🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Circuit Breaker Market

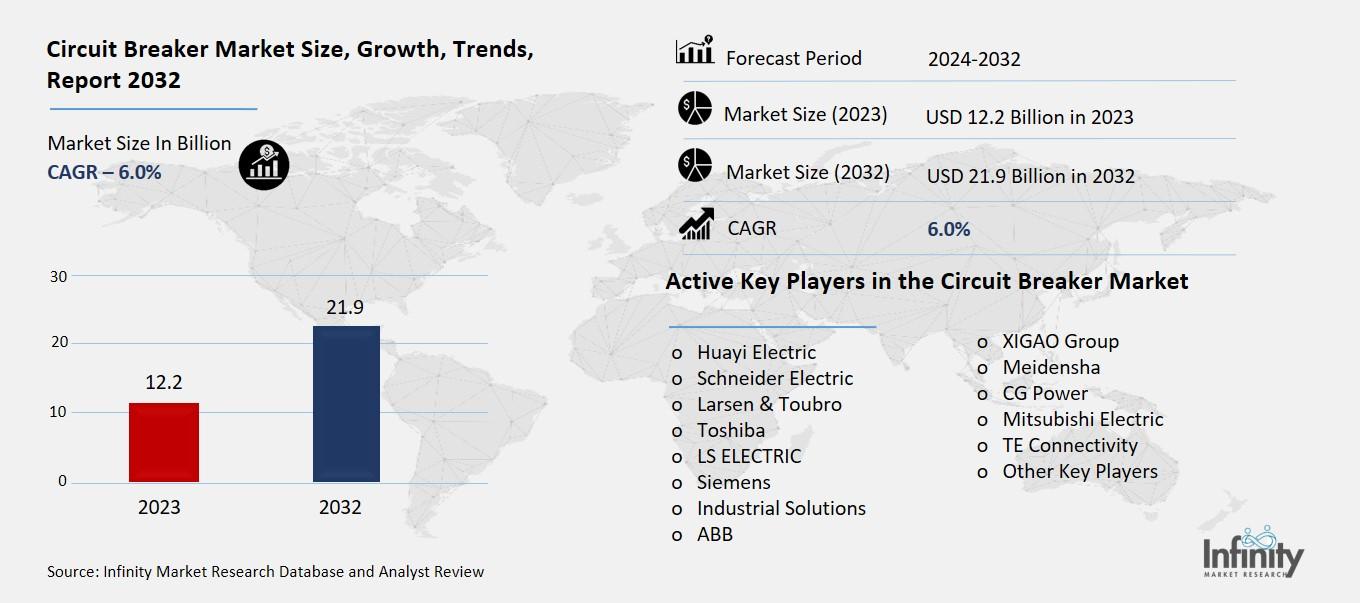

Circuit Breaker Market Global Industry Analysis and Forecast (2024-2032) by Insulation (Vacuum Circuit Breaker, Air Circuit Breaker, Oil Circuit Breaker, and Gas Circuit Breaker), Voltage (High Voltage, Low Voltage, and Medium Voltage), End-use Industry (Industrial, Residential, Commercial, and Utility Scale) and Region

Mar 2025

Energy and Power

Pages: 138

ID: IMR1898

Circuit Breaker Market Synopsis

Circuit Breaker Market Size Was Valued at USD 12.2 Billion in 2023, and is Projected to Reach USD 21.9 Billion by 2032, Growing at a CAGR of 6.0% From 2024-2032.

The circuit breaker market is thriving with the increasing demand for electrical safety and reliability. A circuit breaker is a device that prevents electrical overload from happening in a facility; when an electric current exceeds the defined threshold, the circuit will break immediately, thus helping to prevent equipment damage for both the commercial, industrial facility and utility customers across the licensed electrical Directors. Furthermore, several trends are influencing the market, including the rise of smart grids, the integration of renewable energy sources, and the adoption of advanced digital circuit breakers featuring real-time monitoring capabilities.

Mandatory government regulations about electrical safety and the renovation of the aging power infrastructure are also driving demand. On the other hand, key players involved in the market priorities generate innovative solutions such as vacuum circuit breakers, air circuit breakers, oil circuit breakers, and SF6 circuit breakers, gradually developing eco-friendly and efficient energy alternatives. With the proliferation of technology and electrification stretching across the globe, the market is likely to expand further sooner than later.

Circuit Breaker Market Driver Analysis

Industrial Automation & Electrification

Advancements in circuit breakers and other hardware may include improvements in durability and circuit protection, which is seen as critical to supporting growth in the face of increasing industrialization and automation which demands for them. With the expansion of industries, the use of automated machinery, robotics, and high-power equipment has also increased, leading to a greater probability of electrical faults such as short circuits, overloads, and voltage fluctuations. These devices are an essential part of protecting expensive equipment with minimal downtime and for keeping workers safe. The emergence of Industry 4.0, smart factories, and IoT-enabled factories increases the demand for smarter circuit breakers that offer real-time monitoring and predictive maintenance features. Moreover, automated production lines in industries including automotive, pharmaceutical, and food processing are also increasingly dependent on high-efficiency integrated electronic hardware necessitating highly dependable lasting circuit protection solutions. As industrial automation continues to gain traction across the globe, the circuit breaker market is expected to propel forward due to the increasing requirement for electrical reliability and operational efficiency within various sectors.

Circuit Breaker Market Restraint Analysis

Environmental Concerns on SF6 Circuit Breakers

Climate-related regulatory pressure is growing to replace SF₆ (sulfur hexafluoride) gas, which is widely used as an insulating and arc-snuffing medium in high-voltage circuit breakers, due to its high global warming potential (GWP). With a global warming potential (GWP) 23,500 times higher than carbon dioxide (CO₂) over a century, SF₆ is one of the most dangerous greenhouse gasses and is subject to stricter environmental controls. Governments and international entities like the European Union (EU) and the U.S. Environmental Protection Agency (EPA) are applying restrictions on, phasing out and incentivizing the development of environmentally sound alternatives to SF₆-based equipment. Many manufacturers are innovating SF₆-free circuit breakers in response to these regulations, using alternatives such as vacuum technology, CO₂ or fluoronitrile-based insulation to lessen environmental impact.

Circuit Breaker Market Opportunity Analysis

Growth in Data Centers & EV Infrastructure

Increasing dependence on cloud computing and electric vehicles (EVs) is also substantially driving demand for advanced circuit breakers. From financial transactions to streaming, cloud data centers are part of everyone’s life, but their optimal operation depends on electric power protection that prevents loss of power, loss of equipment and loss of data from power surges or electrical faults. With the growing need for high-speed circuit breakers with real-time monitoring and fault detection as companies expand their cloud storage and computing capabilities, PPPCs are becoming increasingly important to ensure a smooth operation.

Circuit Breaker Market Trend Analysis

Adoption of Solid-State Circuit Breakers

Solid-state circuit breakers (SSCBs), which are a faster and more efficient alternative to mechanical circuit breakers, are on the rise. In contrast to mechanical breakers that utilize physical contacts to halt the flow of electricity, SSCBs employ semiconductor-based switching technologies namely silicon carbide (SiC) or gallium nitride (GaN) transistors to rapidly detect and interrupt faults. This leads to near-instantaneous response times in the microsecond range, greatly minimizing electrical damage, arc flash risks, and downtime.

Moreover, since SSCBs have no mechanical components, they are much more durable as they do not suffer from wear and tear like mechanical breakers. They allow for tight control over load management, which makes the ideal for renewable energy system, electric vehicles (EVs), aerospace, and industrial automation applications.

Circuit Breaker Market Segment Analysis

The Circuit Breaker Market is segmented on the basis of Insulation, Voltage, and End-use Industry.

By Insulation

o Vacuum Circuit Breaker

o Air Circuit Breaker

o Oil Circuit Breaker

o Gas Circuit Breaker

By Voltage

o High Voltage

o Low Voltage

o Medium Voltage

By End-use Industry

o Industrial

o Residential

o Commercial

o Utility Scale

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Insulation, Gas Circuit Breaker Segment is Expected to Dominate the Market During the Forecast Period

The insulation discussed in this research study, the gas circuit breaker segment is expected to account for the largest market share of circuit breaker market in the forecast period. GCBs have an extensive application in high-voltage (HV) and ultra-high-voltage (UHV) power transmission networks, substations, and large-scale industrial plants, where SF₆ (sulfur hexafluoride) gas is the primary medium used. As such, these breakers are employed due to their high dielectric strength, thermal stability and ability to withstand extreme electrical loads, making them critical to reliability in the grid and well as efficient power transfer. With heightened awareness around environmental concerns regarding SF₆ emissions, manufacturers are in the process of developing SF₆-free vacuum products and CO₂-based alternates, in order to adhere to rigorous levels of environmental compliance.

By Voltage, the High Voltage Segment is Expected to Held the Largest Share

The high voltage segment is likely to dominate the market as demand for power transmission and distribution networks and industrial applications increase. Generally, voltage-rated above 72.5 kV high-voltage circuit breakers are extremely important to ensure the stability of the grid and to protect infrastructure vital from electrical throughout. The growing deployment of renewable energy projects, smart grids and ultra-high-voltage (UHV) transmission systems helps to increase their use also.

By End-use Industry, the Residential Segment is Expected to Held the Largest Share

Growing urbanization, increasing demand for electricity, and the need for electrical safety are likely to drive the residential segment, which is expected to have the largest share of the circuit breaker market during the forecast period. Smart homes, new housing developments, and energy efficient buildings have increased the use of circuit breakers for home electrical protection. Governments and regulatory bodies are also enforcing stringent safety standards, thus making circuit breakers indispensable in new builds of residential homes and electrical remodelling.

Circuit Breaker Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Asia Pacific is projected to continue to hold the dominant share in the circuit breaker market during the forecast period, primarily due to rapid industrialization, urbanization, and the growing need for electricity. Countries like China, India, Japan, and South Korea are substantial investors in power infrastructure development, smart grids, and renewable energy initiatives, which predicts high demand for circuit breakers for use in transmission, distribution, and industrial applications.

The market is also driven by the initiatives undertaken by the government for rural electrification, the building of more power generation capabilities, and the adoption of smart electrical networks. Furthermore, aggressive growth in residential and commercial construction, expansion of electric vehicle (EV) charging infrastructure, and power grid upgrades from antiquated systems also help understand the region's leading position in the market.

Recent Development

In January 2020, Siemens acquired C&S Electric, a leading manufacturer of electrical and power electronic equipment, to meet the rising demand for electrification products. The acquisition encompassed C&S Electric’s Indian operations, including its low-voltage switchgear components and panels, low and medium voltage power bus bars, as well as protection and metering devices businesses.

In September 2020, Eaton Cummins Automated Transmission Technologies announced the expansion of its Endurant Automated Transmission lineup with the launch of the Endurant XD series.

Active Key Players in the Circuit Breaker Market

o Huayi Electric

o Schneider Electric

o Larsen & Toubro

o Toshiba

o LS ELECTRIC

o Siemens

o Industrial Solutions

o ABB

o XIGAO Group

o Meidensha

o CG Power

o Mitsubishi Electric

o TE Connectivity

o Other Key Players

Global Circuit Breaker Market Scope

|

Global Circuit Breaker Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.2 Billion |

|

Forecast Period 2024-32 CAGR: |

6.0% |

Market Size in 2032: |

USD 21.9 Billion |

|

Segments Covered: |

By Insulation |

· Vacuum Circuit Breaker · Air Circuit Breaker · Oil Circuit Breaker · Gas Circuit Breaker | |

|

By Voltage |

· High Voltage · Low Voltage · Medium Voltage | ||

|

By End-use Industry |

· Industrial · Residential · Commercial · Utility Scale | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Industrial Automation & Electrification | ||

|

Key Market Restraints: |

· Environmental Concerns on SF6 Circuit Breakers | ||

|

Key Opportunities: |

· Growth in Data Centers & EV Infrastructure | ||

|

Companies Covered in the report: |

· Huayi Electric, Schneider Electric, Larsen & Toubro, Toshiba, and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Circuit Breaker Market Research report?

Answer: The forecast period in the Circuit Breaker Market Research report is 2024-2032.

2. Who are the key players in the Circuit Breaker Market?

Answer: Huayi Electric, Schneider Electric, Larsen & Toubro, Toshiba, and Other Major Players.

3. What are the segments of the Circuit Breaker Market?

Answer: The Circuit Breaker Market is segmented into Insulation, Vacuum Circuit Breaker, Air Circuit Breaker, Oil Circuit Breaker, and Gas Circuit Breaker. By Voltage, the market is categorized into High Voltage, Low Voltage, and Medium Voltage. By End-use Industry, the market is categorized into Industrial, Residential, Commercial, and Utility Scale. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Circuit Breaker Market?

Answer: Circuit Breaker Market The circuit breaker market is the global industry involved in the manufacturing, distribution, and sale of circuit breakers, safety devices used to protect an electrical circuit from damage caused by excess current from an overload or short circuit. Other factors contributing to the growth of this market include rapid expansion of electricity consumption, industrial automation, development of infrastructures, and the increasing importance of electrical safety. The residential, commercial, industrial, and utility sectors are critical drivers of market expansion, and the manufacturing, data center, and renewable energy industries are among the leading users. Market dynamics are driven by innovations in smart grid technology, increasing adoption of renewable energy sources, and strict electrical safety regulations imposed by governments worldwide.

5. How big is the Circuit Breaker Market?

Answer: Circuit Breaker Market Size Was Valued at USD 12.2 Billion in 2023, and is Projected to Reach USD 21.9 Billion by 2032, Growing at a CAGR of 6.0% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.