🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Digital Banking Platform Market

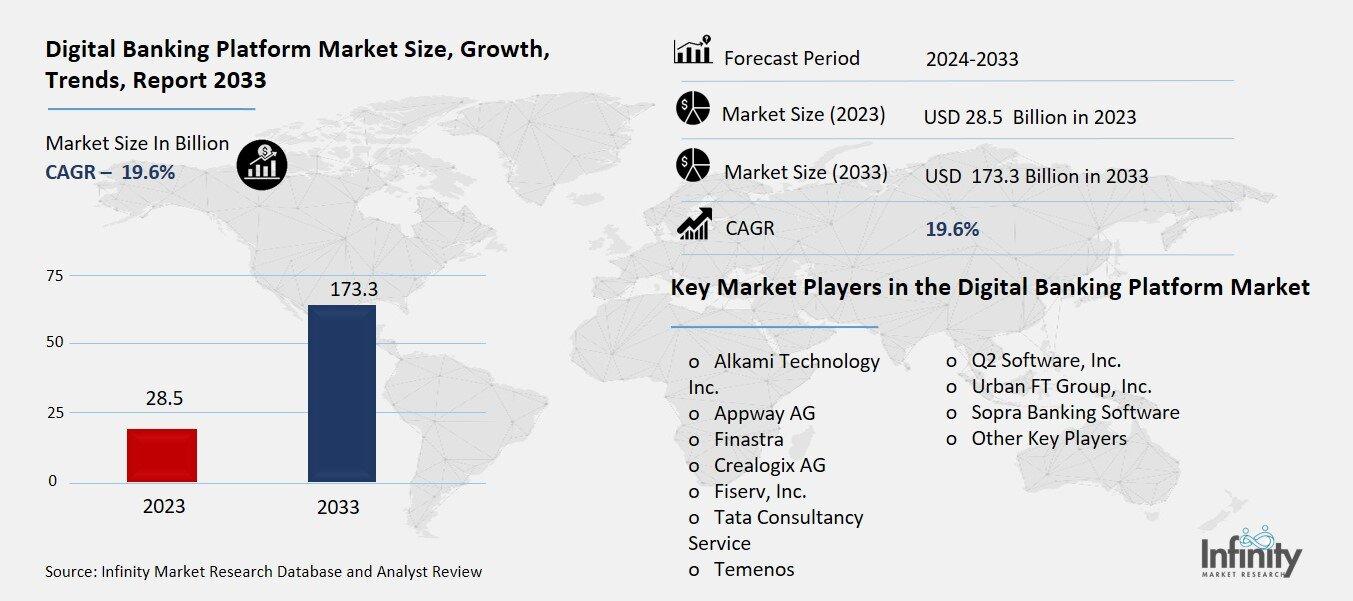

Global Digital Banking Platform Market (By Component, Platforms and Services; By Type, Retail Banking, Investment Banking, and Corporate Banking; By Deployment Mode, Cloud and On-Premises; By Banking Mode, Online Banking and Mobile Banking; By Region and Companies), 2024-2033

Oct 2024

Financial Services & Insurance

Pages: 138

ID: IMR1278

Digital Banking Platform Market Overview

Global Digital Banking Platform Market acquired the significant revenue of 28.5 Billion in 2023 and expected to be worth around USD 173.3 Billion by 2033 with the CAGR of 19.6% during the forecast period of 2024 to 2033. The market of digital banking platforms is growing very fast due to, advancements in the uses of technology, financial innovations and active uptake of mobile banking services. These platforms help financial organizations, including banks and other institutions, provide clients with an extensive variety of services, including Internet banking, mobile banking applications, and online payments, while providing secure, integrated, and client-oriented software.

The growth drivers of this market include the implementation of factors such as artificial intelligence, cloud and block chain they help in providing better experience to the customer and optimizing operations. Moreover, requirements such as the open banking principle force classic banks into the use of digital instruments to stand a chance. Banks are also now using technology partners to help advance their digitalization agenda on the market.

Drivers for the Digital Banking Platform Market

Growing Demand for Convenience

Mobile banking has become popular among consumers because it provides easy access to financial services via mobile applications and websites. Such opportunities offered without the necessity to visit branches are equally important: money transfers, bill payments, account monitoring and etc., are available 24/7. The nominal interfaces, the real time transactions, the secure means of logging in brings satisfaction to the customers while the ability to transact from anywhere pleases the uninterruptible kinetic age customer. This growing preference is one of the leading factors for the development of new and advanced form of digital banking.

Restraints for the Digital Banking Platform Market

Legacy System Integration

Many traditional banks encounter significant challenges when trying to integrate new digital banking platforms with their existing legacy systems. These legacy infrastructures, often built decades ago, are not designed to handle the flexibility, speed, and scalability required by modern digital solutions. Integration issues can lead to operational inefficiencies, such as slow processing times and system incompatibilities, which hinder the seamless rollout of new digital services.

Additionally, upgrading or replacing these systems is often costly, time-consuming, and fraught with risk, as it may disrupt core banking operations. As a result, many banks struggle to balance innovation with the need to maintain stable, reliable services.

Opportunity in the Digital Banking Platform Market

Personalized Banking Experiences

AI and big data analytics are transforming the way banks interact with their customers by enabling highly personalized financial services. These technologies allow banks to analyze vast amounts of customer data, such as transaction history, spending patterns, and behavioral insights, to offer tailored solutions that meet individual needs. For example, AI-driven systems can recommend personalized investment options, savings plans, or credit products based on a customer's financial goals. Additionally, predictive analytics help banks anticipate customer needs and provide proactive support, leading to enhanced customer engagement and satisfaction. This personalization not only deepens customer relationships but also increases loyalty and drives long-term business growth.

Trends for the Digital Banking Platform Market

Increasing Use of AI-driven Tools

The increasing use of AI-driven tools is playing a pivotal role in shaping the future of digital banking platforms by enhancing personalized services, improving fraud detection, and boosting operational efficiency. AI algorithms analyze customer data in real-time, allowing banks to deliver customized product recommendations, financial advice, and seamless customer support experiences. In terms of security, AI is highly effective in detecting and preventing fraud by identifying unusual transaction patterns and potential risks, allowing banks to respond quickly to threats.

Additionally, AI automates routine tasks like customer inquiries, loan processing, and account management, which significantly reduces operational costs and improves service speed. As AI continues to evolve, it will further drive innovation and competitiveness in the digital banking sector.

Segments Covered in the Report

By Component

o Platforms

o Services

By Type

o Retail Banking

o Investment Banking

o Corporate Banking

By Deployment Mode

o Cloud

o On-Premises

By Banking Mode

o Online Banking

o Mobile Banking

Segment Analysis

By Component Analysis

On the basis of component, the market is divided into platforms and services. Among these, platforms segment acquired the significant share in the market owing to the growing demand for robust, integrated solutions that enable seamless management of digital banking operations. Banks and financial institutions are increasingly adopting digital banking platforms to streamline their core processes, enhance customer experiences, and ensure scalability as digital banking services expand.

These platforms offer comprehensive features such as real-time transaction processing, customer analytics, and secure APIs for third-party integrations, making them essential for modernizing banking infrastructure. Additionally, the rising need for regulatory compliance, data security, and faster service delivery further boosts the adoption of digital banking platforms over standalone services.

By Type Analysis

On the basis of type, the market is divided into retail banking, investment banking, and corporate banking. Among these, retail banking segment held the prominent share of the market due to the widespread adoption of digital channels by individual consumers for everyday financial activities. Retail banking platforms are heavily utilized for services such as online and mobile banking, money transfers, bill payments, and personal loan management, which are in high demand by consumers seeking convenience and ease of access.

The surge in smartphone usage and increased internet penetration have further accelerated the shift towards digital retail banking. Moreover, the growing trend of personalized financial services and enhanced customer experience through AI-driven tools has also contributed to the dominance of the retail banking segment in the market.

By Deployment Mode Analysis

On the basis of deployment mode, the market is divided into cloud and on-premises. Among these, retail banking segment held the significant share of the market. Cloud-based platforms enable retail banks to rapidly deploy digital services, reduce infrastructure costs, and scale operations in response to customer demand. The cloud also offers enhanced data storage capabilities, real-time analytics, and seamless integration with third-party applications, allowing retail banks to provide personalized and secure services to a large customer base. Furthermore, the shift towards cloud adoption is driven by the need for faster innovation, improved disaster recovery, and compliance with evolving regulatory standards. These factors make cloud deployment a more attractive option for retail banking compared to traditional on-premises systems.

By Banking Mode Analysis

On the basis of banking mode, the market is divided into online banking and mobile banking. Among these, online banking segment held the most of the share of the market. Online banking platforms typically offer extensive features, including account management, fund transfers, bill payments, loan applications, and investment services, all accessible from a desktop or laptop. This versatility attracts a significant number of users who prefer the convenience of managing their finances from a larger screen, which can be especially beneficial for more complex transactions.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 34.5% of the market. The region dominated the digital banking platform market with the highest revenue share, primarily due to the region's advanced technological infrastructure and high internet penetration. The presence of major financial institutions and a rapidly growing fintech ecosystem have driven significant investments in digital banking innovations. Moreover, consumers in North America exhibit a strong preference for online and mobile banking services, prompting banks to enhance their digital offerings to meet increasing demand for convenience and personalized experiences. Regulatory support, such as open banking initiatives, has further accelerated the adoption of digital banking platforms in the region.

Competitive Analysis

The competitive analysis of the digital banking platform market reveals a dynamic landscape characterized by both traditional financial institutions and emerging fintech companies vying for market share. Major players, such as JPMorgan Chase, Bank of America, and Wells Fargo, leverage their established customer bases and vast resources to enhance their digital offerings, focusing on integrating advanced technologies like artificial intelligence and blockchain to improve customer experiences. Meanwhile, fintech startups like Chime, Robinhood, and Revolut are disrupting the market with innovative, user-friendly solutions that cater to tech-savvy consumers seeking convenience and lower fees.

Recent Developments

In September 2023, Temenos introduced an industry-first secure solution for banks that incorporates generative artificial intelligence (AI) to automatically classify customers' banking transactions. This transaction classification enhances the bank's ability to deliver personalized insights and recommendations, creating more engaging and intuitive digital banking experiences.

In August 2021, Finastra has partnered with Salt Edge Limited, a financial technology firm, to improve the speed of compliance with the Payment Services Directive 2 (PSD2) and other banking standards for Electronic Money Institutions (EMIs) and banks worldwide.

Key Market Players in the Digital Banking Platform Market

o Alkami Technology Inc.

o Appway AG

o Finastra

o Crealogix AG

o Fiserv, Inc.

o Tata Consultancy Service

o Temenos

o Q2 Software, Inc.

o Urban FT Group, Inc.

o Sopra Banking Software

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 28.5 Billion |

|

Market Size 2033 |

USD 173.3 Billion |

|

Compound Annual Growth Rate (CAGR) |

19.6% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Component, Type, Deployment Mode, Banking Mode, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Alkami Technology Inc., Appway AG, Finastra, Crealogix AG, Fiserv, Inc., Tata Consultancy Service, Temenos, Q2 Software, Inc., Urban FT Group, Inc., Sopra Banking Software, and Other Key Players. |

|

Key Market Opportunities |

Legacy System Integration |

|

Key Market Dynamics |

Growing Demand for Convenience |

📘 Frequently Asked Questions

1. Who are the key players in the Digital Banking Platform Market?

Answer: Alkami Technology Inc., Appway AG, Finastra, Crealogix AG, Fiserv, Inc., Tata Consultancy Service, Temenos, Q2 Software, Inc., Urban FT Group, Inc., Sopra Banking Software, and Other Key Players.

2. How much is the Digital Banking Platform Market in 2023?

Answer: The Digital Banking Platform Market size was valued at USD 28.5 Billion in 2023.

3. What would be the forecast period in the Digital Banking Platform Market?

Answer: The forecast period in the Digital Banking Platform Market report is 2024-2033.

4. What is the growth rate of the Digital Banking Platform Market ?

Answer: Digital Banking Platform Market is growing at a CAGR of 19.6% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.