🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Decorative High-Pressure Laminates Market

Decorative High-Pressure Laminates Market Global Industry Analysis and Forecast (2024-2033) by Product Type (Post forming HPL, Standard HPL, Compact HPL, and Other Product Types), Application (Commercial, Residential, Transportation, and Other Applications), End-User (Flooring, Furniture, Wall Panels, Countertops, and Other End-Users) and Region

Apr 2025

Chemicals and Materials

Pages: 138

ID: IMR1910

Decorative High-Pressure Laminates Market Synopsis

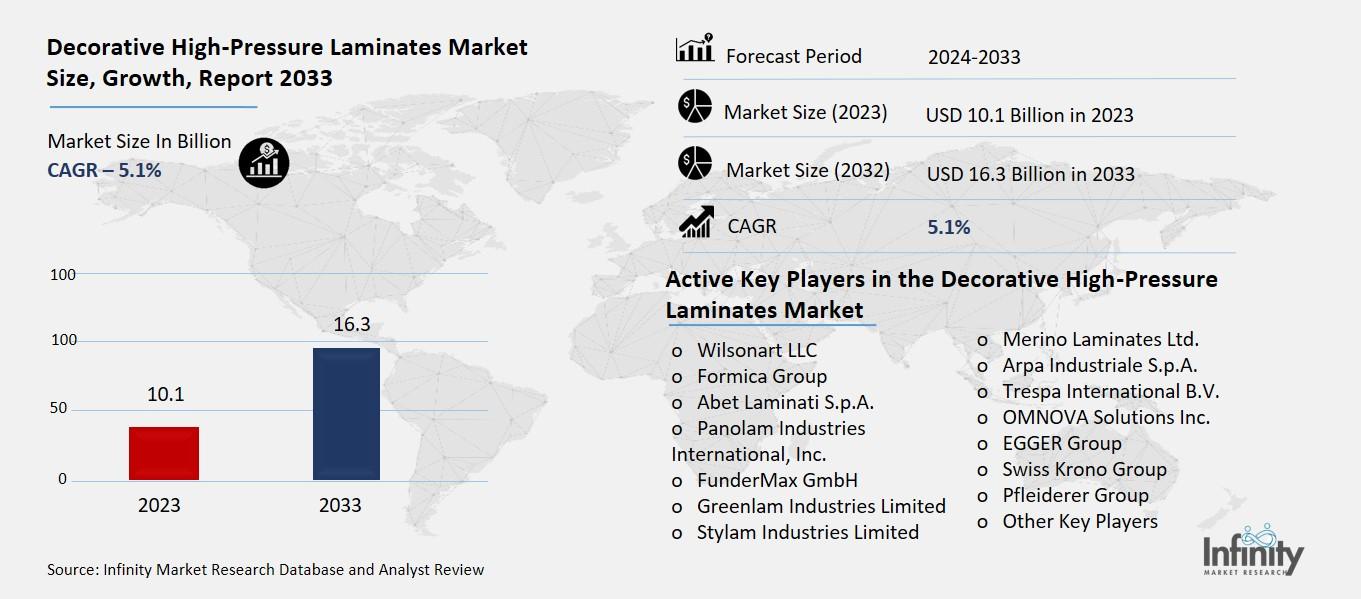

The global decorative high-pressure laminates market was valued at USD 10.1 billion in 2023 and is expected to grow from USD 10.6 billion in 2024 to USD 16.3 billion by 2033, reflecting a CAGR of 5.1% over the forecast period.

Decorative High-Pressure Laminates (HPL) represents the worldwide business that produces and distributes weatherproof decorative surface materials intended for use in interior design and furniture construction. The manufacturing process involves joining layers of craft paper with resins while applying high pressure and temperature which produces a strong surface resistant to scratches.The decorative HPL material serves different applications across residential, commercial and institutional spaces where it becomes the leading option for countertops, cabinets, wall panels and floor coverings and door components. The market continues to grow because customers require attractive and maintenance-free affordable surface solutions while global construction and renovation initiatives expand. The market adoption of furniture surfacing materials increased due to digital printing technology alongside antimicrobial coating advancements in design potential expansion.

Decorative High-Pressure Laminates Market Driver Analysis

Rising Demand for Aesthetic Interiors

People from all consumer categories along with businesses give priority now to interior space visual aesthetics with emphasis on ambiance in residential and professional environments alike and retail stores and hospitality settings. An increasing preference for attractive spaces has boosted the demand for decorative high-pressure laminates because they allow users to choose from many textures and patterns and finishes that emulate wooden and stone and metallic appearances. Decorative high-pressure laminates enable architects and designers to acquire stylish appearance options at economical prices along with flexible design capabilities and easy customization functions. Decorative laminates have emerged as essential interior choices because they enable people to improve visual aesthetics yet maintain durability and functionality in their spaces.

Decorative High-Pressure Laminates Market Restraint Analysis

Volatility in Raw Material Prices

The decorative high-pressure laminates (HPL) market faces an important manufacturing challenge caused by changing prices of its essential raw materials including resins decorative paper and kraft paper. Raw materials prove crucial to manufacturing yet their unpredictable costs create volatile expenses throughout the production procedures. Rising raw material prices directly boosts production costs and reduces profit margins especially because it becomes difficult for manufacturers to transfer costs to customers in competitive markets. The industry faces risks from both changing petroleum product prices and supply chain breakdowns since it depends on petrochemical-based resins. Operating in an unstable environment generates manufacturing obstacles for manufacturers and subsequently hinders their long-term business expansion and investment programs.

Decorative High-Pressure Laminates Market Opportunity Analysis

Sustainability and Eco-Friendly Products

The sustainability push in the construction and interior design industries provides developing opportunities for decorative high-pressure laminates (HPL) manufacturers. The architectural construction and building industry now demands sustainable materials which can be recycled and emit minimal emissions from sustainable production methods. The market demand for sustainable materials prompts manufacturers to create HPL products from FSC-certified paper together with water-based adhesives and resins that contain low VOC levels. The connection of product lines to LEED and BREEAM sustainability standards enables firms to reach vital markets dedicated to green building performance requirements. Companies that adopt this transition benefit sustainable global targets and increase their market standing through better brand perception while remaining competitive for conscious consumer choices.

Decorative High-Pressure Laminates Market Trend Analysis

Focus on Sustainable Manufacturing

More companies within the decorative high-pressure laminate (HPL) market are using FSC-certified papers and water-based adhesives as well as low-VOC resins in their manufacturing processes due to environmental concerns. The market transforms because environmental consciousness grows together with enhanced sustainability standards that enforce eco-friendly building methods. Resources managed by FSC certification provide safe forest timber while water-based glue production minimizes unsafe chemical emissions. Resins with minimal VOC content help improve indoor air quality since they produce reduced toxic substance emissions. The increased priority of sustainability in architectural decision-making prompts manufacturers to integrate environment-friendly materials in their product lines which leads to better green construction project acceptability and compliance with worldwide environmental protocols.

Decorative High-Pressure Laminates Market Segment Analysis

The Decorative High-Pressure Laminates Market is segmented on the basis of Product Type, Application, and End-User.

By Product Type

o Postforming HPL

o Standard HPL

o Compact HPL

o Other Product Types

By Application

o Commercial

o Residential

o Transportation

o Other Applications

By End-User

o Flooring

o Furniture

o Wall Panels

o Countertops

o Other End-Users

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Product Type, Standard HPL Segment is Expected to Dominate the Market During the Forecast Period

The product types discussed in this research study, the standard HPL segment is expected to account for the largest market share of decorative high-pressure laminates market in the forecast period. Standard HPL controls more than 50% of the decorative HPL market primarily because it finds extensive use in all three segments of residential, commercial and institutional properties. The standard HPL delivers exceptional resistance against high-traffic while maintaining affordable costs and wide design flexibility for countertops together with cabinets and partitions as well as furniture. Standard HPL demonstrates its value for regular use throughout horizontal and vertical setups because it resists all types of damage from scratches to moisture as well as stains and heat exposure. Manufacturers constantly enrich standard HPL aesthetics by offering diverse finishes which helps boost their market popularity.

By Application, the Residential Segment is Expected to Held the Largest Share

Based on application, the decorative high-pressure laminates (HPL) market is segmented into residential and non-residential segments. This could be attributed to the ever-growing need for style, functionality, and affordability in homes, and is seen most in the housing sector. Due to its durability, ease of maintenance, and numerous design alternatives, homeowners are choosing decorative HPLs for use in kitchen countertops, wardrobes, cabinets, wall graphics, and flooring. Growing popularity of renovation and urban housing and apartments are also driving the demand for space-saving, customizable and aesthetically appealing interiors materials.

By End-User, the Furniture Segment is Expected to Held the Largest Share

The furniture segment is expected to be the largest holder of decorative high-pressure laminates (HPL) market, by end-user, during the forecast period. More so than in all types of commercial and residential furniture, where HPL is known for its durability, easy maintenance and broad aesthetic range. HPLs with decorative surfaces are also widely used as surfacing materials for tables, chairs, cabinets, bookshelves, and office furniture due to their scratch, stain, and moisture resistance properties that make them suitable for day-to-day use. Rising demand for modular as well as ready-to-assemble furniture, the growing rate of urbanization, and the cost-effective and easy customizability of HPL are some of the prominent factors that are expected to further spur the adoption of HPL.

Decorative High-Pressure Laminates Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Asia Pacific region is expected to be the prominent market for decorative high-pressure laminates (HPL) during the forecast period. The market expansion results from high-speed urbanization together with expanding residential and commercial infrastructure and increasing consumer need for reasonably priced interior solutions across China India Indonesia and Vietnam. Home improvement projects along with modern furniture purchases from middle-class consumers maintain market demand at high levels. Manufacturing operations in this area thrive because of abundant raw materials and affordable production expenses and therefore HPL production centers here alongside exporting activities. Decorative laminates consumption grows because government programs execute development of housing and infrastructure across the nation. The Asia Pacific region holds prime positioning to steer the worldwide HPL market ahead throughout the forecasting period because of its big consumer base together with extensive building and interior design sector modernization initiatives.

Recent Development

· In September 2021, To meet the growing demand for antimicrobial surface protection, Formica Corporation launched its Formica Laminate Antimicrobial collection, featuring 20 of its most popular laminate designs. Available in the U.S. and Mexico, these laminates incorporate BioCote® technology, which helps inhibit the growth of odor- and stain-causing bacteria, enhancing hygiene and surface durability.

Active Key Players in the Decorative High-Pressure Laminates Market

o Wilsonart LLC

o Formica Group

o Abet Laminati S.p.A.

o Panolam Industries International, Inc.

o FunderMax GmbH

o Greenlam Industries Limited

o Stylam Industries Limited

o Merino Laminates Ltd.

o Arpa Industriale S.p.A.

o Trespa International B.V.

o OMNOVA Solutions Inc.

o EGGER Group

o Swiss Krono Group

o Pfleiderer Group

o Other Key Players

Global Decorative High-Pressure Laminates Market Scope

|

Global Decorative High-Pressure Laminates Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.1 Billion |

|

Market Size in 2024: |

USD 10.6 Billion | ||

|

Forecast Period 2024-33 CAGR: |

5.1% |

Market Size in 2033: |

USD 16.3 Billion |

|

Segments Covered: |

By Product Type |

· Postforming HPL · Standard HPL · Compact HPL · Other Product Types | |

|

By Application |

· Commercial · Residential · Transportation · Other Applications | ||

|

By End-User |

· Flooring · Furniture · Wall Panels · Countertops · Other End-Users | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Rising Demand for Aesthetic Interiors | ||

|

Key Market Restraints: |

· Volatility in Raw Material Prices | ||

|

Key Opportunities: |

· Sustainability and Eco-Friendly Products | ||

|

Companies Covered in the report: |

· Wilsonart LLC, Formica Group, Abet Laminati S.p.A., Panolam Industries International, Inc., and Other Key Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Decorative High-Pressure Laminates Market Research report?

Answer: The forecast period in the Decorative High-Pressure Laminates Market Research report is 2024-2033.

2. Who are the key players in the Decorative High-Pressure Laminates Market?

Answer: Wilsonart LLC, Formica Group, Abet Laminati S.p.A., Panolam Industries International, Inc., and Other Key Players.

3. What are the segments of the Decorative High-Pressure Laminates Market?

Answer: The Decorative High-Pressure Laminates Market is segmented into Product Type, Application, End-User, and Regions. By Product Type, the market is categorized into Postforming HPL, Standard HPL, Compact HPL, and Other Product Types. By Application, the market is categorized into Commercial, Residential, Transportation, and Other Applications. By End-User, the market is categorized into Flooring, Furniture, Wall Panels, Countertops, and Other End-Users. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Decorative High-Pressure Laminates Market?

Answer: The Decorative High-Pressure Laminates (HPL) market refers to the sector of the building materials and interior design industry that deals with the creation, distribution, and usage of high-pressure laminates that have decorative surfaces. They are a heat and pressure laminated surface material consisting of layers of resin-impregnated paper and decorative brown kraft paper. Sheet laminated decorative HPLs are widely used in furniture, cabinetry, wall panels, countertops and flooring and provide benefits such as stain, scratch, heat, and impact resistance along with a wide variety of colors, textures and patterns.

5. How big is the Decorative High-Pressure Laminates Market?

Answer: The global Decorative High-Pressure Laminates Market was valued at USD 10.1 billion in 2023 and is expected to grow from USD 10.6 billion in 2024 to USD 16.3 billion by 2033, reflecting a CAGR of 5.1% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.