🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Crohn’s Disease Drug Market

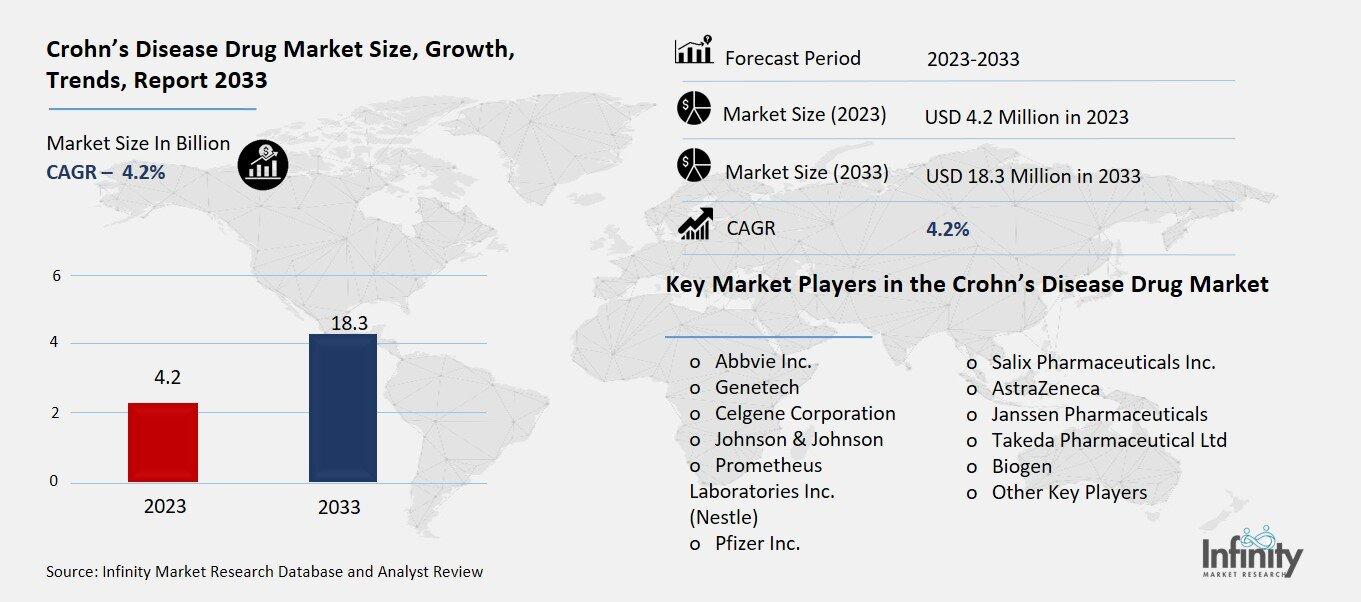

Global Crohn’s Disease Drug Market (By Drug Type, Antibiotics, Corticosteroids, Amino Salicylates, Immunomodulators, and Other Drug Types; By Distribution Channel, Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies; By Region and Companies), 2024-2033

Oct 2024

Healthcare

Pages: 138

ID: IMR1251

Crohn’s Disease Drug Market Overview

Global Crohn’s Disease Drug Market acquired the significant revenue of 12.1 Billion in 2023 and expected to be worth around USD 18.3 Billion by 2033 with the CAGR of 4.2% during the forecast period of 2024 to 2033. The market has seen expansion in the recent years as more individuals are being diagnosed with the disease and they are also being treated using biologic therapies. An effective cure is needed for this long treated inflammatory bowel disease creating demand for long term therapy options in Crohn’s disease. This market is dominated by the biologics mainly the TNF inhibitors.

However, there is also growing interest in newer treatment classes, such as Janus kinase (JAK) inhibitors and integrin inhibitors. Key players in the market include AbbVie, Johnson & Johnson, and Takeda Pharmaceuticals, which have substantial portfolios of biologics and small molecule drugs.

Drivers for the Crohn’s Disease Drug Market

Advancements in Biologic and Small Molecule Therapies

The landscape of therapy within the treatment for Crohn’s disease changed intensely with the advent of new biologic drugs and specific small molecules. Biologics, especially TNF antagonists like infliximab and adalimumab, produce powerful anti-inflammatory effects and sustain remission in those patients who do not respond well to other forms of therapy. These drugs are made such that they can inhibit specific inflammation triggering process and lessen the inflammation more than other medicines do. In addition, newer biologics such as interleukin inhibitors and integrin antagonists promise further options to patients on whom TNF inhibitors may prove ineffective or cause side effects.

Restraints for the Crohn’s Disease Drug Market

Adverse Side Effects and Treatment Limitations

The risk of side effects and the potential loss of response over time are significant challenges that can hinder long-term adherence to existing Crohn's disease treatments. Biologic therapies, while highly effective for many patients, are associated with various side effects, such as increased susceptibility to infections, injection site reactions, and rare but serious risks like malignancies. These side effects can discourage patients from continuing treatment, especially if the risks outweigh the perceived benefits. Additionally, a phenomenon known as "secondary loss of response" can occur, where patients who initially respond well to biologics gradually lose effectiveness due to the development of antibodies against the drug. This situation often necessitates switching to alternative therapies, which may be less effective or come with their own side effect profiles.

Opportunity in the Crohn’s Disease Drug Market

Increasing Adoption of Biosimilars

Biosimilars offer a cost-effective alternative to original biologic drugs, playing a crucial role in expanding treatment access for Crohn's disease patients and driving market growth. These drugs are highly similar in terms of safety, efficacy, and quality to the reference biologics, but are typically priced lower, making them more accessible to a broader population. The introduction of biosimilars has helped reduce the economic burden associated with long-term biologic therapy, especially in regions where the high cost of treatment limits patient access. As patent protections for original biologics expire, biosimilars are increasingly being approved and adopted, providing competitive options for healthcare providers and payers looking to manage treatment costs. This increased availability not only allows more patients to receive necessary treatment but also fosters a more competitive market, encouraging innovation and potentially leading to further price reductions across therapeutic options.

Trends for the Crohn’s Disease Drug Market

Shift Toward Personalized Medicine

Precision diagnostics and tailored treatment plans are increasingly being adopted in the management of Crohn's disease, leading to improved patient outcomes. Advances in diagnostic technologies, such as genetic profiling, biomarker analysis, and advanced imaging techniques, enable healthcare providers to better understand the underlying mechanisms of an individual's disease. This allows for a more accurate classification of disease severity, identification of potential complications, and prediction of response to specific therapies. By integrating these insights, clinicians can create personalized treatment plans that cater to the unique needs of each patient, optimizing therapeutic efficacy while minimizing adverse effects. Tailored treatment plans are particularly beneficial in selecting the most appropriate biologic or small molecule therapy, as different patients may respond variably to the same drug.

Segments Covered in the Report

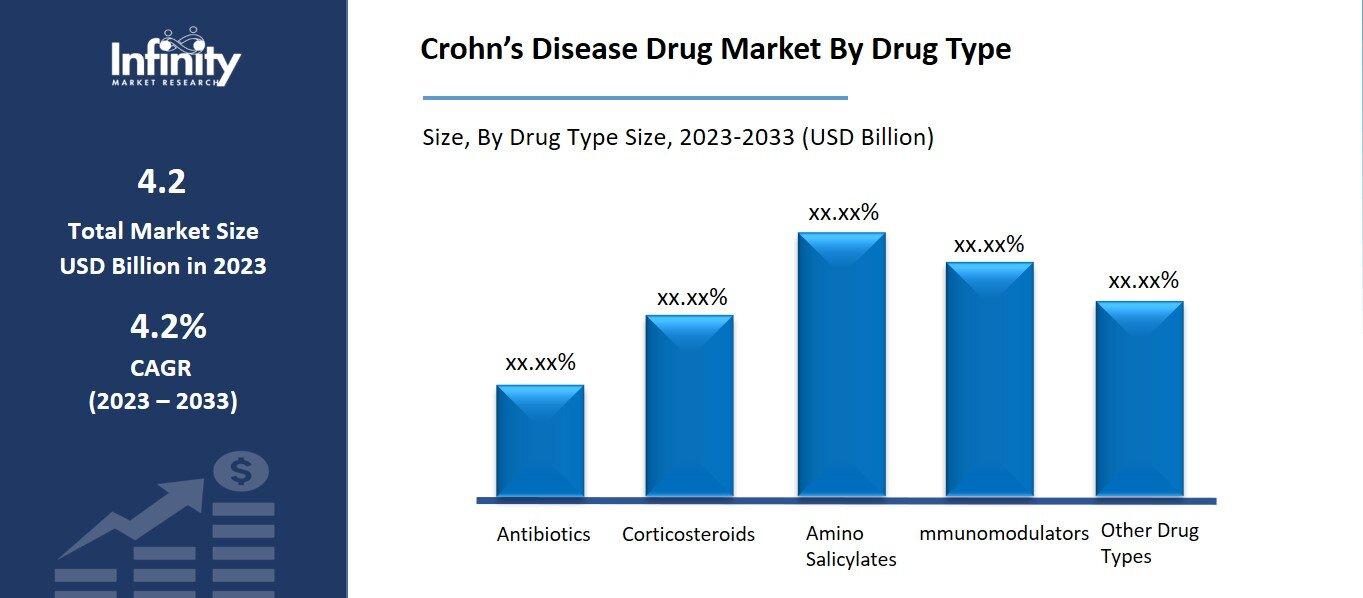

By Drug Type

o Antibiotics

o Corticosteroids

o Amino Salicylates

o Immunomodulators

o Other Drug Types

By Distribution Channel

o Hospital Pharmacies

o Retail Pharmacies

o Online Pharmacies

Segment Analysis

By Drug Type Analysis

On the basis of drug type, the market is divided into antibiotics, corticosteroids, amino salicylates, immunomodulators, and other drug types. Among these, immunomodulators segment acquired the significant share around 37.5% in the market owing to the growing preference for these drugs in managing moderate to severe Crohn's disease. Immunomodulators, such as azathioprine and methotrexate, help suppress the immune system's overactivity, reducing inflammation and allowing for long-term disease control. They are often used as maintenance therapy to prevent relapse, especially in patients who have not responded adequately to other treatments or who wish to reduce their dependence on corticosteroids. Their ability to improve treatment outcomes and maintain remission, combined with increasing clinical adoption as an effective long-term strategy, has driven the significant market share of the immunomodulator segment.

By Distribution Channel Analysis

On the basis of distribution channel, the market is divided into hospital pharmacies, retail pharmacies, and online pharmacies. Among these, hospital pharmacies held the prominent share of the market due to the critical role they play in managing complex chronic conditions like Crohn's disease. Hospital pharmacies are often the primary source for patients requiring specialized care, as they provide direct access to a wide range of therapies, including biologics and immunomodulators that are frequently administered under medical supervision.

Additionally, hospital pharmacies are equipped to handle the unique needs of patients, including those requiring intravenous medications and comprehensive care management. The presence of healthcare professionals in these settings facilitates personalized medication management and monitoring of potential side effects, enhancing patient safety and treatment efficacy.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 34.2% of the market owing to the high prevalence of Crohn's disease in the region, coupled with a strong healthcare infrastructure, has led to increased diagnosis and treatment rates. The availability of advanced medical technologies and innovative therapeutic options, including a robust pipeline of biologics and immunomodulators, further supports the market's expansion in North America. Additionally, the presence of major pharmaceutical companies and ongoing research and development activities contribute to the growth of this market segment. Increasing awareness of Crohn's disease among healthcare professionals and patients alike has also facilitated earlier diagnosis and treatment initiation, driving demand for effective therapies.

Competitive Analysis

The competitive landscape of the Crohn’s disease drug market is dynamic, featuring a mix of established pharmaceutical giants and emerging biotechnology firms, each striving to innovate and capture market share. Key players such as AbbVie, Johnson & Johnson, and Takeda Pharmaceuticals dominate the market with their strong portfolios of biologics and immunomodulators, including Humira and Entyvio. These companies benefit from extensive research and development capabilities, allowing them to maintain a robust pipeline of therapies. Emerging players are also gaining traction, particularly in the development of novel JAK inhibitors and biosimilars, which provide cost-effective alternatives to expensive biologics.

Recent Developments

In May 2023, The FDA has granted approval for Rinvoq (upadacitinib) as a treatment for adults with moderately to severely active Crohn’s disease who have not responded adequately or have shown intolerance to one or more tumor necrosis factor blockers. Rinvoq is notable for being the first oral medication approved for the treatment of this condition.

Key Market Players in the Crohn’s Disease Drug Market

o Abbvie Inc.

o Genetech

o Celgene Corporation

o Johnson & Johnson

o Prometheus Laboratories Inc. (Nestle)

o Pfizer Inc.

o Salix Pharmaceuticals Inc.

o AstraZeneca

o Janssen Pharmaceuticals

o Takeda Pharmaceutical Ltd

o Biogen

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 4.2 Billion |

|

Market Size 2033 |

USD 18.3 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.2% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Drug Type, Distribution Channel, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Abbvie Inc., Genetech, Celgene Corporation, Johnson & Johnson, Prometheus Laboratories Inc. (Nestle), Pfizer Inc., Salix Pharmaceuticals Inc., AstraZeneca, Janssen Pharmaceuticals, Takeda Pharmaceutical Ltd, Biogen, and Other Key Players. |

|

Key Market Opportunities |

|

|

Key Market Dynamics |

Advancements in Biologic and Small Molecule Therapies |

📘 Frequently Asked Questions

1. How much is the Crohn’s Disease Drug Market in 2023?

Answer: The Crohn’s Disease Drug Market size was valued at USD 4.2 Billion in 2023.

2. What would be the forecast period in the Crohn’s Disease Drug Market?

Answer: The forecast period in the Crohn’s Disease Drug Market report is 2024-2033.

3. Who are the key players in the Crohn’s Disease Drug Market?

Answer: Abbvie Inc., Genetech, Celgene Corporation, Johnson & Johnson, Prometheus Laboratories Inc. (Nestle), Pfizer Inc., Salix Pharmaceuticals Inc., AstraZeneca, Janssen Pharmaceuticals, Takeda Pharmaceutical Ltd, Biogen, and Other Key Players.

4. What is the growth rate of the Crohn’s Disease Drug Market?

Answer: Crohn’s Disease Drug Market is growing at a CAGR of 4.2% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.