🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Diesel Exhaust Fluid Market

Diesel Exhaust Fluid Market Global Industry Analysis and Forecast (2024-2033) by Vehicle (HCVs, LCVs, and Passenger Cars), Component (Catalysts, Injectors, Tanks, Sensors, and Other Components), Application (Construction Equipment, Agricultural Tractors, and Other Applications) and Region

Apr 2025

Chemicals and Materials

Pages: 138

ID: IMR1909

Diesel Exhaust Fluid Market Synopsis

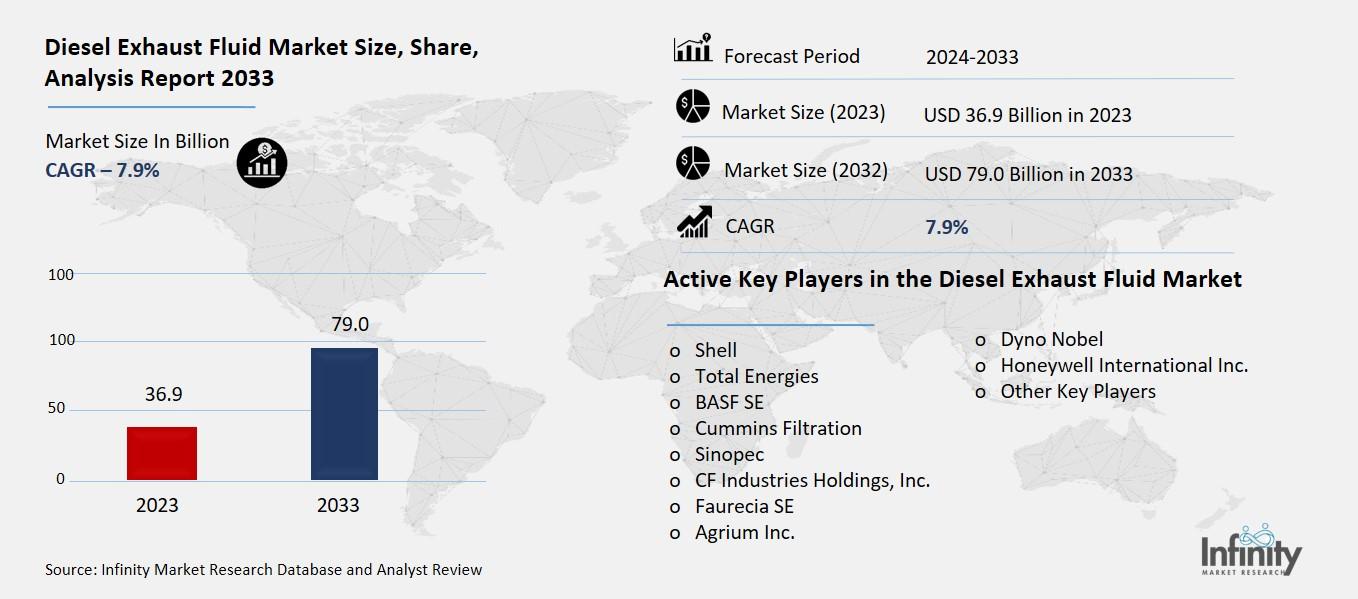

The global diesel exhaust fluid market was valued at USD 36.9 billion in 2023 and is expected to grow from USD 39.8 billion in 2024 to USD 79.0 billion by 2033, reflecting a CAGR of % over the forecast period.

The worldwide emphasis on environmental regulations and cleaner emissions promotes rapid market expansion of Diesel Exhaust Fluid (DEF) throughout automotive and industrial applications. The Diesel Exhaust Fluid (DEF) exceeds minimum quality standards because it combines 32.5% urea and 67.5% deionized water to function with Selective Catalytic Reduction (SCR) technology for reducing nitrogen oxide (NOx) emissions from diesel engines. The regulatory standard compliance for emission standards Euro 6 and EPA Tier 4 depends on this essential fluid. All segments of this market consist of manufacturing entities and distribution channels alongside logistics operations and consumer end-users who come from transportation and agriculture and mining and construction industries. The DEF market expands because of the rising number of diesel vehicle manufacturing operations and expanding logistics and construction industries alongside public interest in environmental sustainability. The DEF market will experience further growth because regulatory entities maintain tighter emission standards alongside technological breakthroughs and improved facilities for DEF delivery and supply.

Diesel Exhaust Fluid Market Driver Analysis

Rising Diesel Vehicle Sales

The growing number of commercial vehicles utilizing transportation and logistics represents a substantial driver of required Diesel Exhaust Fluid (DEF) in the market. The worldwide growth of trade and e-commerce requires better cargo transportation thus commercial fleets such as trucks buses and delivery vans need to expand. SCR technology has become standard equipment in diesel-powered vehicles to fulfil strict emission regulations but diesel remains the main power source for most commercial vehicles. The effective performance of SCR systems depends on regular DEF use because it enables them to reduce harmful NOx emissions. Deployment and operation of these vehicles result in increased DEF use because of the fundamental requirement for Selective Catalytic Reduction (SCR) systems. Regions with mandatory DEF standards make the market grow because they require fleet users to operate DEF-compliant vehicles.

Diesel Exhaust Fluid Market Restraint Analysis

Lack of Awareness in Developing Regions

Insufficient understanding of both Diesel Exhaust Fluid (DEF) products and emission standards in developing marketplaces will slow down the adoption of DEF technology and limit market expansion. Regions undergoing developmental change have limited understanding about both the environmental effects of diesel emissions and the available emission reduction methods that involve SCR systems and DEF. Transport operators along with small-scale transport enterprises as well as equipment owners sometimes lack complete understanding of requisite regulations and operational benefits which DEF provides. The knowledge deficit regarding diesel emissions and DEF solutions exists because government-centred emission regulations are not consistently enforced and because national incentives and public awareness programs are lacking. A lack of knowledge about emission control systems among operators of diesel vehicles within these markets causes them to depart without DEF compliance which diminishes market demand and prevents the adoption of more advanced and compliant technology.

Diesel Exhaust Fluid Market Opportunity Analysis

Development of Distribution Infrastructure

Market penetration will improve significantly when companies invest in Diesel Exhaust Fluid (DEF) dispensers combined with advanced supply chain systems at gas stations. Consumers need dependable DEF access since SCR-equipped diesel vehicle adoption is rising so the market demand increases. DEF dispensers placed at major transport routes fuel stations create user-friendly systems for customers while leading to increased usage rates. A well-developed supply chain with enhanced storage systems as well as bulk delivery networks with dependable distribution routes ensures that DEF remains at good quality while becoming easily obtainable in both urban and distant regions. This type of infrastructure development decreases operational difficulties with DEF fueling and increases end-user confidence which speeds up DEF market penetration and achieves regulatory targets in various markets around the world.

Diesel Exhaust Fluid Market Trend Analysis

Increased Use in Non-Road Equipment

The use of Diesel Exhaust Fluid (DEF) now goes beyond conventional on-road applications to include various off-road machinery used in construction mining and agricultural sectors. The various industries need diesel engines with great power to operate their essential machinery like excavators and bulldozers and tractors and harvesters that generate significant nitrogen oxide (NOx) emissions. The industry adopted stricter non-road diesel engine emission requirements thus Selective Catalytic Reduction systems (SCR) became standard equipment for producing off-road equipment that meets regulatory standards. Scar systems require DEF as their essential component so the demand within these industries continues to rise. The DEF market expands to new sectors following increased emphasis on sustainability and emissions control across multiple industrial applications which establish DEF as an indispensable product outside transportation.

Diesel Exhaust Fluid Market Segment Analysis

The Diesel Exhaust Fluid Market is segmented on the basis of Vehicle, Component, and Application.

By Vehicle

o HCVs

o LCVs

o Passenger Cars

By Component

o Catalysts

o Injectors

o Tanks

o Sensors

o Other Components

By Application

o Construction Equipment

o Agricultural Tractors

o Other Applications

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

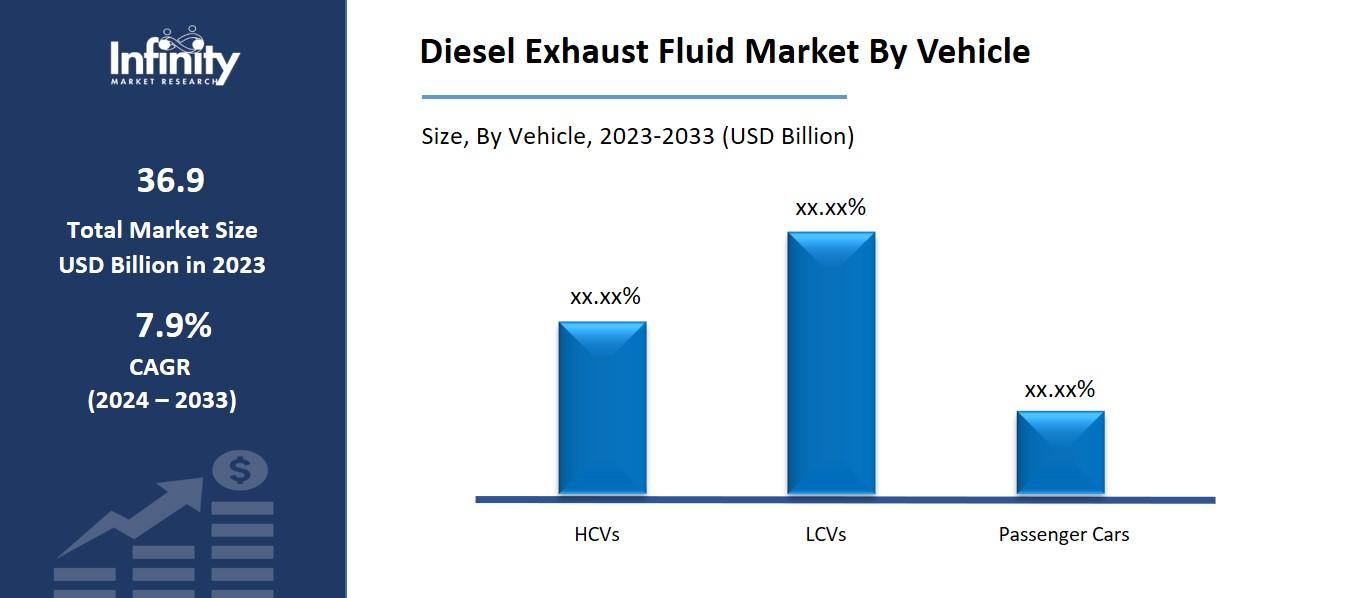

By Vehicle, LCVs Segment is Expected to Dominate the Market During the Forecast Period

The adoption of Diesel Exhaust Fluid (DEF) extends now to off-road equipment in agriculture apart from mining infrastructure and construction equipment. Off-road equipment machines operated by strong diesel engines serve these industries as their main polluting factor while using excavator’s bulldozers tractors and harvesters as major sources of nitrogen oxide (NOx) emissions. Non-road diesel engines now require strict emission standards that push manufacturers to add Selective Catalytic Reduction (SCR) technology to their off-road products. The rising demand in these sections stems from SCR systems needing DEF because it functions as a key component for effective system operation.

By Component, the Catalysts Segment is Expected to Held the Largest Share

The catalysts segment is likely to dominate the market on account of its widespread use in urban and regional transportation, last-mile delivery, and small-scale logistics. The Selective Catalytic Reduction (SCR) system employs catalysts as essential components to convert hazardous nitrogen oxide (NOx) emissions into nitrogen and water vapour while functioning in diesel engines. The catalysts consisting of platinum, palladium and vanadium materials support the chemical process that bonds DEF with exhaust gases to enable emission control. The demand for advanced SCR systems with high-performance catalysts is increasing in both on-road and off-road applications since new global emission requirements become stricter.

By Application, the Construction Equipment Segment is Expected to Held the Largest Share

By component, the catalysts segment is expected to hold the largest share of the Diesel Exhaust Fluid (DEF) market during the forecast period. Catalysts are a critical part of the Selective Catalytic Reduction (SCR) system, which is used in diesel engines to convert harmful nitrogen oxide (NOx) emissions into harmless nitrogen and water vapour. These catalysts typically made from materials such as platinum, palladium, and vanadium facilitate the chemical reaction between DEF and exhaust gases, enabling effective emission control. As global emission standards become increasingly stringent, the demand for high-performance SCR systems with advanced catalysts is rising across both on-road and off-road applications.

Diesel Exhaust Fluid Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

The Diesel Exhaust Fluid (DEF) market will experience North American dominance because of its initial adoption of strict emission standards throughout its diverse industrial sectors which operate with diesel engines. The United States and Canada enforce EPA Tier 4 standards that require Selective Catalytic Reduction (SCR) systems in diesel engines thereby creating robust DEF market demand. The extensive network of DEF bulk supply systems together with DEF dispensers located at fuelling stations enables end-users in North America to conveniently obtain this fluid.

The vast fleet of commercial vehicles together with construction equipment along with agricultural machinery within this region constitutes strong DEF usage. Upper-level investments within the logistics sector combined with increased spending in transportation and industrial activities strengthen the leading position of North America regarding DEF market dominance.

Recent Development

In January 2022, CrossChem International's Hong Kong branch received accreditation from the German Association of the Automotive Industry (VDA), authorizing it to begin the production of AdBlue Diesel Exhaust Fluid. This certification affirms that the final product adheres to the highest quality standards and is expected to strengthen the company's position and growth within the diesel exhaust fluid market.

Active Key Players in the Diesel Exhaust Fluid Market

o Shell

o Total Energies

o BASF SE

o Cummins Filtration

o Sinopec

o CF Industries Holdings, Inc.

o Faurecia SE

o Agrium Inc.

o Dyno Nobel

o Honeywell International Inc.

o Other Key Players

Global Diesel Exhaust Fluid Market Scope

|

Global Diesel Exhaust Fluid Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 36.9 Billion |

|

Market Size in 2024: |

USD 39.8 Billion | ||

|

Forecast Period 2024-33 CAGR: |

7.9% |

Market Size in 2033: |

USD 79.0 Billion |

|

Segments Covered: |

By Vehicle |

· HCVs · LCVs · Passenger Cars | |

|

By Component |

· Catalysts · Injectors · Tanks · Sensors · Other Components | ||

|

By Application |

· Construction Equipment · Agricultural Tractors · Other Applications | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Rising Diesel Vehicle Sales | ||

|

Key Market Restraints: |

· Lack of Awareness in Developing Regions | ||

|

Key Opportunities: |

· Development of Distribution Infrastructure | ||

|

Companies Covered in the report: |

· Shell, Total Energies, BASF SE, Cummins Filtration, and Other Key Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Diesel Exhaust Fluid Market Research report?

Answer: The forecast period in the Diesel Exhaust Fluid Market Research report is 2024-2033.

2. Who are the key players in the Diesel Exhaust Fluid Market?

Answer: Shell, Total Energies, BASF SE, Cummins Filtration, and Other Key Players.

3. What are the segments of the Diesel Exhaust Fluid Market?

Answer: The Diesel Exhaust Fluid Market is segmented into Vehicle, Component, Application, and Regions. By Vehicle, the market is categorized into HCVs, LCVs, and Passenger Cars. By Component, the market is categorized into Catalysts, Injectors, Tanks, Sensors, and Other Components. By Application, the market is categorized into Construction Equipment, Agricultural Tractors, and Other Applications. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Diesel Exhaust Fluid Market?

Answer: Diesel exhaust fluid market encompasses worldwide activities that create and distribute non-toxic urea solution with deionized water for vehicles employing Selective Catalytic Reduction systems. Auto industries use DEF as a fluid injection into diesel engine exhaust streams to decrease NOx contaminations while meeting environmental standards that apply mostly to North America and Europe. The combination of stricter greenhouse gas emission targets and spreading usage of SCR technology in commercial transportation and off-road machinery creates rising DEF market requirements.

5. How big is the Diesel Exhaust Fluid Market?

Answer: The global Diesel Exhaust Fluid Market was valued at USD 36.9 billion in 2023 and is expected to grow from USD 39.8 billion in 2024 to USD 79.0 billion by 2033, reflecting a CAGR of 7.9% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.