🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Construction Chemicals Market

Construction Chemicals Market (By Product (Concrete Admixtures, Concrete Adhesives, Concrete Sealants, Protective Coatings, Other Products), By End-use ( Residential, Non-residential & Infrastructure, Other End-use), By Region and Companies)

Jul 2024

Chemicals and Materials

Pages:

ID: IMR1144

Construction Chemicals Market Overview

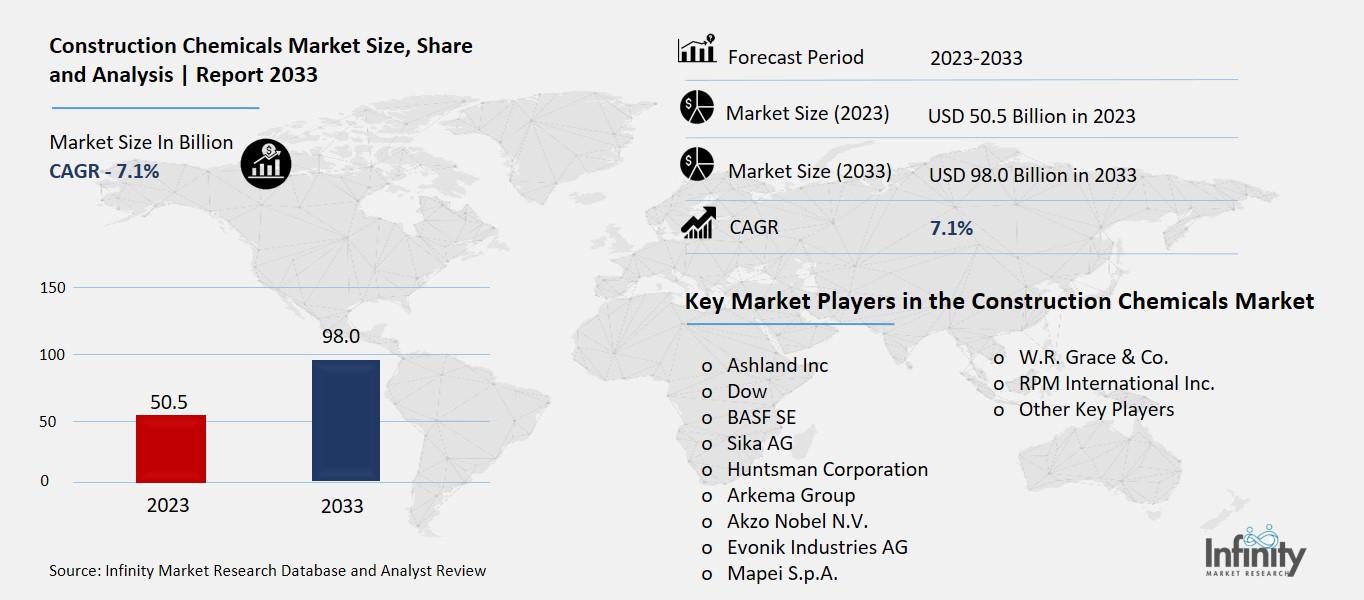

Global Construction Chemicals Market size is expected to be worth around USD 98.0 Billion by 2033 from USD 50.5 Billion in 2023, growing at a CAGR of 7.1% during the forecast period from 2023 to 2033.

The Construction Chemicals Market includes products specifically designed to enhance the properties and durability of structures during their construction and maintenance. These chemicals improve the quality, strength, and longevity of buildings and infrastructure. Common construction chemicals include concrete admixtures, waterproofing agents, flooring compounds, sealants, and adhesives. By using these chemicals, builders can ensure that structures are more resistant to environmental factors like water, heat, and chemicals, which helps reduce maintenance costs and extend the buildings' lifespan.

Construction chemicals also play a crucial role in sustainable building practices. They help reduce the environmental impact of construction activities by improving energy efficiency and enabling eco-friendly materials. For instance, certain admixtures can reduce the amount of cement required in concrete, which in turn lowers carbon dioxide emissions. Additionally, these chemicals support the development of green buildings by enhancing insulation and reducing energy consumption. Overall, the construction chemicals market is essential for modern construction practices, contributing to both the performance and sustainability of buildings and infrastructure.

Drivers for the Construction Chemicals Market

Growing Construction Activities Worldwide

The global construction industry is booming due to factors such as population growth, urbanization, and increased demand for infrastructure. As more people move to cities for better job opportunities and living standards, the need for residential and commercial buildings rises. Additionally, governments are investing heavily in infrastructure projects like roads, bridges, and airports to support economic growth, further boosting the demand for construction chemicals.

Technological Advancements

Innovation in construction materials and methods is another significant driver. New construction chemicals, such as advanced concrete admixtures and waterproofing solutions, offer superior performance, including higher strength, faster setting times, and improved durability. Technologies like building information modeling (BIM) and virtual reality (VR) are also transforming the design and construction processes, making projects more efficient and reducing costs.

Emphasis on Sustainable Construction

Environmental concerns are driving the demand for eco-friendly construction chemicals. There's a growing trend towards using sustainable materials that reduce the environmental impact of construction activities. Green buildings, which use materials and methods that are environmentally responsible and resource-efficient, are becoming more popular. This shift towards sustainability is encouraging the development and use of construction chemicals that meet these green standards.

Urbanization and Infrastructure Development in Emerging Markets

Emerging economies, particularly in the Asia-Pacific region, are experiencing rapid urbanization and industrialization. Countries like China and India are investing heavily in infrastructure development to support their growing urban populations. This surge in construction activities in these regions significantly drives the demand for construction chemicals, making Asia-Pacific a key market for these products.

Increased Renovation and Remodeling Activities

In developed countries, there is a significant focus on renovating and remodeling existing structures to improve their energy efficiency and sustainability. This trend is particularly strong in the residential sector, where homeowners are increasingly investing in home improvement projects. The use of construction chemicals in these renovation projects enhances the performance and lifespan of the structures, driving market growth.

Growth in Industrial and Commercial Construction

The industrial and commercial construction sectors are also major contributors to the demand for construction chemicals. Industrial facilities, such as factories and warehouses, require high-performance flooring and protective coatings to withstand harsh conditions. Similarly, commercial buildings, including offices and retail spaces, demand advanced construction materials that ensure durability and aesthetic appeal. The continuous development in these sectors supports the growth of the construction chemicals market.

Restraints for the Construction Chemicals Market

High Costs of Raw Materials

One of the significant restraints in the construction chemicals market is the high cost of raw materials. The production of construction chemicals often requires expensive raw materials such as polymers, resins, and additives. Fluctuations in the prices of these materials, driven by factors like crude oil prices and supply chain disruptions, can significantly impact the overall cost of construction chemicals. This, in turn, makes the end products more expensive for consumers, affecting demand and market growth.

Environmental and Regulatory Challenges

Another major challenge is the stringent environmental regulations imposed on the production and use of construction chemicals. Many countries have implemented strict guidelines to control the emission of volatile organic compounds (VOCs) and other pollutants associated with these chemicals. Complying with these regulations often requires manufacturers to invest in advanced technologies and processes, which can be costly. Additionally, obtaining the necessary certifications and approvals can be time-consuming and expensive, further hindering market growth.

Health and Safety Concerns

The use of construction chemicals also raises health and safety concerns. Many of these chemicals are hazardous and require careful handling and application to avoid risks to workers and the environment. Issues such as skin irritation, respiratory problems, and other health hazards can arise from improper use or prolonged exposure to these chemicals. These concerns necessitate stringent safety measures and training, adding to the operational costs and complexities for companies in the construction chemicals market.

Market Fragmentation and Competition

The construction chemicals market is highly fragmented, with numerous small and large players competing for market share. This intense competition can lead to price wars, reducing profit margins for companies. Additionally, the presence of various local manufacturers who offer low-cost products can make it difficult for established companies to maintain their market position and profitability. The need to continuously innovate and offer superior products to stay ahead of the competition further adds to the cost pressures faced by companies in this market.

Limited Awareness and Adoption

In many developing regions, there is limited awareness about the benefits of using advanced construction chemicals. Builders and contractors in these areas often rely on traditional materials and methods, which can be cheaper and more familiar. This lack of awareness and reluctance to adopt new technologies can slow down the growth of the construction chemicals market in these regions. Companies need to invest in educational and marketing initiatives to promote the advantages of their products, which can be both time-consuming and expensive.

Supply Chain Issues

Supply chain disruptions pose another significant restraint for the construction chemicals market. The production and distribution of these chemicals depend on a complex supply chain involving the procurement of raw materials, manufacturing, and logistics. Any disruptions in this chain, such as delays in raw material supply, transportation issues, or geopolitical tensions, can lead to shortages and increased costs. These challenges can affect the timely delivery and availability of construction chemicals, impacting construction projects and market growth.

Opportunity in the Construction Chemicals Market

Expanding Urbanization and Infrastructure Development

Urbanization is on the rise globally, particularly in developing regions. As more people move to cities, the need for residential, commercial, and infrastructure projects increases. This urban growth drives demand for construction chemicals, which are essential for modern building techniques that emphasize durability and efficiency. Additionally, major infrastructure projects, including roads, bridges, and public facilities, significantly boost the market for these chemicals.

Technological Innovations

Technological advancements in construction chemicals are opening up new possibilities. Innovations such as self-healing concrete, advanced waterproofing systems, and environmentally friendly admixtures are becoming more prevalent. These advancements not only improve the performance and longevity of construction projects but also meet the growing demand for sustainable and eco-friendly building materials.

Sustainability and Green Building Initiatives

Sustainability is a major focus in the construction industry. The push for green buildings and eco-friendly construction practices is creating a significant opportunity for the construction chemicals market. Products that help reduce carbon footprints, enhance energy efficiency, and promote the use of recycled materials are in high demand. This trend is particularly strong in regions with stringent environmental regulations and a high emphasis on sustainable development.

Growth in Emerging Markets

Emerging markets in Asia-Pacific, Latin America, and Africa are experiencing rapid economic growth and urbanization, leading to a surge in construction activities. These regions are increasingly investing in large-scale infrastructure projects and urban development, creating a substantial demand for construction chemicals. For instance, the Asia-Pacific region holds a significant market share and is expected to continue growing at a robust pace due to ongoing industrialization and urbanization efforts.

Increasing Renovation and Repair Activities

The need for renovation and repair of existing structures also presents a lucrative opportunity. Aging infrastructure in developed countries requires regular maintenance and upgrading, which fuels the demand for repair and rehabilitation chemicals. This sector is particularly important as it ensures the safety and integrity of older buildings and infrastructure, extending their useful life and reducing the need for complete replacements.

Rising Investment in Smart Cities

The concept of smart cities is gaining traction worldwide. These cities incorporate advanced technologies to create efficient, sustainable, and livable urban environments. Construction chemicals play a crucial role in the development of smart cities by providing materials that support innovative construction methods and sustainable practices. As more cities adopt smart technologies, the demand for high-performance construction chemicals is expected to grow.

Trends for the Construction Chemicals Market

Emphasis on Sustainable Practices

Sustainability is a growing trend in the construction chemicals market. There's a strong push towards using eco-friendly materials that reduce environmental impact. Companies are developing green chemicals that lower carbon footprints and promote energy efficiency in buildings. This shift is driven by stricter environmental regulations and increasing awareness of sustainable building practices.

Rise of Advanced Technologies

Technology innovation is significantly impacting the market. The development of self-healing concrete, which can repair its cracks, is one example. Other advancements include improved adhesives and sealants for better construction efficiency and the use of corrosion inhibitors to enhance the durability of infrastructure projects. These technological improvements are enhancing the performance and longevity of construction materials.

Growing Demand for Residential Projects

The residential construction sector is experiencing a surge, contributing to the demand for construction chemicals. With urbanization on the rise, there's a need for new housing projects. This demand is particularly strong in developing regions like Asia-Pacific, where urban populations are expanding rapidly. The market is seeing increased use of chemicals that improve concrete strength, waterproofing, and overall building resilience.

Focus on Safety and Resilience

Safety and resilience are becoming critical factors in construction. The market is moving towards chemicals that enhance the structural integrity and safety of buildings. This includes materials that can withstand natural disasters and extreme weather conditions. The use of these chemicals helps in constructing buildings that are not only safe but also have a longer lifespan.

Strategic Collaborations and Partnerships

Collaborations and partnerships among major companies are becoming a notable trend. These strategic alliances help firms strengthen their market positions and expand their product offerings. For instance, companies are partnering to develop new products and improve supply chain efficiencies. Such collaborations are essential for innovation and meeting the growing market demands.

Expansion of Non-Residential Construction

Non-residential construction, including commercial and infrastructure projects, is also driving the market. There's a rising demand for high-performance construction chemicals in large-scale projects like airports, bridges, and commercial buildings. These chemicals play a vital role in ensuring the durability and strength required for such massive constructions.

Segments Covered in the Report

By Product

o Concrete Admixtures

o Concrete Adhesives

o Concrete Sealants

o Protective Coatings

o Other Product

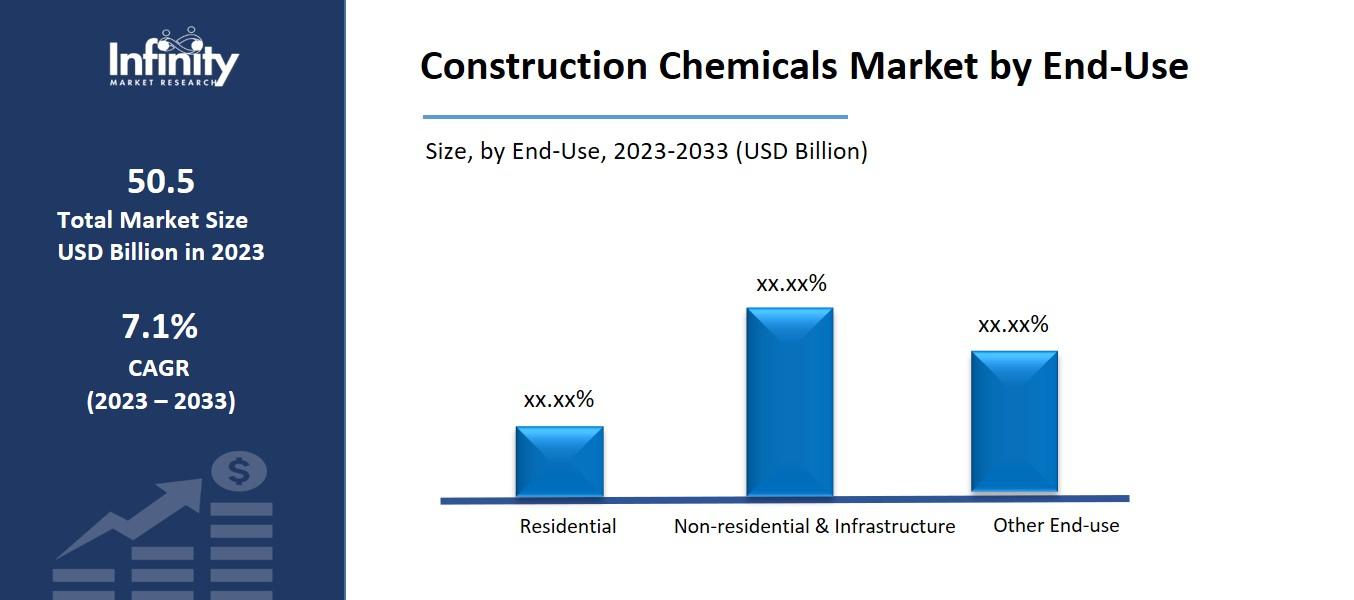

By End-use

o Residential

o Non-residential & Infrastructure

o Other End-use

Segment Analysis

By product

In 2023, the largest product segment was the concrete admixture, accounting for 65.9% of the market. The most common binding substance in the construction sector is cement. The ingredients of concrete include cement, sand, water, and broken rocks, or aggregate. To improve the strength and finish of the concrete, admixtures are added. Admixtures are mostly used to increase the durability and lower the water content of concrete. Sulfonated Melamine Formaldehyde (SMF), Sulfonated Naphthalene Formaldehyde (SNF), and Lingo-based admixtures are the main types of admixtures employed. Lingo-based admixtures were the first of these sorts to be utilized in concrete.

Throughout the projection period, construction adhesives are anticipated to have profitable expansion. They are constructed with premium components. They improve adhesives' strength and bonding range. Polymer formulation, cement, and epoxy are used to manufacture adhesives. The majority of adhesives used in floor and wall tiles are based on cement. They are made up of cement that is resistant to water and cement that has been treated with polymers for both interior and external uses. Epoxy adhesives are cold-curing adhesives that are impervious to a wide range of solvents, including water, oil, and alkalis.

The use of protective coatings is common in both new construction and maintenance projects. Resistance to oil, acids, solvents, and other fuels is provided by protective coatings. Among the main compounds utilized in protective coatings are polyester, urethane, epoxy, and polyurea. Water-borne, solvent-borne, and solvent-less coatings for walls, floors, and structural steel are among the protective coating products.

By End-use Analysis

In the non-residential and infrastructure sectors, construction chemicals are widely utilized and will account for about 68.2% of the worldwide volume in 2023. Joints and cracks are typically sealed using non-residential and infrastructural materials. Sealants are also utilized as a proofing material to keep heat, dust, and moisture out of the structure. Sealants find extensive usage in various business and residential settings.

Over the projection period, upcoming projects like the development of the Panama Canal are anticipated to support the segment's growth. The market has grown as a result of the expansion of ultramodern workplaces and offices, as well as the quick urbanization and improved lifestyles.

Shortly, the market is anticipated to increase due to the optimistic outlook for the housing sectors in rising economies such as China, India, South Africa, Turkey, and Middle Eastern countries. In the upcoming years, demand for construction chemicals is expected to rise due to the growing number of single-family housing projects and the increasing purchasing power of consumers in developing nations like Zimbabwe, Mozambique, and Nigeria.

Regional Analysis

In 2023, the North American market for construction chemicals accounted for a 20.4% share of the global market. The market in this area is defined by an increase in construction activity in both Canada and the United States. The government's numerous efforts to support infrastructure development in tandem with the expanding residential sector will significantly aid in the market's expansion in the area throughout the projection period.

Because of the expanding building industries in South Korea, Japan, China, India, and South Korea, the Asia Pacific region dominated the market. China is becoming a big user of building chemicals due to its fast-increasing population. Moreover, the building chemicals industry is expanding due to rapid industrialization.

The European construction chemical industry is anticipated to be predominantly driven by the residential segment, encompassing middle-class, elite, and affordable housing. Penthouses, flats, bungalows, and villas with luxurious features and facilities are in high demand, and this need is growing quickly.

Competitive Analysis

A small number of dominant corporations control the lion's share of the highly competitive worldwide market. These businesses are concentrating on the creation of novel substitutes, including bio-based construction chemicals, in response to strict environmental laws.

Recent Developments

In June 2021: RPM International Inc. declared that its Carboline subsidiary has acquired Dudick Inc. Based in Streetsboro, Ohio, Dudick is a manufacturer of flooring systems, tank linings, and high-performance coatings with yearly net sales of about USD 10 million. The terms of the deal were not disclosed.

In May 2022: The CMA will investigate GCP Applied Technologies' acquisition by Saint-Gobain. In December 2021, Saint-Gobain declared that they had secured a deal to acquire GCP for around $2.3 billion (USD).

Key Market Players in the Construction Chemicals Market

o Dow

o BASF SE

o Sika AG

o Akzo Nobel N.V.

o Mapei S.p.A.

o W.R. Grace & Co.

o RPM International Inc.

o Other Key Players

Report Scope:

|

Report Features |

Description |

|

Market Size 2023 |

USD 50.5 Billion |

|

Market Size 2033 |

USD 98.0 Billion |

|

Compound Annual Growth Rate (CAGR) |

7.1% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product, End-use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Ashland Inc., Dow, BASF SE, Sika AG, Huntsman Corporation, Arkema Group, Akzo Nobel N.V., Evonik Industries AG, Mapei S.p.A., W.R. Grace & Co., RPM International Inc., Other Key Players |

|

Key Market Opportunities |

Government Support and Funding |

|

Key Market Dynamics |

Increasing Demand in the Automotive Industry |

📘 Frequently Asked Questions

1. Who are the key players in the Construction Chemicals Market?

Answer: Ashland Inc., Dow, BASF SE, Sika AG, Huntsman Corporation, Arkema Group, Akzo Nobel N.V., Evonik Industries AG, Mapei S.p.A., W.R. Grace & Co., RPM International Inc., Other Key Players

2. How much is the Construction Chemicals Market in 2023?

Answer: The Construction Chemicals Market size was valued at USD 50.5 Billion in 2023.

3. What would be the forecast period in the Construction Chemicals Market?

Answer: The forecast period in the Construction Chemicals Market report is 2023-2033.

4. What is the growth rate of the Construction Chemicals Market?

Answer: Construction Chemicals Market is growing at a CAGR of 7.1% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.