🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Cyber Insurance Market

Cyber Insurance Market By Insurance Type (Standalone, Packaged), By Coverage Type (First-Party Coverage, Third-Party Coverage), By Enterprise Size (Small and Medium-Sized Enterprises (SMEs), Large Enterprises), By Industry Vertical (IT & Telecommunications, BFSI, Healthcare, Retail & E-Commerce, Government, Other Industry Verticals), By Region and Companies)

Jun 2024

Information and Communication Technology

Pages: 160

ID: IMR1110

Cyber Insurance Market Overview

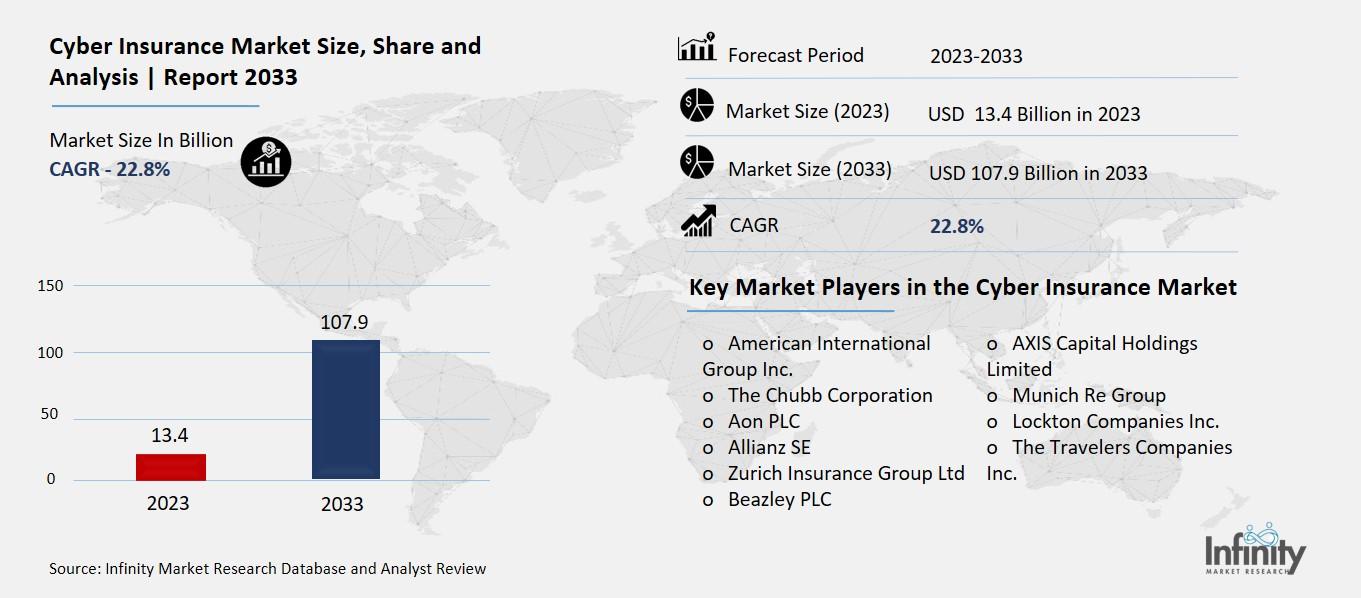

Global Cyber Insurance Market size is expected to be worth around USD 107.9 Billion by 2033 from USD 13.4 Billion in 2023, growing at a CAGR of 22.8% during the forecast period from 2023 to 2033.

The cyber insurance market is where companies and people can buy insurance to protect themselves against online risks and cyberattacks. Just like car insurance helps you pay for repairs after an accident, cyber insurance helps cover costs if your computer systems get hacked, sensitive information gets stolen, or your business gets disrupted because of a cyberattack.

This type of insurance is becoming more popular because cyberattacks are happening more often and causing more damage. Businesses want to protect themselves from losing money or getting into legal trouble if they get hacked. The cyber insurance market includes different types of policies that can help pay for things like fixing security problems, notifying customers about data breaches, and dealing with lawsuits.

Drivers for the Cyber Insurance Market

Growing Cyber Threats

The cyber insurance market is being propelled by a significant increase in cyber threats, such as data breaches, ransomware attacks, and phishing scams. Cyber incidents can lead to substantial financial losses, including costs associated with data recovery, business interruptions, legal expenses, and reputational damage. For instance, ransomware attacks alone have caused billions in downtime and recovery costs, driving businesses to seek financial protection through cyber insurance policies. The increasing frequency and sophistication of these attacks make cyber insurance an essential investment for organizations across various sectors.

Stringent Regulatory Compliance

Another major driver is the growing regulatory landscape requiring organizations to adopt robust cybersecurity measures. Regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States mandate stringent data protection practices. Non-compliance can result in heavy fines and legal repercussions. These regulations incentivize businesses to invest in cyber insurance to mitigate the risks of potential regulatory breaches and ensure compliance, thereby protecting themselves from hefty penalties.

Remote Work and Digital Transformation

The shift to remote work and digital transformation, accelerated by the COVID-19 pandemic, has heightened cybersecurity vulnerabilities. The rapid increase in remote working environments exposed companies to more cyber threats as employees accessed corporate networks from various locations. This led to a surge in cyber incidents, prompting businesses to strengthen their cybersecurity frameworks and invest in cyber insurance to safeguard against financial losses from these new vulnerabilities. The demand for cyber insurance saw a notable rise during the pandemic and continues to grow as digitalization trends persist.

Evolving Cyber Insurance Products

Insurance companies are continuously innovating to meet the changing needs of businesses. New products and services, such as parametric insurance that pays out based on specific cyber events, and comprehensive cyber risk management services, are being introduced. These innovations help businesses better manage their cyber risks and make cyber insurance more attractive. As insurers offer more tailored solutions, including services to assess and mitigate cyber risks, the adoption of cyber insurance is expected to increase significantly.

Increased Awareness and Education

Growing awareness and education about cybersecurity threats and the importance of risk management are also driving the cyber insurance market. Businesses are becoming more knowledgeable about the potential financial and operational impacts of cyber incidents. Educational initiatives and resources provided by industry bodies and insurers help organizations understand their vulnerabilities and the benefits of cyber insurance. This increased awareness encourages more businesses to adopt cyber insurance as a critical component of their risk management strategies.

Business Continuity Concerns

Lastly, concerns about business continuity in the face of cyber threats are pushing companies to invest in cyber insurance. Cyber incidents can cause significant disruptions, leading to operational downtime and financial losses. Businesses recognize the importance of ensuring continuity and resilience against cyber threats. Cyber insurance provides a safety net that helps companies recover quickly from cyber incidents, maintaining their operations and financial stability. This assurance of business continuity is a compelling reason for the rising adoption of cyber insurance.

Restraints for the Cyber Insurance Market

High Costs of Cyber Insurance

One of the main restraints in the cyber insurance market is the high cost of premiums. As cyber threats become more sophisticated and frequent, insurers face increased risk, leading to higher premiums for businesses. This increase in cost can be a significant burden, especially for small and medium-sized enterprises (SMEs), which may already have limited budgets. These businesses may struggle to afford comprehensive coverage, potentially leaving them exposed to cyber risks. Additionally, the high costs can deter new companies from entering the market, reducing competition and innovation within the industry.

Complexity and Ambiguity in Coverage

Another challenge is the complexity and ambiguity surrounding cyber insurance policies. Many businesses find it difficult to understand the terms and conditions of these policies, which can include numerous exclusions and limitations. This complexity can lead to misunderstandings about what is covered, leaving companies vulnerable to certain types of cyber incidents. For instance, some policies might not cover losses from social engineering attacks or might have specific requirements for coverage to be valid. This ambiguity can create a lack of trust between insurers and policyholders, hindering the market's growth.

Rapidly Evolving Threat Landscape

The cyber threat landscape is continuously evolving, making it challenging for insurers to accurately assess and price risk. New types of cyberattacks, such as ransomware and advanced persistent threats, emerge regularly, often faster than insurers can adapt their models and coverage options. This rapid evolution can result in insurers being overly cautious, leading to conservative coverage terms and high premiums. Furthermore, it can make it difficult for businesses to keep their defenses up to date, complicating the underwriting process and making risk assessment more complex.

Lack of Historical Data

Cyber insurance is a relatively new market, and there is a lack of extensive historical data to help insurers predict future risks accurately. Unlike traditional insurance lines like auto or property insurance, which have decades of data to inform risk assessment, cyber insurance relies on limited data sets. This scarcity of information makes it harder for insurers to create reliable risk models, often resulting in higher premiums to compensate for the uncertainty. The lack of historical data also makes it difficult to identify trends and predict future threats, adding another layer of complexity to the market.

Regulatory and Compliance Challenges

Regulatory and compliance issues present another significant restraint. Different countries and regions have varying regulations regarding data protection and cyber insurance, creating a complex landscape for multinational companies. Ensuring compliance with all applicable regulations can be costly and time-consuming for insurers and policyholders alike. Additionally, as governments introduce new regulations to address emerging cyber threats, insurers must continuously update their policies and practices, which can be a resource-intensive process.

Opportunity in the Cyber Insurance Market

Growing Demand for Cyber Insurance in Emerging Markets

The demand for cyber insurance is growing significantly in emerging markets. Countries in Asia-Pacific, such as Japan, Singapore, Indonesia, and Malaysia, have seen substantial increases in cyberattacks, leading to a rise in insurance demand. Governments in these regions are investing in cybersecurity insurance to mitigate the impact of cybercrimes, creating new opportunities for insurance providers. As more businesses in these regions become aware of the risks, the demand for cyber insurance is expected to continue rising, offering a lucrative market for insurers to expand their presence and services.

Integration of Advanced Technologies

The cyber insurance market is also benefiting from the integration of advanced technologies. Insurers are leveraging technologies like artificial intelligence and machine learning to better assess risks and streamline underwriting processes. These technologies help in providing more accurate pricing and personalized policies, improving customer satisfaction. Additionally, the use of advanced analytics helps in identifying emerging threats and developing proactive measures to mitigate risks. This technological integration not only enhances the efficiency of insurance providers but also offers a competitive edge in the market.

Increasing Regulatory Requirements

Regulatory requirements are creating new opportunities for the cyber insurance market. Governments around the world are implementing stricter regulations to protect against cyber threats, which in turn drives the demand for cyber insurance. For instance, in Europe, the General Data Protection Regulation (GDPR) has increased the need for businesses to have comprehensive cyber insurance policies to comply with data protection laws. Similarly, in the United States, various states are enacting laws that require businesses to have cyber insurance as part of their risk management strategy. These regulatory pressures are pushing more businesses to invest in cyber insurance, expanding the market.

Focus on Small and Medium-Sized Enterprises (SMEs)

Small and medium-sized enterprises (SMEs) represent a significant growth opportunity for the cyber insurance market. Many SMEs are increasingly becoming targets of cyberattacks due to their relatively weaker cybersecurity measures. As a result, there is a growing awareness among SMEs about the importance of cyber insurance. Insurance providers are developing tailored policies to cater to the specific needs of SMEs, making it easier and more affordable for them to obtain coverage. This focus on SMEs is expected to drive substantial growth in the cyber insurance market.

Expanding Market in Developing Regions

Developing regions, including South America, the Middle East, and Africa, are also presenting new opportunities for the cyber insurance market. These regions are experiencing a surge in cyber threats as they become more digitally connected. Governments and businesses in these areas are starting to recognize the importance of cyber insurance in protecting against potential losses from cyberattacks. For example, countries like Qatar, Oman, and the UAE are increasingly adopting cyber insurance as part of their cybersecurity strategy. This expansion into developing regions offers a significant growth potential for cyber insurance providers.

Trends for the Cyber Insurance Market

Increasing Cyber Attacks

The rise in cyber-attacks is one of the most significant trends driving the cyber insurance market. As businesses become more digital, they face a growing number of cyber threats, including data breaches, ransomware, and phishing attacks. Companies are increasingly recognizing the need for cyber insurance to protect against these risks, which can lead to significant financial losses and damage to their reputations. The surge in high-profile cyber incidents has heightened awareness about the importance of cybersecurity measures and insurance coverage as a critical component of risk management strategies.

Growing Regulatory Requirements

Another major trend influencing the cyber insurance market is the implementation of stricter regulatory requirements. Governments around the world are enacting data protection laws, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. These regulations mandate businesses to adopt comprehensive cybersecurity measures and report data breaches promptly. Compliance with these laws often necessitates cyber insurance to cover the potential financial impacts of non-compliance and breach notifications, driving demand for policies that cater to these regulatory requirements.

Expansion of Cyber Insurance Products

The expansion of cyber insurance products and services is also a notable trend. Insurers are developing more comprehensive and tailored policies to address the evolving landscape of cyber threats. This includes offering coverage for specific risks related to emerging technologies like the Internet of Things (IoT), cloud services, and artificial intelligence (AI). Companies are also extending cyber liability coverage to their supply chains, providing opportunities for insurers to innovate and create customized solutions for different industries. This diversification in product offerings helps businesses find policies that better meet their unique needs and risk profiles.

Focus on Incident Response and Risk Management

Cyber insurance providers are increasingly focusing on incident response and risk management services as part of their offerings. Insurers are not only covering financial losses but also providing resources to help businesses respond to and recover from cyber incidents. This includes access to cybersecurity experts, legal counsel, and public relations support to manage the aftermath of a breach. By offering these value-added services, insurers can help clients minimize the impact of cyber-attacks and improve their overall cybersecurity posture.

Increased Demand in Emerging Markets

The demand for cyber insurance is rising in emerging markets, particularly in Asia-Pacific, Latin America, and the Middle East. As these regions experience rapid digital transformation and an increase in cyber threats, businesses and governments are becoming more aware of the importance of cyber insurance. For instance, countries like Japan, Singapore, and India are witnessing significant growth in cyber insurance adoption due to heightened cybersecurity awareness and government initiatives to improve data protection. This trend is expected to continue as more organizations in these regions seek to mitigate cyber risks through insurance.

Collaboration and Partnerships Among Insurers

Collaboration and partnerships among cyber insurance providers are becoming more common as companies seek to enhance their offerings and expand their market presence. Insurers are partnering with technology firms, cybersecurity companies, and other stakeholders to develop innovative solutions and improve their risk assessment capabilities. These partnerships enable insurers to leverage advanced technologies and expertise to offer more effective and comprehensive cyber insurance products. By working together, insurers can better address the complex and dynamic nature of cyber threats.

Segments Covered in the Report

By Insurance Type

- Standalone

- Packaged

By Coverage Type

- First-Party Coverage

- Third-Party Coverage

By Enterprise Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- IT & Telecommunications

- BFSI

- Healthcare

- Retail & E-Commerce

- Government

- Other Industry Verticals

Segment Analysis

By Insurance Type

With almost 67.9% of the market, the standalone cyber insurance category continued to have a commanding lead in 2023. A policy that focuses exclusively on cybersecurity-related risks and is not combined with other insurance products is referred to as standalone cyber insurance. The noteworthy market share of this sector can be attributed to firms' growing cognizance of the distinct hazards linked to cyber threats and the requirement for all-inclusive coverage designed specifically for cyber incidents.

Policies for stand-alone cyber insurance provide tailored coverage against ransomware, cyberattacks, data breaches, business disruptions, and legal liability. Businesses can efficiently manage their distinct cyber risk profiles thanks to this specific strategy, which also helps them control potential financial losses in the case of a cyber disaster. Additionally, businesses in a variety of industries are calling for independent cyber insurance coverage due to the escalation of strict regulatory requirements and the increased frequency of cyber threats.

However, in 2023, the market share of the Packaged Cyber Insurance segment—which combines cyber insurance with other forms of insurance coverage—was significantly lower. Packaged cyber insurance combines protection against cyber threats with other conventional insurance plans, such as property or general liability. Despite offering a more comprehensive insurance solution, this method frequently falls short of the specificity and all-inclusive coverage provided by standalone policies, particularly when dealing with sophisticated and constantly changing cyber threats.

By Coverage Type Analysis

Third-party coverage held a dominant market share of about 61.8% in the cyber insurance industry in 2023. In the context of cyber insurance, third-party coverage refers to contracts that shield companies from lawsuits brought by other parties—like clients, customers, or other impacted organizations—as a result of a cyber incident or data breach. The noteworthy market share of this particular segment can be ascribed to the increasing focus on minimizing legal liabilities and the possible financial fallout linked to cyber events that affect external stakeholders.

Protection against legal fees, settlement costs, and regulatory fines resulting from claims made by impacted third parties as a result of data breaches or other cyber-related incidents is commonly included in third-party coverage in cyber insurance policies. Businesses are realizing how crucial it is to protect themselves against potential legal and financial obligations coming from cyber breaches affecting other entities, as the usage of digital technology and data privacy concerns grow.

Conversely, the First-Party Coverage category, which includes insurance plans that shield companies' assets from losses brought on by cyberattacks, had a far lower market share in 2023. First-party coverage pays for actual financial losses suffered by the covered company as a result of a cyber incident. These losses might include ransom payments, data recovery charges, and other related expenses.

By Enterprise Size

With a market share of more than 72.8% in 2023, large enterprises established a commanding presence in the cyber insurance sector. Organizations classified as large enterprises have a sizable workforce, and extensive operations, and usually operate on a national or international level. Due to their proactive approach and increased knowledge of the financial risks associated with sophisticated and complex cyber threats, large enterprises have a significant market share in this area.

Large enterprises are attractive targets for cyberattacks because they frequently have more advanced IT systems, a larger volume of sensitive data, and a broader digital infrastructure. To protect their enormous assets, data, and operational continuity from potential cyber threats like ransomware attacks, data breaches, and other types of malicious cyber activity, big businesses place a high priority on having strong cyber insurance coverage.

However, in 2023, Small and Medium-Sized Enterprises (SMEs), which are companies with fewer employees and resources, had a lower market share. Compared to their larger counterparts, SMEs usually operate on a smaller scale, having more modest digital footprints and simpler IT infrastructures. Even while SMEs could be subject to comparable cyber dangers, putting in place thorough cybersecurity measures and purchasing extensive cyber insurance coverage might be difficult due to their tight budgets and resources.

The importance of proactive risk management and comprehensive insurance solutions for businesses with significant digital footprints and high-value assets is shown by the dominance of large enterprises in the cyber insurance industry in 2023. Large businesses seek to strengthen their resilience against possible financial losses and operational interruptions resulting from cyber events by making significant investments in cyber insurance. SMEs make up a significant portion of the industry, but their lower market share emphasizes the difficulties they have in giving comprehensive cyber insurance coverage a priority because of limited funding.

By Industry Vertical

With a market share of more than 27.9%, the Banking, Financial Services, and Insurance (BFSI) continued to maintain its leading position in the cyber insurance industry in 2023. They are a prime target for sophisticated cyber threats including data breaches and financial fraud because of their significant handling of sensitive financial data and transactions. The BFSI industry's proactive investment in comprehensive cyber insurance solutions demonstrates its dedication to protecting sensitive financial data and upholding stakeholder and consumer confidence.

Concurrently, the market for cyber insurance saw a notable contribution from the Information Technology (IT) and Telecommunications industry, which is a fundamental component of the digital infrastructure. Due to its critical role in facilitating digital connectivity and communication, this industry is vulnerable to several cyber threats, such as network flaws and data breaches. To strengthen its digital infrastructure and guarantee the security and dependability of its services in the face of changing cyber threats, the IT and telecommunications sector has made it a priority to get comprehensive cyber insurance coverage.

In addition, the healthcare industry demonstrated a growing understanding of the necessity of having comprehensive cyber insurance coverage to safeguard private patient information and guarantee the continuous provision of essential healthcare services. The healthcare sector is facing more and more cybersecurity needs as a result of the digitization of medical information and the growing reliance on networked medical devices and systems. As a result, the healthcare industry now has a strategic obligation to invest in customized cyber insurance solutions to guard against data breaches and maintain patient confidentiality and confidence.

Propelled by the swift expansion of digital retail platforms and online transactions, the Retail & E-Commerce industry also manifested a noteworthy presence in the cyber insurance market. The Retail & E-Commerce industry has prioritized strong cybersecurity measures and insurance coverage to protect customer trust and guard against potential financial losses resulting from data breaches and cyber fraud, as consumer data and financial information are becoming prime targets for cybercriminals.

Finally, the market for cyber insurance benefited from the combined efforts of Other Industry Verticals, which included a range of industries like manufacturing, government, education, and entertainment. The widespread understanding of the vital role that comprehensive cybersecurity measures and insurance coverage play in reducing potential risks and guaranteeing operational resilience in the face of emerging cyber threats is demonstrated by the growing adoption of cyber insurance solutions across a variety of industry verticals.

Regional Analysis

In the cyber insurance market, North America has become a dominant force, with a significant revenue share of 37.1% in 2023.

Because of the region's significant market presence and broad industry use of technology, it is a prime target for sophisticated cyber threats due to its solid digital infrastructure. Businesses in North America have proactively invested in comprehensive cyber insurance solutions to defend their operations and protect against potential financial losses and data breaches due to the growing frequency and complexity of cyberattacks.

Owing in large part to the region's strict data protection laws and the increasing focus on cybersecurity across all industries, the European market showed notable traction in the cyber insurance space at the same time. To protect sensitive customer data and comply with regulatory obligations, businesses in Europe are realizing the need to have strong insurance coverage. This has encouraged a proactive approach to managing cyber risks and guaranteeing business continuity in the face of growing threats.

Moreover, the Asia-Pacific area demonstrated a noteworthy uptick in the adoption of cyber insurance solutions, driven by the economies' quick digitization and the growing frequency of cyber incidents in a range of industry sectors. Businesses in Asia-Pacific are investing in comprehensive insurance coverage to strengthen their digital infrastructure and protect contrary to potential financial and reputational damages resulting from cyber threats, given the region's rapidly advancing technological capabilities and growing awareness of cybersecurity measures.

Furthermore, there has been a rising awareness in the Middle East and Africa (MEA) area of the vital role that cyber insurance plays in reducing possible risks and guaranteeing operational resilience in the face of changing cyber threats. Businesses in the Middle East and Africa have concentrated on bolstering their cybersecurity frameworks and investing in comprehensive insurance solutions in response to the region's growing digital transformation of all industries. This is done to safeguard sensitive data and uphold the confidence of their stakeholders and customers.

Competitive Analysis

The international market, which shields businesses against cyberattacks, is still in its infancy. The market becomes more competitive when there are fewer well-established insurance providers. Due to the rising ransom demands for cybersecurity, insurers will have a huge potential to boost customer trust and adoption of cyber insurance advances. The industry participants are offering solutions that lessen the impact of successful attacks by taking advantage of the shifting online threat landscape. Market leaders are creating new methods for determining their clients' cyber risk so they can provide specialized terms and conditions for their insurance products.

Recent Developments

April 2022: Beazley Group and Cytora collaborated to automate risk processing, expedite profitable development, and simplify insurance for brokers and customers. Beazley will streamline its worldwide underwriting operations, enhance straight-through processing, and cut down on manual procedures by putting the Cytora platform into place.

July 2022: A customized commercial cyber product for Small and Medium-sized Enterprises (SMEs) was introduced by Spring Insure. This cyber solution gives users access to Beazley Cyber services, such as risk management and pre-breach services, and protects against loss due to cyberattacks.

Key Market Players in the Cyber Insurance Market

- American International Group Inc.

- The Chubb Corporation

- Aon PLC

- Allianz SE

- Zurich Insurance Group Ltd

- Beazley PLC

- AXIS Capital Holdings Limited

- Munich Re Group

- Lockton Companies Inc.

- The Travelers Companies Inc.

|

Report Features |

Description |

|

Market Size 2023 |

USD 13.4 Billion |

|

Market Size 2033 |

USD 107.9 Billion |

|

Compound Annual Growth Rate (CAGR) |

22.8% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Insurance Type, Coverage Type, Enterprise Size, Industry Vertical, and by region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

American International Group Inc., The Chubb Corporation, Aon PLC, Allianz SE, Zurich Insurance Group Ltd, Beazley PLC, AXIS Capital Holdings Limited, Munich Re Group, Lockton Companies Inc., The Travelers Companies Inc., Other Key Players |

|

Key Market Opportunities |

Growing Demand for Cyber Insurance in Emerging Markets |

|

Key Market Dynamics |

Growing Cyber Threats |

📘 Frequently Asked Questions

1. How much is the Cyber Insurance Market in 2023?

Answer: The Cyber Insurance Market size was valued at USD 13.4 Billion in 2023.

2. What would be the forecast period in the Cyber Insurance Market report?

Answer: The forecast period in the Cyber Insurance Market report is 2023-2033.

3. Who are the key players in the Cyber Insurance Market?

Answer: American International Group Inc., The Chubb Corporation, Aon PLC, Allianz SE, Zurich Insurance Group Ltd, Beazley PLC, AXIS Capital Holdings Limited, Munich Re Group, Lockton Companies Inc., The Travelers Companies Inc., Other Key Players

4. What is the growth rate of the Cyber Insurance Market?

Answer: Cyber Insurance Market is growing at a CAGR of 22.8% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.