🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Cloud Application Security Market

Cloud Application Security Market (By Solution (Data Protection, Analytics & Reporting, Threat Protection, Cloud Application Discovery), By Service (Support Services, Consulting Services, Training & Education Services), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By End-Use (Banking, Financial Services & Insurance (BFSI), IT & Telecommunication, Media & Entertainment, Healthcare & Life Sciences, Other End-Uses), By Region and Companies)

Jun 2024

Information and Communication Technology

Pages: 110

ID: IMR1074

Cloud Application Security Market Overview

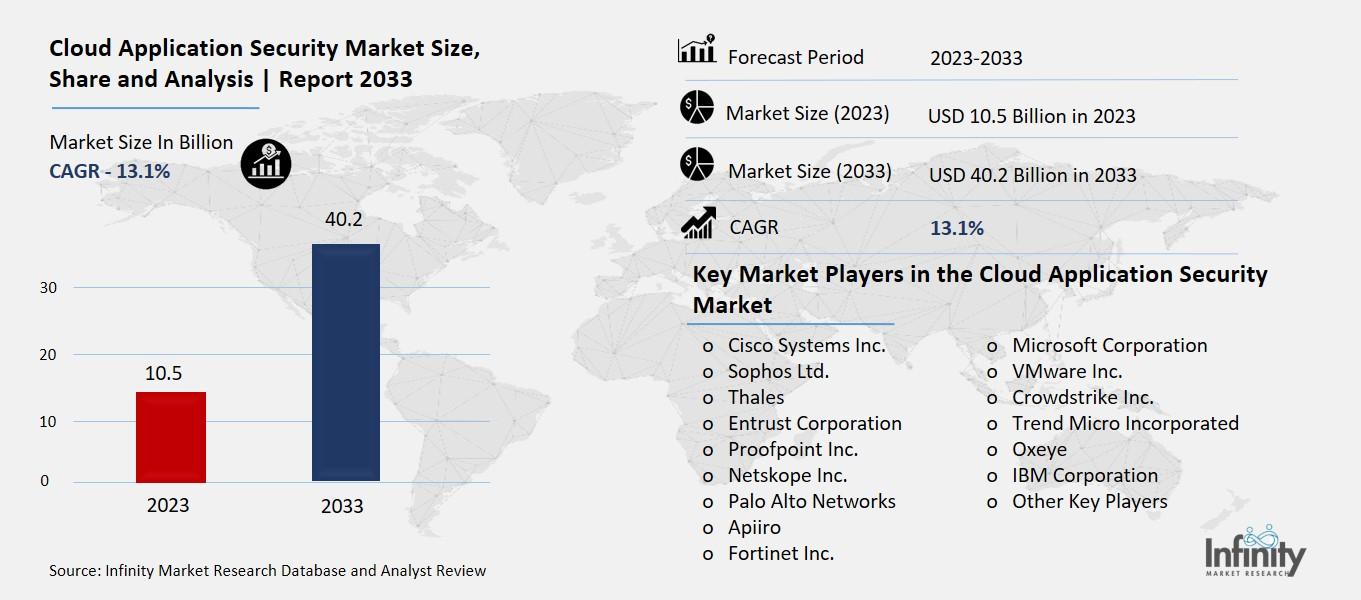

Global Cloud Application Security Market size is expected to be worth around USD 40.2 Billion by 2033 from USD 10.5 Billion in 2023, growing at a CAGR of 13.1% during the forecast period from 2023 to 2033.

The Cloud Application Security Market refers to the industry focused on protecting cloud-based applications from various threats and vulnerabilities. As businesses increasingly use cloud services to store data and run applications, ensuring the security of these applications becomes crucial. This market includes a variety of solutions and services designed to safeguard cloud apps from cyber-attacks, data breaches, and other security risks. These solutions help businesses maintain the confidentiality, integrity, and availability of their cloud-stored data.

In simple terms, the Cloud Application Security Market provides tools and services to keep the apps and data that businesses use in the cloud safe from hackers and other cyber threats. This includes technologies that detect and prevent unauthorized access, secure data transmission, and monitor for suspicious activities. As more companies rely on cloud services for their daily operations, the need for robust cloud application security solutions continues to grow.

Drivers for the Cloud Application Security Market

Growing Concerns Over Data Breaches

One of the primary drivers of the cloud application security market is the increasing concern over data breaches. As organizations migrate their applications to the cloud, they face new security challenges. Data breaches can lead to significant financial losses, damage to brand reputation, and legal repercussions. Thus, businesses are investing in cloud application security solutions to safeguard their sensitive data and ensure compliance with regulatory requirements.

Compliance Requirements and Regulatory Standards

Another factor driving the adoption of cloud application security solutions is the need to comply with regulatory standards and industry regulations. Many industries, such as healthcare and finance, have strict data protection laws that organizations must adhere to. Cloud security solutions help companies meet these requirements by providing encryption, access controls, and auditing capabilities.

Rise in Sophisticated Cyber Threats

The rise in sophisticated cyber threats is also contributing to the growth of the cloud application security market. Hackers are constantly evolving their tactics to exploit vulnerabilities in cloud applications. As a result, there is a growing demand for advanced security measures such as threat intelligence, behavioral analytics, and anomaly detection to protect against these threats.

Shift Toward Bring Your Device (BYOD) Policies

The increasing adoption of Bring Your Device (BYOD) policies in workplaces is another factor driving the demand for cloud application security solutions. Employees are accessing corporate data from their devices, which can pose security risks if not properly managed. Cloud security solutions offer features such as mobile device management (MDM) and endpoint security to secure data accessed via BYOD.

Cost-Effectiveness and Scalability of Cloud Security Solutions

Cloud application security solutions are often more cost-effective and scalable compared to traditional on-premises security solutions. Cloud-based security solutions eliminate the need for large upfront investments in hardware and maintenance costs. They also offer scalability, allowing businesses to adjust their security needs as they grow or as threats evolve.

Competitive Advantage and Business Continuity

Lastly, adopting robust cloud application security measures can provide businesses with a competitive advantage. By demonstrating a commitment to data security and compliance, organizations can build trust with customers and partners. Additionally, effective cloud security measures ensure business continuity by minimizing the risk of disruptions due to security breaches.

Restraints for the Cloud Application Security Market

Complexity in Integrating Security Solutions

One of the major challenges for the cloud application security market is the complexity involved in integrating security solutions across diverse cloud environments. Many organizations use multi-cloud or hybrid cloud environments, which can make it difficult to implement a cohesive security strategy. Different cloud platforms may have varying security protocols and APIs, requiring customized integration efforts and potentially leading to interoperability issues.

Lack of Awareness and Skills Gap

A significant hurdle in the adoption of cloud application security solutions is the lack of awareness and expertise among organizations. Many businesses, especially small and medium-sized enterprises (SMEs), may not fully understand the importance of cloud security or lack the internal skills to effectively implement and manage cloud security measures. This awareness gap can delay adoption and leave organizations vulnerable to cyber threats.

Concerns Over Data Privacy and Sovereignty

Data privacy concerns and regulatory requirements related to data sovereignty present another challenge for the cloud application security market. Organizations may hesitate to adopt cloud security solutions due to uncertainties about where their data is stored and processed. Compliance with regional data protection laws, such as GDPR in Europe or CCPA in California, adds complexity to cloud security implementation, requiring businesses to carefully navigate legal and regulatory landscapes.

Performance Impact and Latency Issues

Implementing security measures in the cloud can sometimes lead to performance impacts and latency issues, especially for applications that require high-speed data processing or real-time interactions. Security solutions such as encryption and data monitoring can introduce delays in data access and transmission, affecting user experience and operational efficiency. Balancing security with performance remains a critical challenge for organizations seeking to optimize their cloud environments.

Budget Constraints and Cost of Implementation

Cost is a significant consideration for businesses when adopting cloud application security solutions. While cloud security offers potential cost savings compared to traditional on-premises solutions, the initial investment in security tools, training, and ongoing management can be substantial. Budget constraints may limit the ability of organizations, particularly SMEs, to invest in comprehensive cloud security measures, leading to compromises in security posture and resilience against cyber threats.

Opportunity in the Cloud Application Security Market

Increasing Adoption of Hybrid and Multi-Cloud Environments

One of the key opportunities for the cloud application security market lies in the increasing adoption of hybrid and multi-cloud environments by organizations. As businesses seek to optimize their operations and infrastructure, many are embracing a combination of public, private, and hybrid cloud solutions. This trend presents a significant opportunity for cloud security providers to offer integrated and scalable solutions that can secure data across various cloud platforms.

Demand for Comprehensive Security Solutions

There is a growing demand for comprehensive cloud security solutions that can address a wide range of security challenges. Organizations are looking for integrated security platforms that offer features such as data encryption, threat detection, identity and access management (IAM), and security monitoring. Cloud security providers have the opportunity to innovate and develop advanced solutions that can protect sensitive data and applications from evolving cyber threats.

Emphasis on Compliance and Regulatory Standards

The emphasis on compliance with regulatory standards such as GDPR, HIPAA, and PCI-DSS presents a significant opportunity for the cloud application security market. Businesses across industries must adhere to stringent data protection laws and regulations to avoid fines and penalties. Cloud security providers can capitalize on this opportunity by offering solutions that help organizations achieve and maintain compliance while protecting their data from unauthorized access and breaches.

Integration of AI and Machine Learning in Security Solutions

The integration of artificial intelligence (AI) and machine learning (ML) technologies in cloud security solutions is another promising opportunity. AI and ML can enhance threat detection capabilities, automate security operations, and improve incident response times. Cloud security providers can leverage these technologies to offer more proactive and predictive security measures that can adapt to emerging threats in real time.

Expansion in Emerging Markets

The cloud application security market is also experiencing growth opportunities in emerging markets across Asia-Pacific, Latin America, and the Middle East. Rapid digital transformation, increasing internet penetration, and adoption of cloud services in these regions are driving the demand for cloud security solutions. Cloud security providers can expand their presence in these markets by offering localized solutions, addressing unique cybersecurity challenges, and partnering with local businesses and governments.

Trends for the Cloud Application Security Market

Adoption of Zero Trust Security Models

One of the prominent trends in the cloud application security market is the adoption of zero-trust security models. Traditionally, security measures focused on securing the perimeter of the network. However, with the increasing number of sophisticated cyber threats and the rise in remote workforces, organizations are shifting towards a zero-trust approach. This model assumes that threats could be both inside and outside the network, requiring strict identity verification and access management policies. Cloud security solutions are integrating Zero Trust principles to ensure that only authenticated and authorized users and devices can access sensitive data and applications.

Increased Focus on DevSecOps and Cloud-Native Security

Another trend shaping the cloud application security market is the increased focus on DevSecOps and cloud-native security solutions. DevSecOps integrates security practices into the DevOps (Development and Operations) pipeline, ensuring that security is a part of the software development lifecycle from the beginning. Cloud-native security solutions are designed to protect applications that are developed and deployed in cloud environments, leveraging containerization, microservices, and serverless computing. These solutions provide continuous security monitoring and automated response capabilities, enabling organizations to detect and mitigate threats more effectively.

Rise of Edge Computing and IoT Security

The rise of edge computing and Internet of Things (IoT) devices is also influencing the cloud application security landscape. Edge computing brings computation and data storage closer to the location where it is needed, reducing latency and bandwidth usage. However, securing these distributed environments and IoT devices poses significant challenges. Cloud security providers are developing solutions that can protect data and applications at the edge, ensuring that sensitive information is secured from endpoint to cloud.

Shift Towards Unified Security Platforms

Organizations are increasingly seeking unified security platforms that can provide centralized visibility and control over their entire IT environment, including on-premises, cloud, and hybrid environments. Unified security platforms offer integrated solutions for network security, endpoint security, cloud security, and identity management. This trend towards consolidation simplifies security management, reduces operational complexity, and enhances overall security posture.

Enhanced Threat Intelligence and Analytics

Advanced threat intelligence and analytics are becoming crucial components of cloud application security solutions. Threat intelligence helps organizations proactively identify and respond to emerging threats, while analytics provide insights into security incidents and vulnerabilities. Cloud security providers are integrating AI, machine learning, and big data analytics to deliver more accurate threat detection, faster incident response times, and improved security decision-making.

Segments Covered in the Report

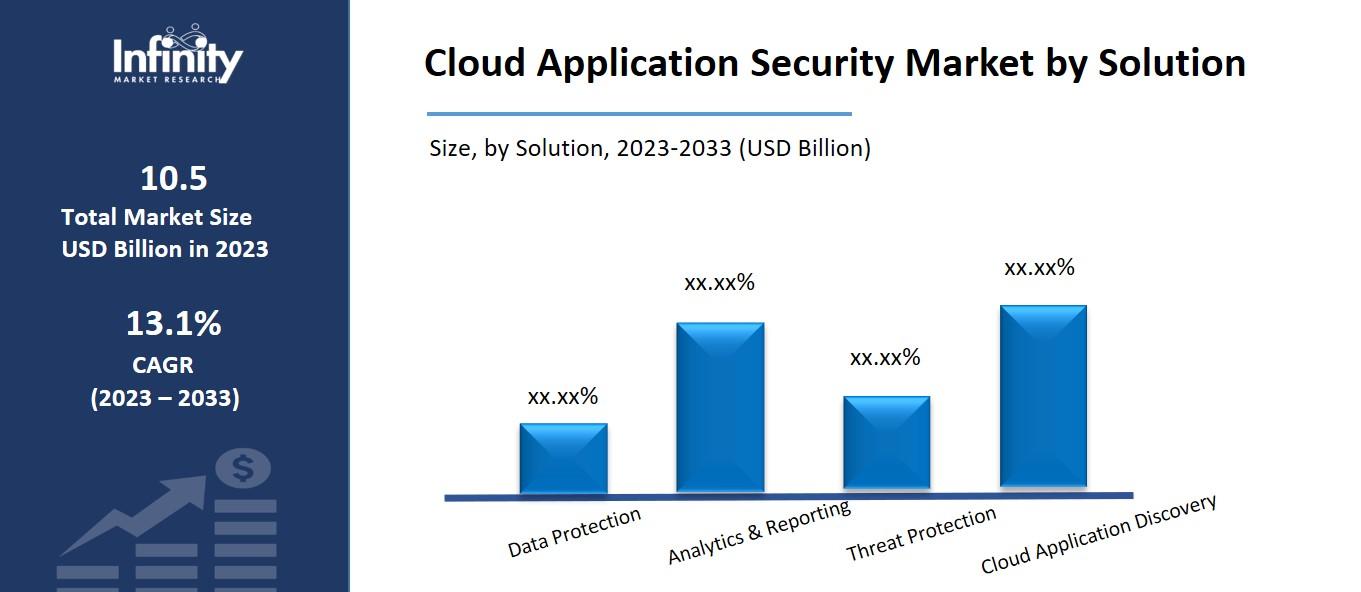

By Solution

o Data Protection

o Analytics & Reporting

o Threat Protection

o Cloud Application Discovery

By Service

o Support Services

o Consulting Services

o Training & Education Services

By Enterprise Size

o Large Enterprises

o Small & Medium Enterprises (SMEs)

By End-Use

o Banking, Financial Services & Insurance (BFSI)

o IT & Telecommunication

o Media & Entertainment

o Healthcare & Life Sciences

o Other End-Uses

Segment Analysis

By Solution Analysis

The global market for cloud application security is divided into four segments based on the type of solution: threat prevention, cloud application discovery, analytics & reporting, and data protection. In 2023, the data protection segment had the highest revenue share. Cloud data protection refers to the set of technologies, rules, services, and security measures that guard against loss, leakage, abuse, and unauthorized access to any type of data held on the cloud. Businesses are collecting enormous volumes of data, which range from essentially unimportant information to extremely private financial, consumer, and corporate data.

Furthermore, more than ever before, they are storing their data in software-as-a-service apps, cloud storage environments, public, private, and hybrid clouds, and other locations. Laws and rules about data protection and privacy, such as the General Data Protection Regulation (GDPR) in the European Union (EU), must also be followed by businesses. Cloud security concerns nine out of ten cybersecurity specialists for these reasons. Protecting against data loss and leakage (67%), risks to data privacy (61%), and breaches of confidentiality (53%), according to them, are their major challenges.

The cloud application discovery sector is anticipated to record the greatest revenue CAGR over the forecast period, Finding and mapping all of the components and interdependencies inside a business environment to gain a comprehensive picture of it is the process of cloud application discovery. Enterprise settings can include multiple related applications from different vendors; this makes discovery more challenging than with client-server network topologies and requires deep knowledge of application domains in addition to proficiency with Application Programming Interface (API) toolkits specific to each vendor. Application discovery in Information Technology (IT)-Conductor employs a multi-layer approach to automatically identify intricate relationships among components in an application context.

By Service Analysis

The global cloud application security market has been divided into three segments based on services: training & education, consultancy, and support services. Throughout the forecast period, the support services category is anticipated to account for the biggest revenue share. Support services are often used to describe an organization's workplace technology usage. For certain technologies, third parties offer IT support services, also referred to as support services. These services provide the help needed to ensure that an organization employs technology safely and efficiently. Internal IT teams might concentrate on IT projects that help businesses and reduce possible issues that users may encounter as a result of IT support services. Experts use support services to carry out a core program or operation that generates revenue. The IT, customer service, and human resources departments are among the departments that make use of these services. Bug bounty hunters are discovering an increasing number of cloud-based vulnerabilities as firms go through a "digital transformation." In 2022, over 65,000 software vulnerabilities were found through the bug reward program HackerOne, a 21% increase from the year before. According to HackerOne's 2022 Hacker-Powered Security Report, which was released on October 20, 2022, the percentage increase is precisely the same as it was in the report from the previous year.

By Enterprise Size Analysis

The global market for cloud application security is divided into two segments based on enterprise size: large organizations and small and medium-sized businesses. Throughout the forecast period, the large enterprises sector is anticipated to account for the largest revenue share. Large companies employ cloud computing to create a single point of control for managing infrastructure and apps across all clouds, combining public, private, and distributed clouds into a single IT operating environment.

For both cloud operators and users of cloud-delivered services and apps, the enterprise cloud offers a reliable, fast, and seamless experience. The enterprise cloud is a model for platform services and IT infrastructure that offers enterprise applications the benefits of public cloud offerings without sacrificing the value that comes from private data center settings. For large enterprises with a variety of cloud workloads, the corporate cloud is perfect. No two businesses will need cloud computing in the same way. Even when circumstances and expectations change, the IT staff can match workloads to the most appropriate environment thanks to the business cloud.

By End-Use Analysis

The global cloud application security market is divided into the following end-user segments: media & entertainment, healthcare & life sciences, IT & telecommunication, banking, financial services & insurance (BFSI), and others. Owing to the increasing use of Bring Your Device (BYOD) and work-from-home practices, as well as the fact that IT companies are giving priority to the usage of cloud security services and solutions, the IT and communications category is anticipated to hold the biggest revenue share over the projected period. Unauthorized traffic to virtual server instances, storage beaches for search as objects, authorized access to database services, Identity and Access Management (IAM) permissions, user logins, and unauthorized API requests are all on the rise as a result of cloud misconfigurations leading to data breaches. Public cloud security deployments are essential for businesses with little privacy concerns.

However, an urge for more scalability and flexibility is driving an increase in hybrid cloud deployments among tech organizations. They can balance their load by utilizing both private and public clouds. These conditions have increased the need for hybrid cloud security solutions among IT enterprises. Businesses are adopting cloud security solutions due to a rise in cloud-native threats and cloud-based cyberattacks. The need to meet security and compliance requirements, as well as the growing use of cloud computing platforms, will propel the use of cloud security solutions in the IT and telecom sectors.

Regional Analysis

With a rate of internet penetration of 86.9% in 2023, the North American area possessed the greatest market share of 44.8%. The United States has emerged as one of the most connected countries in the world in terms of online business and consumer traction. Growing cyberattacks and cybercrimes across the globe are the main factors propelling the cloud application market's expansion. With cutting-edge innovations like the Internet of Things and Big Data, cyberspace is constantly growing, posing new security risks and degrees of complexity.

The Asia Pacific area is anticipated to experience tremendous growth throughout the projection period. The rapidly expanding internet usage services and the increasing BYOD adoption in businesses will propel the market's expansion. The Indian application security market is expanding as a result of the growing use of mobile and cloud-based technologies as well as strict application security compliance.

Competitive Analysis

The global market for cloud application security is very competitive, with numerous large players operating both locally and internationally. To increase their distinct product portfolios and establish a strong presence in the global market, major corporations are involved in strategic alliances and product creation.

Recent Developments

October 2022: With the help of e92plus and Censornet, the leading provider of integrated cloud security in the UK, MSPs (Managed Service Providers) can now provide mid-market businesses the assurance and control of enterprise-level cyber protection. With the ability to provide a single view of numerous products through a multi-tiered, multi-tenant solution, e92plus will allow MSPs to successfully provide their partner's services.

March 2023: The leading global cybersecurity company, Palo Alto Networks (NASDAQ: PANW), has released its 2023 State of Cloud-Native Security Report. As more and more businesses of all kinds shift their operations to the cloud, most are finding it difficult to automate cloud security and reduce risks. It's one of the reasons why a lot of businesses are attempting to enhance security earlier on in the development cycle and are searching for fewer suppliers that can provide greater security features.

Key Market Players in the Cloud Application Security Market

o Thales

o Apiiro

o VMware Inc.

o Oxeye

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 10.5 Billion |

|

Market Size 2033 |

USD 40.2 Billion |

|

Compound Annual Growth Rate (CAGR) |

13.1% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

Solution, Service, Enterprise Size, End-Use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Cisco Systems Inc., Sophos Ltd., Thales, Entrust Corporation, Proofpoint Inc., Netskope Inc., Palo Alto Networks, Apiiro, Fortinet Inc., Microsoft Corporation, VMware Inc., Crowdstrike Inc., Trend Micro Incorporated, Oxeye, IBM Corporation, Other Key Players |

|

Key Market Opportunities |

Increasing Adoption of Hybrid and Multi-Cloud Environments |

|

Key Market Dynamics |

Growing Concerns Over Data Breaches |

📘 Frequently Asked Questions

1. How much is the Cloud Application Security Market in 2023?

Answer: The Cloud Application Security Market size was valued at USD 10.5 Billion in 2023.

2. What would be the forecast period in the Cloud Application Security Market report?

Answer: The forecast period in the Cloud Application Security Market report is 2024-2033.

3. Who are the key players in the Cloud Application Security Market?

Answer: Cisco Systems Inc., Sophos Ltd., Thales, Entrust Corporation, Proofpoint Inc., Netskope Inc., Palo Alto Networks, Apiiro, Fortinet Inc., Microsoft Corporation, VMware Inc., Crowdstrike Inc., Trend Micro Incorporated, Oxeye, IBM Corporation, Other Key Players

4. What is the growth rate of the Cloud Application Security Market?

Answer: Cloud Application Security Market is growing at a CAGR of 13.1% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.