🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Compressed Natural Gas Vehicles Market

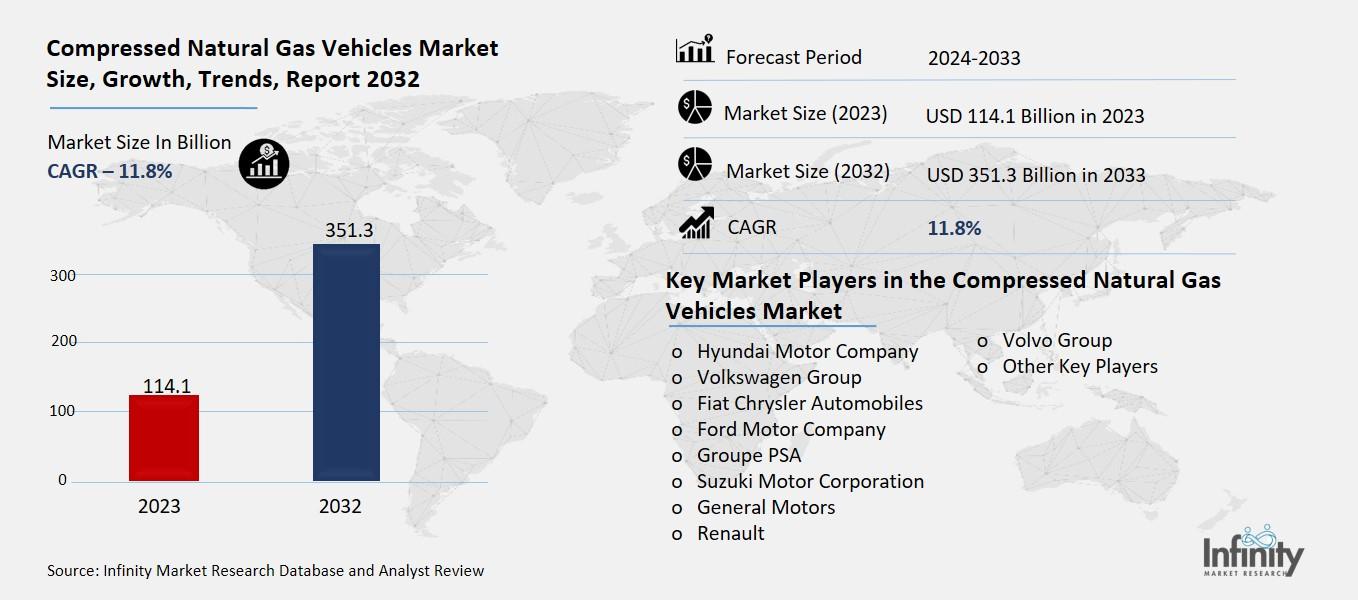

Global Compressed Natural Gas Vehicles Market (By Product Type, OEM and Car Modification; By Application, Personal Use and Commercial Use; By Region and Companies), 2024-2033

Feb 2025

Energy and Power

Pages: 138

ID: IMR1778

Compressed Natural Gas Vehicles Market Overview

Global Compressed Natural Gas Vehicles Market acquired the significant revenue of 114.1 Billion in 2023 and expected to be worth around USD 351.3 Billion by 2033 with the CAGR of 11.8% during the forecast period of 2024 to 2033. The global compressed natural gas (CNG) vehicles market has been growing rapidly as a result of concerns over the rising emissions, growing fuel prices, and new and tightened emission norms. CNG cars which are those vehicles that use compressed natural gas more so as a fuel to the typical gasoline or diesel fare cleaner and cheaper due to reduced CO2 emission and other pollutants.

The market is backed up by government policies, incentives and infrastructure for CNG fueling stations. It has also been fueled by factors like a need for sustainable transport in developed nations, but most importantly, the increasing need for green transport in urban centers. Some of these markets are passenger cars, buses and CVs mainly because CNG is viewed as a fleet solution as per the cost and environmental impacts analysis.

Drivers for the Compressed Natural Gas Vehicles Market

Government Support and Incentives

Most governments of the world today are promoting the use of CNG vehicles through policy incentives including: tax exemptions, grants, and policies. These measures are intended to promote consumers, businesses, and fleet managers to replace conventional gasoline and diesel category vehicles. Common tax measures for CNG vehicles consist of tax credits or deductions in applicable sales taxes, road taxes and the registration fees to be paid for vehicles. They also included subsidies to enable those that may be initially costly to purchase CNG vehicles to be developed. Furthermore, the stringency of emissions control standards by governments is rising because it compels producers and users to employ sustainable technologies, and cleaner fuel among them is CNG.

Restraints for the Compressed Natural Gas Vehicles Market

Limited Refueling Infrastructure

The limited availability of CNG refueling stations, particularly in rural and remote areas, presents a significant barrier to the widespread adoption of Compressed Natural Gas (CNG) vehicles. While CNG is a cleaner and more cost-effective fuel alternative, the lack of accessible refueling infrastructure hampers the practicality and convenience of owning and operating CNG vehicles, especially for consumers living outside urban centers. In regions with sparse or no CNG stations, drivers may face "range anxiety," where they are concerned about running out of fuel and being unable to find a refueling station nearby. This limitation makes CNG vehicles less attractive, especially for long-distance travelers or fleet operators who require consistent and easy access to fueling points. Expanding CNG refueling infrastructure is crucial to addressing this challenge, as it would enhance the feasibility of CNG vehicles in more remote areas and contribute to increased adoption across different regions.

Opportunity in the Compressed Natural Gas Vehicles Market

Expansion of Refueling Infrastructure

The growth of CNG refueling stations worldwide presents a crucial opportunity for the market expansion and increased adoption of Compressed Natural Gas (CNG) vehicles. As the number of CNG stations increases, it becomes more convenient for consumers and businesses to refuel their CNG vehicles, thereby overcoming one of the main barriers to adoption. The development of a robust refueling infrastructure enhances the practical usability of CNG vehicles, making them more appealing to both individual consumers and fleet operators who rely on consistent fuel availability. This growth not only boosts consumer confidence in CNG vehicles but also facilitates their use in a broader range of regions, including rural and remote areas where refueling options were previously scarce. Furthermore, the establishment of more CNG stations creates a network effect, encouraging both private and public investment in the alternative fuel infrastructure. This expansion can also lead to cost reductions in fueling due to economies of scale, making CNG vehicles even more attractive.

Trends for the Compressed Natural Gas Vehicles Market

Integration with Smart Technologies

The integration of smart technologies, such as GPS tracking and telematics, into CNG vehicles is becoming an increasingly popular trend, especially in commercial fleets. These technologies enable fleet operators to improve overall fleet management and optimize fuel consumption, making CNG vehicles even more cost-effective and efficient. GPS tracking allows for real-time monitoring of vehicle locations, ensuring that fleet operators can plan the most efficient routes, reducing fuel usage and travel time. Telematics systems, which gather and transmit data about vehicle performance, provide insights into key metrics such as fuel efficiency, engine performance, and driving behavior.

By analyzing this data, fleet managers can identify areas where fuel consumption can be reduced, such as optimizing driving patterns (e.g., avoiding idling, rapid acceleration, or harsh braking). Additionally, telematics systems help in predictive maintenance, alerting operators about potential mechanical issues before they become serious, reducing downtime and repair costs.

Segments Covered in the Report

By Product Type

o OEM

o Car Modification

By Application

o Personal Use

o Commercial Use

Segment Analysis

By Product Type Analysis

On the basis of product type, the market is divided into OEM and car modification. Among these, OEM segment acquired the significant share in the market owing to the growing number of vehicle manufacturers offering factory-fitted CNG systems as part of their standard models. OEM vehicles come with CNG systems that are fully integrated into the vehicle during production, ensuring optimal performance, reliability, and warranty coverage. Consumers and fleet operators prefer OEM vehicles because they are designed and tested to work seamlessly with the CNG technology, reducing the risk of malfunctions or compatibility issues.

By Application Analysis

On the basis of Application, the market is divided into personal use and commercial use. Among these, commercial use segment held the prominent share of the market due to the cost-effectiveness and sustainability of CNG as a fuel source, making it a preferred option for businesses that operate fleets of vehicles, such as public transportation companies, delivery services, and logistics operators.

Commercial fleets, including buses, trucks, and delivery vehicles, benefit significantly from the lower fuel costs associated with CNG, especially when used in large quantities. CNG also helps companies reduce their carbon footprints, aligning with corporate sustainability goals and compliance with increasingly stringent environmental regulations. Moreover, governments often provide incentives, such as subsidies and tax breaks, to businesses that adopt CNG vehicles, making the switch even more attractive for commercial operators.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 30.1% of the market. Key countries like India and China play a significant role in this dominance due to their large populations, high levels of urbanization, and growing concerns over air pollution and environmental sustainability.

In India, the government has implemented several initiatives to promote CNG as an alternative fuel, including subsidies for CNG vehicles, tax incentives, and the expansion of CNG refueling infrastructure. India's focus on reducing pollution in major cities, such as Delhi, has led to an increase in the adoption of CNG-powered vehicles, particularly in the public transport and commercial sectors. Moreover, CNG is a cost-effective solution compared to gasoline and diesel, which has made it highly attractive to both individual consumers and businesses looking to reduce fuel costs.

Competitive Analysis

The competitive landscape of the global CNG vehicle market is characterized by a mix of established automobile manufacturers, technology innovators, and energy companies. Major automakers, including Tata Motors, Honda, Volkswagen, Ford, and Mercedes-Benz, are key players in the OEM segment, offering factory-fitted CNG vehicles that cater to both personal and commercial use. These companies are leveraging their extensive distribution networks, brand recognition, and technological expertise to capture a larger share of the growing demand for eco-friendly transportation solutions. Additionally, there is increasing competition among local manufacturers in emerging markets like India and China, where government incentives and favorable policies are fueling market expansion.

Recent Developments

In January 2023, Toyota Kirloskar Motor Pvt. Ltd., a joint venture between Toyota Motor Corp. and the Kirloskar Group, introduced the Toyota Urban Cruiser Hyryder, marking Toyota's debut in the CNG-powered SUV segment in India. The vehicle is available in the 'S' and 'G' variants and can be purchased either online or at any nearby Toyota dealership.

Key Market Players in the Compressed Natural Gas Vehicles Market

o Hyundai Motor Company

o Volkswagen Group

o Fiat Chrysler Automobiles

o Ford Motor Company

o Groupe PSA

o Suzuki Motor Corporation

o General Motors

o Renault

o Volvo Group

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 114.1 Billion |

|

Market Size 2033 |

USD 351.3 Billion |

|

Compound Annual Growth Rate (CAGR) |

11.8% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Hyundai Motor Company, Volkswagen Group, Fiat Chrysler Automobiles, Ford Motor Company, Groupe PSA, Suzuki Motor Corporation, General Motors, Renault, Volvo Group, and Other Key Players. |

|

Key Market Opportunities |

Expansion of Refueling Infrastructure |

|

Key Market Dynamics |

Government Support and Incentives |

📘 Frequently Asked Questions

1. How much is the Compressed Natural Gas Vehicles Market in 2023?

Answer: The Compressed Natural Gas Vehicles Market size was valued at USD 114.1 Billion in 2023.

2. What would be the forecast period in the Compressed Natural Gas Vehicles Market report?

Answer: The forecast period in the Compressed Natural Gas Vehicles Market report is 2023-2033.

3. Who are the key players in the Compressed Natural Gas Vehicles Market?

Answer: Hyundai Motor Company, Volkswagen Group, Fiat Chrysler Automobiles, Ford Motor Company, Groupe PSA, Suzuki Motor Corporation, General Motors, Renault, Volvo Group, and Other Key Players.

4. What is the growth rate of the Compressed Natural Gas Vehicles Market?

Answer: Compressed Natural Gas Vehicles Market is growing at a CAGR of 11.8% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.