🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Cooling Water Treatment Chemicals Market

Cooling Water Treatment Chemicals Market Global Industry Analysis and Forecast (2024-2032) By Type(Corrosion Inhibitors, Scale Inhibitors, Biocides, Dispersants, Others),By End-Use Industry( Power, Oil & Gas, Chemicals & Petrochemicals, Food & Beverage, Pharmaceuticals, Others),By Application(Closed Cooling Systems, Open Cooling Systems, Once-Through Cooling Systems) and Region

Feb 2025

Chemicals and Materials

Pages: 137

ID: IMR1699

Cooling Water Treatment Chemicals Market Synopsis

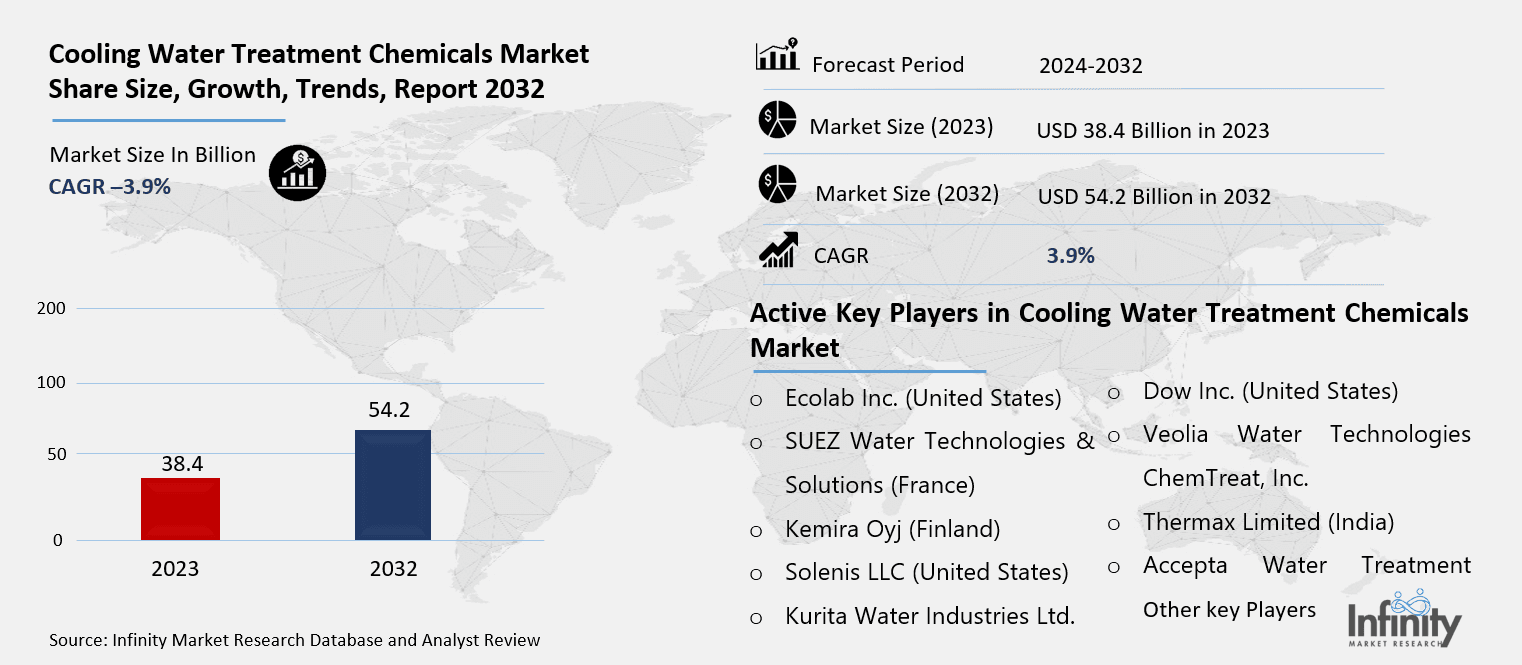

Cooling Water Treatment Chemicals Market Size Was Valued at USD 38.4 Billion in 2023, and is Projected to Reach USD 54.2 Billion by 2032, Growing at a CAGR of 3.9% From 2024-2032.

Cooling water treatment chemicals are chemicals that are fundamentally distinctive products and are used specifically to ensure that cooling systems as well as commercial and industrial cooling systems are effective, and long-lasting. They deal with problems like corrosion, scaling and fouling by bacterial and other formation, with a view to achieving the best performance, lowest maintenance cost and environmental requirements. It includes anti-corrosion agents, anti-scaling agents, biocides, and dispersants which find applications to power generation, oil & gas, chemical & manufacturing among others.

The cooling water treatment chemicals market has grown because of industrialization, urbanization and potential water management systems. These chemicals are of great importance in preserving the equipment from degrading, improving energy conservation and maintaining continuity of cooling systems. The sectors like power, petrochemicals, and food processing, and other industries require cooling water systems, and if water is untreated or insufficient treatment, it results in corrosion or scaling or microbial problems which compromise system reliability.

It owes its market growth to specific strict existing laws in regard to water quality and environmental conservation. Today, governments of various countries are enforcing stringent policies regarding use of environmental friendly chemicals and technologies to minimize wastage of water and pollute it. These needs are being met by enhanced formulations including biodegradable and non-toxic chemicals.

However, progress in modern techniques such as membrane cooling water treatment systems have made it possible to monitor the systems and dose chemicals required in real time hence lowering operating costs while raising efficiency of the systems. IoT and AI are the extensions of the proposed system as they provide the ability to make predictive maintenance and other data analysis which can improve system functionality immensely.

Cooling Water Treatment Chemicals Market Outlook, 2023 and 2032: Future Outlook

Cooling Water Treatment Chemicals Market Trend Analysis

Trend: Eco-Friendly and Sustainable Chemicals

The cooling water treatment chemicals market is also experiencing the shift towards green and sustainable chemicals. Fuel efficiency and other environmental issues have pushed most companies to design products with less adverse effects on the environment while offering great performance. Biodegradable scale inhibitors, non toxic biocides and phosphorus free compositions are slowly coming into market as industries try to become more sustainable.

This trend is clearly observable in areas located in the territory of countries with strict environmental standards for businesses, especially in Europe and in North America. Businesses are spending huge resources in developing solutions that meet these standards and are innovative enough to solve the problems of ensuring that they do not inflate the costs of business exponentially as they are asked to scale up the solutions. The transition to the circular water management systems that include treated water reuse also adds a stronger requirement for sustainable chemical offerings to this market.

Opportunity: Growing Demand in Emerging Economies

Asia-Pacific, Latin America and the Middle East are expected to be the cooling water treatment chemicals market hot-beds for growth owing to the relatively higher rates of economic development. Population growth, industrialization and urban lands and the growth of manufacturing industries in these regions have also created demand for effective cooling. Two industries that significantly use these chemicals are the power generation industry, and the petrochemical industry.

The market is also being driven by government action towards purification of water resources for domestic, industrial and commercial use, and improving the infrastructure of the industrial sector. For example, most of the nations are implementing big physical industrialization plans and also possessing polices to effective water management. This has resulted in the right climate for market players to enhance their footprint, bring efficient solutions into the market and collaborate with local industries.

Driver : Stringent Environmental Regulations

The cooling water treatment chemicals market is spurred by increased stringency of environmental standards and regulations. All world governments and regulatory authorities are setting and implementing very high standards and codes to reduce and avoid pollution of water. Many of these regulations require higher levels of technology of water treatment systems to minimize the release of dangerous emissions as well as enhance water quality.

To this effect, industries are slowly opting for high performance treatment chemicals that will pass the compliance test while at the same time promoting system efficiency. The trend toward using ZLD systems and the management of water reuse strategies add emphasis to the need for cooling water treatment solutions. This regulatory push not only spurs on development but also creates a market for sustainable and high performance solutions.

Restraints: High Costs of Advanced Chemicals

Another limitation towards advancement of the market is the relatively high costs of the cooling water treatment chemicals in the global market. However, due to their performance, effectiveness and compliance to the environmental standards, most of these chemicals are expensive hence they reduce their uptake among SMEs and others due to the high prices.

Also, the cost of adopting and utilizing proper treatment systems, which involves usage of monitor tools, has had a huge cost implication. This is especially painful when the given markets and regions think in terms of price points and their budgets allow little to no industrial spends. This is a major barrier that manufacturers have to face and they should find cheaper ways of executing their production processes.

Cooling Water Treatment Chemicals Market Segment Analysis

Cooling Water Treatment Chemicals Market Segmented on the basis of type, application and end user.

By Type

o Corrosion Inhibitors

o Scale Inhibitors

o Biocides

o Dispersants

o Others

By Application

o Closed Cooling Systems

o Open Cooling Systems

o Once-Through Cooling Systems

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Type, Corrosion Inhibitors segment is expected to dominate the market during the forecast period

Cooling water treatment chemicals market is classified into corrosion inhibitors, scale inhibitors, biocide, dispersants & others. Cooling system corrosion inhibitors are currently the most widely used inhibitors due to their requirement for prevention of metal surfaces’ oxidation as well as the prevention of cooling systems’ degradation. They are also used to mitigate the potential of mineral formation in heat transfer surfaces which hampers heat transfer efficiency.

Microbial growth and system cleanliness requires use of biocides and dispersants respectively. The most essential include biocides particularly in industries where water quality affects the product quality. The rest of the sectors – included in the “Others” category – are also quite specific, pointing toward the fact that the market is vast and continually growing.

By Application, Closed Cooling Systems segment expected to held the largest share

Closed cooling water treatment chemicals may be used, open cooling water treatment chemical may be used and once through cooling water treatment chemical may be used. Closed coolings systems on the other hand are usually systems where there is negligible make-up water and, hence, the chemical treatment is paramount to minimize corrosion and scaling.

Since open cooling systems interact more with environmental contaminants, their chemical treatment to counter issues such as microbial fouling and scaling, must also be more intense. Once-through cooling systems, while they are not used as frequently because of problems with discharges, also require specific chemicals to meet various requirements for discharge and to optimize system performance.

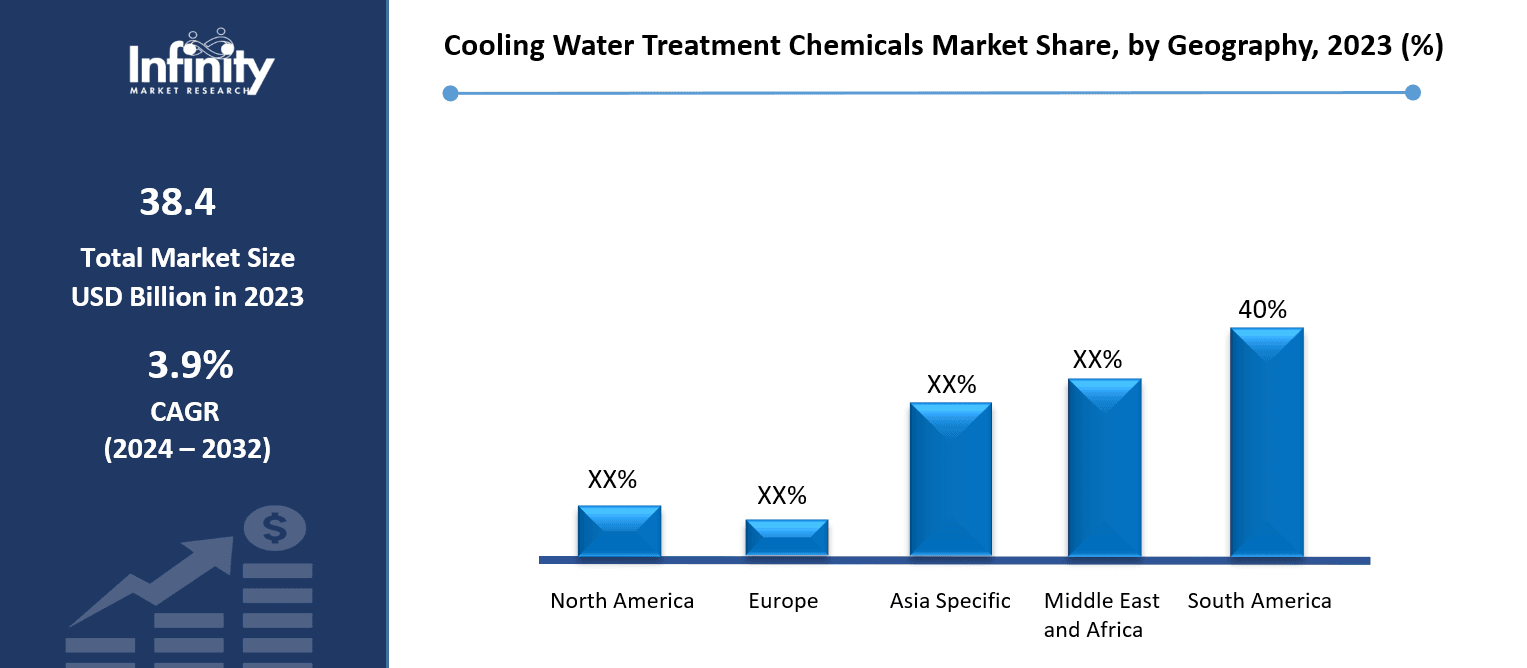

Cooling Water Treatment Chemicals Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

North America leads the overall market for cooling water treatment chemicals due to increased industrial development, mandatory environmental norms, and increasing technological advancement. This industry is driven primarily by the power generation and petrochemical industries concerning the demand of these chemicals in the region.

The US remains at the forefront in Terms of embracing and implementing efficient treatment technologies backed by an appropriate framework and massive Research and Development spending. Additional focus on the sustainable methods and water management also strengthens the position of North America on the international market.

Cooling Water Treatment Chemicals Market Share, by Geography, 2023 (%)

Active Key Players in the Cooling Water Treatment Chemicals Market

o Ecolab Inc. (United States)

o SUEZ Water Technologies & Solutions (France)

o Kemira Oyj (Finland)

o Solenis LLC (United States)

o BASF SE (Germany)

o Kurita Water Industries Ltd. (Japan)

o Dow Inc. (United States)

o Veolia Water Technologies (France)

o ChemTreat, Inc. (United States)

o Thermax Limited (India)

o Accepta Water Treatment (United Kingdom)

o Buckman Laboratories International, Inc. (United States)

o Other key Players

Key Industry Developments in the Cooling Water Treatment Chemicals Market

· In January 2023, Kemira, a chemical solutions provider for water-intensive industries, completed the full acquisition of SimAnalytics. This strategic move enhances Kemira's ability to provide data-driven predictive services and machine learning solutions to support its customers' businesses effectively. Through this acquisition, Kemira strengthens its portfolio and reinforces its commitment to delivering advanced and tailored solutions to meet evolving industry needs.

Global Cooling Water Treatment Chemicals Market Scope

|

Global Cooling Water Treatment Chemicals Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 38.4 Billion |

|

Forecast Period 2024-32 CAGR: |

3.9% |

Market Size in 2032: |

USD 54.2 Billion |

|

Segments Covered: |

By Type |

· Corrosion Inhibitors · Scale Inhibitors · Biocides · Dispersants · Others | |

|

By Application |

· Closed Cooling Systems · Open Cooling Systems · Once-Through Cooling Systems | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Stringent Environmental Regulations | ||

|

Key Market Restraints: |

· High Costs of Advanced Chemicals | ||

|

Key Opportunities: |

· Growing Demand in Emerging Economies | ||

|

Companies Covered in the report: |

· Ecolab Inc. (United States), SUEZ Water Technologies & Solutions (France), Kemira Oyj (Finland), Solenis LLC (United States), BASF SE (Germany), Kurita Water Industries Ltd. (Japan), Dow Inc. (United States), Veolia Water Technologies (France) and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Cooling Water Treatment Chemicals Market research report?

Answer: The forecast period in the Cooling Water Treatment Chemicals Market research report is 2024-2032.

2. Who are the key players in the Cooling Water Treatment Chemicals Market?

Answer: Ecolab Inc. (United States), SUEZ Water Technologies & Solutions (France), Kemira Oyj (Finland), Solenis LLC (United States), BASF SE (Germany), Kurita Water Industries Ltd. (Japan), Dow Inc. (United States), Veolia Water Technologies (France) and Other Major Players.

3. What are the segments of the Cooling Water Treatment Chemicals Market?

Answer: The Cooling Water Treatment Chemicals Market is segmented into Type, Application, End User and region. By Type, the market is categorized into Corrosion Inhibitors, Scale Inhibitors, Biocides, Dispersants, Others. By End-Use Industry, the market is categorized into Power, Oil & Gas, Chemicals & Petrochemicals, Food & Beverage, Pharmaceuticals, Others. By Application, the market is categorized into Closed Cooling Systems, Open Cooling Systems, Once-Through Cooling Systems. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Cooling Water Treatment Chemicals Market?

Answer: Cooling water treatment chemicals are chemicals that are fundamentally distinctive products and are used specifically to ensure that cooling systems as well as commercial and industrial cooling systems are effective, and long-lasting. They deal with problems like corrosion, scaling and fouling by bacterial and other formation, with a view to achieving the best performance, lowest maintenance cost and environmental requirements. It includes anti-corrosion agents, anti-scaling agents, biocides, and dispersants which find applications to power generation, oil & gas, chemical & manufacturing among others.

5. How big is the Cooling Water Treatment Chemicals Market?

Answer: Cooling Water Treatment Chemicals Market Size Was Valued at USD 38.4 Billion in 2023, and is Projected to Reach USD 54.2 Billion by 2032, Growing at a CAGR of 3.9% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.