🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Digital Banking Market

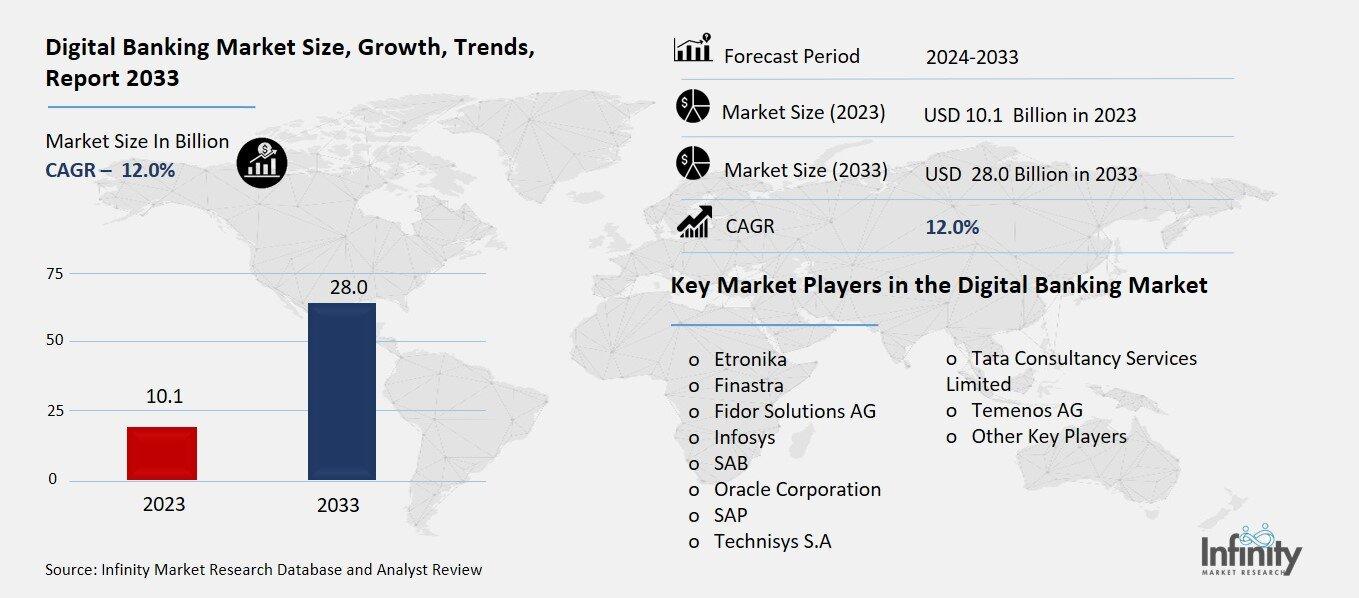

Global Digital Banking Market (By Type, Investment Banking, Corporate Banking, and Retail Banking; By Service, Transactional Services and Non-Transactional Services; By Region and Companies), 2024-2033

Oct 2024

Financial Services & Insurance

Pages: 138

ID: IMR1277

Digital Banking Market Overview

Global Digital Banking Market acquired the significant revenue of 10.1 Billion in 2023 and expected to be worth around USD 28.0 Billion by 2033 with the CAGR of 12.0% during the forecast period of 2024 to 2033. The digital banking market is defined as the offering of banking services in the digital space using such items as a mobile application, website or even the internet banking platform. This market has been steadily on the rise, because of technological developments, high demand for round-the-clock services and emergence of such new players as compagnies affiliated with financial technologies.

Some of the reasons that revolve closely around the sales include the rise of the number of Smartphone users, better and improved internet connection, and need for customized financial services. Digital banking can include a number of services: account maintenance, payments, credit, investments; It is often leveraged with AI, data analysis and blockchain technology putting traditional and new players on relatively equal footing.

Drivers for the Digital Banking Market

Increased Smartphone and Internet Penetration

The growth of smartphone uses and enhanced internet connection has opened up the usage of digital banking to a broad population. With an increase in smartphone penetration and ongoing advancements in mobile connectivity especially in developing countries, everybody in varying social classes had been able to participate in FinTech services. It brings the reach of the banking services closer to the consumers making it possible for consumers to transact at any time and in any place regardless of the absence of branch infrastructure.

Convenient features of m-banking applications include, among others; money transfer, payment of bills, loans, and investments among others through the phone. Incorporated features such as, biometric authentication, instant notifications and artificial intelligent customer support make digital banking not only a convenient method of banking but safe as well. Which brought together with the elements of mobility and use of the internet made enhancements of the financial services delivery and making it easier for financially excluded or un-banked population to be integrated into the financial systems, thus improving the financial inclusion and advancement of the economic status.

Restraints for the Digital Banking Market

Cybersecurity and Data Privacy Concerns

Growing incidents of data breaches and cyberattacks pose significant challenges to the expansion of the digital banking market by undermining customer trust. As more banking services migrate online, the volume of sensitive financial data being transmitted and stored digitally increases, making banks’ prime targets for cybercriminals. Data breaches can lead to the exposure of personal information, including account details, passwords, and financial histories, which can be exploited for fraud or identity theft. High-profile cyberattacks on financial institutions erode consumer confidence in the safety and security of digital banking platforms, leading to hesitancy among customers to fully adopt these services. This distrust can slow down the growth of the market, as individuals may prefer traditional banking methods or limit their use of digital channels due to concerns over privacy and data security.

Opportunity in the Digital Banking Market

Adoption of Blockchain and Cryptocurrency

Integrating blockchain technology and cryptocurrency into digital banking opens up new opportunities for enhancing the security and efficiency of transactions while enabling decentralized financial services. Blockchain’s decentralized ledger system offers an immutable and transparent record of transactions, significantly reducing the risk of fraud and tampering. This makes it an ideal solution for secure and real-time processing of payments, cross-border transfers, and settlement of financial transactions. In traditional banking, these processes often involve intermediaries, which can slow down transactions and increase costs. By utilizing blockchain, digital banking can streamline these processes, offering faster, cheaper, and more secure alternatives to conventional methods.

Cryptocurrency integration further expands the potential of digital banking by allowing customers to hold, transfer, and invest in digital assets. This is particularly appealing for users in regions with unstable currencies or limited access to traditional banking services, as cryptocurrencies can offer a more stable and accessible alternative.

Trends for the Digital Banking Market

Partnerships Between Traditional Banks and Fintechs

Many traditional banks are increasingly collaborating with fintech companies to enhance their digital offerings and meet evolving customer expectations in an era marked by rapid technological advancements and shifting consumer preferences. This partnership allows banks to leverage the innovative capabilities and agility of fintech firms, which are often more adept at developing cutting-edge technologies and user-friendly platforms. By integrating fintech solutions, banks can accelerate their digital transformation efforts, offering enhanced services such as mobile banking applications, real-time payments, automated lending, and personalized financial advice powered by artificial intelligence and data analytics.

Segments Covered in the Report

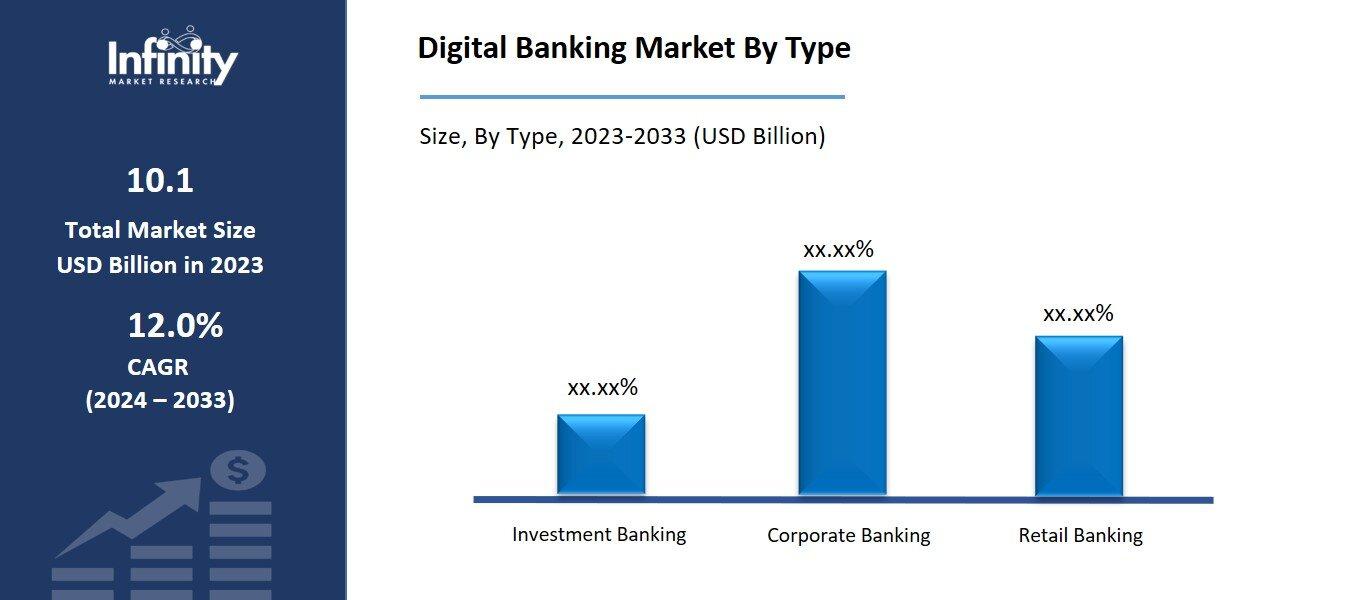

By Type

o Investment Banking

o Corporate Banking

o Retail Banking

By Service

o Transactional Services

o Non-Transactional Services

Segment Analysis

By Type Analysis

On the basis of type, the market is divided into investment banking, corporate banking, and retail banking. Among these, investment banking segment acquired the significant share in the market due to its early adoption of advanced digital technologies and high demand for innovative financial solutions. Investment banks have been quick to leverage artificial intelligence, data analytics, and blockchain technologies to streamline complex processes such as trading, portfolio management, and risk assessment. The digitalization of investment banking allows for faster execution of trades, more efficient capital raising, and enhanced decision-making based on real-time data insights, making it highly attractive to institutional investors and high-net-worth individuals.

By Service Analysis

On the basis of service, the market is divided into transactional services and non-transactional services. Among these, transactional services segment held the prominent share of the market owing to the high demand for fast, secure, and convenient financial transactions. Transactional services include essential activities such as fund transfers, bill payments, deposits, withdrawals, and online purchases, all of which are critical to the day-to-day operations of individuals and businesses. The growing reliance on digital platforms for conducting these activities has been driven by the increasing consumer preference for mobile banking apps, digital wallets, and online payment systems, which offer 24/7 access and real-time transaction processing.

Regional Analysis

Asia-Pacific Dominated the Market with the Highest Revenue Share

Asia-Pacific held the most of the share of 34.1% of the market. This region is characterized by a large, young, and tech-savvy population, particularly in countries like China, India, and Indonesia, where smartphone penetration and internet connectivity have surged in recent years. The proliferation of digital payment solutions and mobile banking applications has reshaped consumer behavior, with individuals increasingly opting for digital channels for their financial transactions over traditional banking methods.

Moreover, the region has witnessed substantial investments in fintech innovations, with numerous startups and established financial institutions embracing digital transformation to offer enhanced banking experiences. Initiatives such as China's mobile payment platforms, including Alipay and WeChat Pay, have set new standards for convenience and accessibility, driving widespread adoption of digital banking services.

Competitive Analysis

The competitive analysis of the digital banking market reveals a dynamic and rapidly evolving landscape where traditional banks, fintech companies, and neobanks vie for market share by leveraging technology and innovation. Established financial institutions are undergoing significant digital transformation efforts to adapt to changing consumer preferences and expectations for seamless, user-friendly banking experiences. These banks are investing in advanced technologies such as artificial intelligence, machine learning, and data analytics to enhance their service offerings, improve operational efficiency, and provide personalized financial solutions.

Recent Developments

o In April 2024, nCino improved its consumer banking solution for banks and credit unions by expanding its omnichannel capabilities and simplifying multi-product origination processes for both bankers and customers.

o In February 2023, Oracle introduced Banking Cloud Services, a suite of six solutions aimed at helping banks modernize their offerings. These services can be utilized individually or integrated into existing banking infrastructures, allowing banks to customize their approach to modernization.

Key Market Players in the Digital Banking Market

o Etronika

o Finastra

o Fidor Solutions AG

o Infosys

o SAB

o Oracle Corporation

o SAP

o Technisys S.A

o Tata Consultancy Services Limited

o Temenos AG

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 10.1 Billion |

|

Market Size 2033 |

USD 28.0 Billion |

|

Compound Annual Growth Rate (CAGR) |

12.0% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Service, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Etronika, Finastra, Fidor Solutions AG, Infosys, SAB, Oracle Corporation, SAP, Technisys S.A, Tata Consultancy Services Limited, Temenos AG, and Other Key Players. |

|

Key Market Opportunities |

Adoption of Blockchain and Cryptocurrency |

|

Key Market Dynamics |

Increased Smartphone and Internet Penetration |

📘 Frequently Asked Questions

1. Who are the key players in the Digital Banking Market?

Answer: Etronika, Finastra, Fidor Solutions AG, Infosys, SAB, Oracle Corporation, SAP, Technisys S.A, Tata Consultancy Services Limited, Temenos AG, and Other Key Players.

2. How much is the Digital Banking Market in 2023?

Answer: The Digital Banking Market size was valued at USD 10.1 Billion in 2023.

3. What would be the forecast period in the Digital Banking Market?

Answer: The forecast period in the Digital Banking Market report is 2024-2033.

4. What is the growth rate of the Digital Banking Market

Answer: Digital Banking Market is growing at a CAGR of 12.0% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.