🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Cloud Computing Market

Cloud Computing Market (By Service Type (Software as a Service (SaaS), Infrastructure as a Service(laaS), Platform as a Service (PaaS)), By Deployment Mode (Hybrid Cloud, Private Cloud, Public Cloud), By Enterprise Size (Small & Medium Enterprises, Large Enterprises), By End-Use Industry (IT & Telecommunications, BFSI, Retail & Consumer Goods, Energy & Utilities, Manufacturing, Government & Public Sector, Media & Entertainment, Healthcare, Other End-Use Industries), By Region and Companies)

Jun 2024

Information and Communication Technology

Pages: 167

ID: IMR1099

Cloud Computing Market Overview

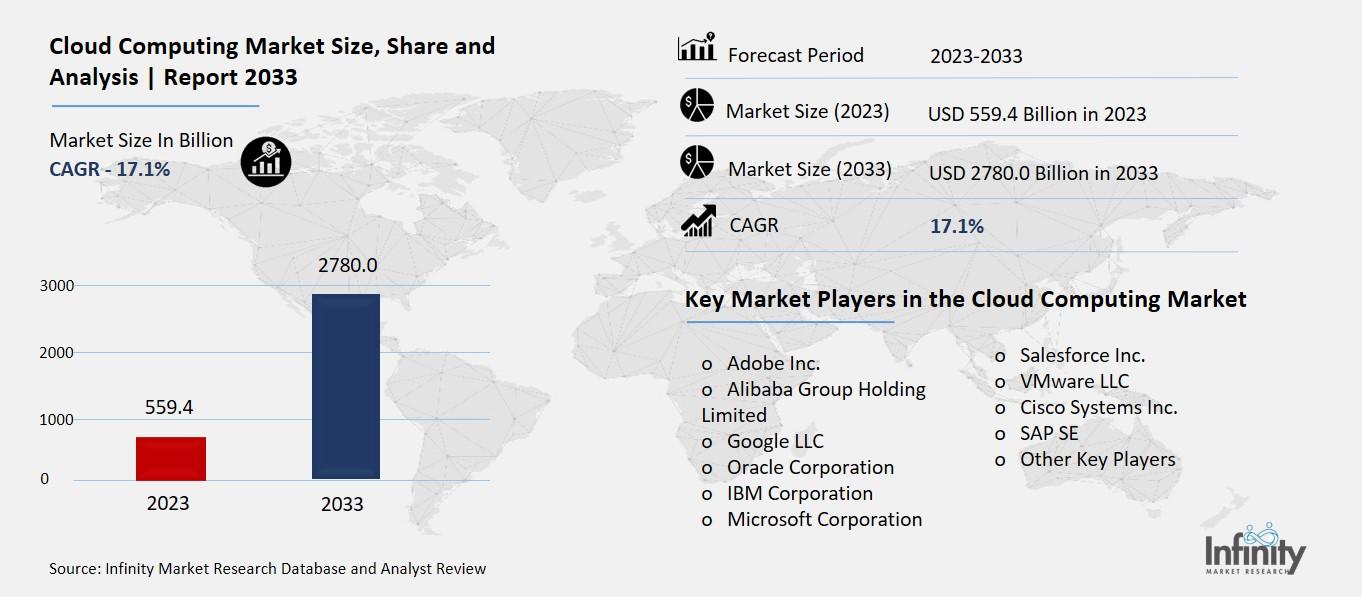

Global Cloud Computing Market size is expected to be worth around USD 2,780.0 Billion by 2033 from USD 559.4 Billion in 2023, growing at a CAGR of 17.1% during the forecast period from 2023 to 2033.

Cloud computing refers to using the internet to access and manage data, applications, and services instead of relying on a local server or personal computer. It's like renting space and tools online to store your files, run software, or use apps. This approach allows businesses and individuals to access their information from anywhere with an internet connection, making it flexible and convenient. For example, instead of storing files on your computer, you can save them on the internet (in the cloud), making sharing and accessing them from different devices easier.

The cloud computing market includes companies that provide these services, like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. They offer different types of services, such as storage, computing power, and software applications, which can be customized based on the needs of the user. This technology is becoming increasingly popular because it reduces the need for costly hardware and allows for more efficient use of resources. Overall, cloud computing simplifies how we store and access data, making it a fundamental part of modern digital operations.

Drivers for the Cloud Computing Market

Increasing Demand for Scalable and Cost-Efficient IT Solutions

One of the primary drivers of the cloud computing market's growth is the increasing demand for scalable and cost-efficient IT solutions. As businesses continue to digitize their operations and rely more heavily on digital infrastructure, the need for flexible and scalable computing resources grows. Cloud computing offers a solution by allowing organizations to scale their IT infrastructure up or down based on demand, without the need for significant upfront investments in hardware and infrastructure. This scalability enables businesses to adapt quickly to changing market conditions and customer demands while minimizing operational costs.

Proliferation of Data-Driven Technologies and Internet of Things (IoT) Devices

The proliferation of data-driven technologies and Internet of Things (IoT) devices is another major driver of the cloud computing market. With the increasing volume of data generated by IoT devices, sensors, and connected systems, businesses require robust infrastructure and storage solutions to manage and analyze this data effectively. Cloud computing provides the necessary computing power and storage capacity to process and derive insights from large datasets, enabling organizations to harness the value of their data for business intelligence, predictive analytics, and decision-making.

Adoption of Hybrid and Multi-Cloud Strategies

The adoption of hybrid and multi-cloud strategies is driving the growth of the cloud computing market as organizations seek to optimize performance, flexibility, and resilience. Hybrid cloud environments allow businesses to leverage a combination of public cloud services and private cloud infrastructure, providing greater control over sensitive data and workloads while taking advantage of the scalability and cost-effectiveness of public cloud platforms. Similarly, multi-cloud architectures enable organizations to distribute workloads across multiple cloud providers, reducing dependency on a single vendor and mitigating the risk of vendor lock-in. These hybrid and multi-cloud strategies empower businesses to tailor their cloud infrastructure to meet specific requirements and optimize performance across diverse workloads.

Digital Transformation Initiatives and Remote Workforce Trends

Digital transformation initiatives and remote workforce trends are accelerating the adoption of cloud computing solutions. With the shift to remote work and the increasing reliance on digital collaboration tools and online services, organizations are prioritizing cloud-based solutions to support remote work environments, enhance collaboration, and ensure business continuity. Cloud-based productivity suites, communication platforms, and collaboration tools enable employees to work from anywhere with an internet connection, improving productivity, efficiency, and flexibility. Additionally, cloud-based applications and services facilitate seamless access to data and resources, empowering remote teams to collaborate effectively and stay connected.

Emphasis on Data Security, Compliance, and Privacy

The emphasis on data security, compliance, and privacy is driving the adoption of cloud computing solutions, particularly among regulated industries and enterprises handling sensitive information. Cloud service providers invest heavily in robust security measures, encryption technologies, and compliance certifications to protect data and ensure regulatory compliance. Additionally, advancements in cloud security tools and threat detection mechanisms enable organizations to strengthen their cybersecurity posture and mitigate risks associated with data breaches and cyberattacks. By leveraging cloud-based security solutions, businesses can enhance data protection, maintain regulatory compliance, and safeguard sensitive information from unauthorized access or exposure.

Restraints for the Cloud Computing Market

Data Security Concerns and Privacy Issues

One of the primary restraints for the cloud computing market is the concern over data security and privacy. As organizations increasingly migrate sensitive data and critical workloads to the cloud, they face heightened risks of data breaches, unauthorized access, and cyberattacks. Despite advancements in cloud security measures, such as encryption, identity and access management, and threat detection tools, security remains a top concern for businesses and governments alike. Compliance with stringent data protection regulations, such as GDPR in Europe and CCPA in California, adds complexity and costs to cloud deployments. Organizations must ensure that cloud service providers adhere to rigorous security standards and compliance requirements to protect sensitive data and maintain customer trust.

Potential for Downtime and Service Disruptions

Cloud service outages and downtime pose another significant challenge for the cloud computing market. Despite the reliability and redundancy of cloud infrastructure, occasional service disruptions can occur due to technical issues, human errors, or cyberattacks. These disruptions can lead to business disruptions, loss of productivity, and financial losses for organizations relying on cloud-based services. Service level agreements (SLAs) between cloud providers and customers often include uptime guarantees, but the impact of downtime on business operations underscores the importance of disaster recovery plans and backup strategies to minimize risks and ensure continuity.

Complexity of Integration and Migration

The complexity of integrating and migrating existing IT systems and applications to the cloud is a barrier for many organizations. Legacy systems, customized applications, and complex data architectures can pose challenges during the migration process, requiring careful planning, testing, and resource allocation. The integration of cloud services with on-premises infrastructure and existing IT environments requires expertise in cloud architecture, networking, and data management. Organizations must navigate compatibility issues, data interoperability, and dependencies between different applications and systems to ensure seamless integration and minimize disruptions to business operations.

Cost Management and Operational Expenses

While cloud computing offers cost savings and scalability benefits, managing cloud expenses and operational costs can be challenging for organizations. Cloud pricing models, such as pay-as-you-go and subscription-based plans, can lead to unpredictable costs if not managed effectively. Organizations must monitor usage, optimize resource allocation, and implement cost management strategies to avoid overspending on cloud services. Additionally, hidden costs, such as data transfer fees, storage costs, and charges for premium support services, can impact overall IT budgets. Cloud cost management tools and strategies, such as cloud cost analytics and budgeting frameworks, are essential for organizations to control expenses and maximize the return on their cloud investments.

Limited Control Over Data and Service Level Agreements (SLAs)

Organizations may face challenges related to limited control over data and service level agreements (SLAs) when relying on third-party cloud service providers. Cloud SLAs define the terms of service availability, performance guarantees, and support response times, but they may not always align with the organization's specific needs or expectations. Lack of transparency in SLAs, vendor lock-in, and dependency on cloud providers for data management and governance can limit organizational autonomy and flexibility. Organizations must negotiate SLAs carefully, establish clear communication channels with cloud providers, and implement contingency plans to mitigate risks associated with service interruptions and contractual disputes.

Opportunity in the Cloud Computing Market

Accelerated Digital Transformation Across Industries

One of the primary opportunities in the cloud computing market is the accelerated digital transformation across industries. Organizations are increasingly adopting cloud solutions to modernize their IT infrastructure, improve agility, and enhance operational efficiency. Cloud computing enables businesses to deploy scalable and flexible computing resources, reducing the reliance on traditional on-premises infrastructure and accelerating time-to-market for new products and services. As industries embrace digital transformation, cloud technologies play a pivotal role in supporting emerging trends such as artificial intelligence (AI), machine learning (ML), Internet of Things (IoT), and big data analytics. These technologies leverage cloud capabilities to process and analyze vast amounts of data, drive innovation, and gain competitive advantages in the global marketplace.

Expansion of Hybrid and Multi-Cloud Strategies

The expansion of hybrid and multi-cloud strategies presents significant growth opportunities for the cloud computing market. Organizations are increasingly adopting hybrid cloud environments, combining public cloud services with private cloud infrastructure and on-premises systems. This hybrid approach allows businesses to optimize performance, security, and compliance while leveraging the scalability and cost-effectiveness of public cloud platforms. Similarly, multi-cloud strategies enable organizations to distribute workloads across multiple cloud providers, reducing vendor lock-in and enhancing resilience. As businesses seek to maximize flexibility and mitigate risks, hybrid and multi-cloud adoption is expected to drive demand for cloud management, orchestration, and integration solutions.

Rising Demand for Edge Computing and IoT Solutions

The rising demand for edge computing and Internet of Things (IoT) solutions represents a significant opportunity for the cloud computing market. Edge computing brings computing resources closer to the data source, enabling real-time data processing and reducing latency for IoT devices and applications. Cloud providers are expanding their capabilities to support edge computing architectures, offering edge-to-cloud integration, data management, and analytics services. This convergence of cloud and edge computing technologies empowers businesses to deliver enhanced user experiences, optimize operational efficiency, and unlock new revenue streams in industries such as manufacturing, healthcare, and transportation.

Increasing Focus on Cybersecurity and Data Privacy

The increasing focus on cybersecurity and data privacy presents opportunities for cloud computing providers to differentiate themselves through robust security solutions and compliance certifications. As businesses migrate sensitive data and mission-critical workloads to the cloud, they prioritize cloud providers that offer advanced security features, encryption technologies, and regulatory compliance. Cloud security solutions, such as identity and access management (IAM), data encryption, and threat detection, are essential for protecting against cyber threats and ensuring data privacy. Cloud providers that can demonstrate strong security practices and compliance with global regulations will be well-positioned to capitalize on the growing demand for secure cloud solutions.

Adoption of Serverless Computing and Containerization

The adoption of serverless computing and containerization technologies presents opportunities for the cloud computing market to optimize resource utilization and enhance application scalability. Serverless computing allows developers to focus on writing code without managing the underlying infrastructure, reducing operational overhead and accelerating application development cycles. Containerization technologies, such as Docker and Kubernetes, enable businesses to package and deploy applications consistently across different cloud environments, improving portability and agility. Cloud providers that offer serverless computing platforms and container orchestration services can cater to the evolving needs of developers and enterprises seeking to build, deploy, and manage modern applications efficiently.

Global Expansion and Market Penetration

Global expansion and market penetration opportunities abound in the cloud computing market, as cloud providers target new geographic regions and industry verticals. Emerging markets in Asia-Pacific, Latin America, and Africa present untapped opportunities for cloud adoption, driven by digital transformation initiatives, increasing internet penetration, and demand for scalable IT solutions. Cloud providers are investing in data center infrastructure, network expansion, and localization of services to meet the unique requirements and compliance standards of regional markets. By expanding their global footprint and establishing strategic partnerships, cloud providers can capture market share and drive growth in emerging economies.

Trends for the Cloud Computing Market

Rise of Serverless Computing and Function-as-a-Service (FaaS)

Serverless computing, also known as Function-as-a-Service (FaaS), is a trend gaining momentum in the cloud computing market. This model allows developers to write and deploy code without worrying about the underlying infrastructure. Instead of managing servers, developers focus on writing functions that run in response to events, such as user requests or IoT sensor triggers. Serverless computing offers scalability, reduced operational costs, and faster time to market for applications. As more businesses adopt microservices architectures and event-driven applications, serverless computing is becoming a preferred choice for building scalable and cost-effective cloud applications.

Adoption of Kubernetes and Containers Orchestration

The adoption of Kubernetes and container orchestration is another significant trend in the cloud computing market. Containers, such as Docker, package applications and their dependencies together, providing a lightweight and consistent environment for running applications. Kubernetes, an open-source container orchestration platform, automates the deployment, scaling, and management of containerized applications. Organizations are leveraging Kubernetes to build and manage scalable, resilient, and portable applications across hybrid and multi-cloud environments. As container adoption grows, Kubernetes has emerged as the de facto standard for container orchestration, driving innovation in cloud-native development and deployment practices.

Expansion of Edge Computing Capabilities

Edge computing is expanding the capabilities of cloud computing by processing data closer to where it is generated, rather than in centralized data centers. This trend is driven by the proliferation of IoT devices and the need for real-time data processing and analysis. Edge computing reduces latency, bandwidth usage, and response times, making it ideal for applications requiring immediate insights and actions, such as autonomous vehicles and smart city initiatives. Cloud providers are extending their services to the edge, offering edge computing platforms and solutions that integrate with their core cloud offerings, enabling organizations to build and deploy edge-enabled applications seamlessly.

Growth of AI and Machine Learning Integration

The integration of artificial intelligence (AI) and machine learning (ML) into cloud computing services is transforming how organizations analyze data, automate processes, and deliver intelligent applications. Cloud providers are offering AI/ML services, such as pre-trained models, automated machine learning (AutoML), and AI inferencing capabilities, to help businesses extract insights and drive innovation. These services enable organizations to build predictive models, personalize customer experiences, optimize operations, and improve decision-making. The democratization of AI through cloud platforms empowers businesses of all sizes to leverage advanced AI capabilities without needing deep expertise in data science or machine learning.

Focus on Sustainability and Green Cloud Computing

Sustainability and green cloud computing have become key priorities for cloud providers and their customers. As the demand for cloud services grows, so does the energy consumption of data centers powering these services. Cloud providers are investing in renewable energy sources, energy-efficient data centers, and carbon-neutral initiatives to reduce their environmental impact. Green cloud computing initiatives aim to minimize carbon footprints, optimize resource usage, and promote sustainability practices across the industry. Customers are increasingly choosing cloud providers that prioritize sustainability, driving competition and innovation in environmentally friendly cloud solutions.

Evolution of Quantum Computing and Hybrid Cloud Architectures

The evolution of quantum computing and hybrid cloud architectures represents a future trend that is beginning to shape the cloud computing landscape. Quantum computing promises to revolutionize data processing, cryptography, and optimization problems that are infeasible for classical computers. Cloud providers are exploring hybrid cloud models that integrate quantum computing capabilities, enabling businesses to combine classical and quantum computing resources to solve complex problems efficiently. While quantum computing is still in its early stages, it holds potential for breakthroughs in fields such as materials science, drug discovery, and financial modeling.

Segments Covered in the Report

By Service Type

- Software as a Service (SaaS)

- Infrastructure as a Service(laaS)

- Platform as a Service (PaaS)

By Deployment Mode

- Hybrid Cloud

- Private Cloud

- Public Cloud

By Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

By End-Use Industry

- IT & Telecommunications

- BFSI

- Retail & Consumer Goods

- Energy & Utilities

- Manufacturing

- Government & Public Sector

- Media & Entertainment

- Healthcare

- Other End-Use Industries

Segment Analysis

By Service Type Analysis

The cloud computing market is further subdivided into three service type segments: Software as a Service (SaaS), Infrastructure as a Service (laas), and Platform as a Service (PaaS). Of these service-type segments, the Software as a Service (SaaS) segment held a significant revenue share of 56.2% in 2023, indicating its dominance in the market. The reason for this segment's ease of use and accessibility is that SaaS solutions give businesses access to sophisticated applications without requiring complicated software and hardware management.

This concept greatly reduces IT overheads and resource allocation by doing away with the need for labor-intensive installation procedures and continuous maintenance. Because SaaS apps are easily accessed through web browsers, users can operate remotely and with freedom thanks to their ability to access services from any location. Scalability is another benefit of the SaaS model, which enables companies to readily modify their usage by present requirements without incurring large upfront expenditures. SaaS's prominence in the cloud computing market can be attributed to these qualities, which make it particularly desirable to a wide spectrum of businesses, from small startups to major enterprises.

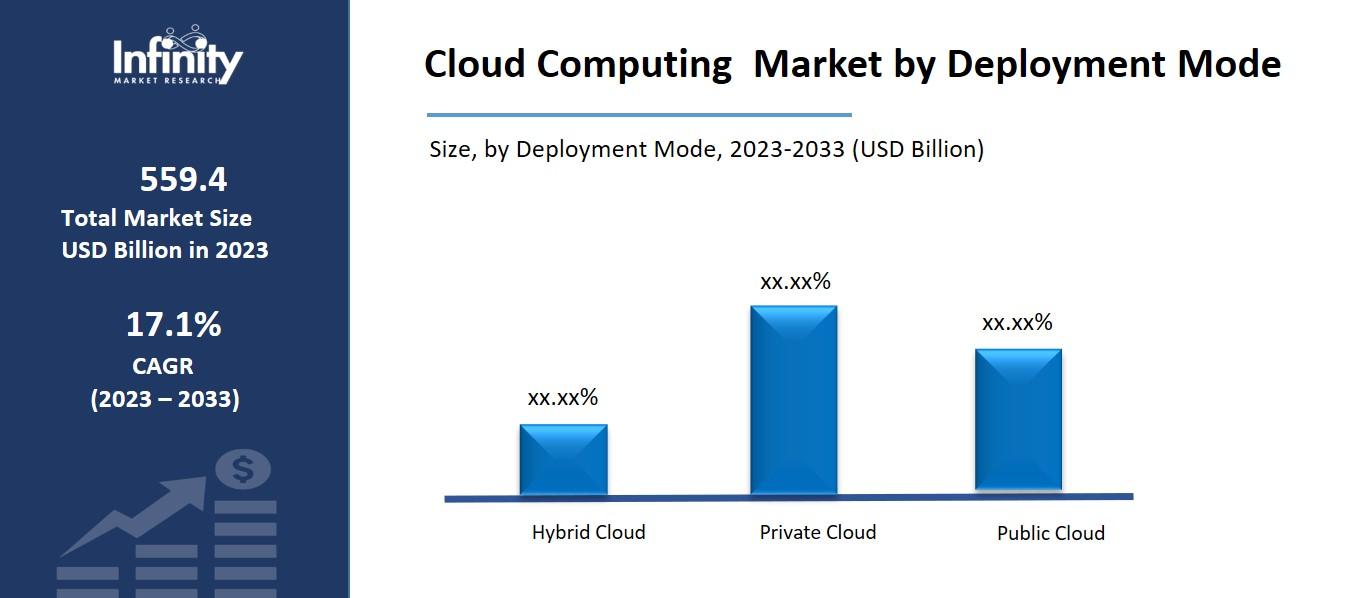

By Deployment Mode Analysis

The market is segmented into Hybrid Cloud, Private Cloud, and Public Cloud based on Deployment Mode. The private cloud deployment mode segment led the market in 2023 with a higher revenue share of 42.8% among all segments.

The private cloud deployment mode's superior security and control capabilities are mostly to blame for its market domination. Compared to public clouds, private clouds offer a greater degree of security and privacy since they are exclusive to one company. This is especially important for companies that deal with sensitive data, such as those in the government, healthcare, and financial industries.

Furthermore, private clouds give enterprises more control over the IT environment by enabling them to tailor their infrastructure to meet unique business demands and regulatory requirements. This capacity for customization is a big benefit for businesses with intricate or particular IT requirements. Furthermore, because resources are not shared with other businesses, private clouds may provide higher performance and dependability. Because of these advantages, private cloud computing is a desirable choice for companies that value security, control, and customization in their cloud computing solutions.

By Enterprise Size Analysis

The market is divided into two categories: large enterprises and small and medium-sized enterprises. With a projected revenue share of 58.7% in 2023, the big businesses category leads all of these enterprise-size categories. Large organizations dominate this market because of their substantial resources and demanding need for reliable IT infrastructure. Large businesses frequently handle enormous amounts of data and intricate business procedures, which calls for a scalable and effective computing solution.

Because of its scalability, cloud computing helps these kinds of enterprises better handle their large-scale data and application requirements. Large businesses also have the financial and technological means to purchase advanced and bespoke cloud services, as well as comprehensive cloud solutions. Furthermore, large organizations' greater adoption rates of cloud technologies are fueled by the strategic importance of digital transformation, which further solidifies their leading position in the cloud computing market.

By End-Use Industry Analysis

The market is divided into the following segments based on End-Use Industry: Manufacturing, Government & Public Sector, Media & Entertainment, Healthcare, Retail & Consumer Goods, Energy & Utilities, IT & Telecommunications, BFSI, Retail & Consumer Goods, and Other End-Use Industries. The BFSI category led the market among these end-use industries in 2023, securing a higher revenue share of 22.1%. The market domination of the Banking, Financial Services, and Insurance (BFSI) sector is mostly due to the industry's demand for highly efficient, scalable, and secure data management solutions.

Large amounts of sensitive financial data are handled by the BFSI industry, necessitating the need for reliable systems for safe data processing, transmission, and storage. These features, together with improved data analytics tools, are made possible by cloud computing and are crucial for risk management, fraud detection, and consumer analytics in this industry.

Furthermore, given that market conditions and regulatory requirements are always changing in the BFSI industry, the flexibility and scalability provided by cloud services are a great fit. BFSI institutions can quickly adjust to these developments thanks to cloud technologies, assuring compliance and preserving their competitive edge. Due to its considerable market share, cloud computing is a great alternative for the BFSI sector because of its security, efficiency, and adaptability.

Regional Analysis

In 2023, North America held a greater revenue share of 38.9%, making it the leader in the global cloud computing market. Numerous factors contribute to this supremacy. First off, the area has a developed, cutting-edge technology infrastructure that is advantageous for the integration and broad use of cloud computing services.

The existence of significant cloud service providers with regional headquarters, such as Microsoft Azure, Google Cloud Platform, and Amazon Web Services, spurs innovation and market expansion.

Moreover, cloud computing is one of the new technologies that North American businesses—especially those in the US and Canada- usually adopt first, showing a market trend that is open to innovation and digital transformation. The region's strong emphasis on research and development and large investments in the IT sector, when combined, further contribute to the growth and market dominance of cloud computing in North America.

Competitive Analysis

Major firms like Google Cloud Platform, Microsoft Azure, and Amazon Web Services (AWS) dominate the competitive landscape of the global cloud computing market, but challengers like IBM Cloud and Oracle Cloud are becoming more and more prevalent. The market's innovation and diversity are further enhanced by the emergence of smaller, specialized businesses that target specific industries or specialize in particular cloud services, hence intensifying competition.

This ever-changing landscape is fueled by ongoing technology developments, strategic alliances, and mergers and acquisitions as businesses aim to broaden their product and service offerings. Because of the fierce competition, businesses must constantly develop and enhance their offerings, putting special emphasis on features like security, scalability, and affordability to hold onto and increase their market share.

Recent Developments

November 2023: Meeting-Rooms-as-a-Service (MRaaS), a subscription-based solution from HCLTech and Cisco, modernizes outdated meeting spaces and lets customers join sessions via Webex from any device. This partnership makes it easier to plan, set up, and maintain integrated conference spaces, which helps teams who are dispersed throughout the globe to collaborate effectively.

October 2022: Siemens introduced Capital Electra X, an electrical design software as a service for small and medium-sized enterprises that runs on the cloud. For a minimal monthly fee, designers and engineers can develop electrical schematics more quickly and easily using the browser-based solution, which works with any device. The solution is an inventive approach to electrical design, and it is based on technology from Radica Software, a leader in electrical design software.

Key Market Players in the Cloud Computing Market

- Adobe Inc.

- Alibaba Group Holding Limited

- Google LLC

- Oracle Corporation

- IBM Corporation

- Microsoft Corporation

- Salesforce Inc.

- VMware LLC

- Cisco Systems Inc.

- SAP SE

- Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 559.4 Billion |

|

Market Size 2033 |

USD 2780.0 Billion |

|

Compound Annual Growth Rate (CAGR) |

17.1% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Service Type, Deployment Mode, Enterprise Size, End-Use Industry, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Adobe Inc., Alibaba Group Holding Limited, Google LLC, Oracle Corporation, IBM Corporation, Microsoft Corporation, Salesforce Inc., VMware LLC, Cisco Systems Inc., SAP SE, Other Key Players |

|

Key Market Opportunities |

Accelerated Digital Transformation Across Industries |

|

Key Market Dynamics |

Increasing Demand for Scalable and Cost-Efficient IT Solutions |

📘 Frequently Asked Questions

1. How much is the Cloud Computing Market in 2023?

Answer: The Cloud Computing Market size was valued at USD 559.4 Billion in 2023.

2. What would be the forecast period in the Cloud Computing Market report?

Answer: The forecast period in the Cloud Computing Market report is 2023-2033.

3. Who are the key players in the Cloud Computing Market?

Answer: Adobe Inc., Alibaba Group Holding Limited, Google LLC, Oracle Corporation, IBM Corporation, Microsoft Corporation, Salesforce Inc., VMware LLC, Cisco Systems Inc., SAP SE

4. What is the growth rate of the Cloud Computing Market?

Answer: Cloud Computing Market is growing at a CAGR of 17.1% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.