🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Chromed Metal Market

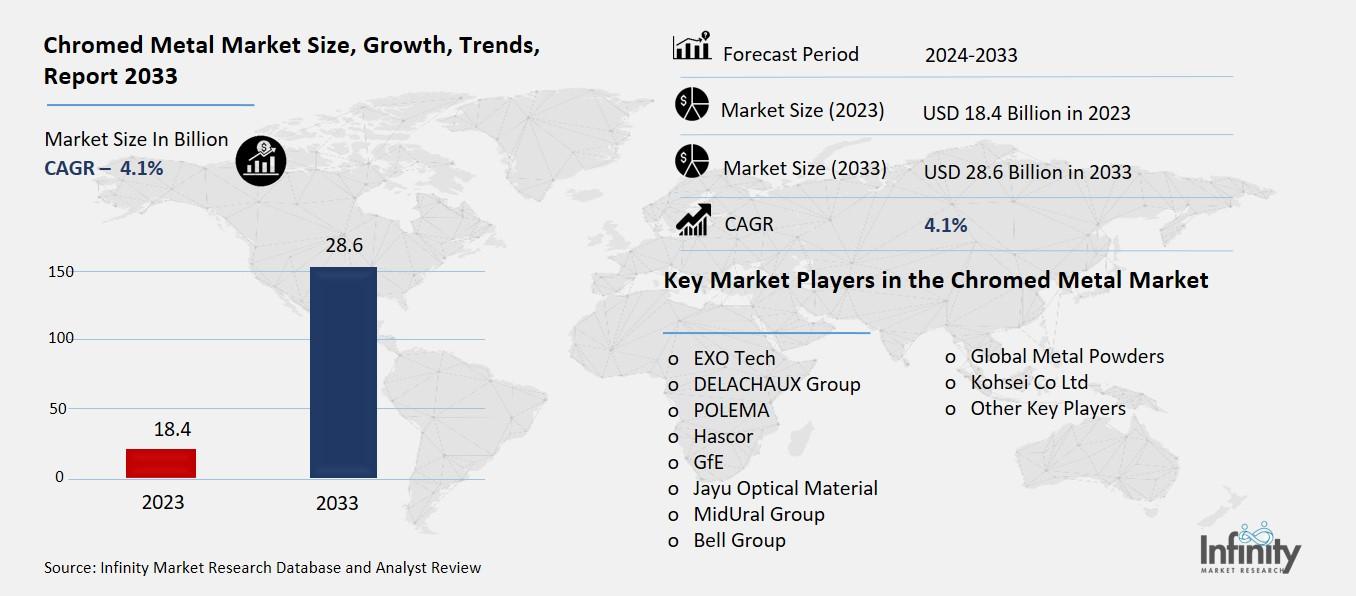

Global Chromed Metal Market (By Product Type, High Purity Chrome Metal and Low Purity Chrome Metal; By Form, Pellets, Powder, and Ingots; By End-Use Industry, Automotive, Aerospace, Construction, Electrical and Electronics, Consumer Goods, and Other End-Use Industries, By Region and Companies), 2024-2033

Dec 2024

Chemicals and Materials

Pages: 138

ID: IMR1352

Chromed Metal Market Overview

Global Chromed Metal Market acquired the significant revenue of 18.4 Billion in 2023 and expected to be worth around USD 28.6 Billion by 2033 with the CAGR of 4.1% during the forecast period of 2024 to 2033. Chromed metal is a large market segment in the metals and manufacturing industries, due to the need for a material with resistance to corrosion, high durability and attractive appearances. Chromed metals are commonly developed through the electrochemical process of placing a thin layer of chromium onto a metal surface and are valued in car manufacture, construction, planes, and various machinery as they are hardwearing, resistant to reactions with moisture or oxidation and shiny. A large variety of the products is used in the automotive industry; chromed metals are used frequently in vehicle trims, wheels and exhaust systems. Also, the rising demand of industrial equipment and machinery components, and consumer’s electronics propel the market growth.

Drivers for the Chromed Metal Market

Rising Demand in Automotive Industry

The automotive industry is a major end user for chromed metals as it takes advantage of the superior properties of chromed metals in engineering as well as in aesthetic applications in vehicles. Chromed metals which are usually a metallic coating of chromium are more preferred since they are heavier, are hard wearing, more resistant to corrosion and are highly valued for their beauty. Chrome plating is very popular in automobile production for aesthetic parts like grills, bumpers, handles and mirror, etc, and for operational parts like wheels and exhaust system, etc. The polished chromium surface gives automobile parts such as the bumper, a glamorous and elegant appearance a feature that goes well with luxury automobiles since consumers within this segment are very picky about the looks of their automobiles.

Furthermore, chromed metals have enhanced ability to resist other unfavorable conditions such as moisture, salts and dirt that cause metal to rust and degrade. This makes chrome a desirable material in car components which are exposed to aggressive weather conditions or high usage. The near universal applicability of chromed metals for durability and appearance make them remain essential architectural pieces of automobile manufacturing and constructions, giving both the look and life to vehicles.

Restraints for the Chromed Metal Market

Fluctuating Raw Material Prices

The price volatility of raw materials, particularly chromium, significantly impacts the manufacturing costs and overall stability of the chromed metal market. Chromium, the primary material used in chrome plating, is a critical component in achieving the desired durability, corrosion resistance, and aesthetic finish of chromed metals. However, the price of chromium can fluctuate due to various factors such as supply chain disruptions, geopolitical tensions in chromium-producing regions (notably South Africa and Kazakhstan), changes in demand from key industries, and global economic conditions. These fluctuations can result in unpredictable raw material costs, making it challenging for manufacturers to maintain consistent production expenses.

Opportunity in the Chromed Metal Market

Development of Eco-friendly Alternatives

The growing global focus on environmental sustainability presents significant opportunities for the development of eco-friendly chroming processes and alternatives to traditional chromium-based plating. As concerns about the harmful environmental and health effects of hexavalent chromium, a toxic substance commonly used in chrome plating, intensify, there is increasing pressure on industries to adopt more sustainable practices. This trend encourages the research and development of new, environmentally friendly chroming techniques that reduce the use of harmful chemicals or entirely replace them with safer materials. For example, the adoption of chrome-free coatings, such as those using trivalent chromium or alternative metals like nickel, is gaining traction as a safer and more eco-conscious option. These alternatives offer similar durability and corrosion resistance without the hazardous byproducts associated with traditional chroming processes.

Trends for the Chromed Metal Market

Increasing Use in 3D Printing

With the rapid advancement of 3D printing technologies, the use of chromed metals is expanding into new areas, particularly in the creation of custom parts and prototypes. 3D printing, or additive manufacturing, allows for the precise and flexible production of complex geometries that would be difficult or impossible to achieve with traditional manufacturing methods. As 3D printing techniques evolve, the ability to print parts with a chromed metal finish is becoming increasingly viable, offering a combination of the versatility of additive manufacturing with the durability, aesthetic appeal, and corrosion resistance of chromed metals.

In industries such as automotive, aerospace, and consumer electronics, the ability to produce custom, high-quality metal parts with a chrome-like finish allows for greater design freedom and the rapid prototyping of components. For instance, automotive companies can design and test prototype parts, such as grilles or decorative trims, in short production runs without the need for expensive molds or tooling. This reduces lead times and production costs, while enabling manufacturers to iterate designs more efficiently.

Segments Covered in the Report

By Product Type

o High Purity Chrome Metal

o Low Purity Chrome Metal

By Form

o Pellets

o Powder

o Ingots

By End-Use Industry

o Automotive

o Aerospace

o Construction

o Electrical and Electronics

o Consumer Goods

o Other End-Use Industries

Segment Analysis

By Product Type Analysis

On the basis of product type, the market is divided into high purity chrome metal and low purity chrome metal. Among these, high purity chrome metal segment acquired the significant share in the market. Industries such as aerospace, electronics, and high-end automotive manufacturing demand materials that meet stringent quality standards, making high-purity chrome metal the preferred choice. For instance, in the aerospace sector, components require materials that can withstand extreme conditions without degradation, necessitating the use of high-purity chrome metal.

Additionally, the electronics industry relies on high-purity materials for components that require precise electrical conductivity and minimal impurities. The demand for high-purity chrome metal in these critical applications underscores its dominant position in the market.

By Form Analysis

On the basis of form, the market is divided into pellets, powder, and ingots. Among these, powder segment held the prominent share of the market due to its versatility and widespread applications across various industries. Chrome metal powder is extensively used in the production of refractory materials, steel manufacturing, and surface coating applications. Its fine particle size allows for uniform distribution and effective coating, making it ideal for processes like thermal spraying and additive manufacturing. Additionally, the powder form facilitates easier handling and storage compared to pellets and ingots, contributing to its significant market presence.

By End-Use Industry Analysis

On the basis of end-use industry, the market is divided into automotive, aerospace, construction, electrical and electronics, consumer goods, and other end-use industries. Among these, automotive segment held the prominent share of the market owing to its versatility and widespread applications across various industries. Chrome metal powder is extensively used in the production of refractory materials, steel manufacturing, and surface coating applications. Its fine particle size allows for uniform distribution and effective coating, making it ideal for processes like thermal spraying and additive manufacturing. Additionally, the powder form facilitates easier handling and storage compared to pellets and ingots, contributing to its significant market presence.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 34% of the market. Countries like China, India, and Japan are key players, with significant investments in industries such as automotive, aerospace, construction, and electronics, all of which are major consumers of chromed metals. The automotive sector, in particular, is a driving force, with increasing demand for both domestic production and exports of vehicles, many of which incorporate chromed metals for decorative and functional purposes.

Additionally, the region benefits from a large number of chromed metal manufacturers, enabling cost-efficient production and supply. The rise of urbanization and infrastructure development in emerging markets further fuels the demand for chromed metals in construction and industrial applications. Moreover, the growth of the electronics industry, especially in countries like China and South Korea, contributes to the region's dominant market position.

Competitive Analysis

The competitive landscape of the global chromed metal market is marked by the presence of several key players vying for market share through strategies such as product innovation, technological advancements, and strategic partnerships. Major manufacturers of chromed metals are focusing on expanding their production capacities, improving the efficiency of electroplating processes, and developing more environmentally sustainable alternatives to traditional chroming methods. Leading companies are investing in research and development to introduce high-purity chromed metals and explore chrome-free coating solutions, responding to the growing demand for eco-friendly materials and regulatory pressures on hazardous substances.

Recent Developments

In January 2022, Yildirim Group acquired Albchrome Holding, an Albanian company specializing in chrome and ferrochromium production. The primary objective of this acquisition is to sustain the company’s growth and further enhance its position in global markets.

In May 2021, Wall Colmonoy Limited, a UK-based company, introduced a new range of Cobalt-Chromium powders and cast discs for the dental industry. These powders are ideal for dental implants, partial dentures, and prosthetics due to their high strength, biocompatibility, and wear resistance.

Key Market Players in the Chromed Metal Market

o EXO Tech

o DELACHAUX Group

o POLEMA

o Hascor

o GfE

o Jayu Optical Material

o MidUral Group

o Bell Group

o Global Metal Powders

o Kohsei Co Ltd

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 18.4 Billion |

|

Market Size 2033 |

USD 28.6 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.1% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product Type, Form, End-Use Industry, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

EXO Tech, DELACHAUX Group, POLEMA, Hascor, GfE, Jayu Optical Material, MidUral Group, Bell Group, Global Metal Powders, Kohsei Co Ltd., and Other Key Players. |

|

Key Market Opportunities |

Development of Eco-friendly Alternatives |

|

Key Market Dynamics |

Rising Demand in Automotive Industry |

📘 Frequently Asked Questions

1. Who are the key players in the Chromed Metal Market

Answer: EXO Tech, DELACHAUX Group, POLEMA, Hascor, GfE, Jayu Optical Material, MidUral Group, Bell Group, Global Metal Powders, Kohsei Co Ltd., and Other Key Players.

2. How much is the Chromed Metal Market in 2023?

Answer: The Chromed Metal Market size was valued at USD 18.4 Billion in 2023.

3. What would be the forecast period in the Chromed Metal Market?

Answer: The forecast period in the Chromed Metal Market report is 2024-2033.

4. What is the growth rate of the Chromed Metal Market?

Answer: Chromed Metal Market is growing at a CAGR of 4.1% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.