🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Dicalcium Phosphate Market

Dicalcium Phosphate Market Global Industry Analysis and Forecast (2024-2033) by Production Method (Phosphoric Acid and Hydrochloric Acid), End-Use (Food & Beverage, Agriculture, Animal Feed, Pharmaceutical, and Other End-Uses) and Region

May 2025

Chemicals and Materials

Pages: 138

ID: IMR1949

Dicalcium Phosphate Market Synopsis

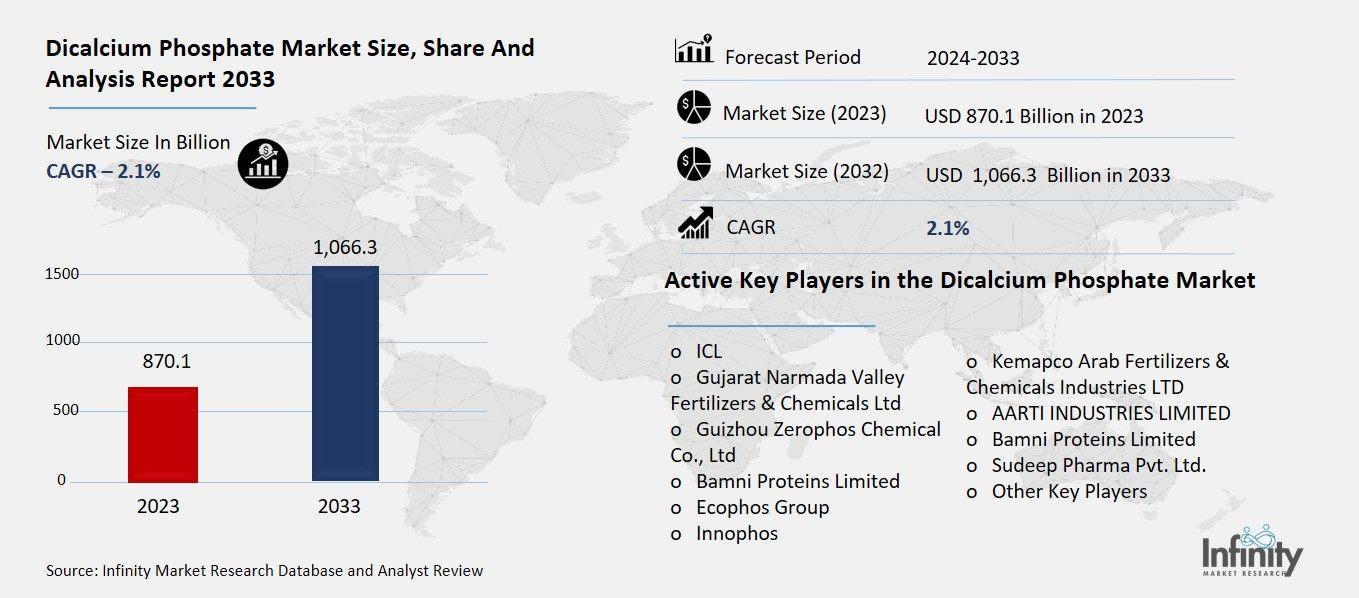

The global dicalcium phosphate market was valued at USD 870.1 billion in 2023 and is expected to grow from USD 888.0 billion in 2024 to USD 1,066.3 billion by 2033, reflecting a CAGR of 2.1% over the forecast period.

The dicalcium phosphate market functions as a primary sector of the worldwide feed, food and pharmaceutical industries since it serves as a fundamental calcium and phosphorus supplement. Reasons for the extensive use of dicalcium phosphate (DCP) in animal feed include its capability to support bone development and general wellness in livestock and poultry thus leading the livestock sector to become the principal consumer. Human dietary supplements, toothpaste and pharmaceutical tablets use dicalcium phosphate as binding agent while providing nutritional benefits. Market drivers include expanding demand for premium meat and dairy goods and rising public knowledge regarding animal nutrition alongside the rise of health-oriented buyers who pursue nutritional supplements.

Dicalcium Phosphate Market Driver Analysis

Rising Demand for Animal Feed Additives

The worldwide increase in meat and dairy product consumption produces substantial market demand for nutritional feed additives including dicalcium phosphate (DCP). The world's growing population and increasing disposable income has led developing regions to adopt diets containing more animal proteins. Increased meat and dairy consumption drives the livestock and poultry industries to increase their productivity output while sustaining good health for their animals. Animals require DCP as an essential nutritional feed additive because it provides the necessary calcium and phosphorus elements required for bone development and metabolism and overall growth. DCP improves nutritional value in animal feeds while optimizing animal performance through enhanced growth rates and reproductive outcomes and milk production capabilities to fulfill growing consumer demands. Growing global consumer preferences for animal-based food create a permanent expansion of the market need for high-performance animal feed with DCP fortification.

Dicalcium Phosphate Market Restraint Analysis

Fluctuating Raw Material Prices

Consumer confidence for DCP-based food and dietary supplements could face obstacles because of potentially harmful health risks linked to high phosphate consumption. Consuming DCP within recommended amounts establishes its recognition as safe yet excessive phosphate ingestion from processed foods links to healthcare issues including kidney injury and coronary difficulties and calcium imbalances. People with chronic kidney disease and metabolic disorders face elevated risks from consuming phosphates. Public awareness about phosphate side effects leads to increasing consumer wariness about additive chemicals in food diets. Monitors assigned by regulatory bodies in different areas could establish tighter labeling rules and set maximum product content thresholds and promote product updates.

Dicalcium Phosphate Market Opportunity Analysis

Expansion in Nutraceuticals and Functional Foods

The use of Dicalcium phosphate (DCP) for calcium fortification enables substantial market opportunities in health-oriented food and beverage industries. The combination of being both tasteless and easily absorbed by the body makes DCP highly attractive to manufacturers while meeting nutritional labeling standards. Beyond its role as a solid calcium and phosphorus source DCP offers an effective method to fortify nutritional cereals and dairy alternatives alongside dietary supplements and nutritional bars. The food manufacturer finds DCP appealing because it possesses no detectable taste and allows excellent nutrient absorption and matches with diverse food production methods. The awareness about osteoporosis prevention along with understanding the necessity for appropriate calcium levels in all age groups and especially older demographics has boosted its position in nutritional fortified foods.

Dicalcium Phosphate Market Trend Analysis

Shift Toward Organic and Eco-Friendly Feed Additives

The rise of environmental priorities alongside sustainability targets has driven dicalcium phosphate (DCP) manufacturers to research sustainable alternative sources and cleaner production methods. The conventional production methods for DCP use phosphate rock together with chemical treatments which create waste streams and demand heavy energy consumption. Manufacturers now invest in new production methods which reduce environmental effects by recovering phosphorus from waste materials and implementing energy-saving production technologies. Some companies have established programs to reduce their carbon emissions while making water usage more effective and meeting the new standards required by environmental laws. The introduction of sustainability innovations in DCP manufacturing ties in with rising consumer and business interest in environmentally responsible processes while lowering the industry's overall environmental impact.

Dicalcium Phosphate Market Segment Analysis

The Dicalcium Phosphate Market is segmented on the basis of Production Method, Processing Method, and End-Use.

By Production Method

o Phosphoric Acid

o Hydrochloric Acid

By End-Use

o Food & Beverage

o Agriculture

o Animal Feed

o Pharmaceutical

o Other End-Uses

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Production Method, Phosphoric Acid Segment is Expected to Dominate the Market During the Forecast Period

The production methods discussed in this research study, the phosphoric acid segment is expected to account for the largest market share of dicalcium phosphate market in the forecast period. The production of DCP occurs through phosphoric acid reacting with calcium-containing sources such as calcium carbonate or limestone. The manufacturing process utilizes phosphoric acid because it produces high purity end products with consistent quality while supporting both food-grade and feed-grade uses. The DCP segment leads the market due to its efficient production processes along with its capacity for scale-up operations and minimal creation of by-products in comparison to hydrochloric acid and sulfuric acid methods. Better control of phosphorus content during the phosphoric acid process enables manufacturers to meet regulatory requirements in animal feed and nutritional supplements production.

By End-Use, the Food & Beverage Segment is Expected to Held the Largest Share

By end-use, the food and beverage segment is expected to hold the largest share of the dicalcium phosphate (DCP) market during the forecast period. The growing market for calcium-fortified products drives the dominance of DCP as manufacturers seek to enhance bone health benefits particularly for elderly consumers and health-conscious consumers. DCP functions as a dietary supplement ingredient as well as a leavening agent while providing nutritional enhancement in breakfast cereals and bakery items and dairy alternatives and functional beverages. The food manufacturing industry selects DCP as its preferred ingredient because of its superior bioavailability and stability combined with its lack of taste impact. The global consumption of fortified foods experienced growth because people are now better informed about how to prevent osteoporosis and recognize the need for sufficient mineral consumption.

Dicalcium Phosphate Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

The Asia Pacific region is expected to dominate the dicalcium phosphate (DCP) market over the forecast period, driven by a combination of economic growth, expanding population, and rising demand for animal protein. The rapid agricultural and food production industrialization throughout China India and Southeast Asia drives increased applications of feed additive DCP to stabilize livestock and poultry health. The rising middle class within the region advocates for fortified foods and dietary supplements while creating new business opportunities for DCP consumption in both the food and pharmaceutical industries. Government support for livestock productivity and food fortification while offering low-cost materials and labor force continues to enhance the competitive position of DCP production and usage in this area. Asia Pacific maintains its position as the main DCP market due to its extensive customer base together with its advancing agricultural industry.

Recent Development

In May 2023, John Deere and Yara International partnered to combine Yara's agronomic expertise with John Deere's precision technology and advanced machinery. This collaboration aimed to help farmers enhance crop yields and optimize fertilizer usage, supporting the European Union's Farm to Fork Strategy goals.

Active Key Players in the Dicalcium Phosphate Market

o ICL

o Gujarat Narmada Valley Fertilizers & Chemicals Ltd

o Guizhou Zerophos Chemical Co., Ltd

o Bamni Proteins Limited

o Ecophos Group

o Innophos

o Kemapco Arab Fertilizers & Chemicals Industries LTD

o AARTI INDUSTRIES LIMITED

o Bamni Proteins Limited

o Sudeep Pharma Pvt. Ltd.

o Other Key Players

Global Dicalcium Phosphate Market Scope

|

Global Dicalcium Phosphate Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 870.1 Billion |

|

Market Size in 2024: |

USD 888.0 Billion | ||

|

Forecast Period 2024-33 CAGR: |

2.1% |

Market Size in 2033: |

USD 1,066.3 Billion |

|

Segments Covered: |

By Production Method |

· Phosphoric Acid · Hydrochloric Acid | |

|

By End-Use |

· Food & Beverage · Agriculture · Animal Feed · Pharmaceutical · Other End-Uses | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Rising Demand for Animal Feed Additives | ||

|

Key Market Restraints: |

· Health Concerns with Excessive Phosphate Intake | ||

|

Key Opportunities: |

· Expansion in Nutraceuticals and Functional Foods | ||

|

Companies Covered in the report: |

· ICL, Gujarat Narmada Valley Fertilizers & Chemicals Ltd, Guizhou Zerophos Chemical Co., Ltd, Bamni Proteins Limited, and Other Key Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Dicalcium Phosphate Market Research report?

Answer: The forecast period in the Dicalcium Phosphate Market Research report is 2024-2033.

2. Who are the key players in the Dicalcium Phosphate Market?

Answer: ICL, Gujarat Narmada Valley Fertilizers & Chemicals Ltd, Guizhou Zerophos Chemical Co., Ltd, Bamni Proteins Limited, and Other Key Players.

3. What are the segments of the Dicalcium Phosphate Market?

Answer: The Dicalcium Phosphate Market is segmented into Production Method, End-Use, and Regions. By Production Method, the market is categorized into Phosphoric Acid and Hydrochloric Acid. By End-Use, the market is categorized into Food & Beverage, Agriculture, Animal Feed, Pharmaceutical, and Other End-Uses. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Dicalcium Phosphate Market?

Answer: The global industry devoted to producing and distributing dicalcium phosphate (DCP) as an essential chemical compound maintains the dicalcium phosphate market structure. DCP holds value because it offers excellent calcium and phosphorus availability which serve important functions both at a metaphysical and skeletal level within human and animal bodily systems. The primary driver for the market stems from the livestock and poultry industries which utilize DCP as a feed additive to boost growth rates and bone strengthening. The pharmaceutical as well as personal care industries depend on DCP since the compound appears in dietary supplements and dental products. The market response depends on worldwide meat consumption together with agricultural advancements as well as nutritional fortification trends alongside phosphate mining environmental regulations.

5. How big is the Dicalcium Phosphate Market?

Answer: The Global Dicalcium Phosphate Market was valued at USD 870.1 billion in 2023 and is expected to grow from USD 888.0 billion in 2024 to USD 1,066.3 billion by 2033, reflecting a CAGR of 2.1% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.