🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Chrome Plating Market

Chrome Plating Market (By Type (Hard Chrome Plating, Decorative Chrome Plating, Other Types), By Application (Aerospace & Defense, Automotive, Metal Finishing, Other Applications), By Region and Companies)

Jul 2024

Chemicals and Materials

Pages: 122

ID: IMR1175

Chrome Plating Market Overview

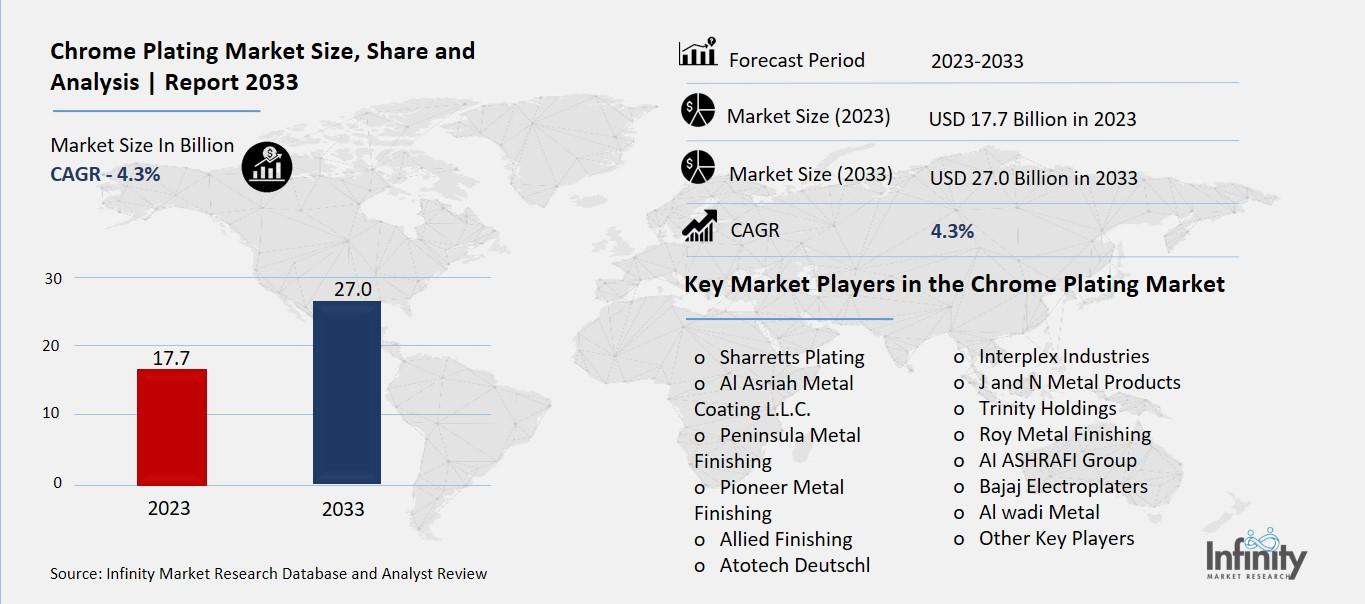

Global Chrome Plating Market size is expected to be worth around USD 27.0 Billion by 2033 from USD 17.7 Billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2023 to 2033.

The Chrome Plating Market refers to the industry involved in applying a layer of chromium onto metal surfaces through a process called electroplating. This plating enhances the appearance of the metal by giving it a shiny, reflective finish. Chrome plating is commonly used on various metal objects, such as automotive parts, household fixtures, and even furniture, to improve their aesthetic appeal and durability. It provides corrosion resistance, making the metal more resistant to rust and wear over time. The process involves immersing the metal object in a solution containing chromium ions, which are deposited onto the surface through an electric current, creating a thin layer that adheres tightly to the base metal.

Businesses in the chrome plating market cater to industries seeking to enhance the visual appeal and durability of their products. The market serves automotive manufacturers, where chrome-plated parts like bumpers and grilles are popular for their decorative and protective qualities. Additionally, consumer goods manufacturers utilize chrome plating for items such as faucets, knobs, and lighting fixtures to offer customers products that are both aesthetically pleasing and long-lasting. The market's growth is influenced by trends in automotive customization and home décor preferences, as well as advancements in plating technologies aimed at improving efficiency and environmental sustainability in the chrome plating process.

Drivers for the Chrome Plating Market

Automotive Industry Demand

One of the primary drivers of the chrome plating market is the significant demand from the automotive industry. Chrome-plated parts such as bumpers, grilles, and trim are widely used to enhance the aesthetic appeal of vehicles. Consumers often associate chrome finishes with luxury and prestige, making them a popular choice for both original equipment manufacturers (OEMs) and aftermarket customizations. As the automotive industry continues to innovate and introduce new vehicle models, the demand for chrome-plated components is expected to remain robust.

Consumer Preference for Aesthetic Appeal

Consumer preference for products with a glossy appearance contributes significantly to the growth of the chrome plating market. Chrome-plated items are favored in industries ranging from automotive to household goods and electronics due to their attractive finish. This aesthetic appeal not only enhances the perceived value of products but also plays a crucial role in consumer purchasing decisions. Manufacturers leverage chrome plating to differentiate their products in competitive markets and appeal to consumers seeking visually appealing and durable products.

Durability and Corrosion Resistance

Chrome plating offers excellent durability and corrosion resistance properties, which are essential drivers for its widespread adoption across various industries. The chromium layer applied through electroplating forms a protective barrier that enhances the lifespan of metal parts by reducing wear and preventing rust formation. This makes chrome-plated components ideal for applications where exposure to harsh environments, moisture, or chemicals is common, such as in automotive, aerospace, and industrial equipment.

Customization Trends in the Automotive Sector

Customization trends in the automotive sector, driven by consumer preferences for personalized vehicles, contribute significantly to the demand for chrome plating. Car enthusiasts and owners often opt for custom chrome finishes on wheels, grilles, and interior trim to achieve a unique look and enhance the overall appearance of their vehicles. This customization trend fuels growth in the aftermarket chrome plating segment, where specialized shops cater to individual preferences for vehicle aesthetics.

Technological Advancements in Plating Processes

Advancements in plating technologies, including improvements in electroplating processes and materials, are driving efficiency and sustainability in the chrome plating market. Innovations such as trivalent chromium plating, which offers environmental benefits compared to traditional hexavalent chromium plating, are gaining traction. These technological advancements not only improve the performance and durability of chrome-plated products but also address regulatory concerns regarding environmental impact, positioning chrome plating as a sustainable choice in manufacturing.

Growing Industrial Applications

Beyond automotive and consumer goods, chrome plating finds increasing applications in industrial sectors such as aerospace, defense, and machinery. In aerospace, for instance, chrome-plated components are used in critical applications where high strength, corrosion resistance, and wear resistance are paramount. The expanding industrial applications of chrome plating further drive market growth, as industries seek reliable and high-performance surface finishing solutions for their equipment and machinery.

Restraints for the Chrome Plating Market

Environmental Concerns and Regulations

One of the significant restraints affecting the chrome plating market is environmental concerns and stringent regulations related to chromium emissions and waste disposal. Chromium, especially in its hexavalent form used in traditional chrome plating processes, is classified as a hazardous substance due to its toxicity and potential health risks. Regulatory bodies in many countries have imposed strict limits on chromium emissions and wastewater discharges from chrome plating facilities, necessitating costly compliance measures and investments in pollution control technologies. These regulations pose challenges for chrome platers in terms of operational costs and regulatory compliance, impacting market growth.

Health and Safety Risks

Health and safety risks associated with chromium exposure pose another restraint for the chrome plating market. Workers in chrome plating facilities are at risk of inhaling chromium particles or absorbing them through skin contact, leading to respiratory issues, skin allergies, and potentially more severe health effects such as lung cancer. Occupational health regulations require stringent safety measures, including personal protective equipment (PPE) and ventilation systems, which increase operational costs for chrome-plating businesses. Concerns over worker safety and health risks limit the expansion of chrome plating operations, particularly in regions with stringent labor laws and occupational health standards.

Rising Costs of Raw Materials

The rising costs of raw materials, particularly chromium and other metals used in plating processes, present a significant restraint for the chrome plating market. Chromium, nickel, and other metals required for electroplating are subject to price fluctuations influenced by global supply chain dynamics, geopolitical factors, and market demand. Fluctuating raw material prices can disrupt production schedules and increase manufacturing costs for chrome plating companies, impacting profit margins and competitiveness in the market. Price volatility in raw materials poses challenges for long-term planning and investment in chrome plating operations.

Shift Towards Alternative Coating Technologies

The shift towards alternative coating technologies, such as electroless nickel plating, powder coating, and ceramic coatings, represents a competitive restraint for traditional chrome plating methods. These alternative technologies offer advantages such as improved corrosion resistance, environmental friendliness, and reduced health risks compared to traditional chrome plating processes. Manufacturers and consumers increasingly prefer alternative coatings that provide comparable or superior performance while addressing environmental and regulatory concerns associated with chromium-based plating methods. This trend towards alternatives limits the growth potential of the chrome plating market, particularly in industries seeking more sustainable and cost-effective surface finishing solutions.

Complexity in Recycling and Waste Management

The complexity of recycling chrome-plated materials and managing hazardous waste streams poses operational and regulatory challenges for chrome-plating businesses. Chrome plating generates hazardous waste streams containing chromium ions and other contaminants, requiring specialized handling, treatment, and disposal methods to prevent environmental contamination. Compliance with waste management regulations adds to operational costs and logistical complexities for chrome platers, particularly small and medium-sized enterprises (SMEs) with limited resources. Effective waste management practices and recycling technologies are essential for minimizing environmental impact and ensuring regulatory compliance in the chrome plating industry.

Market Saturation and Intense Competition

Market saturation and intense competition within the chrome plating industry represent economic restraints affecting market growth. Established chrome plating companies face competition from both domestic and international players offering similar services and products. Price competition, coupled with the commoditization of chrome plating services, exerts pressure on profit margins and limits revenue growth opportunities for market incumbents. Differentiation strategies based on quality, customer service, and technological innovation are crucial for chrome plating businesses to maintain market share and sustain profitability in a competitive environment.

Opportunity in the Chrome Plating Market

Automotive Industry Expansion

An outstanding opportunity for the chrome plating market lies in the expanding automotive industry, which continues to drive demand for aesthetically enhanced vehicles. Chrome-plated components such as grilles, wheels, and trim are favored for their decorative appeal, contributing significantly to the overall aesthetics of vehicles. As global automotive production and sales rise, particularly in emerging markets, the demand for chrome-plated parts is expected to grow. Manufacturers are increasingly incorporating chrome finishes to differentiate their products and meet consumer preferences for stylish and luxurious vehicle designs, presenting a lucrative opportunity for chrome plating businesses to expand their market presence and cater to growing automotive customization trends.

Technological Advancements in Plating Processes

Technological advancements in chrome plating processes present opportunities for market growth by improving efficiency, reducing environmental impact, and expanding application capabilities. Innovations such as trivalent chromium plating, which offers environmental benefits over traditional hexavalent chromium plating, are gaining traction. These advancements not only address regulatory concerns but also enhance the performance and durability of chrome-plated products, opening new opportunities in industries such as aerospace, electronics, and consumer goods. As manufacturers seek sustainable and high-performance surface finishing solutions, technological innovations in chrome plating processes are expected to drive market expansion and adoption.

Emerging Markets and Industrial Applications

The chrome plating market is poised for growth in emerging markets, where rapid industrialization and infrastructure development create demand for durable and corrosion-resistant surface treatments. Countries in Asia Pacific, Latin America, and Africa are witnessing increased investments in automotive manufacturing, construction, and industrial sectors, driving demand for chrome-plated components. Furthermore, industrial applications such as aerospace, defense, and machinery present untapped opportunities for chrome plating companies to expand their product offerings and market reach. As these industries prioritize quality, durability, and aesthetics, chrome plating emerges as a viable solution to meet diverse application requirements and capitalize on emerging market opportunities.

Customization Trends and Consumer Preferences

Consumer preferences for personalized products and customized designs represent a significant opportunity for the chrome plating market. The rise of automotive customization and aftermarket modifications, fueled by consumer demand for unique vehicle aesthetics, drives the adoption of chrome-plated finishes on wheels, accessories, and interior components. Chrome plating offers versatility in design and customization, allowing manufacturers to cater to individual preferences and differentiate their products in competitive markets. By leveraging customization trends and offering tailored chrome plating solutions, businesses can capitalize on consumer-driven opportunities and expand their market share in diverse industries.

Investments in Research and Development

Investments in research and development (R&D) to innovate chrome plating technologies and materials present strategic opportunities for market growth. Companies are investing in advanced plating processes, eco-friendly coatings, and novel materials to enhance product performance, durability, and sustainability. R&D initiatives aim to address industry challenges such as environmental regulations, material costs, and technological advancements, positioning chrome plating as a competitive and preferred surface finishing solution across global markets. By fostering innovation and collaboration in R&D, chrome plating businesses can seize opportunities to develop cutting-edge products and capture new market segments, driving sustainable growth and industry leadership.

Collaboration with End-User Industries

Collaboration with end-user industries, including automotive OEMs, consumer electronics manufacturers, and industrial equipment suppliers, offers strategic opportunities for market expansion and product diversification. Chrome-plating companies can partner with industry leaders to co-develop customized solutions, optimize product designs, and integrate chrome-plated components into new applications. Collaborative partnerships facilitate knowledge exchange, technology transfer, and market insights, enabling chrome platers to align their offerings with evolving industry trends and customer preferences. By forging strategic alliances with key stakeholders, businesses can leverage mutual strengths and capitalize on market opportunities to enhance competitiveness and sustain long-term growth in the chrome plating industry.

Trends for the Chrome Plating Market

Growing Adoption of Trivalent Chromium Plating

A prominent trend in the chrome plating market is the increasing adoption of trivalent chromium plating over traditional hexavalent chromium processes. Trivalent chromium plating offers environmental advantages by significantly reducing hazardous emissions and waste compared to hexavalent chromium, aligning with stringent regulatory requirements worldwide. This trend is driven by growing environmental consciousness among consumers, businesses, and regulatory bodies, prompting chrome plating companies to invest in trivalent chromium technologies. Manufacturers are leveraging trivalent chromium's improved performance characteristics, such as enhanced corrosion resistance and durability, to meet industry demands for sustainable and compliant surface finishing solutions.

Shift Towards Decorative and Functional Applications

There is a notable shift towards both decorative and functional applications of chrome plating across various industries. Beyond traditional automotive applications, chrome plating is increasingly used in consumer electronics, home appliances, and architectural fittings to enhance aesthetic appeal and durability. Manufacturers are incorporating chrome-plated finishes on products such as smartphones, kitchen appliances, and furniture to cater to consumer preferences for stylish and long-lasting surface treatments. This trend reflects a broader market demand for customizable and visually appealing finishes that blend functionality with design aesthetics, driving the diversification of chrome plating applications across global markets.

Rise in Demand for High-Quality Surface Finishes

The chrome plating market is witnessing a rising demand for high-quality surface finishes characterized by superior gloss, smoothness, and uniformity. Consumers and industries alike prioritize products with flawless chrome-plated surfaces that convey a sense of quality and craftsmanship. Chrome plating companies are investing in advanced polishing techniques, automated plating processes, and quality control measures to achieve consistent surface finishes that meet stringent performance standards. This trend underscores the importance of aesthetic appeal and product differentiation in driving market growth and enhancing customer satisfaction across diverse applications.

Technological Innovations in Plating Equipment and Processes

Technological innovations in plating equipment and processes are reshaping the chrome plating market, enabling enhanced efficiency, productivity, and environmental sustainability. Advancements in robotic automation, computerized plating controls, and eco-friendly electrolyte formulations are optimizing plating operations while minimizing resource consumption and waste generation. Manufacturers are adopting state-of-the-art plating technologies to achieve precise coating thickness, uniform distribution, and adherence to complex geometries, thereby expanding the applicability of chrome plating in advanced industrial and electronic applications. These technological advancements drive operational efficiencies and cost-effectiveness while meeting evolving market demands for sustainable and high-performance surface treatments.

Emerging Trends in Chrome Plating Materials and Alloys

Emerging trends in chrome plating materials and alloys are fostering innovation and diversification within the market. Beyond traditional chrome plating on steel and aluminum substrates, there is growing interest in plating on new materials such as plastics, composites, and magnesium alloys. Chrome plating companies are exploring novel coating materials and alloy compositions to enhance performance attributes such as wear resistance, thermal stability, and electrical conductivity across diverse applications. This trend reflects ongoing research and development efforts aimed at expanding the functional capabilities and application versatility of chrome-plated products in emerging industries and technological sectors.

Integration of Sustainability Initiatives

The integration of sustainability initiatives is becoming a pivotal trend shaping the chrome plating market, driven by heightened environmental awareness and regulatory pressures. Chrome plating companies are implementing sustainable practices throughout their operations, including the adoption of recycled materials, energy-efficient processes, and waste minimization strategies. By prioritizing environmental stewardship and corporate responsibility, manufacturers are positioning themselves as industry leaders in sustainable surface finishing solutions. This trend not only supports compliance with stringent environmental regulations but also enhances brand reputation and fosters customer loyalty among eco-conscious consumers and businesses.

Segments Covered in the Report

By Type

o Hard Chrome Plating

o Decorative Chrome Plating

o Other Types

By Application

o Aerospace & Defense

o Automotive

o Metal Finishing

o Other Applications

Segment Analysis

By Type Analysis

Hard chrome plating was probably the biggest subsegment of the chrome plating market in 2023, according to the market segmentation by type. Because of its remarkable hardness, wear resistance, and longevity, this form of plating is frequently utilized in many industrial applications, including machine tools, hydraulic cylinders, and automotive components. Hard chrome plating has been increasingly popular because of the growing need for durable and high-performance components in sectors including manufacturing, automotive, and aerospace.

Decorative chrome plating is anticipated to be the fastest-growing subsegment shortly. The growing trend of personalization and customization along with the increased emphasis on aesthetics and design in consumer goods will likely drive a large increase in demand for decorative chrome plating. This kind of plating is widely employed to improve the aesthetic appeal and give a luxury sense to a variety of consumer goods, including furniture, appliances, and interior trims for cars. The expanding subsegment of ornamental chrome plating is expected to be driven by consumer preferences for fashionable and appealing products as well as increased prosperity.

By Application Analysis

The automotive industry was probably the largest subsegment in the chrome plating market in 2023, according to the market segmentation by application. For both aesthetic and practical reasons, chrome plating is widely utilized on a variety of vehicle components, including bumpers, grilles, wheels, and interior trim. The need for chrome plating services in this subsegment has been fueled by the ongoing growth of the global automotive sector as well as the rising desire for high-end, aesthetically pleasing automobiles.

Aerospace and defense is anticipated to be the subsegment with the fastest rate of growth shortly. Materials and coatings that provide outstanding durability, corrosion resistance, and wear protection must meet strict industrial requirements. To meet these strict criteria, landing gear, aviation components, and other vital applications use chromium plating extensively. The demand for chrome plating in this subsegment is expected to rise significantly because of the expanding investment in the aerospace sector, which is being driven by the development of upgraded aircraft and the growing demand for air travel.

Regional Analysis

North America is the market leader for chrome plating, with over 48.1% of the market in 2023 thanks to its robust aerospace and military industries. Here, chrome plating is essential to the longevity and robustness of aircraft parts. The United States is the largest country in North America, and Canada is growing at the quickest rate. With a robust market share, Europe is the second most dominant area, driven by a thriving automobile sector that produces both passenger automobiles and commercial vehicles. Europe's creative applications of chromium for premium components are anticipated to propel more market expansion over the following nine years.

Europe's Chrome Plating market accounted for a healthy market share in 2023. This is due to the increased production of automobiles in this area. These nations are heavily involved in the production of both passenger and commercial automobiles. Over the next nine years, the market is anticipated to benefit from the creative use of chromium to produce high-quality components that meet industry requirements. Further, the German Chrome Plating market held the largest market share, and the U.K. Chrome Plating market was the fastest-growing market in the European region.

The Asia Pacific Chrome Plating market is expected to register significant growth from 2023 to 2032. This is due to the region's highly developed industrial sectors in China, India, and other countries, as well as rising demand in the metallurgical industry. In comparison to other regions, Asia-Pacific utilizes the most chromium to produce stainless steel. This is due to the increasing importance of stainless steel in every production industry worldwide. Moreover, China’s Chrome Plating market held the largest market share, and the Indian Chrome Plating market was the fastest-growing market in the Asia-Pacific region.

Competitive Analysis

To keep ahead of the competition, major competitors in the market are collaborating with other businesses. To broaden their product offering, numerous businesses are also investing in the introduction of new products. Players also employ mergers and acquisitions as important tactics to diversify their product offerings.

Recent Developments

In July 2023: Kuntz Electroplating of Kitchener saw growth as a result of Canada's expanding EV industry. By helping the EV industry, this expansion will enable them to grow, create environmentally safe plating techniques, update local manufacturing, and ultimately facilitate Kitchener's shift to a more environmentally friendly future.

In October 2023: A new business called ENNOVI was introduced by Blackstone, a prominent investment firm, in collaboration with Interplex, a company recognized for its mechanical and connectivity solutions. This fascinating endeavor is focused on developing novel solutions for electric vehicles (EVs), with a particular emphasis on the design and engineering of key battery, power, and signal system components for next-generation EVs.

Key Market Players in the Chrome Plating Market

o Sharretts Plating

o Al Asriah Metal Coating L.L.C.

o Peninsula Metal Finishing

o Pioneer Metal Finishing

o Allied Finishing

o Interplex Industries

o J and N Metal Products

o Trinity Holdings

o Roy Metal Finishing

o AI ASHRAFI Group

o Al wadi Metal

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 17.7 Billion |

|

Market Size 2033 |

USD 27.0 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.3% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Sharretts Plating, Al Asriah Metal Coating L.L.C., Peninsula Metal Finishing, Pioneer Metal Finishing, Allied Finishing, Atotech Deutschl, Interplex Industries, J and N Metal Products, Trinity Holdings, Roy Metal Finishing, AI ASHRAFI Group, Bajaj Electroplaters, Al wadi Metal, Other Key Players |

|

Key Market Opportunities |

Technological Advancements in Plating Processes |

|

Key Market Dynamics |

Consumer Preference for Aesthetic Appeal |

📘 Frequently Asked Questions

1. What would be the forecast period in the Chrome Plating Market

Answer: The forecast period in the Chrome Plating Market report is 2024-2033.

2. How much is the Chrome Plating Market in 2023?

Answer: The Chrome Plating Market size was valued at USD 17.7 Billion in 2023.

3. Who are the key players in the Chrome Plating Market?

Answer: Sharretts Plating, Al Asriah Metal Coating L.L.C., Peninsula Metal Finishing, Pioneer Metal Finishing, Allied Finishing, Atotech Deutschl, Interplex Industries, J and N Metal Products, Trinity Holdings, Roy Metal Finishing, AI ASHRAFI Group, Bajaj Electroplaters, Al wadi Metal, Other Key Players

4. What is the growth rate of the Chrome Plating Market?

Answer: Chrome Plating Market is growing at a CAGR of 4.3% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.