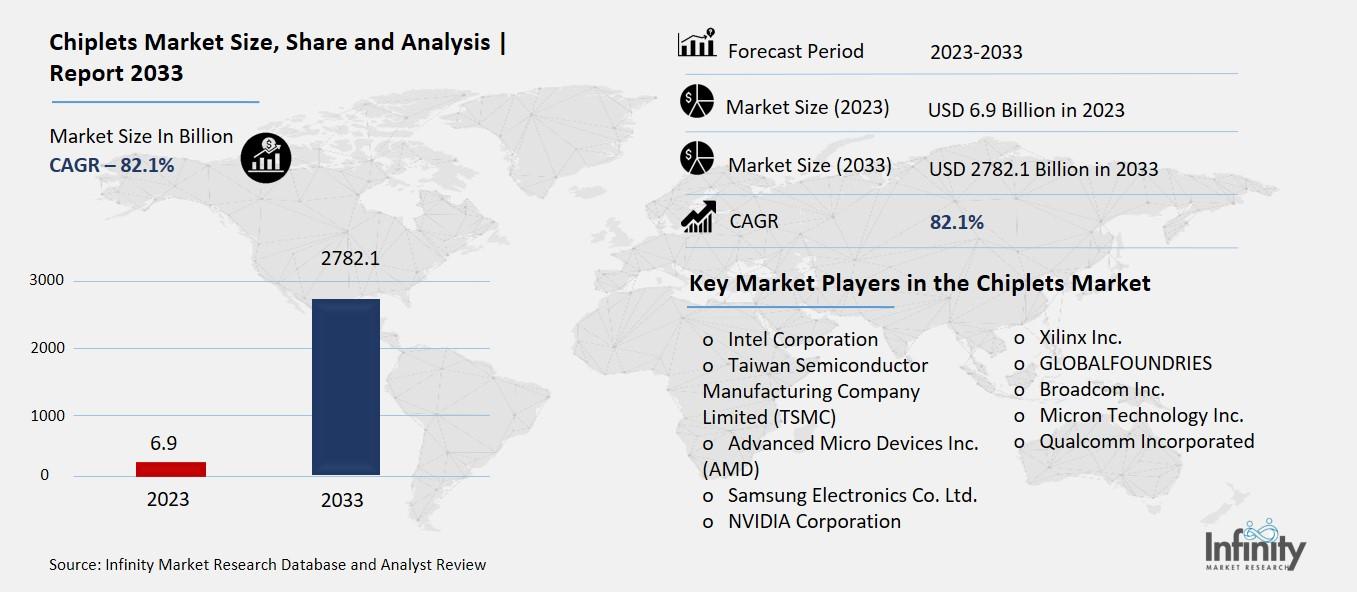

Global Chiplets Market size is expected to be worth around USD 2,782.1 Billion by 2033 from USD 6.9 Billion in 2023, growing at a CAGR of 82.1% during the forecast period from 2023 to 2033.

The chiplets market refers to the industry that deals with making and selling chiplets, which are small pieces of a computer chip. Instead of building a big chip with all the parts in one piece, companies make several smaller chiplets that can be put together like building blocks. This method allows for more flexibility, better performance, and often lower costs in creating complex chips used in devices like computers, smartphones, and data centers.

Chiplets are becoming popular because they help solve some of the problems with traditional chip design. For example, they can make it easier to upgrade or customize parts of a chip without having to redesign the whole thing. This can lead to faster development times and more efficient use of resources. Companies in the chiplets market are working on new technologies and ways to connect these small pieces to keep improving how devices work.

Drivers for the Chiplets Market

Increasing Demand for Electronic Devices

The chiplets market is driven by the rising demand for electronic gadgets, including smartphones, laptops, and wearable devices. These gadgets require sophisticated and compact chip solutions, which chiplets provide effectively. Chiplets offer a flexible, cost-effective, and scalable approach to developing electronic gadgets, catering to the evolving complexity and requirements of modern technologies. For example, consumer electronics production in Japan reached USD 2.18 trillion in May 2023, up from USD 1.71 trillion in May 2022. This increasing production reflects the growing consumer demand, which in turn drives the chiplets market forward.

Advances in Semiconductor Technology

Significant advancements in semiconductor technology are propelling the chiplets market. Companies like Intel and AMD are heavily investing in new packaging facilities and acquiring other tech companies to enhance their chiplet integration capabilities. Intel, for instance, has partnered with TSMC and invested USD 7 billion in packaging facilities in Arizona to advance 3D packaging technologies. Similarly, AMD's acquisition of Xilinx for USD 35 billion highlights the strategic importance of chiplets and 3D packaging, particularly for high-performance computing applications like data centers and AI.

Growth in Data Centers

The rapid expansion of data centers is another key driver for the chiplets market. Data centers require scalable and efficient solutions to handle increasing data processing needs, driven by cloud computing and big data analytics. Chiplets offer an ideal solution with their modular design, allowing data centers to optimize their operations. This demand for high-performance computing solutions has positioned chiplets as essential components in the data center infrastructure.

Adoption in Consumer Electronics

Consumer electronics remains a dominant segment in the chiplets market. The need for compact, high-performance devices like smartphones, tablets, and smartwatches aligns perfectly with the capabilities of chiplets. These devices benefit from chiplets' ability to enhance processing power while minimizing physical space, driving their adoption in the consumer electronics sector.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions are significantly influencing the chiplets market. For instance, Nvidia's acquisition of ARM for USD 40 billion and its focus on GPUs with multi-chipset packaging reflect the importance of chiplet technology in maintaining a competitive edge in high-performance computing (SemiWiki - All Things Semiconductor!). Similarly, the emergence of startups like zGlue and Ayar Labs, which are innovating in chiplet interconnect and optical I/O technologies, indicates a vibrant ecosystem supportive of chiplet market growth.

Restraints for the Chiplets Market

High Costs

One of the main restraints for the chiplets market is the high cost associated with their design and production. Developing chiplets involves significant investment in research and development (R&D) to create modular and scalable designs that meet performance and efficiency requirements. These high initial costs can be a barrier for smaller companies or startups looking to enter the market. Additionally, the manufacturing process for chiplets can be complex and expensive, requiring advanced fabrication facilities and precise assembly techniques. These factors contribute to the overall cost, making chiplets less accessible for cost-sensitive applications and limiting their widespread adoption in some markets.

Integration Challenges

Integrating chiplets into a cohesive system poses another significant challenge. Unlike traditional monolithic chips, chiplets need to communicate effectively with each other, which requires sophisticated interconnect technologies and design methodologies. Ensuring seamless integration while maintaining high performance and low power consumption can be technically challenging. These integration issues can lead to potential bottlenecks, reducing the overall efficiency of the chiplet-based system. Furthermore, the need for specialized tools and expertise to design and integrate chiplets adds to the complexity, making it difficult for companies without substantial technical capabilities to adopt this technology.

Limited Standardization

The lack of industry-wide standards for chiplets is another major restraint. Currently, different companies may develop their proprietary chiplet designs and interconnect, leading to compatibility issues and fragmentation in the market. This lack of standardization can hinder the interoperability of chiplets from different vendors, making it challenging for system designers to mix and match chiplets from various sources. The absence of standardized protocols and interfaces also complicates the development of a robust ecosystem around chiplets, potentially slowing down the pace of innovation and adoption.

Market Competition

The competitive landscape of the semiconductor industry also poses a challenge for the chiplets market. Established semiconductor companies with strong footholds in traditional chip designs may be reluctant to shift towards chiplets, preferring to leverage their existing technologies and infrastructure. Additionally, the intense competition in the semiconductor market means that companies are continually pressured to deliver high-performance, cost-effective solutions. In this environment, the relatively new and potentially higher-cost chiplet technology might struggle to gain traction against more established alternatives.

Supply Chain Constraints

Supply chain issues are another critical restraint affecting the chiplets market. The semiconductor industry has faced significant supply chain disruptions in recent years, exacerbated by the COVID-19 pandemic and geopolitical tensions. These disruptions can impact the availability of key materials and components needed for chiplet production. Furthermore, the reliance on a limited number of advanced semiconductor fabrication facilities (fabs) can create bottlenecks, slowing down the production and delivery of chiplets. Such supply chain constraints can hinder the timely adoption and scaling of chiplet technology in the market.

Opportunity in the Chiplets Market

Expanding High-Performance Computing

One of the biggest opportunities in the chiplets market is their potential to enhance high-performance computing (HPC). As traditional methods of improving chip performance hit physical and economic limits, chiplets offer a way to continue advancing computational power. They allow manufacturers to piece together specialized mini-chips to create powerful systems. This modular approach helps overcome issues with manufacturing defects and costs, making high-performance chips more attainable and efficient.

Revolutionizing Consumer Electronics

Chiplets are set to transform the consumer electronics industry. By allowing the integration of different functionalities into a single, compact chip, they provide greater flexibility and performance. This is particularly important for devices like smartphones, laptops, and wearables, which are becoming more complex and powerful. The ability to mix and match different chiplets means that manufacturers can create more versatile and efficient products, catering to the rapid technological advancements in this sector.

Enhancing AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) applications stand to benefit greatly from chiplet technology. AI and ML require immense computational power, which chiplets can provide more effectively than traditional chips. Companies like Nvidia are already using chiplets to build more powerful GPUs for AI applications. This not only improves performance but also helps manage power consumption and heat dissipation, critical factors in AI hardware.

Supporting Data Centers and Cloud Computing

Data centers and cloud computing services are other areas where chiplets offer significant opportunities. These facilities require high-performance, scalable, and efficient computing solutions. Chiplets can be customized to meet specific needs, allowing data centers to optimize their operations. This customization capability, combined with the enhanced performance and energy efficiency of chiplets, makes them ideal for supporting the growing demands of cloud infrastructure.

Encouraging Innovation and Collaboration

The adoption of chiplets is also fostering innovation and collaboration across the semiconductor industry. Standardized interfaces and protocols, like the Universal Chiplet Interconnect Express, are being developed to ensure compatibility and ease of integration. This open-source approach encourages companies to collaborate, share resources, and innovate together, accelerating the advancement and adoption of chiplet technology. Such collaborations are vital for tackling the technical challenges and unlocking the full potential of chiplets.

Trends for the Chiplets Market

Increasing Adoption in High-Performance Computing

One of the main trends in the chiplets market is their growing use in high-performance computing. Chiplets allow for the integration of different types of processors, memory, and specialized accelerators in a single package, enhancing performance and efficiency. This is particularly useful for data centers and supercomputers, where the demand for high bandwidth and specialized processing capabilities is increasing. By using chiplets, companies can create more powerful processors tailored for specific workloads, such as AI, machine learning, and complex simulations.

Expansion in Consumer Electronics

Consumer electronics is another sector where chiplets are making significant inroads. Devices like smartphones, laptops, and gaming consoles benefit from chiplets' ability to combine multiple functions into a compact and efficient package. This trend is driven by the constant demand for more powerful and energy-efficient consumer devices. The flexibility and scalability offered by chiplets help manufacturers keep up with rapid advancements in technology, providing better performance and longer battery life for consumer gadgets.

Growth in Artificial Intelligence Applications

The use of chiplets in AI applications is growing rapidly. AI-specific integrated circuits (AI ASICs) are designed to handle the intensive computational requirements of AI workloads. These chiplets are becoming essential in industries such as healthcare, finance, and automotive, where AI is increasingly used for data analysis, decision-making, and automation. The ability of chiplets to deliver high performance while consuming less power makes them ideal for AI applications, helping to accelerate AI development and deployment.

Advances in Packaging Technologies

Advancements in packaging technologies are also shaping the chiplets market. Techniques like 2.5D and 3D IC packaging allow for the integration of multiple chips within a single package, enhancing performance and reducing space requirements. This is especially important for applications in mobile devices, automotive electronics, and high-performance computing. These packaging methods improve interconnect density and performance, enabling the development of more sophisticated and compact electronic systems.

Strategic Collaborations and Acquisitions

Another notable trend is the strategic collaborations and acquisitions among major players in the chiplets market. Companies like Intel and AMD are investing heavily in chiplet technology through mergers and acquisitions to strengthen their market positions and expand their technological capabilities. For example, AMD's acquisition of Xilinx has allowed it to integrate complementary technologies and target new markets. Such collaborations are driving innovation and accelerating the adoption of chiplets across various industries.

Segments Covered in the Report

By Type

-

-

CPU Chiplets

-

GPU Chiplets

-

Memory Chiplets

-

Networking Chiplets

-

Sensor Chiplets

-

By Application

-

Consumer Electronics

-

Data Centers

-

Automotive

-

Industrial

-

Healthcare

-

Other Applications

By End-User

-

Telecommunications

-

IT and Telecommunication Services

-

Automotive

-

Healthcare and Life Sciences

-

Consumer Electronics

-

Other End-Users

Segment Analysis

By Type Analysis

With a market share of over 40.8% in 2023, the CPU Chiplets category held a commanding position in the industry. There are a few main reasons for this segment's dominance. First, there is a growing need for more powerful and efficient processors due to the need for high-performance computing in a variety of areas, such as technology, healthcare, and finance. CPU Chiplets successfully meet this need because of their modular design and capacity to increase processing power while preserving energy efficiency.

The growth of data centers and cloud computing has also helped the CPU Chiplets business. These chips make solutions more scalable and configurable, allowing data centers to tailor their operations to meet particular requirements. Because of their exceptional performance and versatility, CPU Chiplets are a great option for cloud infrastructure.

Moving on to GPU Chiplets, these are primarily employed in applications related to machine learning, AI, and high-end gaming. They are an essential part of these industries because of their capacity to manage intricate graphics and computational operations effectively. They do, however, have a somewhat smaller market share than CPU Chiplets, mainly because of their specialized use in industries where market penetration is still developing.

By Application Analysis

With more than 26.2% of the chiplets market in 2023, the Consumer Electronics category commanded a commanding market share. This dominance might be linked to several important reasons that have fueled demand in this industry.

First, more advanced and compact chip solutions have to be integrated due to the quick evolution of consumer electronics technology, especially in smartphones, laptops, and wearables. Chiplets provide the scalability and flexibility required for these increasingly complicated systems because of their modular nature. They make it possible for producers to integrate many semiconductor technologies into a single package, resulting in electronics that are more potent and effective.

Second, the need for chiplets in consumer electronics has increased due to the proliferation of Internet of Things (IoT) devices. Components for Internet of Things devices must be able to process and transmit vast volumes of data while using less energy. Since chiplets are more efficient than conventional monolithic chips, they are a good fit for these demands.

Furthermore, there has been a sharp increase in demand for high-performance gaming consoles and PCs in the gaming business, which accounts for a sizeable chunk of the consumer electronics market. Chiplets, which offer the high-speed processing power required for sophisticated gaming graphics and AI algorithms, have been used to meet this need.

Financially speaking, the sheer number of sales of consumer electronics made worldwide is another factor contributing to the consumer electronics segment's dominance in the chiplets market. To maintain a competitive edge, manufacturers continuously invest in chiplet technology because to the strong demand for new and improved gadgets.

Apart from them, the COVID-19 pandemic contributed to the quickening of the growth of the chiplets market's consumer electronics segment. The epidemic raised demand for solutions for remote work and learning, which increased laptop, tablet, and other communication device sales. This change required quick developments in chip technology, which strengthened the dominance of the consumer electronics market.

By End-User Analysis

With a market share of more than 23.8% in 2023, the IT and Telecommunication Services category dominated the chiplets market. This significance is explained by the increasing requirement for effective network infrastructure as well as the rising demand for high-performance computing solutions in data centers.

To address the industry's constant need for performance improvement and downsizing, chiplet-based solutions are becoming more and more popular. Significant scalability, performance, and cost-effectiveness benefits come with this design approach, which makes it especially appropriate for server and networking applications where processing power and high data throughput are critical.

In a similar vein, the telecom industry has seen significant adoption of chiplets, mainly due to the widespread deployment of 5G technology and the explosion of IoT devices. Chiplets are the perfect solution because they enable more adaptable and scalable system architectures, which are necessary for 5G infrastructure's high-speed data processing and effective power management.

Regional Analysis

With approximately 31.5% of the market share in 2023, the Asia-Pacific (APAC) region became a dominant force in the chiplets industry. Numerous important variables have contributed to our top position. First off, APAC is home to important centers for the production of semiconductors, including China, South Korea, Taiwan, and Japan. These nations are well-known for their sophisticated manufacturing skills and their status as major participants in the world semiconductor market. The region's chiplet market is expanding due to the efficient chiplet production made possible by a strong semiconductor ecosystem.

Furthermore, APAC is seeing a sharp increase in the demand for electronic devices across a range of industries, as well as significant improvements in technology. There is a sizable market for consumer electronics in the area, with a high demand for wearables, tablets, smartphones, and other items. Chiplets are essential for improving these gadgets' functionality and performance. APAC leads the world in chiplets due in part to the requirement for sophisticated semiconductor solutions to fulfill changing customer needs.

Moreover, APAC is seeing significant investments in cutting-edge technologies like IoT, 5G, AI, and driverless cars. The need for chiplets is being driven by these technologies, which mostly rely on cutting-edge semiconductor solutions. APAC is turning into a significant chiplet market as it leads the world in the adoption and application of these cutting-edge technologies.

Competitive Analysis

The market for chiplets is distinguished by the existence of multiple important players who foster its expansion and advancement. These companies offer a variety of chiplet-based products and services and are engaged in the design, production, packaging, and integration of chips.

Recent Developments

August 2023: Together, Google Cloud (US) and NVIDIA Corporation (US) are providing cutting-edge AI software and infrastructure for accelerating data science activities and deploying massive generative AI models. Through this agreement, Google Cloud's NVIDIA-powered solutions for AI supercomputer deployment are streamlined, utilizing the same technology that Google DeepMind and research teams use. With the help of the integration, the Google LLM framework PaxML is optimized for NVIDIA accelerated processing, improving scalability and experimentation with H100 and A100 Tensor Core GPUs.

June 2023: Taiwan Semiconductor Manufacturing Company Limited (Taiwan) and Intel Corporation (US) have partnered to produce chips for Intel's high-performance computing and graphics products. With this arrangement, Intel would be less dependent on other foundries.

Key Market Players in the Chiplets Market

o Taiwan Semiconductor Manufacturing Company Limited (TSMC)

o Advanced Micro Devices Inc. (AMD)

o Samsung Electronics Co. Ltd.

o Xilinx Inc.

o GLOBALFOUNDRIES

o Qualcomm Incorporated

|

Report Features |

Description |

|

Market Size 2023 |

USD 6.9 Billion |

|

Market Size 2033 |

USD 2782.1 Billion |

|

Compound Annual Growth Rate (CAGR) |

82.1% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

Type, Service, End-Use Industry, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Intel Corporation, Taiwan Semiconductor Manufacturing Company Limited (TSMC), Advanced Micro Devices Inc. (AMD), Samsung Electronics Co. Ltd., NVIDIA Corporation, Xilinx Inc., GLOBALFOUNDRIES, Broadcom Inc., Micron Technology Inc., Qualcomm Incorporated, Other Key Players |

|

Key Market Opportunities |

Expanding High-Performance Computing |

|

Key Market Dynamics |

Increasing Demand for Electronic Devices |

📘 Frequently Asked Questions

1. How much is the Chiplets Market in 2023?

Answer: The Chiplets Market size was valued at USD 2782.1 Billion in 2023.

2. What would be the forecast period in the Chiplets Market report?

Answer: The forecast period in the Chiplets Market report is 2023-2033.

3. Who are the key players in the Chiplets Market?

Answer: Intel Corporation, Taiwan Semiconductor Manufacturing Company Limited (TSMC), Advanced Micro Devices Inc. (AMD), Samsung Electronics Co. Ltd., NVIDIA Corporation, Xilinx Inc., GLOBALFOUNDRIES, Broadcom Inc., Micron Technology Inc., Qualcomm Incorporated, Other Key Players

4. What is the growth rate of the Chiplets Market?

Answer: Chiplets Market is growing at a CAGR of 82.1% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.