🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Corporate Banking Market

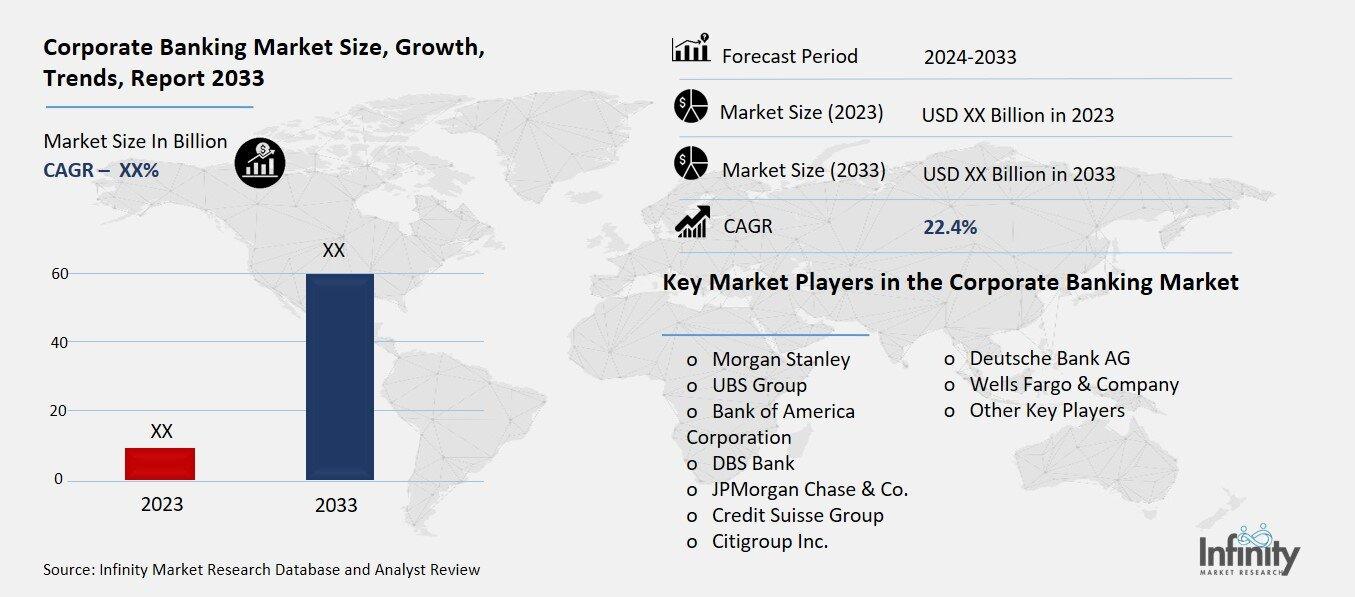

Global Corporate Banking Market (By Service, Corporate & Salary Accounts, Short-term Funding, Cash Management Services, Credit Services & Loans, and Other Services; By End-User, Large Enterprises and Small & Medium-sized Enterprises; By Region and Companies), 2024-2033

Oct 2024

Financial Services & Insurance

Pages: 138

ID: IMR1283

Corporate Banking Market Overview

Global Corporate Banking Market acquired the significant revenue of XX Billion in 2023 and expected to be worth around USD XX Billion by 2033 with the CAGR of XX% during the forecast period of 2024 to 2033. Corporate banking describes the special services that the banking institutions offer to the companies, institutions, and government. This sector deals mostly with financial requirements of enterprises by providing services including loan services and credit facilities, treasury and cash services, trade finance and foreign exchange, and mergers and acquisition advisory services.

In particular, corporate banking is distinct from consumer banking, whose services are aimed at individuals, to support large businesses in organizing their hierarchical forms of ownership and in developing diverse strategies for development. Market is in the significant impact due to this consideration including the economic environment and interest rates, regulatory and business environment and investment of the corporate and there is a rise of the fintech and other digital banking services shifting the traditional banking systems.

Drivers for the Corporate Banking Market

Economic Growth and Globalization

As companies seek to expand into the global market, these corporations experience a plethora of financial requirements that create the need for corporate banking. Trade finance emerges as a crucial component for organizations involved in the conduct of international business; this aspect offers forms of finance such as letters of credit, export financing, and supply chain finance in a bid to mitigate risks and facilitate the accomplishment of transactions across the borders. Another important service is the cross-border payments, which lets businesses make payments to other countries and in different currencies, thus often requiring sophisticated solutions to process such payments quickly, and in accordance with the regulation requirements.

Besides, the foreign exchange services are important for the companies are dealing in multiple currencies; it assists in managing the change and risk in the foreign exchange markets. In such areas, corporate banks offer knowledge and specific services that help companies to manage and coordinate their international processes, ensure sufficient amounts of cash for their operations, and work with regulations and risks successfully.

Restraints for the Corporate Banking Market

Increasing Competition from Fintechs

Traditional banks are facing mounting competition from fintech companies, which are reshaping the financial services landscape by offering specialized, tech-driven solutions with lower overhead costs. Fintech firms leverage cutting-edge technologies like artificial intelligence, blockchain, and data analytics to deliver faster, more convenient services, such as digital lending, peer-to-peer payments, and automated wealth management. These solutions are often more affordable and accessible, appealing to businesses and consumers seeking streamlined, user-friendly alternatives to traditional banking services.

Opportunity in the Corporate Banking Market

Sustainable Finance and ESG Investment

The increasing emphasis on environmental, social, and governance (ESG) factors is significantly shaping the corporate banking landscape, driving demand for sustainable finance products like green bonds and impact investment solutions. As companies and investors place greater importance on sustainability and ethical business practices, corporate banks are stepping up to provide innovative financial instruments that support environmentally and socially responsible projects. Green bonds, for example, allow businesses to raise capital specifically for initiatives that address climate change, such as renewable energy projects or energy-efficient infrastructure. These bonds not only help companies meet their sustainability goals but also appeal to investors looking to align their portfolios with ESG principles.

Trends for the Corporate Banking Market

Digitalization of Banking Services

Corporate banks are progressively integrating advanced technologies like artificial intelligence (AI), machine learning (ML), and blockchain to drive efficiency, automation, and better customer experiences. AI and ML are being deployed to automate routine tasks such as data analysis, risk assessment, and fraud detection, allowing banks to streamline operations and reduce human errors. These technologies enable real-time decision-making, such as evaluating loan applications or detecting suspicious transactions, which improves accuracy and speed. Additionally, AI-powered chatbots and virtual assistants are enhancing customer service by providing instant, 24/7 support, improving client engagement and satisfaction.

Segments Covered in the Report

By Service

o Corporate & Salary Accounts

o Short-term Funding

o Cash Management Services

o Credit Services & Loans

o Other Services

By End-User

o Large Enterprises

o Small & Medium-sized Enterprises

Segment Analysis

By Service Analysis

On the basis of service, the market is divided into corporate & salary accounts, short-term funding, cash management services, credit services & loans, and other services. Among these, credit services & loans segment acquired the significant share in the market due to the critical role these services play in business growth and operational financing. Large corporations rely heavily on credit and loan services for capital-intensive projects, mergers and acquisitions, infrastructure development, and working capital management.

As businesses expand, their need for flexible and substantial financing options grows, making corporate loans, syndicated loans, and revolving credit facilities indispensable. Moreover, the demand for structured financing solutions such as project finance and leveraged buyouts further boosts the market share of credit services.

By End-User Analysis

On the basis of end-user, the market is divided into large enterprises and small & medium-sized enterprises. Among these, large enterprises segment held the prominent share of the market. Large enterprises often engage in complex financial activities, including mergers and acquisitions, international trade, and large-scale project financing, which necessitate a wide range of banking services such as capital markets, treasury management, and specialized credit solutions.

Additionally, large enterprises usually have more established banking relationships, allowing them to access favorable terms and conditions, including lower interest rates and customized services tailored to their unique business strategies.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 34.1% of the market. The region boasts a well-established financial infrastructure, featuring major banks and financial institutions that provide robust solutions and innovations tailored to corporate clients. The region's access to capital markets further enhances its dominance, allowing large corporations to raise funds efficiently and engage deeply with corporate banks.

Moreover, North America is a hub for financial technology advancements, enabling banks to offer streamlined, efficient, and customized services. Finally, a relatively stable regulatory environment fosters operations within the financial sector, creating a conducive atmosphere for corporate banking activities.

Competitive Analysis

The competitive landscape of the corporate banking market is characterized by a dynamic interplay between traditional banks, fintech companies, and emerging players, each vying for market share through innovation and service differentiation. Traditional banks leverage their established reputations, extensive client networks, and comprehensive service offerings to retain large corporate clients and provide customized solutions for complex financial needs. However, they face increasing pressure from fintech companies that offer specialized, tech-driven solutions, such as automated lending platforms, digital payment systems, and data analytics tools, often with lower operational costs and enhanced user experiences.

Key Market Players in the Corporate Banking Market

o Morgan Stanley

o UBS Group

o Bank of America Corporation

o DBS Bank

o JPMorgan Chase & Co.

o Credit Suisse Group

o Citigroup Inc.

o Deutsche Bank AG

o Wells Fargo & Company

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD XX Billion |

|

Market Size 2033 |

USD XX Billion |

|

Compound Annual Growth Rate (CAGR) |

XX% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Service, End-User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Morgan Stanley, UBS Group, Bank of America Corporation, DBS Bank, JPMorgan Chase & Co., Credit Suisse Group, Citigroup Inc., Deutsche Bank AG, Wells Fargo & Company, and Other Key Players. |

|

Key Market Opportunities |

Sustainable Finance and ESG Investment |

|

Key Market Dynamics |

Economic Growth and Globalization |

📘 Frequently Asked Questions

1. Who are the key players in the Corporate Banking Market?

Answer: Morgan Stanley, UBS Group, Bank of America Corporation, DBS Bank, JPMorgan Chase & Co., Credit Suisse Group, Citigroup Inc., Deutsche Bank AG, Wells Fargo & Company, and Other Key Players.

2. How much is the Corporate Banking Market in 2023?

Answer: The Corporate Banking Market size was valued at USD XX Billion in 2023.

3. What would be the forecast period in the Corporate Banking Market?

Answer: The forecast period in the Corporate Banking Market report is 2024-2033.

4. What is the growth rate of the Corporate Banking Market ?

Answer: Corporate Banking Market is growing at a CAGR of XX% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.