🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Digital Freight Brokerage Market

Digital Freight Brokerage Market Global Industry Analysis and Forecast (2024-2032) By Type ( Land Freight, Sea Freight, Air Freight), By Deployment Mode( Cloud-based, On-premises),By End-user(Shippers, Carriers),By Application( Freight Matching, Load Matching, Tracking & Monitoring, Documentation Management) and Region

Jan 2025

Automotive Technology

Pages: 138

ID: IMR1519

Digital Freight Brokerage Market Synopsis

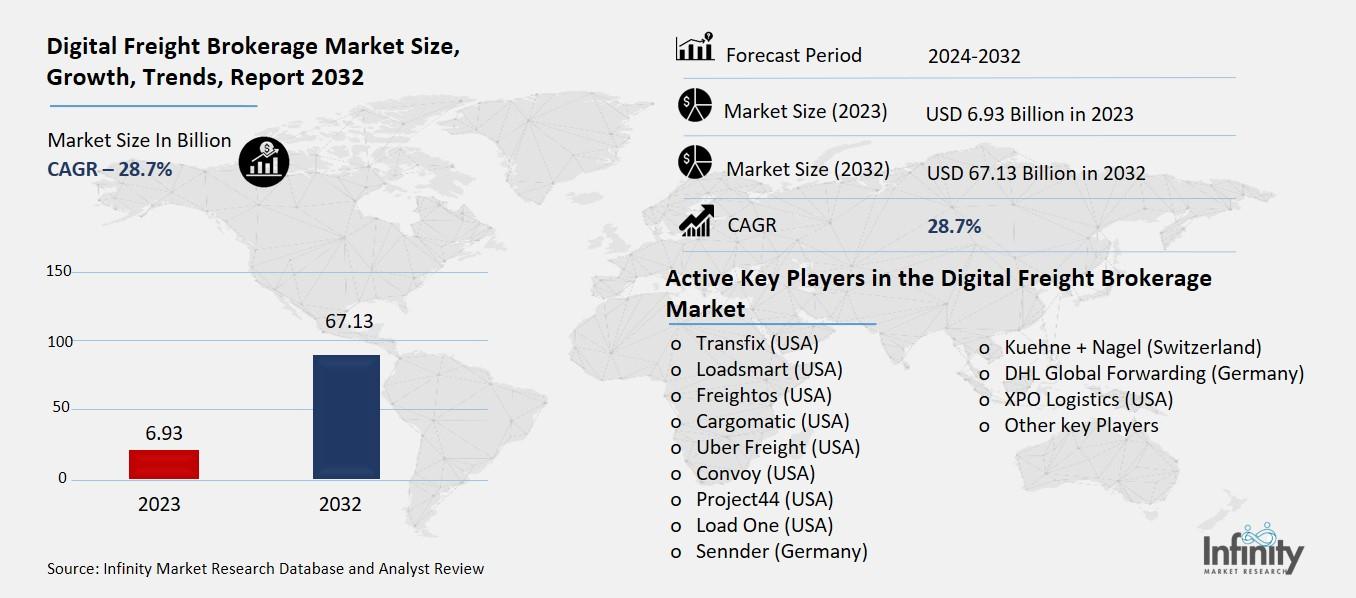

Digital Freight Brokerage Market Size Was Valued at USD 6.93 Billion in 2023, and is Projected to Reach USD 67.13 Billion by 2032, Growing at a CAGR of 28.7% From 2024-2032.

The Digital Freight Brokerage Market is the modern evolution of the conventional freight brokerage business which involves the intermediation between shippers and carriers of freight through automated solutions on the internet. The focus of this market is to use things like AI, cloud, big data to automate operations such as freight matching, tracking of shipments, documentation and optimal routing to make logistic processes, more effective, responsive, and affordable for shippers and carriers.

The Digital Freight Brokerage Market is growing at tremendous speed as forwarders and shippers turn towards technology to improve business processes. Brought about by technology advancement, new freight brokerage systems have been developed to offer timely freight data, integrated work processes, and improved visibility of shippers and carriers. Said platforms assist in simplifying the process as the work here can be complex and time consuming especially for manual brokers. More importantly, in the quest to achieve faster and cheaper solutions to logistics needs, digital freight brokerage platforms have proved vital.

This market is being spurred by the gradual transition from paper based and manual systems that are slow, prone to errors and cannot easily support the real-time collaboration between shippers and transportation providers. The increasing need for visibility is also fostering market development in the supply chain and logistics industry. Businesses are searching for the options on how tracking the shipment, planning the routes, as well as making more precise deliveries. However, the growth of e-commerce, the increasing popularity of which has ensured a constant high demand for various goods, as well as the development of globalization, has accelerated the need for faster, more efficient, and easily scalable freight solutions. New technologies implemented through digital freight brokerages enable the transportation of goods and at the same time help organizations cut costs.

If we consider that the advancements in digital technologies will keep on persisting in the future, then the market for digital platforms of freight brokerage will experience growth in the future. The main drivers that have spurred the growth include ever rising capital investments by logistic companies in adoption of various technologies, use of mobile Applications for freight management, and demand for real time data analytics. In addition, the main drivers supporting the growth of the market are the regulatory updates of digitalization of the supply chain. As AI and machine learning platforms together with blockchain technology become increasingly integrated into the freight brokerage platforms we foresee greater efficiencies, costs reduction and improved customer satisfaction in the future.

Digital Freight Brokerage Market Outlook, 2023 and 2032: Future Outlook

Digital Freight Brokerage Market Trend Analysis

Trend: Artificial Intelligence Integration

AI capability is one of the notable trends in the global Digital Freight Brokerage Market for improving the landscape. At present, AI is playing a role in improving several factors in freight brokerage including load matching, routing and planning, analytical capability and risk management. Massive freight matching have become a reality through the use of real time data through artificial intelligence algorithms, and analysis of historical data to predict possible delays in the delivery process. The application of AI minimizes the need for human involvement, accelerates the decision-making process and makes organizations perform better and at the same time cutting on the operating expenses.

Also, AI can make a contribution in the field of customer servicing as delivery time estimates can be provided to the customer using ideas from the AI technology to reduce the time and sources through which the changes may take place. These functions also enhance accurate pricing and demand estimations that act as a basis for the digital transformation of freight brokerage services. In the future, with improvements in AI technologies in freight matching, freight brokers are already likely to implement machine learning and deep learning to augment their platforms to have a more dynamic and innovative platform with higher efficiency rates, lower costs and most importantly, creating better models that bring satisfaction to their customers.

Opportunity: Expansion into Emerging Markets

The fact still remains that, the Digital Freight Brokerage Market has immense opportunities for growth in emerging markets. It may be explained by the fact that the turbulent development of the economies of developing countries with new infrastructure initiatives requires effective and inexpensive logistics services. These markets are now at the early apex of industrialization and the logistics and transportation industries within these markets are struggling to adopt digital solutions. Extending the offering of digital freight brokerage services to these areas can therefore expose huge opportunities allowing firms to transport goods more effectively and cheaply.

Furthermore, they tend to have infrastructure problems that can be solved through the application of digital products. For example, in some areas integrating value chain communication technologies is still in its infancy and the digital platform can assist by enhancing automation and improving live tracking. This opportunity is much useful in places with increasing e-business markets since they require suitable logistic services mostly. This way digital freight brokers can charter their operations in these markets and be sure of long-term prospects of their companies.

Driver: Increasing Demand for Real-Time Visibility

A major reason that has fueled the growth in the Digital Freight Brokerage Market is the growing need for real time information in the transportation and logistics industry. Companies are seeking to develop better systems of freight flow that would provide visibility of their cargo all through the transportation line. Real time tracking results in less delay, effective delivery, and customer satisfaction. Organizations can track the movement of consignments, identify possible delivery risks, and make immediate adjustments that will ensure delivery happens on time.

Since organisations are relying more on fast and efficient deliveries, middlemen are increasingly using a digital freight brokerage solution that offers real-time information to make better decisions. The need to achieve greater transparency in real time is also fueled by the customer demand for faster delivery as well as the pressure on companies to improve their supply chain. This is possible due to the application of technology whereby digital freight brokers can indeed meet these demands hence is a key driver to the markets growth.

Restraints: Security and Data Privacy Concerns

However, only particular security and data privacy remain a major limitation for the overall growth of the Digital Freight Brokerage Market. Currently, the freight brokerage systems are digitalized, which means that the agent transfers considerable amounts of information – shipment details, financial information, and customer data and consequently the industry is vulnerable to cyberattacks. With the threat levels increasing day by day, logistics firms are forced to spend a lot on the protection of their data from further attacks.

Besides, laws like the GDPR have made data management for digital freight brokers slightly challenging than it used to be. Compliance with these regulatory requirements may involve considerable financial outlay and enormous amounts of time. This would act as a disincentive to companies fully adopting the digital freight brokerage solutions since the risks of data loss or prospect of protracted legal battles are some of the worst nightmares that any business person would not want to entertain. These issues must be effectively met through successful implementation of cybersecurity mechanisms and consistent adherence to the international data protection laws in order for this market to continue to progress.

Digital Freight Brokerage Market Segment Analysis

Digital Freight Brokerage Market Segmented on the basis of type, deployment mode, application and end user.

By Type, Land Freight segment is expected to dominate the market during the forecast period

The Digital Freight Brokerage Market is segmented into different types based on the mode of transport: these are the land, sea and air transport. Land Freight is the biggest category because most domestic freight and last-mile deliveries are done via this medium. Road transport is an important component of the logistics industry, particularly where high frequency flexibility is needed for local shipments. The Sea Freight is another considerable segment as to the requirement of attempting to find the effective solutions for the international shipments of the bulk goods. As a result of rapidly developing global trade, seaborne shipments are on the rise, suggesting that the use of digital solutions to simplify the booking and tracking of sea freight is also on the rise. Air Freight is relatively small in global transport compared to the others but used for goods requiring fast and secure transport. There are always advantages for the air freight since digital platforms affects their flight schedules, cargo capacities and delay time.

High precision digital solutions are needed for every mode of transport that is in use today. For instance, land freight may even emphasize on choosing of routes and real time load management while sea freight gets better container management and optimizing solutions at sea ports. As for air freight a different type of solutions are necessary to meet the demand for managing capacity and time sensitive offerings, services. Some significant digital platforms in freight brokerage sector have been identified as offering a full suite of service solutions across the three primary transport modes, allowing shippers to coordinate Cross- modal contracts uniformly ,reducing complexity and enhancing total transportation performance.

By Application, Freight Matching segment expected to held the largest share

The Digital Freight Brokerage Market is also classified based on the application Freight Matching, Load Matching, Tracking and Monitoring, Documentation Management. Freight Matching is an activity in which shippers are connected or matched with carriers willing to transport loads on behalf of shippers. This is made easier by digital platforms since they allow for better matching with the help of gears that determine the capability, cost and time taken in matching of capacities. Load Matching is similar to this process but further narrows down its goal to matching the correct load to a carrier, optimizing use of vehicles, and preventing high transportation expenses.

Real-time Monitoring & Tracking is one of the most important applications that offers information on the movable location of shipments. This application is very useful for managing the issues of the delay, or finding out better routes for pick-ups, or increasing customer satisfaction. Finally, Documentation Management entails the process of automation of other forms of paperwork such as bills of lading contracts, and any custom documentation. Digital solutions minimize the possibility of making mistakes due to human involvement, take less time, and are always legal. Each of the aforementioned functions is crucial to the actual performance of the freight brokerage and more companies are shifting to engage the services of digital tools to support each of these applications.

Digital Freight Brokerage Market Regional Insights

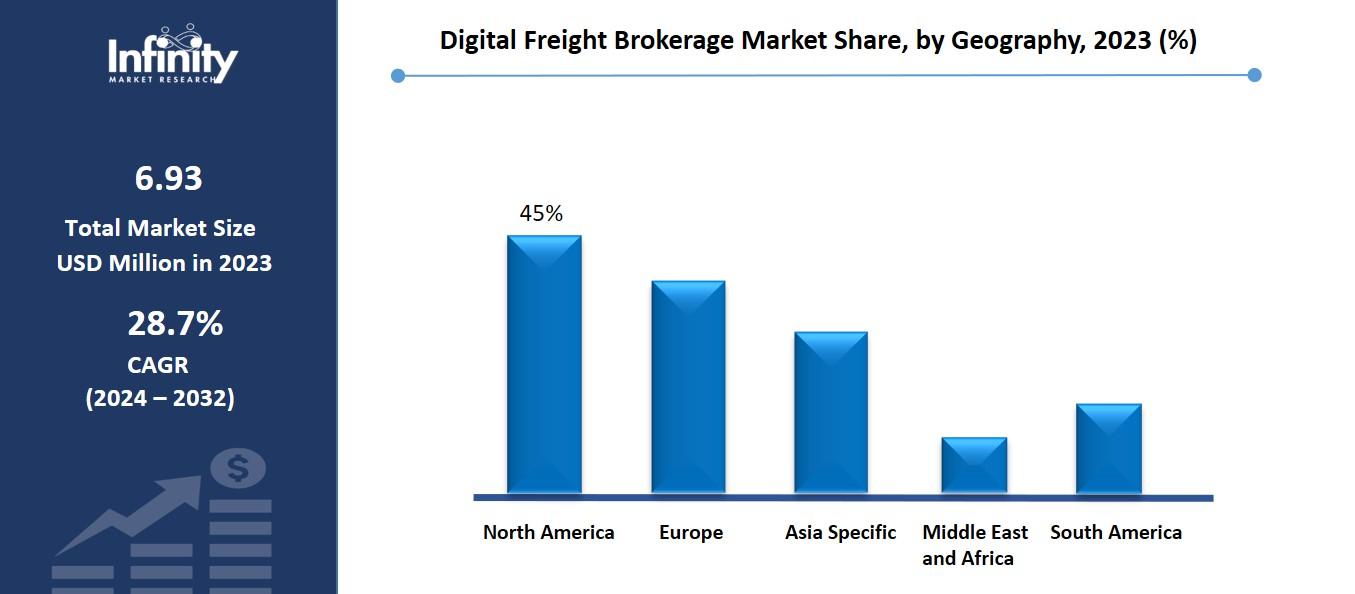

North America is Expected to Dominate the Market Over the Forecast period

North America is in the leading position in the Digital Freight Brokerage Market at the moment. There is already a strong foundation for logistics and transportation functions in the region mainly due to the presence of technologies that can easily accommodate digital freight. The US has particularly dominated this market because of its sizeable B2C buying and selling, manufacturing sector, and well-developed freight circulation. Several digital tools such as cloud-based platforms, artificial intelligence and big data analysis have been adopted in the region to enhance optimization in freight matching and tracking or monitoring activities resulting in efficient freight brokering at little costs.

Besides this, the regulatory environment of the region has been favorable for digital transformation of the logistics industry. Policies used by the U.S. government include providing money towards enhancement of infrastructure of freight management and policies involved in the improvement of transportation technology. Therefore, North America will continue to lead this market due to constant technological enhancements to digitization and increasing need for real-time visibility within the supply chain.

Digital Freight Brokerage Market Share, by Geography, 2023 (%)

Active Key Players in the Digital Freight Brokerage Market

o Transfix (USA)

o Loadsmart (USA)

o Freightos (USA)

o Cargomatic (USA)

o Uber Freight (USA)

o Convoy (USA)

o Project44 (USA)

o Load One (USA)

o Sennder (Germany)

o Kuehne + Nagel (Switzerland)

o DHL Global Forwarding (Germany)

o XPO Logistics (USA)

o Other key Players

Key Industry Developments in the Digital Freight Brokerage Market

July 2024- Lobb, a digital freight brokerage platform based in Bengaluru, has secured $2.9 million (INR 24.2 crore) in an extended Pre-Series A fundraising round from multiple investors.

February 2024- Flexport has recently unveiled the Convoy Platform, some four months after acquiring the technology and intellectual property (IP) of Convoy, a digital truck brokerage that had closed down. Flexport executives stated that the streamlined technology platform is designed to provide small carriers with the opportunity to access freight while also enabling shippers and brokers to access freight at real-time competitive rates, visibility of shipments, and reliable on-time performance.

Global Digital Freight Brokerage Market Scope

|

Global Digital Freight Brokerage Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.93 Billion |

|

Forecast Period 2024-32 CAGR: |

28.7% |

Market Size in 2032: |

USD 67.13 Billion |

|

Segments Covered: |

By Type |

· Land Freight · Sea Freight · Air Freight | |

|

By Application |

· Freight Matching · Load Matching · Tracking & Monitoring · Documentation Management | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Increasing Demand for Real-Time Visibility | ||

|

Key Market Restraints: |

· Security and Data Privacy Concerns | ||

|

Key Opportunities: |

· Expansion into Emerging Markets | ||

|

Companies Covered in the report: |

· Transfix (USA), Loadsmart (USA), Freightos (USA), Cargomatic (USA), Uber Freight (USA), Convoy (USA), Project44 (USA), and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Digital Freight Brokerage Market research report?

Answer: The forecast period in the Digital Freight Brokerage Market research report is 2024-2032.

2. Who are the key players in the Digital Freight Brokerage Market?

Answer: Transfix (USA), Loadsmart (USA), Freightos (USA), Cargomatic (USA), Uber Freight (USA), Convoy (USA), Project44 (USA), and Other Major Players.

3. What are the segments of the Digital Freight Brokerage Market?

Answer: The Digital Freight Brokerage Market is segmented into Type, Deployment Mode, Application, End User and region. By Type, the market is categorized into Land Freight, Sea Freight, Air Freight. By Deployment Mode, the market is categorized into Cloud-based, On-premises. By End-user, the market is categorized into Shippers, Carriers. By Application, the market is categorized into Freight Matching, Load Matching, Tracking & Monitoring, Documentation Management. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Digital Freight Brokerage Market?

Answer: The Digital Freight Brokerage Market is the modern evolution of the conventional freight brokerage business which involves the intermediation between shippers and carriers of freight through automated solutions on the internet. The focus of this market is to use things like AI, cloud, big data to automate operations such as freight matching, tracking of shipments, documentation and optimal routing to make logistic processes, more effective, responsive, and affordable for shippers and carriers.

5. How big is the Digital Freight Brokerage Market?

Answer: Digital Freight Brokerage Market Size Was Valued at USD 6.93 Billion in 2023, and is Projected to Reach USD 67.13 Billion by 2032, Growing at a CAGR of 28.7% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.